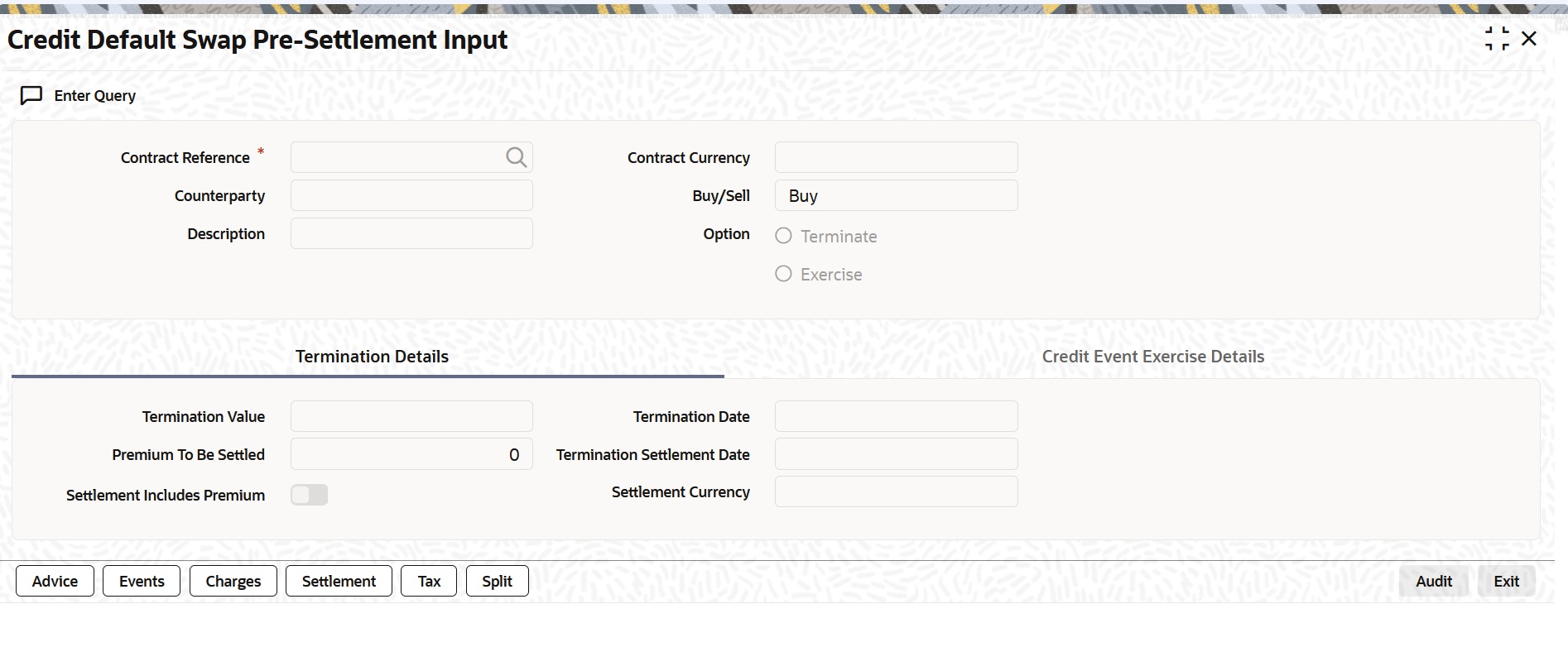

6.4 Credit Default Swap Pre-Settlement Input

This topic describes the systematic instruction for CDs contract termination and contract exercise.

The CDS contract details for contract termination and contract exercise are captured in the Credit Default Swap Pre-Settlement Input screen.

Note:

All fields marked with an asterisk (*) are mandatory.

- On the Home page, enter DCDCNTRM in the text box, and then click next arrow.

Credit Default Swap Pre-Settlement Input screen is displayed.

Figure 6-7 Credit Default Swap Pre-Settlement Input

Description of "Figure 6-7 Credit Default Swap Pre-Settlement Input" - On the Credit Default Swap Contract Input screen, click Enter Query, and specify the contract details as required.

For more information on the fields, refer to the below table.

Table 6-13 Credit Default Swap Contract Input - Field Description

Field Description Contract Reference

Click the search icon and select the unique code from the list for identifying the contract for termination.

Counterparty

The system displays the counterparty of the selected contract.

Description

The system displays the brief description of the counterparty for the selected contract reference.

Contract Currency

Indicates the currency of the nominal amount.

Buy/Sell

Indicates whether the bank is buying the contract or selling the contract.

Option

Select either Terminate Option to terminate the contract or Exercise Option to exercise the contract.

Click Execute Query to execute the selected option.

