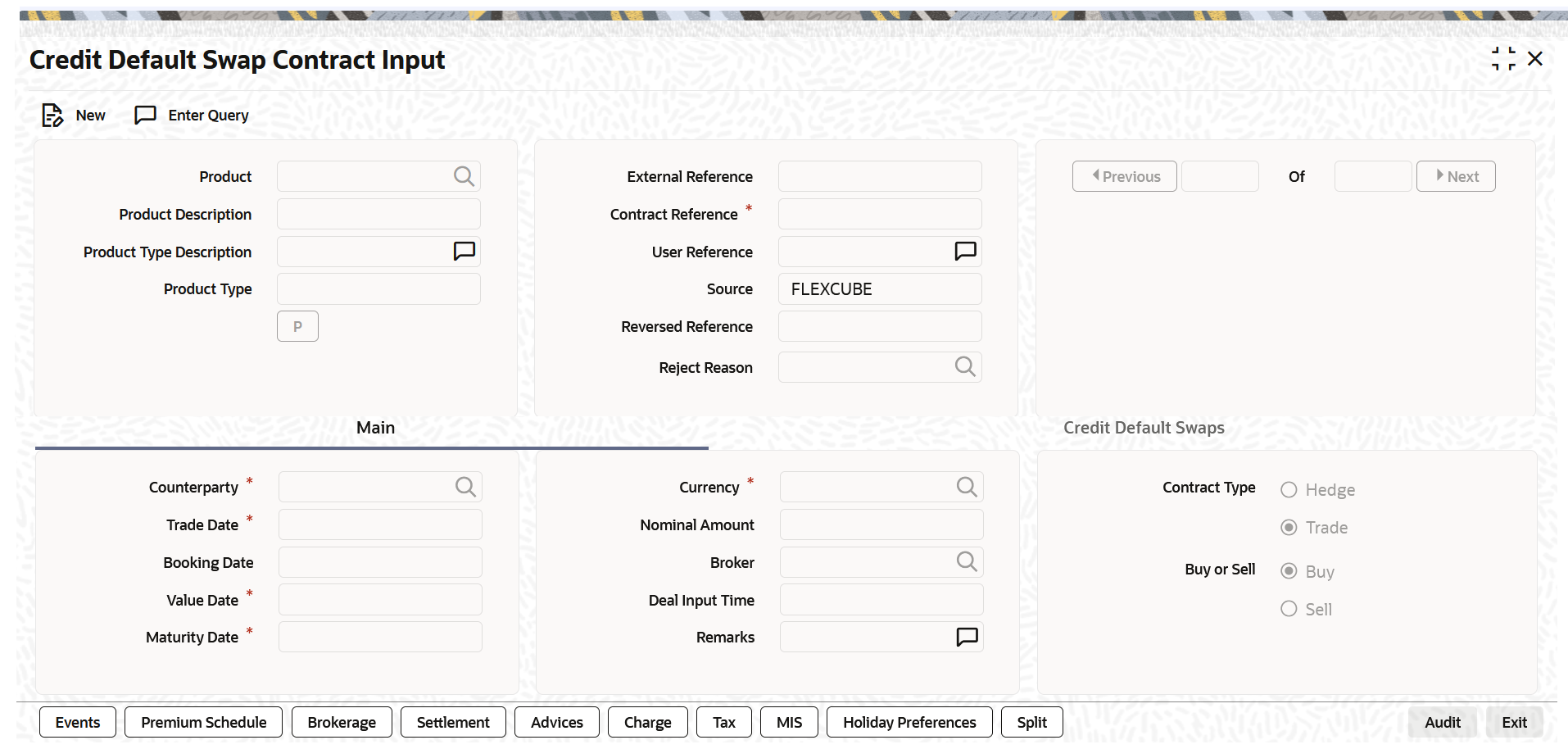

6.3 Credit Default Swap Contract Input

The CDS contract input and summary information are captured in the Credit Default Swap Contract Input screen.

Note:

All fields marked with an asterisk (*) are mandatory.- On the Home page, enter DCDCDSON in the text box, and then click the next arrow.

