18.3.1 Process Bonds and T-bill based on the YTM parameters

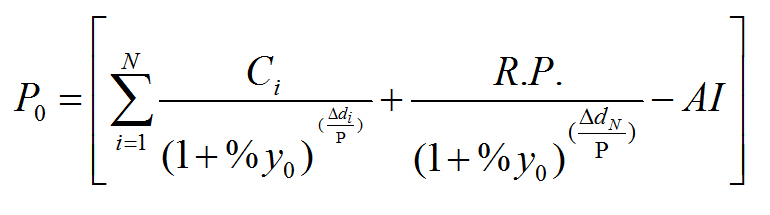

While processing a Bond, if the Price quote is not by ‘Yield to Maturity’, the YTM is computed based on the formula given below:

Where:

- P0 is the Purchase price of the Bond

- N is the Total number of coupons

- Ci is the Coupon payment for coupon i

- y0 is the Periodic YTM

- Y0 is the Annualized YTM

- A is the Day Count Method – Denominator

- n is the Coupons in a Year

- P is the Period of Reinvestment. If Null, defaulted to A/n

- R.P. is the Redemption Price

- AI is the Accrued Interest

- di is the Coupon Date ¡V Value Date

- dN is the Redemption Date – Value Date

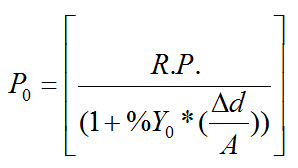

The formula used to calculate the yield given price – for T-Bills (provided you have enabled the Use Bond Formula option), will be

Where

- P0 is the Purchase price of the T-Bill

- R.P. is the Redemption Price

- y0 is the Periodic YTM

- d is the Redemption Date ¡V Value Date

- A is the Day Count Method – Denominator

The following example explains the computation of YTM for T-Bills, using the formula mentioned above.

Table 18-8 Price Table

| Purchase Price | USD 90 |

|---|---|

|

Redemption Price |

USD 100 |

|

Day count method Numerator |

Actual |

|

Day count method Denominator |

365 |

|

Reinvestment Period |

183 days |

|

Redemption Date |

30-June-2003 |

|

Purchase Value Date |

31-Jan-2003 |

|

Annualizing Method |

Simple |

Applying the formula the periodic YTM is calculated as follows:

90 = (100/((1+y0)^(((30-June-2003)-(31-Jan-2003))/183)))

y0 = ((100/90)^ (183/((30-June-2003)-(31-Jan-2003)))) – 1

y0 = 0.1372 or 13.72%

Annual YTM is computed using the relationship given above.

Y0 = 0.14*(365/183)

Y0 = 0.2736 or 27.36%

Refer to the Batch Processing Chapter of this manual for detailed information on End-of-Day processing for Securities with YTM as the as method of accruing Discount or Premium

Parent topic: Specify the Yield Calculation Parameters for a Security