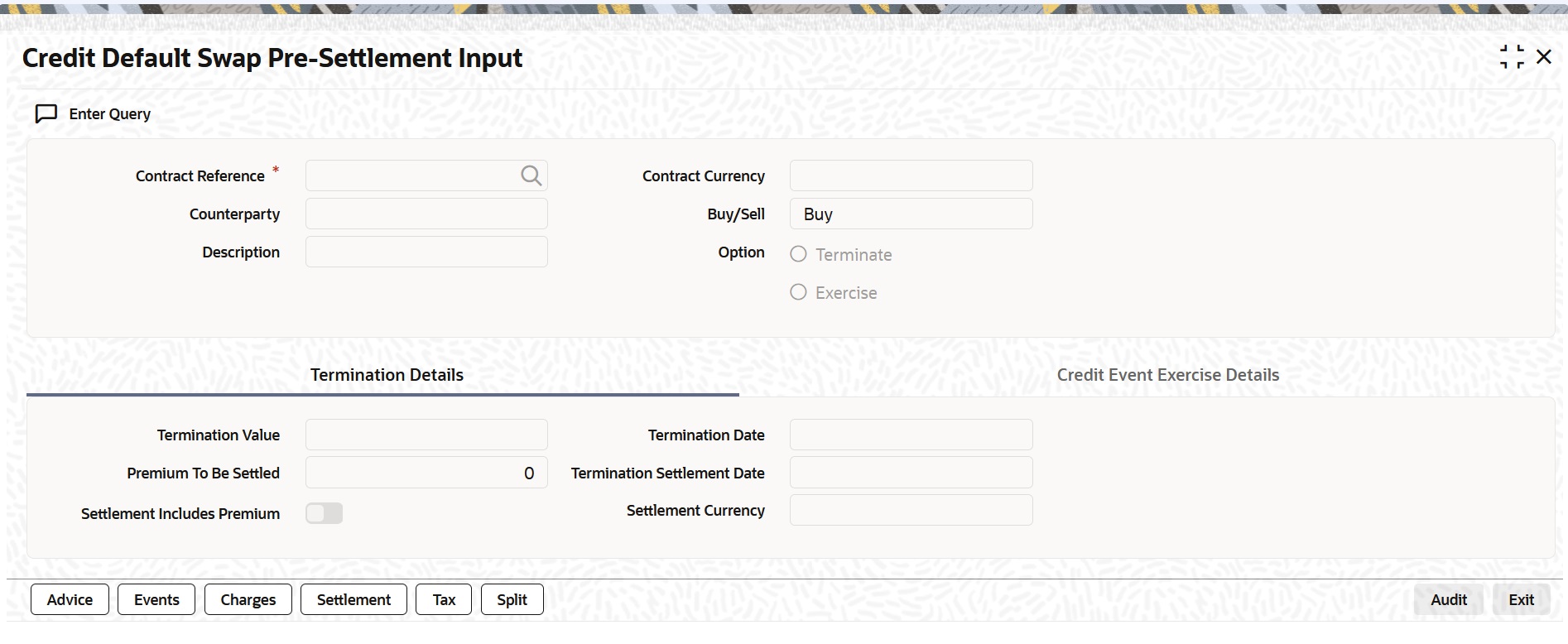

- On the Credit Default Swap Pre-Settlement Input screen, click Termination Details.

- On the Credit Default Swap Contract Input screen, under Termination Details, specify the fields.

For more information on the fields, refer to the below table.

Table 6-14 Credit Default Swaps Contract Input- Termination Details Field Description

Field Description Termination Value

Specify the Termination Value.

Note: Positive value denotes income and Negative value denotes expense.

Premium to be Settled

Indicates the premium for settlement as per the PUR_CDS_PREM_PACD amount tag for buying CDS and WRI_CDS_PREM_PACD for selling CDS.

This field is mandatory, if the user selected the Settlement Includes Premium.

Termination Date

Indicates the effective date of contract termination.

Note: If the Termination Date is less than or equal to Value Date or if the Termination Date is greater than or equal to Maturity Date, an error message is displayed.

Termination Settlement Date

Indicates the settlement date on which the termination begins.

Note: If the Termination Settlement Date is less than or equal to the Termination Date, then an error message is displayed.

Settlement Includes Premium

Indicates whether settlement for credit event exercise must include premium or the premium is suppressed with accrual reversed.

Settlement Currency

Indicates the currency of the contract termination settlement.

