From this screen, you can choose to view either the:

- Interest

- Net consideration of the deal

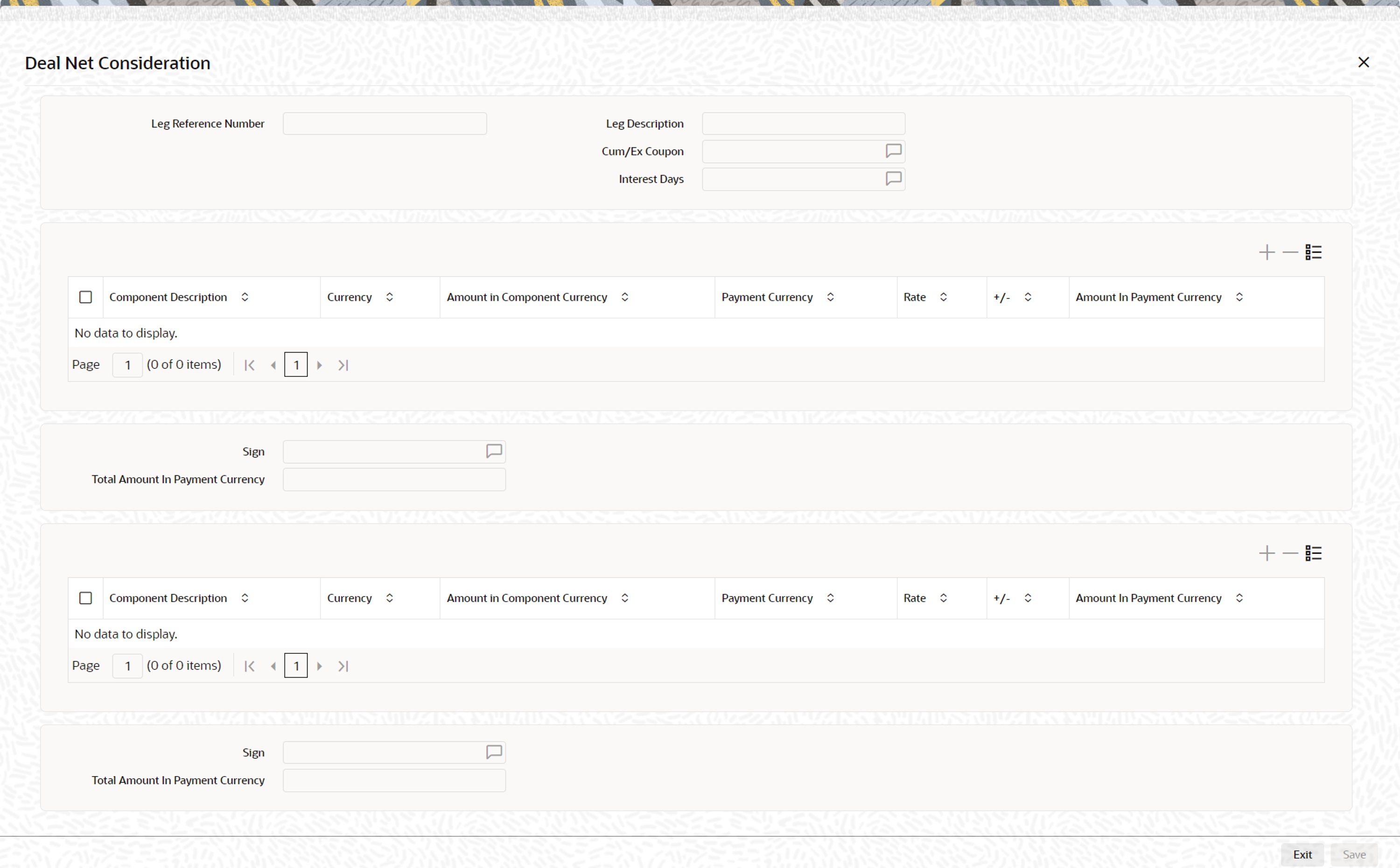

Viewing the Net Consideration

The sum of the different components of a deal determines the net value of the deal. To recall while defining a charge or tax (transaction and issuer) component, you can indicate whether the charge or tax component should be taken into account, when determining the net value of a deal.

All other components of the deal like the interest, premium, discount, forward profit or loss etc will be included in the net consideration of the deal.

- The component in consideration

- The currency in which the component is defined

- The component amount (in the component currency)

- The payment currency of the component

- The payment amount derived using the exchange rate that you specify

- The direction in which money flows. A (+) sign next to a component indicates that the buyer pays the component amount to the seller and a (-) sign indicates that the seller pays the component amount to the buyer.

If the component and payment currencies are different, the default exchange rate used for the conversion is displayed. You have the option to change the exchange rate to be used in the conversion. However, the rate that you specify should be within the exchange rate variance specified for the product to which the deal is associated. The net consideration for the deal expressed in the payment currency is displayed at the bottom of the screen.

Viewing details of the bought or sold interest

Along with other interest details, the interest amount is displayed. This is the amount of accrued interest to be paid or received on the settlement date. The interest is calculated by the system depending on whether the deal is an ex coupon or cum-coupon deal. You have the option to change the amount calculated for the interest and issuer tax components.

Interest is applicable only if:

- It is an interest bearing security

- It is a secondary deal

- Buy or sell type of deal

- Deal type is spot or forward