14.1 Process Security Product

This topic describes the systematic procedures to Process Security Product.

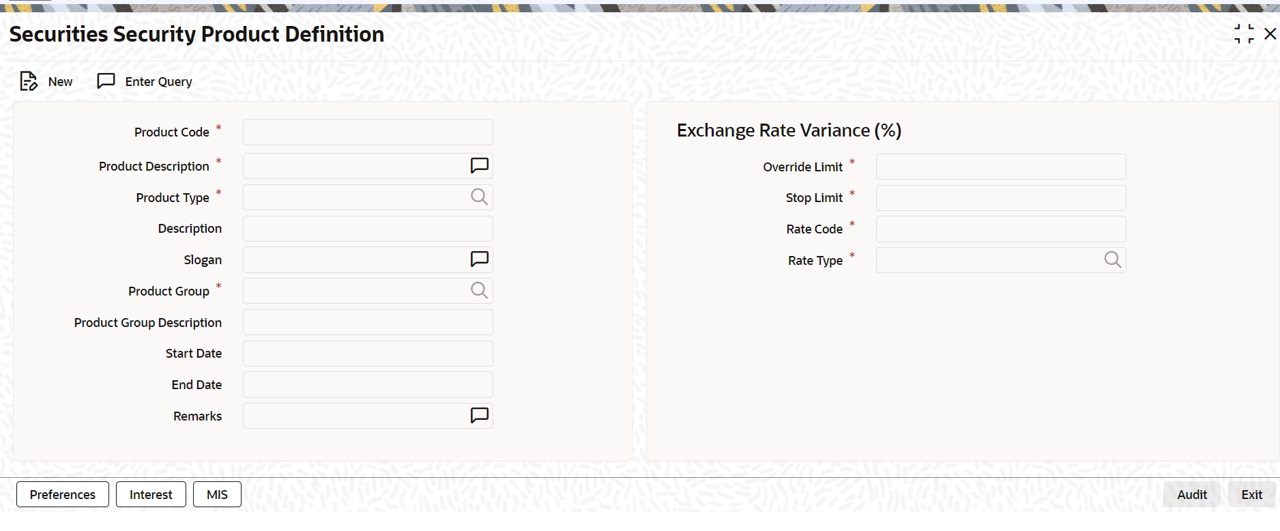

- On the Home page, specify SEDSEPRD in the text box, and click next arrow.

