9.6 Define Deal Limits for a Preference Class

This topic describes the systematic instructions to define deal limits for a preference class.

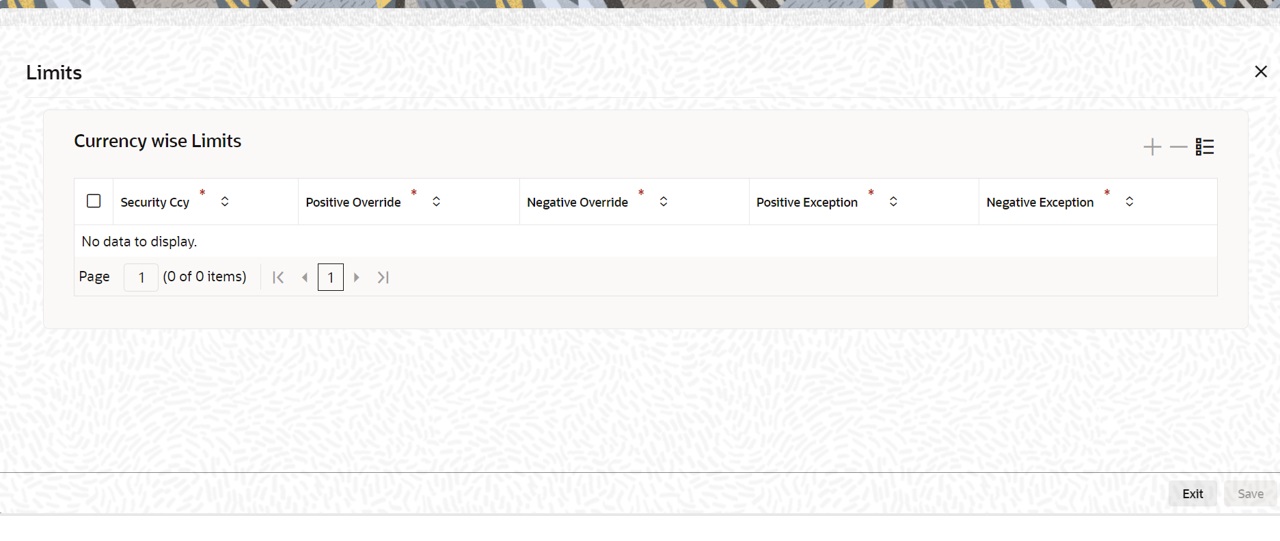

You may not want to sell a security at a deal price that varies beyond a limit, with respect to the market price. In Oracle Banking Treasury Management, you can ensure this by defining currency-wise deal price variance limits for a security preference class. These limits will apply to the securities maintained under products with which you associate the class.

Parent topic: Define Security Preference Classes