The Credit Default Swap Contract Input screen is displayed.

Figure 6-4 Credit Default Swap Contract Input

Description of "Figure 6-4 Credit Default Swap Contract Input" - On the Credit Default Swap Contract Input screen, under Main tab, specify the contract details.

For more information on the fields, refer to the below table.

Table 6-9 Credit Default Swap Contract Input and Main Tab - Field Description

Field Description Product Click on the search icon and select the required CDS product from the displayed list. Product Description The System displays the description of the selected product. Product Type Description The System displays the description of the selected product type. Product Type The System displays the type of the selected product. P Click P to populate the product details and to generate contract reference number.

The system displays the External Reference, Contract Reference, User Reference, and Source details of the selected product.Reversed Reference The reference number displays the reversed and re-booked contract. Reject Reason Specify the Reject Reason Code for the payment reversal message. Counter Party

Select the unique code from the displayed list for identifying the customer. Trade Date Specify the Trade Date.

Indicates the business date on which CDS deal is initiated.

Booking Date Specify the Booking Date.

Indicates the booking date on which the CDS contract option is added in the system

Value Date Specify the Value Date.

Indicates the value date which is the first date of the interest period.

Maturity Date Specify the Maturity Date.

Indicates the maturity date on which the contract expires.

Note: If the Maturity Date is less than the Value date, an error message is displayed.Currency Click the Search icon and select the unique code from the displayed list for identifying the currency of the CDS contract. Nominal Amount Enter the nominal amount in this field. Note: If you enter a nominal amount below zero, then an error message is displayed in the system.

Broker Click the Search icon and select the unique code for identifying the broker of the contract from the list. Note: This field is applicable only if the user selected the brokerage allowed while maintaining the product preferences.

Contract Type Select the contract type from the drop-down list.

Indicates whether the contract type is Hedge or Trade.

Buy or Sell Indicates the nature of the contract that bank is buying the contract or selling the contract. Deal Input Time Indicates the deal execution time at the time of deal booking received from front office.

Default Time Format: YYYY-MM-DD HH:MM:SS:SSS.

Note: The user can change the format in the user setting option based on requirement.