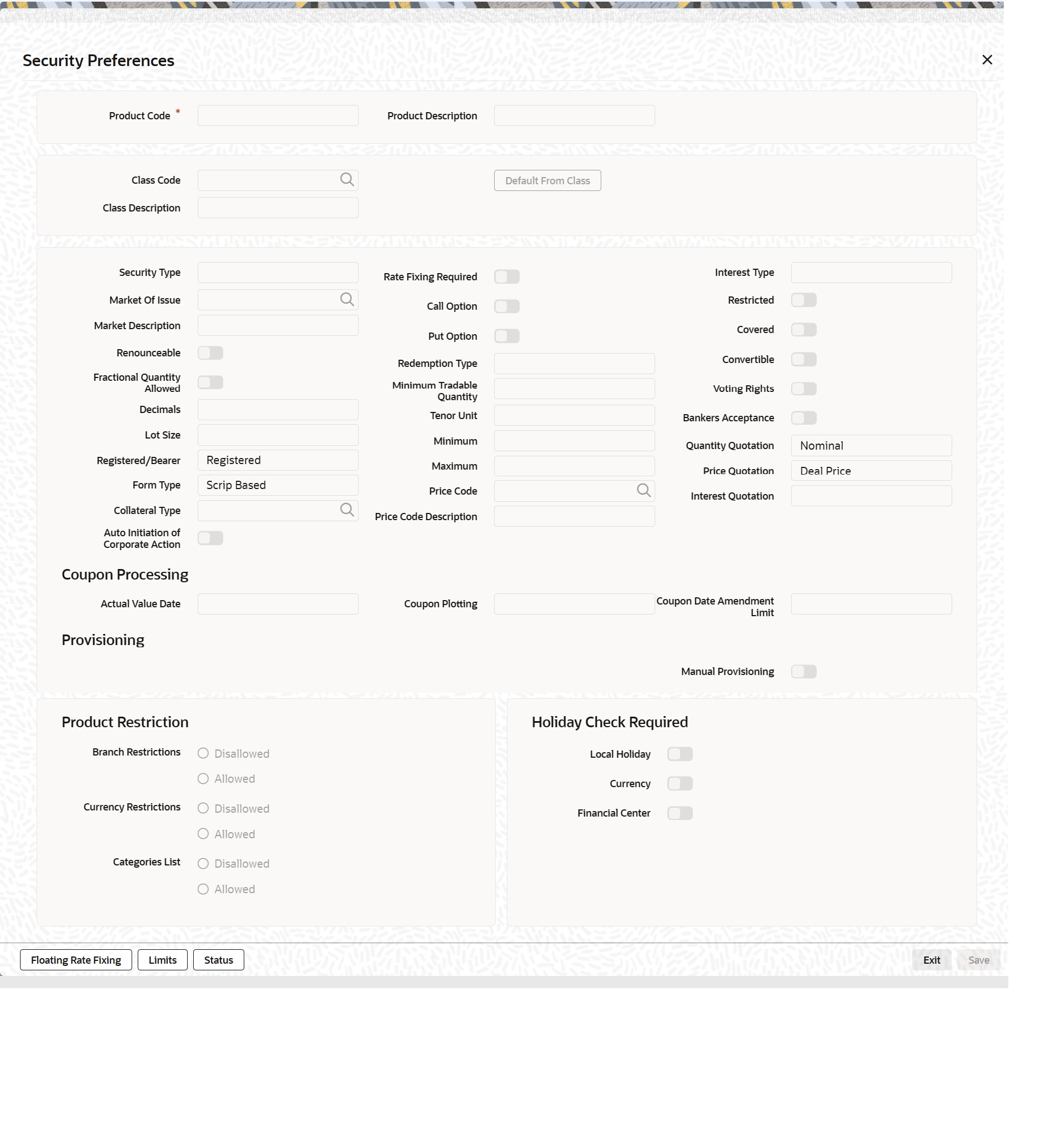

Securities Security Product Definition screen is displayed.

Figure 14-1 Securities Security Product Definition - Field Description

Description of "Figure 14-1 Securities Security Product Definition - Field Description" - On the Securities Security Product Definition screen, specify the fields.

For any product you create in Oracle Banking Treasury Management, you can define generic attributes, such as branch, currency, and customer restrictions, interest details, tax details, etc., by clicking on the appropriate icon in the horizontal array of icons in this screen. For a Portfolio product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this chapter. You can define the attributes specific to a Portfolio product in the SP Product Definition Main screen and the SP Product Preferences screen. In these screens, you can specify the product type and set the product preferences respectively.

For further information on the generic attributes that you can define for a product, refer the following Oracle Banking Treasury Management User Manuals:

- Products

- Interest

- User Defined Fields

- Settlements

Table 14-1 Security Product

Field Description Product Type

The product type identifies the basic nature of a product. A securities product that you create can belong to any one of the following types:

- Bonds

- Zero Coupon Bonds

- Equities

- Rights

- Warrants

Exchange Rate Variance

Define the market price variance that you would like to allow for a security product. This variance is expressed in terms of a percentage. For a special customer or in special cases, you may want to use an exchange rate (a special rate) that is greater than the exchange rate maintained for a currency pair. The variance is referred to as the Exchange Rate Variance. When creating a product, you can express an Exchange Rate Variance Limit in terms of a percentage. This variance limit would apply to all portfolios associated with the portfolio product.

The Override Limit

If the variance between the default rate and the rate input varies by a percentage that is between the Override Limit and the Rate Stop Limit, you can save the transaction (involving the portfolio) by providing an override.