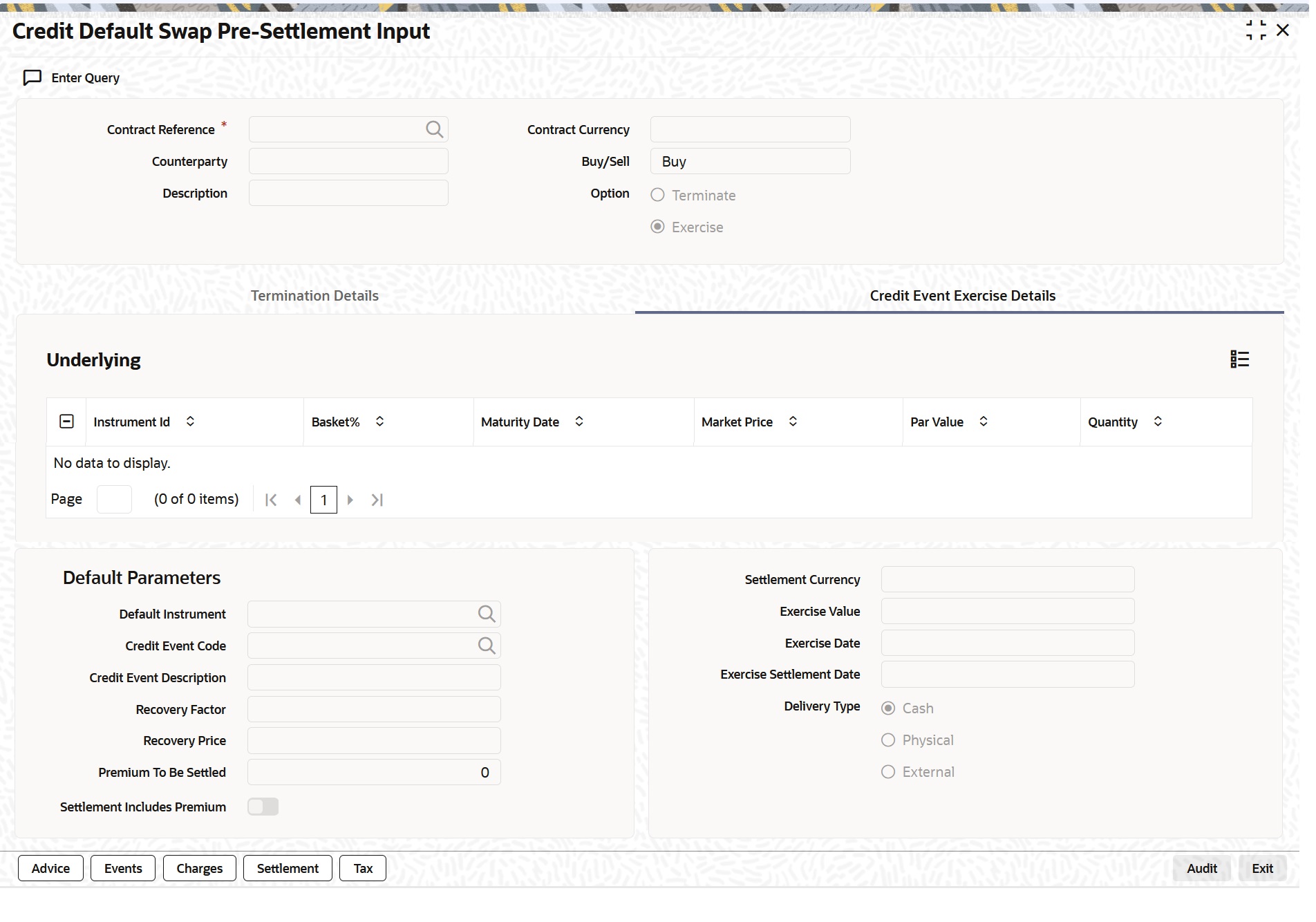

- On the Credit Default Swap Pre-Settlement Input screen, click the Credit Event Exercise Details tab.

- On the Credit Default Swap Contract Input screen, under Credit Event Exercise Details, specify the fields as required.

For more information on the fields, refer to the below table.

.Table 6-15 Credit Default Swap contract Input - Credit Event Exercise Details Field Description

Field Description Instrument ID

Indicates the instrument used as the underlying for the contract.

Basket%

Indicates the percentage portion of the basket constituted by the underlying instrument.

Maturity Date

Indicates the date on which the CDS contract expires.

If the Maturity Date is less than or equal to Value Date, an error message is displayed.

Market Price

Indicates the market price of the underlying instrument

PAR Value

Indicates the current face value of the instrument.

Quantity

Indicates the number of units of the instrument.

Default Instrument

Click the search icon and select the unique code from the displayed list for identifying the defaulted Instrument.

Credit Event Code

Click the search icon and select the unique code from the displayed list for identifying the event code causing the exercise.

Credit Event Description

The system displays the brief description of the selected credit event.

Exercise Value

Indicates whether the settlement must include accrued premium.

Exercise Date

Specify the effective of contract Exercise Date.

Note: If the Exercise Date is less than or equal to the Value Date and greater than the Maturity Date, an error message is displayed.

Exercise Settlement Date

Indicates the Settlement Date of the exercised contract.

Parent topic: Credit Default Swap