2.1 Snapshot of the Module

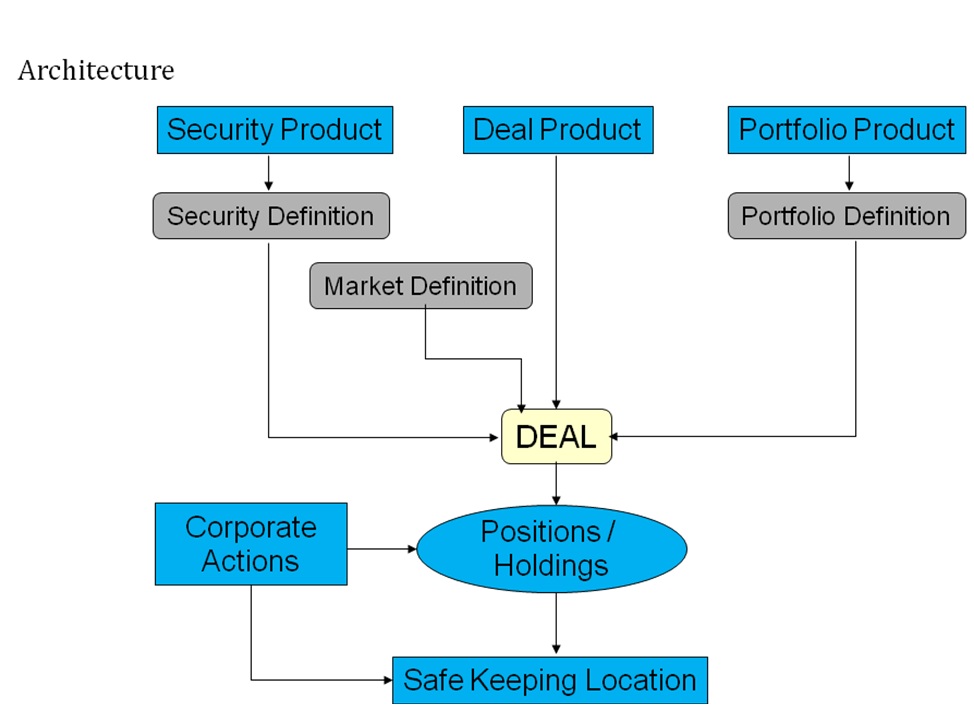

This topic describes the process flow of the Securities module.

The instruments supported

Figure 2-1 Process Flow

- Fixed interest bonds with quantity (staggered), bullet, or series type redemptions, and user-defined coupon schedules supporting different interest methods for accrual and liquidation.

- Flexible interest bonds with quantity, bullet, or series type redemptions, and user defined coupons with synchronous or asynchronous rate revision schedules supporting different interest methods for accrual and liquidation.

- Discounted instruments (Treasury Bills, Zero Coupon Bonds and Commercial Papers)

- Equities

- Rights

- Warrants

Corporate Actions processing supported

Bonds:

- Collection and disbursement of coupons for long and short holdings collected/ disbursed, by batch, from safekeeping location of holding for each portfolio.

- Redemption: processed, by batch, as an auto sell-type deal. The types of redemption supported are:

- Bullet (at premium or face value)

- Quantity (percent of original face value) at a user-defined redemption price for each intermediate redemption

- Series (with user defined series and redemption date and price)

- Warrant events are processed as appropriate auto buy or sell deals between the portfolio and the SK location of the holding.

Equities:

- Cash Dividend (as rate per face value, or value per unit) collected and disbursed, by batch, from the safe keeping location of the holding, for each portfolio.

- Stock Dividend (Bonus) with user-defined resultant security processed, by batch, as a buy deal from the location of holding of the parent security, for each portfolio.

- Partial or full cash conversion, at user-defined encashment price, collected by batchfrom the safe keeping location of the holding, for each portfolio.

- Rights events are processed as appropriate auto buy or sell deals between the portfolio and the SK location of the holding.

Rights and Warrants:

- Tear -off from the parent security at a user-specified ratio.

- Exercise giving a user-defined resultant security at a user-defined ratio and exercise price.

- Automatic expiry on the date specified.

Portfolio features supported:

Bank Portfolio

- Costing basis: Deal Matching, LIFO, FIFO, and Weighted Average Costing.

- Independent accrual option at flexible frequencies.

- Flexible accrual options for forward profit or loss.

- Revaluation using MTM or LOCOM for Settled or Total positions.

- Option to restrict the portfolio from taking a short position.

- Flexible, user-defined accounting entries and advices for each event.

- Facility to specify, upfront, the GLs to which accounting entries for a portfolio product would be posted. You can change the default to suit a specific portfolio maintained under a product.

Issuer Portfolio

- Costing basis is always WAC and the portfolio is always short in the issued security.

- Independent accrual option at flexible frequencies.

- Flexible accrual options for forward profit or loss.

- Revaluation using MTM or LOCOM for Settled or Total positions.

- Option to restrict the portfolio from taking a short position.

- Flexible, user-defined accounting entries and advices for each event.

- Facility to specify, upfront, the GLs to which accounting entries for a portfolio product would be posted. You can change the default to suit a specific portfolio maintained under a product.

Customer Portfolio

- Can attach pre-defined charge components (built with different charge bases, such as the coupon liquidation amount, stock to cash liquidation amount, etc.) to a customer portfolio.

- Specify the notices to be generated for the various corporate actions due on a security in the portfolio

Deal Product Types

The following deal types are supported:

- Buy and sell deals of type bank-to-customer, bank-to-bank, and customer-to-customer

- Rights and warrants ‘exercise’ type deals for bank and customer portfolios

- Lodge and withdraw type deals for customer portfolios

- Block and Release Block type deals for bank and customer portfolios

- Transfer from one SK location to another

Activities Supported through Deal Online are:

- Purchase and sale of securities between bank and customer portfolios, bank and standalone customers, bank and bank, and customer and customer.

- Spot and forward deals can be processed using user-specified market details, rates, trade, and settlement dates bought or sold interest, and deal currency. Most likely values are available as defaults for aiding faster inputs.

- Money settlement, on auto or manual basis, according to pre-defined settlement instructions.

- Deal level messaging based on the parties specified.

- Customer portfolio deals, with accompany withdraw/lodge options, to capture deals by customer portfolio outside bank’s custodial interest.

- Standalone Withdraw/Lodge for customer to handle customer deals struck independently from holdings managed by the bank.

- Repo by bank portfolio/Reverse Repo by the bank to the customer with portfolio (auto-blocking in portfolio of securities and with tracking of the market value of the blocked securities vis-à-vis the contract amount outstanding).

- Block Release Block.

- Transfer across Safe Keeping Locations.

- Facility to change the format of the security.

Parent topic: Overview of Securities