20.1 Process Portfolio Definition Details

This topic describes the systematic instruction to process Portfolio Definition Details.

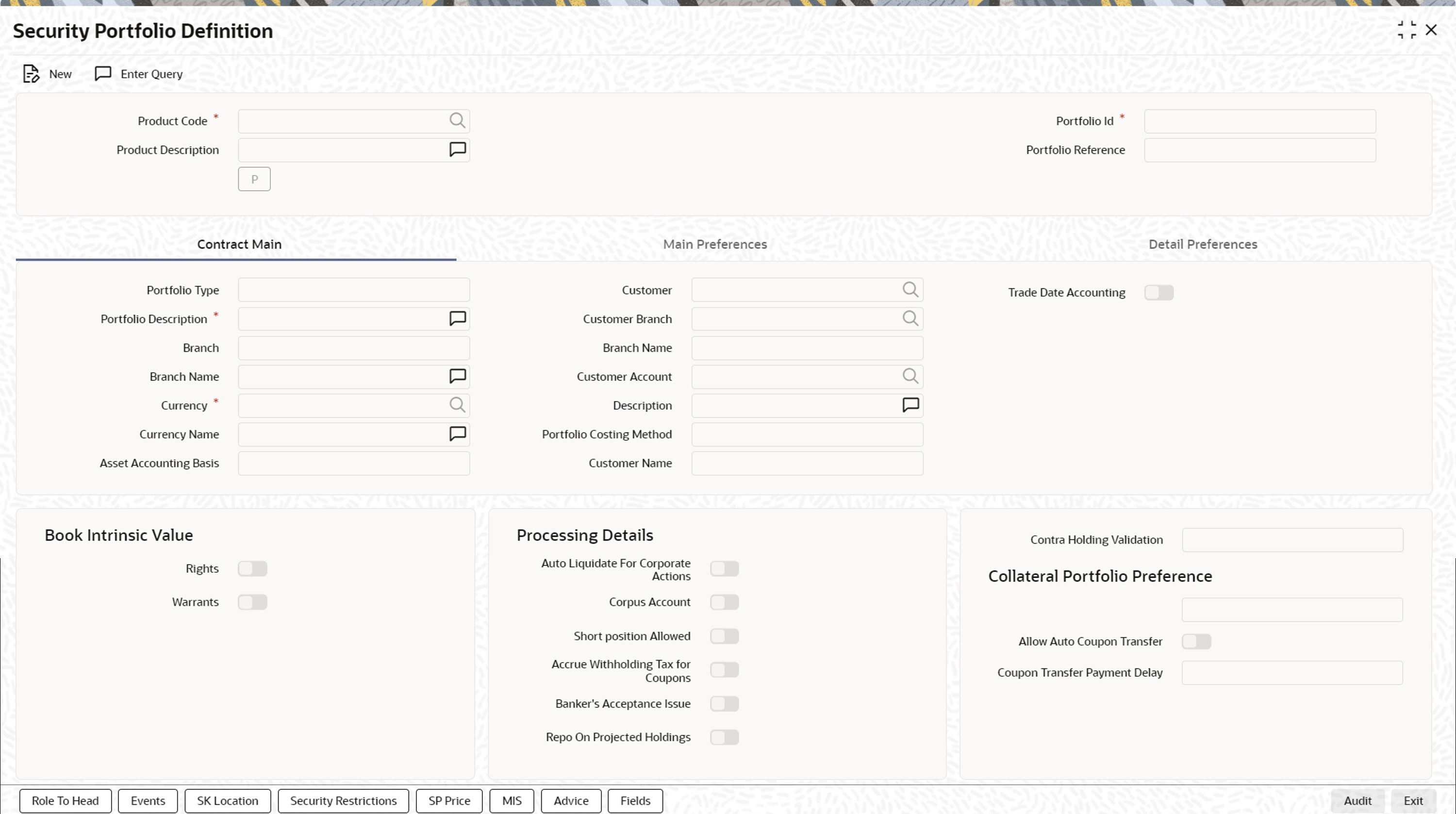

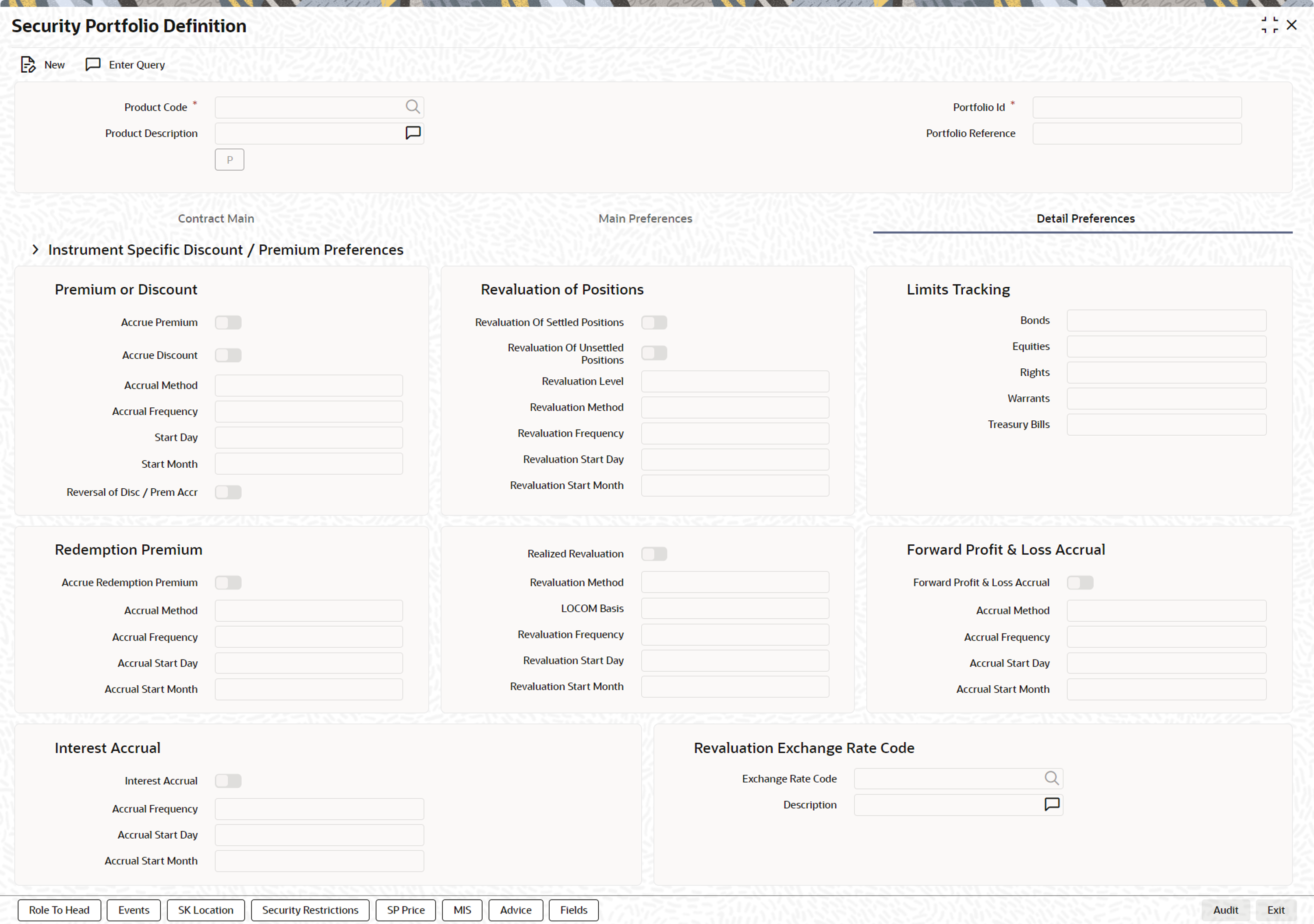

You can invoke the Portfolio Maintenance screen, from the Application Browser. If you are setting up a new portfolio, click new icon on the toolbar. The Portfolio Definition screen is displayed without any details.

Parent topic: Define Portfolio