Stop Limit

If the variance between the default rate and the rate input varies by a percentage greater than or equal to the Rate Stop Limit, you cannot save the transaction involving the portfolio.

- On Security Product page, click Preference.

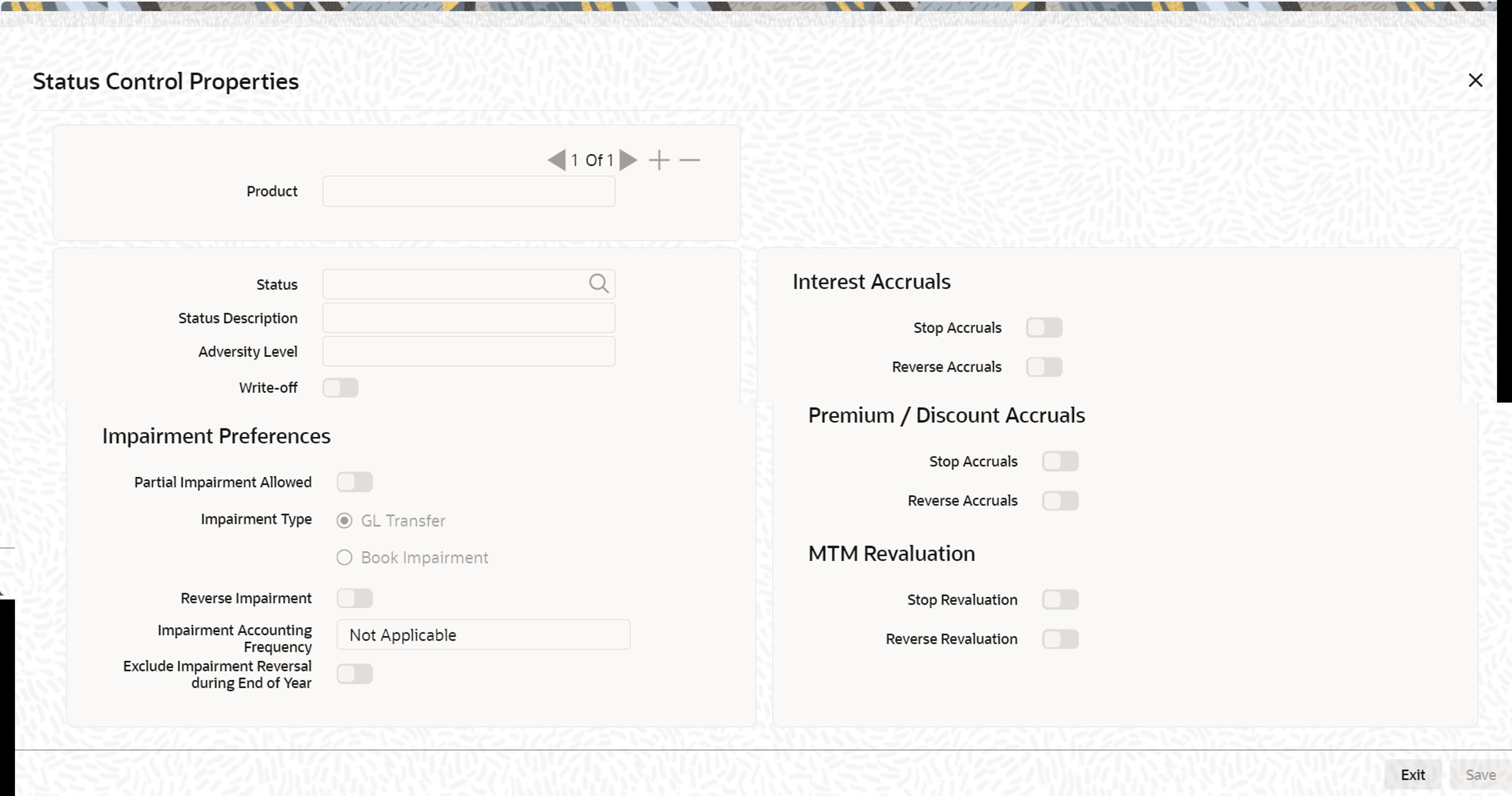

Security Preference screen is displayed.

