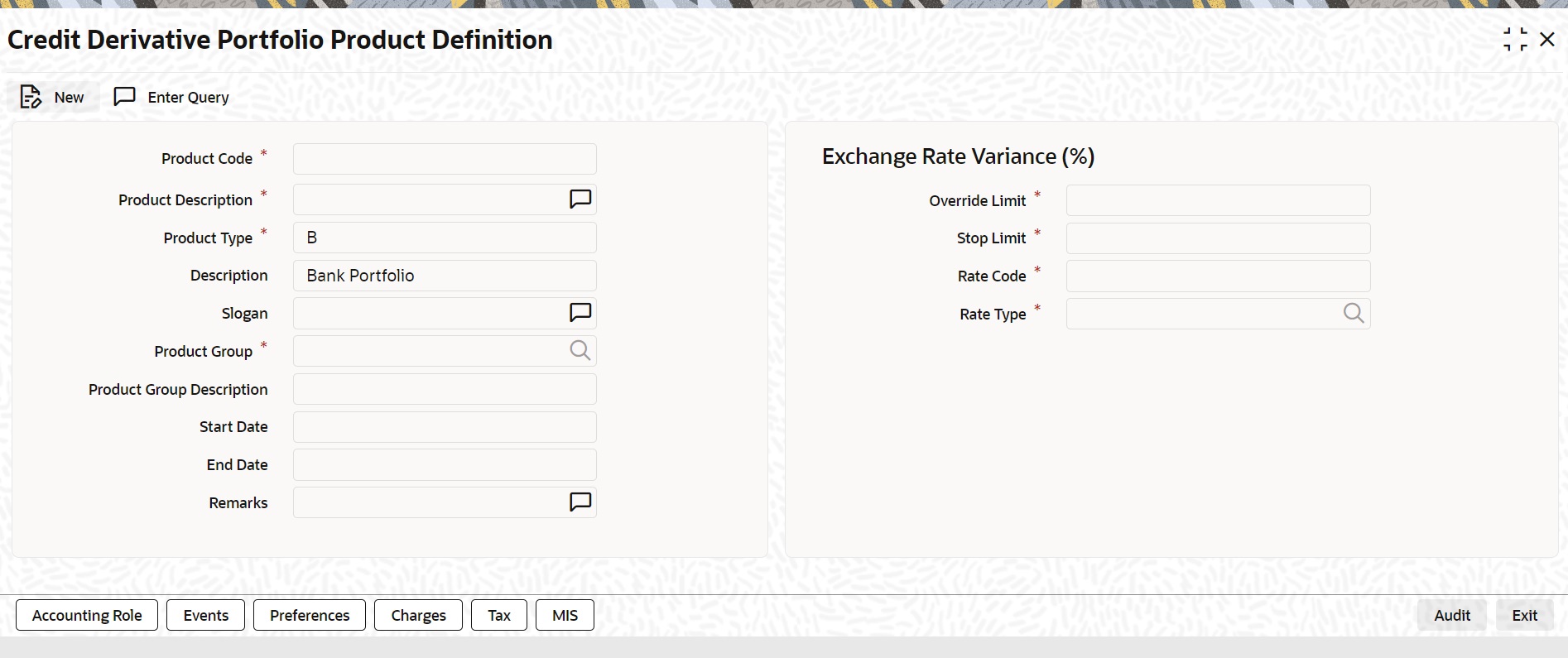

29.4 Credit Derivative Deal Product Definition

This topic describes the credit derivative deal product definition, accounting roles, events, preferences, charges, tax definition, MIS, and market details.

While booking a CDI deal the following four types of deal products are available:

- Bank Sell

- Bank Buy

- Customer Buy

- Customer Sell

The resulting combinations relevant for CDI booking are:

- Bank Sell customer buy (Relevant for purchase of CDI Index)

- Bank buy customer sell (Relevant for sell of CDI Index)

- Bank buy bank sell (Relevant for transfer of holding internally from one SKL to another)

Note:

A CDI buy combination deal product is created using BS and CB product, while a CDI sell combination is created using BB and CS product.

WARNING:

BB and BS combination is used only for internal holdings transfer from one safekeeping to the other.