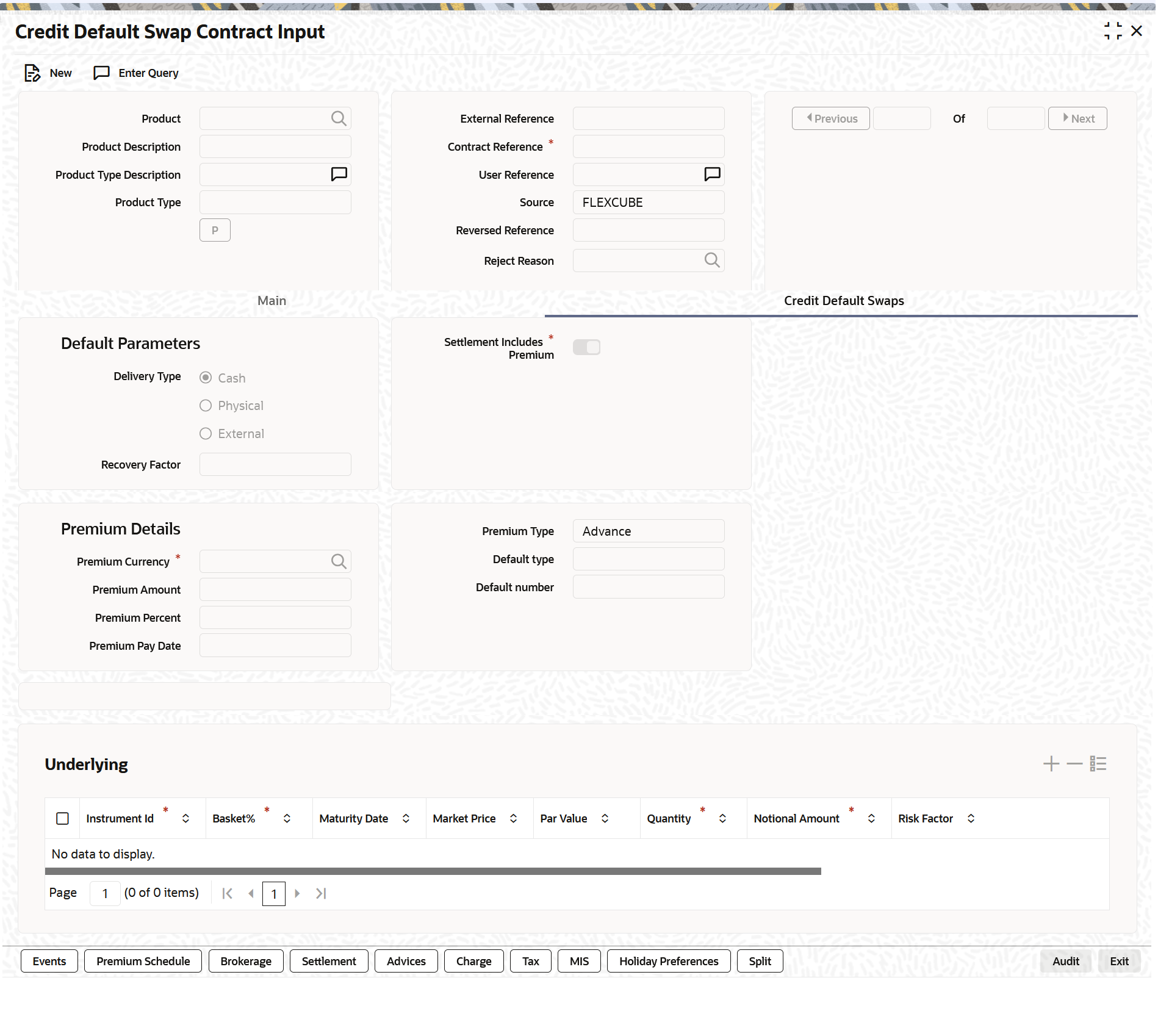

- On the Credit Default Swap Contract Input screen, click the Credit Default Swaps tab.

The Credit Default Swaps page is displayed.

- On the Credit Default Swap Contract Input screen, under Credit Default Swaps, specify the fields.

The user can modify the Default Parameters and Premium Details of the product in this section. For more information on the fields, refer to the below table

Table 6-10 Credit Default Swaps - Default Parameters and Premium Details - Field Description

Field Description Delivery Type Select the Delivery Type option. The available options are:

- Cash

- Physical

Indicates the type of settlement when the credit event is triggered.

Recovery Factor Specify the cash recovery factor.

Settlement Includes Premium Select the Settlement Includes Premium check box, if the settlement for credit event exercise must include premium or the premium is suppressed with accrual reversed. Premium Currency Click on the search icon and select the unique code from the list for identifying the premium currency Premium Amount Specify the premium amount of the contract. Premium Percent Specify the percentage of the premium amount for the contract. Premium Pay Date Specify the date to pay the premium amount.

Premium Type Indicates the type of the premium.

- On the Credit Default Swap Contract Input screen, under Credit Default Swaps, specify the Underlying fields as required.

For more details on the fields, refer to the below table.

Table 6-11 Credit Default Swaps - Underlying Field Description

Field Description Instrument ID Indicates the instrument used as the underlying for the contract.

Basket% Indicates the percentage portion of the basket constituted by the underlying instrument.

Maturity Date Indicates the date on which the CDS contract expires.

If the Maturity Date is less than or equal to Value Date, an error message is displayed.

Market Price Indicates the market price of the underlying instrument

PAR Value Indicates the current face value of the instrument.

Quantity Indicates the number of units of the instrument.

Notional Amount Indicates notional amount of the underlying instrument.

Note: If the notional amount is not greater than zero, then an error message is displayed.

Risk Factor Indicates the risk factor associated with the underlying instrument.

Note: The Risk Factor Value must be between 0 and 1.

Risk Value Indicates the value at risk of underlying instrument.

- Display Credit Default Swap Contract Summary Details

This topic provides the instructions to capture the CDS Contract Summary details.

Parent topic: Credit Default Swap