- On the Security Preference screen, specify the fields.

For more information on fields, refer to the below table.

When defining a product, you can choose to specify preferences for the product by the following methods:

- Associating the product with a Security Preference Class.

- By defining these preferences specifically for the product.

Click the ‘Floating Rate Fixing’ button to display the Floating Rate Fixing Parameter screen. For detailed information on this screen refer to the section, ‘Specifying the Interest Rate Revision Frequency’ in the chapter, ‘Defining Security Preference classes’ of this User Manual. Click the ‘Limits’ button to display Currency Wise Limits screen. For detailed information on this screen, refer to the section ‘Defining deal limits for a preference class’ in the chapter, ‘Defining Security Preference classes’ of this User Manual. For detailed information on each of the attributes please refer to the chapter called Defining Security Preference classes.

Table 14-2 Security Preference - Field Description

Field Description Coupon Plotting

Specify whether coupon events that fall on holidays should be shifted forward or backward. You can also choose not to change the event date even if it is a holiday.

In the Coupon Plotting Holiday Treatment field, you can select from the following options:

- Forward

- Backward

- Ignore

The choice that you make here defaults to the specific securities that you define under this product. Irrespective of the holiday treatment specified by you, the system will not perform any holiday adjustment if, in the Product Event Accounting Entries Maintenance, you select ‘No’ as the Holiday Treatment parameter. A more detailed explanation is available in the Products manual. If the forward/backward shift in a coupon event date entails a movement across months, then the event date will be guided by whether you have allowed/disallowed movement across months in the Branch Parameters screen. For more details and an example, refer to the chapter on Bank and Branch Parameter Maintenance in this manual

Accounting Value Date

Interest calculations and accruals are done till the coupon event date. However, if the coupon event date is a holiday, you can specify whether the actual processing of accounting entries should be shifted forward / backward. You can also choose that the accounting entries shall be passed as of the coupon processing date itself, even though it is a holiday. In the Acct Val Dt Holiday Treatment screen, you can select from the following options:- Forward

- Backward

- Ignore

The choice that you make here defaults to the specific securities that you define under this product. If the forward/backward shift in an accounting value date entails a movement across months,then the value date will be guided by whether you have allowed/ disallowed movement across months in the Branch Parameters screen. A coupon event date falling on a holiday may itself be shifted to the previous or following working day. In that case, holiday treatment for the accounting value date becomes irrelevant. For more details and an example, refer to the chapter on Bank and Branch Parameter Maintenance in this manual.

Coupon Date Amendment Limit

For continuous coupon schedules, the coupon payment dates are automatically populated according to the coupon frequency that you specify while defining security. You can amend these dates within the limit that you specify in the Coupon Date Amendment Limit field. For more details on changing coupon dates for continuous schedules, refer to the Securities Online chapter in this manual.

- On the Security Preferences screen, click Status.

Status Control Properties screen is displayed.

- On the Status Control Properties screen, specify the details as required.

For Information on fields, refer to the below table.

Table 14-3 Status Control Properties - Field Description

Field Description Product

The selected product details is displayed.

Status

Click the search icon and select the status from the list of values displayed.

This field denotes the user defined status code used in the instrument life cycle.

Status Description

The description of the selected status is displayed.

Adversity level

The adversity level of the status is displayed.

Write-off

Select this checkbox to indicate the user defined status is write-off. The Status is changed to Write off

Stop Accruals

Select this checkbox to Indicate the accruals (interest/premium/discount) is discontinued for the selected portfolio.

Reverse Accruals

Select this checkbox to indicate the accruals (interest/premium/discount) is reversed for the selected portfolio, when the status corresponds to this value.

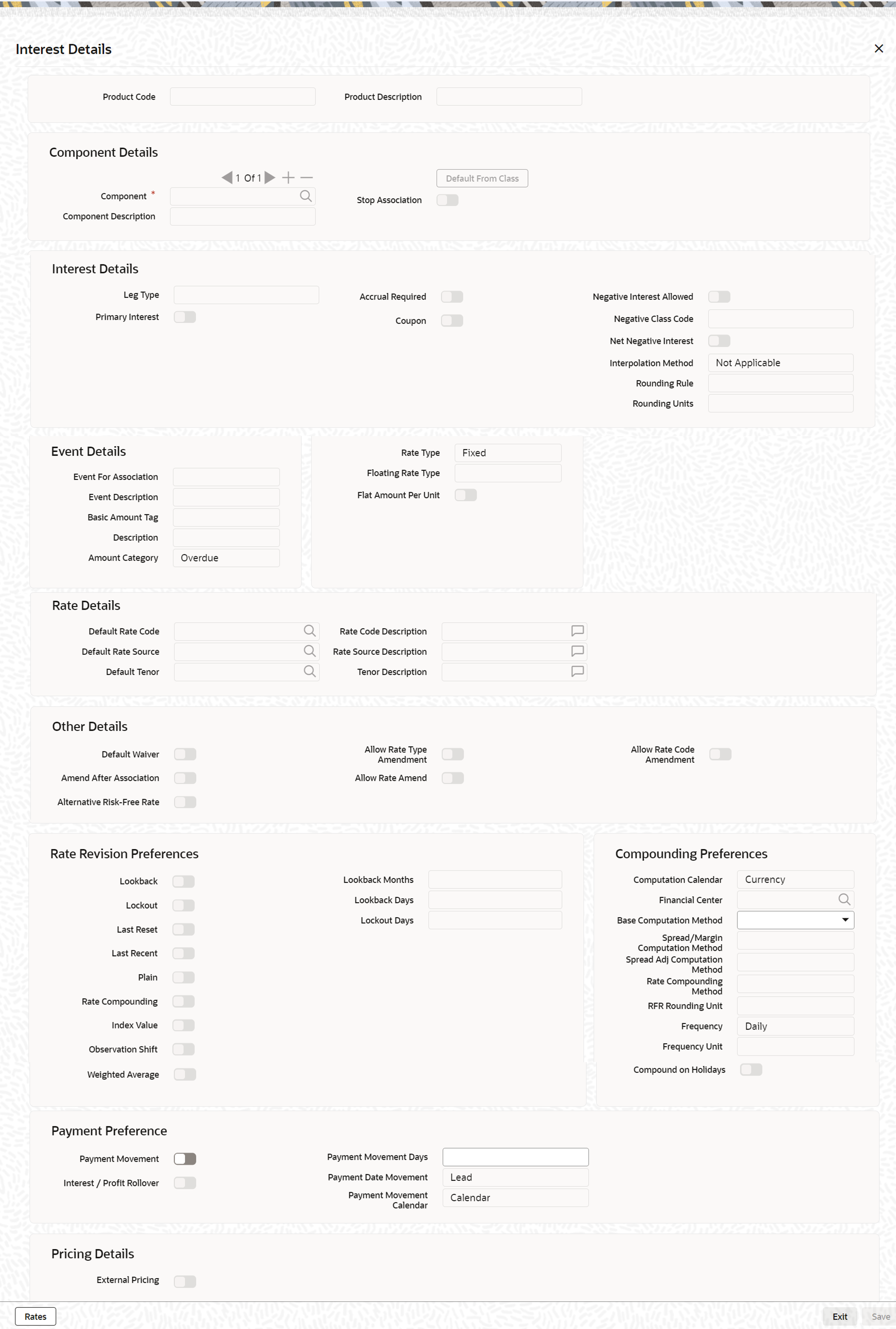

- On the Security Product Definition screen, click Interest.

Interest Details screen is displayed.

- On Interest Details screen, specify the fields.

It contains the following sub-topics: