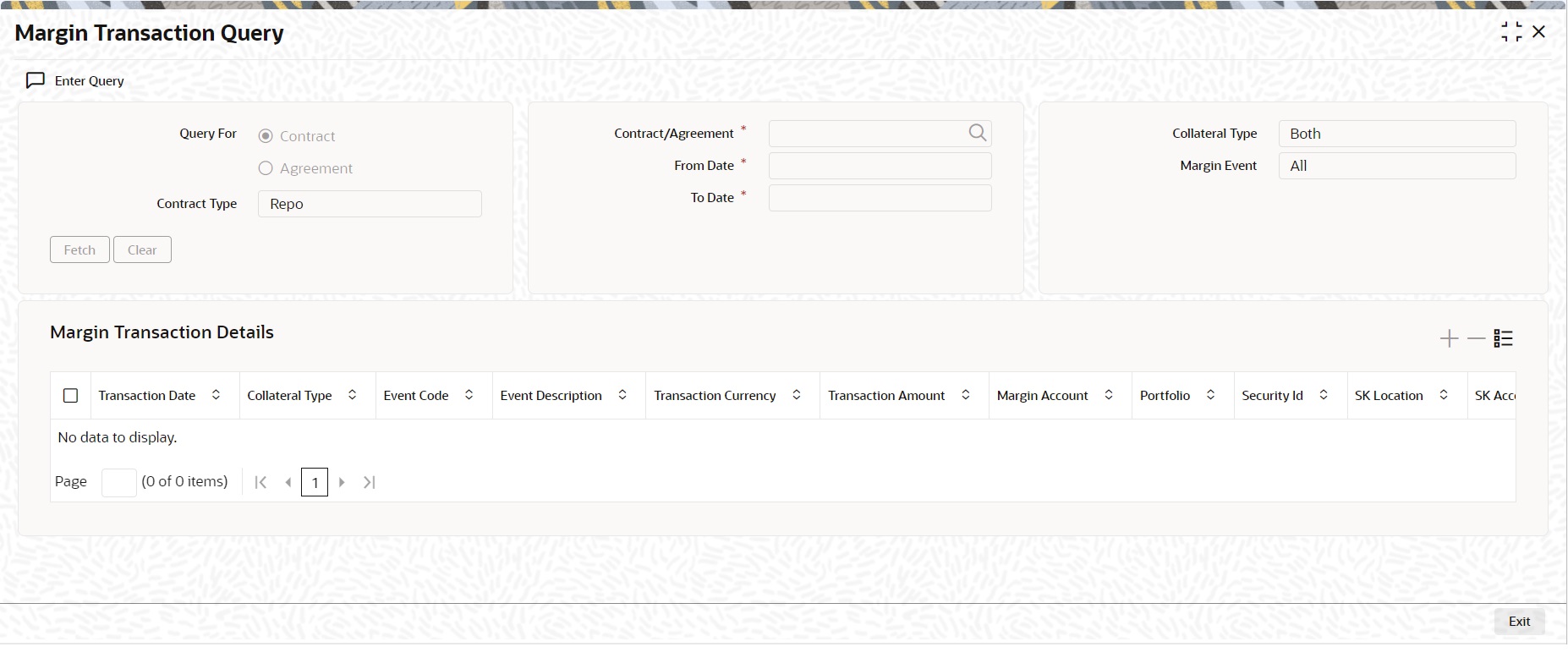

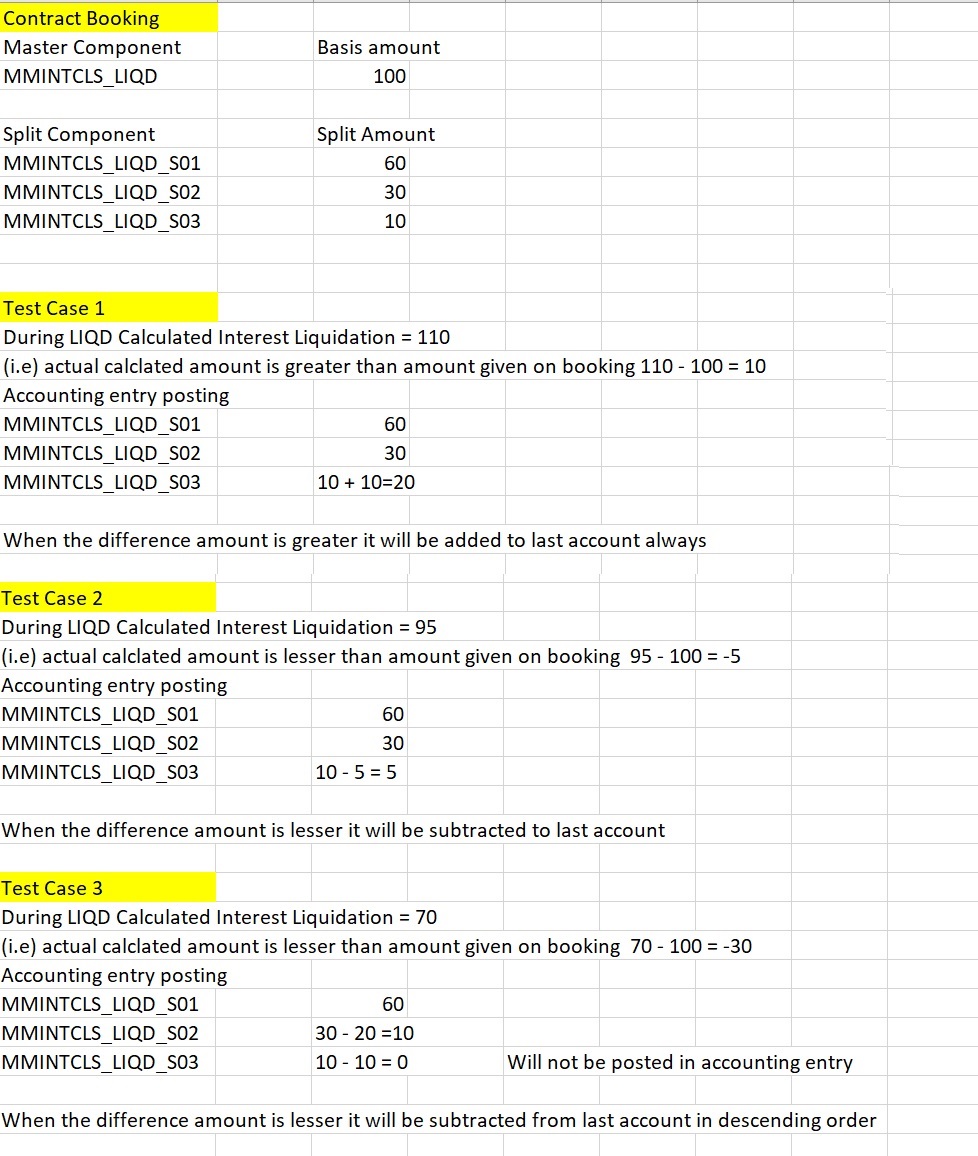

2.7 Capture Details of Repo Contract

This topic describes how to capture details of Repo Contract in the Securities Repo Contract Online.

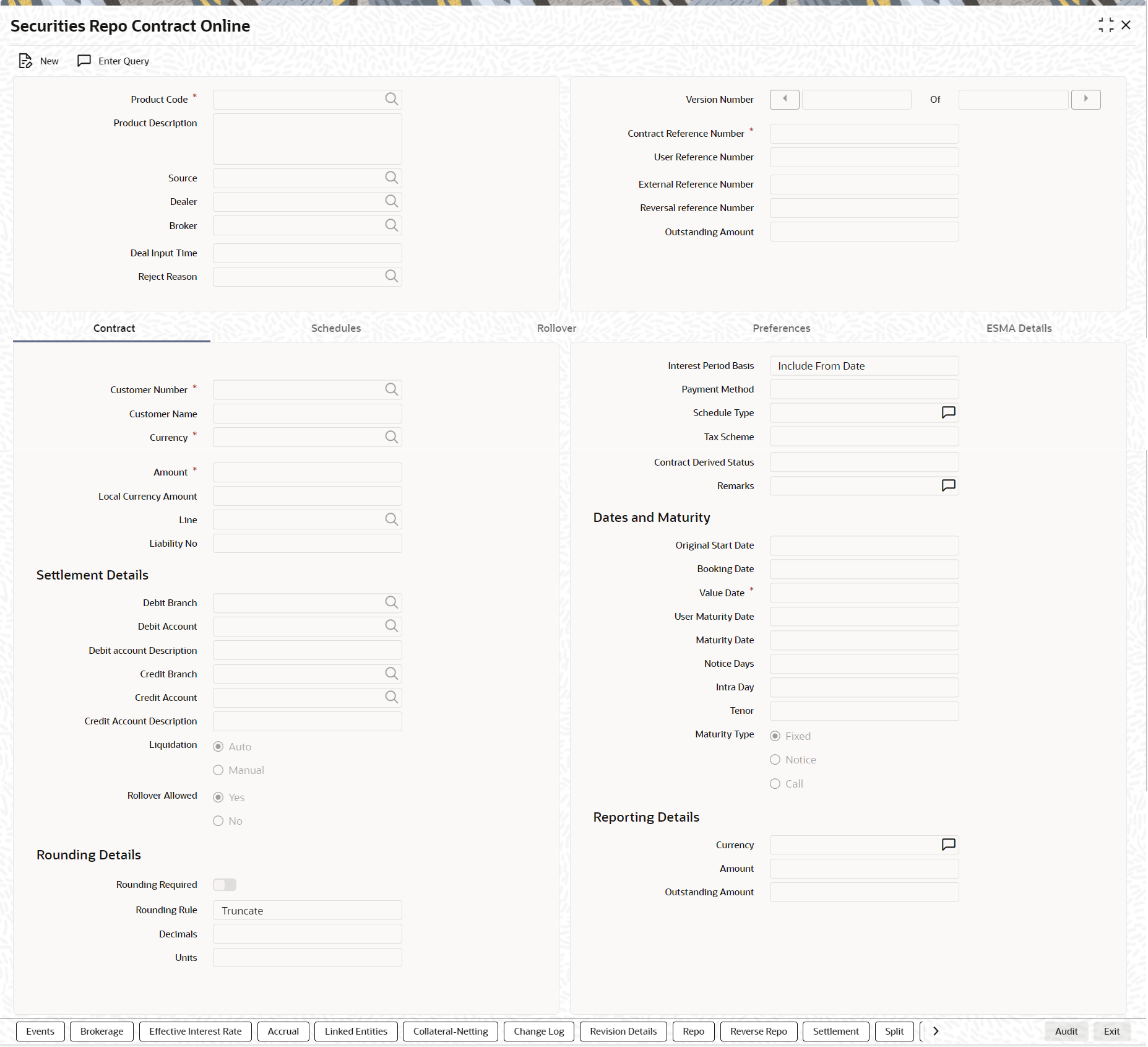

When the user enters into a repo (or reverse repo) deal, the user must associate it with a product that the user has maintained. By default, a deal inherits all the attributes of the product with which it is associated. Most deal details are captured for the product the deal involves. These details default to the deal. The user can capture the details of repo deals in the Securities Repo – Online screen.

- On the Home page, specify SRDTRONL in the text box, and click next arrow.

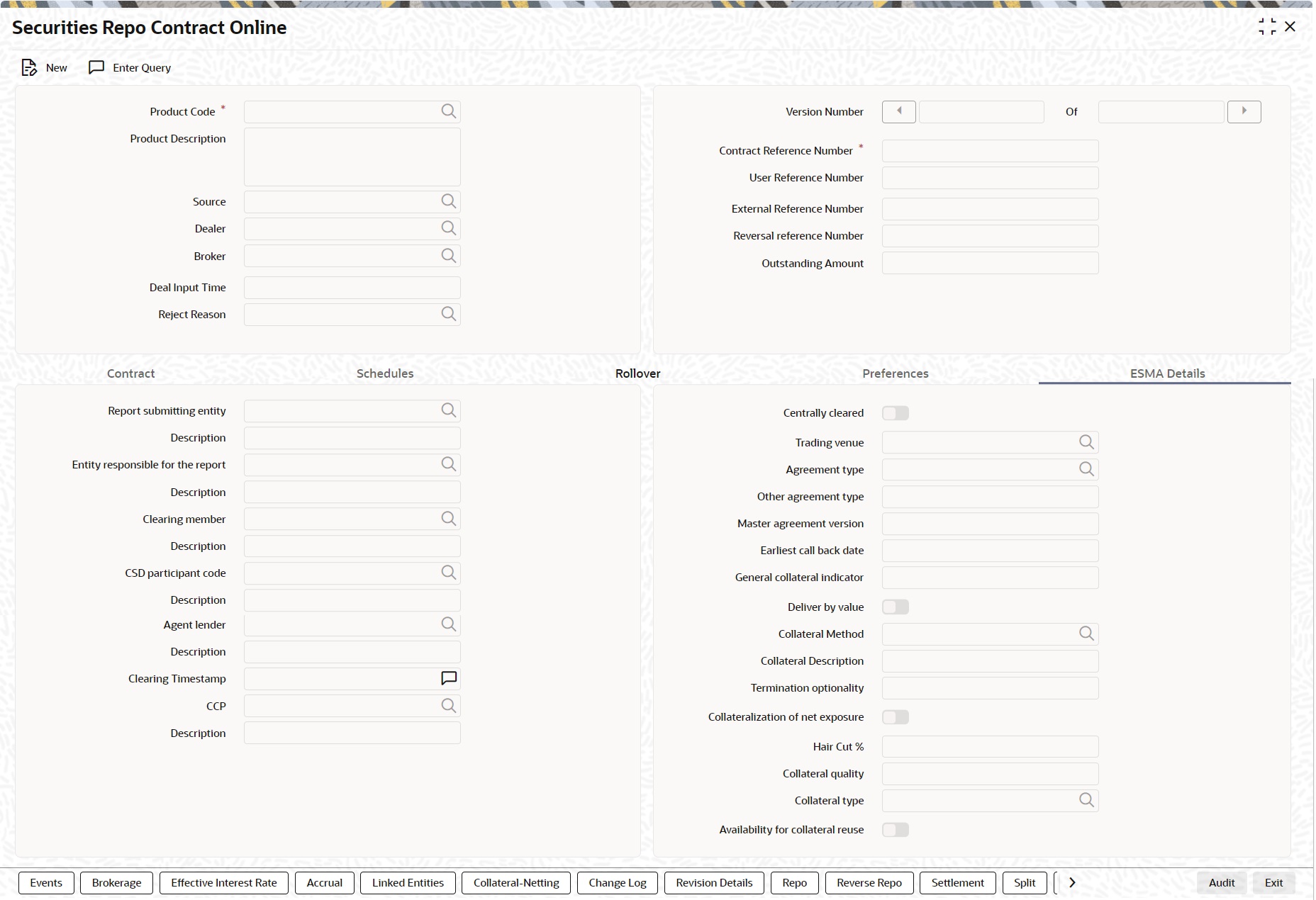

The Securities Repo Contract Online screen is displayed.

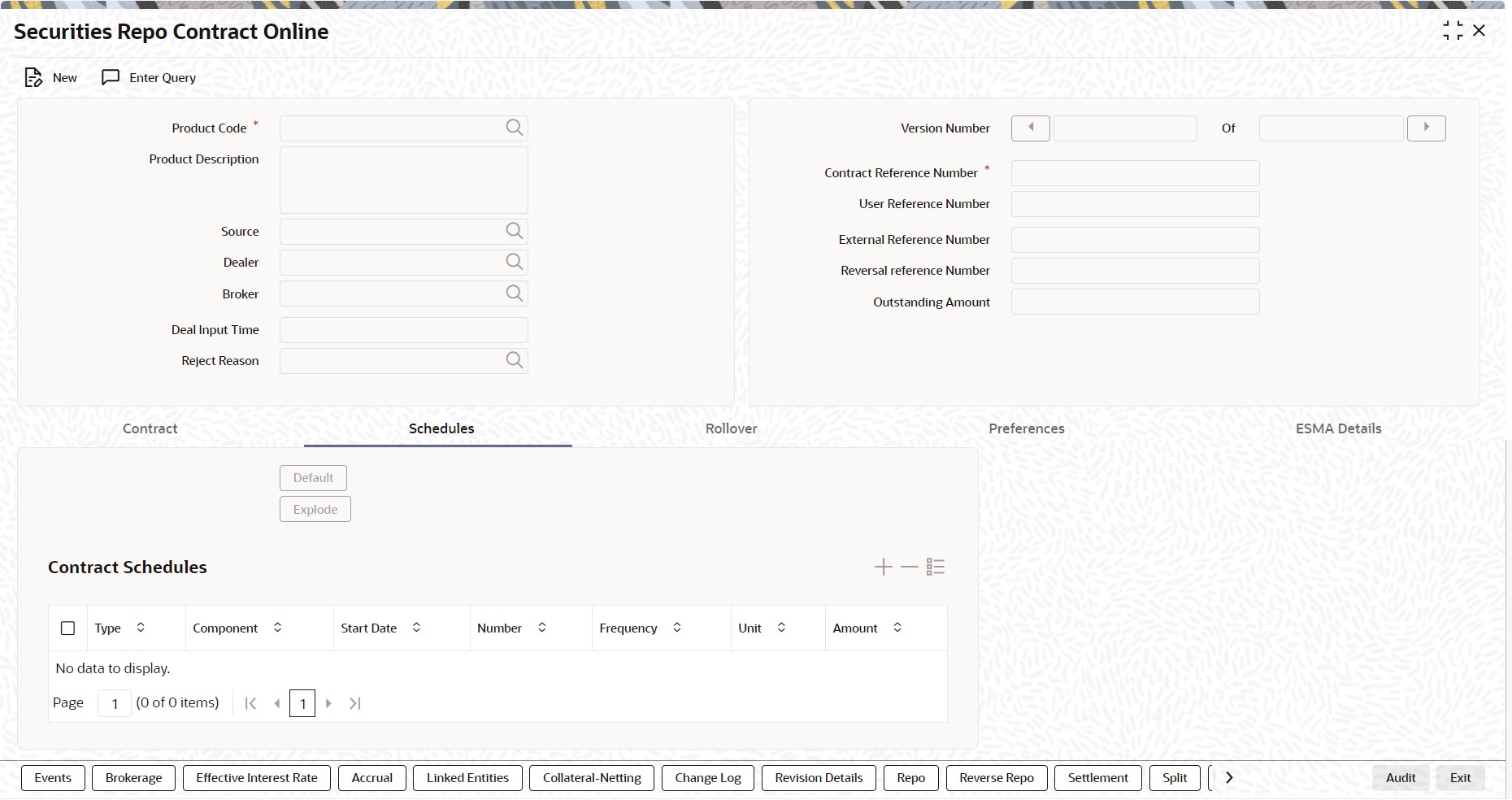

Figure 2-16 Securities Repo Contract Online

Description of "Figure 2-16 Securities Repo Contract Online" - On the Securities Repo Contract screen, specify the fields.

The base number of the counterparty (customer)

- The currency of the contract

- The principal amount (for a deal with True Discounted interest, the user must enter the nominal).

- Securities pledged detail for repo

- Securities received detail for reverse repo

- The credit line under which the reverse repo has to be tracked

- The tenor related details for the deal

- The code of the broker involved

- The dealer involved

- The default settlement account

- The maturity details

- The interest details

- Whether the deal is rolled over

The following details displayed cannot be changed:

- Product type

- Default tax scheme

- Schedule payment method

- Interest type Rollover count

Table 2-19 Security Repo Contract - Field Description

Field Description Product Code

This is a mandatory field

Click the search icon and select the Product code from the list of options displayed.

Product Description

The description of the selected product code is displayed.

Source

Indicate the source from which contracts have to be uploaded.If this value is left null, then the user will not be able to amend the contract. Amendment for the contract can be uploaded only through the same source as that used for creation.

Dealer

Select the Dealer involved in the deal from the list

Broker

Select the Broker involved in the deal from the list

Deal Input Time

This field captures the deal execution time at the time of deal booking received from front office.

Format: YYYY-MM-DD HH:MM:SS:SSS (Default).

Here SSS is milliseconds.

Note: The above date format can be changed in the user setting option based on requirement.

System throws an error when the user gives the wrong date or time format on modification.

Reject Reason

Specify the Reject reason Code for payment reversal message. The option list displays all valid code maintained in the system. Choose the appropriate one. Contract Reference Number

The system automatically generates a Contract Reference Number for each deal. A running serial number, the date in Julian format, the product code, and the branch code are combined to book the deal.

A three-digit branch code, a four-character product code, a five-digit Julian Date, and a four-digit serial number make up the Reference Number.

The Julian Date has the following format:

“YYDDD”

Here, YY stands for the last two digits of the year. and DDD for the number of days (s) that has/have elapsed in the year.

For example, 31 January 1998 translates into the Julian Date: 98031.

On 5 February, the Julian format changes the number 1998 to 98036. This occurs when the number of days that have passed in January is added to the number of days that have passed in February. Therefore, 98036 is determined by the sum of the days in both months.

In case of entity length changes Contract Reference number format will be changed to Product/Process Code (4 char) + Julian Date (5 char) + Sequence Number (7 digits).

User Reference Number

The user can enter any reference number for a deal that the user enter. The deal is identified through this number in addition to the Contract Reference Number generated by the system. No two deals can have the same User Reference Number. By default, the Contract Reference Number generated by the system is taken as the User Reference Number. The user can use this number, besides the deal Reference Number, to retrieve information relating to a deal.

External reference Number

If the transaction is being uploaded from an external source, the user can specify the identification for the transaction in the external source, as the external reference number. The user cannot amend this value post contact save.

Reversed Reference Number

The reference number of the contract that is being reversed and rebooked is displayed here. To enable amendment of SR Contract details Oracle Banking Treasury Management will reverse the old contract and rebook a new contract with the old user reference number and external reference number. The old contract is reversed and a new contract is booked with Reversed FCC ref as the parent contract.

Outstanding Amount

The system displays the total amount due as of the value date.

Customer Number

This is a mandatory field.

Select the customer number from the list of values displayed.

Customer Name

The associated customer name from the selected customer number is displayed.

Currency

This is a mandatory field.

Select the currency from the list of values displayed.

Amount

This is a mandatory field.

Specify the Amount details as per requirement.

If a product has bearing or discounted type of interest, the user must enter the principal of the deal in this screen. For a deal involving a true discounted product, the user must enter the face value (nominal) of the deal. The user can enter “T” or “M” to indicate thousands or millions, respectively. For example, 10T means 10,000 and 10M means 10 million. Amendment to this field is considered a financial amendment.

Note: The amount, which the user enter, would be taken to be in the currency that the user specify as the deal currency.

Local Currency Amount

If the deal amount is in foreign currency, the system displays the equivalent local currency amount.

Line

By default, the user will view the Reverse Repo credit line defined for the customer. The user can change over to another authorized credit line if the user wants to track the Reverse repo under a different line.

During upload, the credit lines for the given Counterparty, Product, Branch, Currency combination are fetched by the system. If there is only one credit line available, the system will display it here. If there are multiple lines found, the field is left blank.

Interest Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification the user made at the product level. The user can choose to change it. The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

The value of interest basis maintained here is used for calculating interest for repo contract.

Payment Method

The payment method defined for the main interest for the product (whether bearing, discounted or true discounted) applies to the contract as well. The method defined for the product is displayed here.

- Bearing: Interest is liquidated on schedule payment date(s).

- Discounted: In this interest payment method, the interest is deducted at the time of initiating the deal.

- True discounted: In this interest payment method, the interest is calculated on the principal of the deal and not on the nominal. All the same, like the discounted method, here too, it is deducted from the principal at the time of initiation of the deal.

Schedule Type

If the user has defined repayment schedules for a product, which is applied to a deal involving the product, automatically. However, the user can change the schedule while processing a deal under the product.

When a deal for which the repayment schedules a changed is rolled over, the new deal can have the repayment schedules defined for the product, or the schedules for the deal.

Tax Scheme

The tax scheme, which has been specified for the product, is displayed in this screen. The tax scheme cannot be changed at the time of deal processing.

Contract Derived Status

The status of placement is indicative of the status of repayments on it. If the user has specified automatic status movement for the placement, it is moved automatically to the status, as per your definition. However, if the user indicates the status change is made manually on the placement, the user can change the status manually in this screen. Even if the user has defined placement with automatic status movement, the user can still change the status manually before the automatic status change is due.

There is another scenario, where the user has defined placement with automatic status moving forward, but manual status movement in the reverse direction. That is, when the conditions for placement being in a particular status no longer exist, if the user has specified manual reverse movement, then the user has to move the placement to the appropriate status manually.

A placement on which the latest repayment has been made is in the Active status. If a payment is outstanding on a placement, its status is changed, based on your requirements of reporting placements with outstanding payments. The different status codes applicable for placement are defined for a product, and it applies to the placement, by default. However, the user can change the status of the contract through this screen.

When the user captures the placement details, the system allows the status Active by default. The user may change it to any of the status codes as per your requirement. While doing manual status change, ensure the status order as defined. For example, the status codes are defined as follows, in that order:

- Active

- Past Due

- Non-accrual

- Write-off

The user cannot change the status of placement from Active to Non-accrual, bypassing Past Due. If the requirement is that the placement has to be put in the Non-accrual status from the Active status, the user must first change the status to Past Due, store and authorize this status change and then change it to the Non-accrual status. If a status change is defined with a change in the GL, the entries are passed for the GL movement.

Remarks

The user can enter information describing the deal that the user is processing. This is available when the user retrieve information on the deal. However, this information will not be printed on any advice printed for the customer's benefit. This information is displayed whenever the user retrieve information on the deal either as a display or in print.

Settlement Details Specify the Settlement Details. Debit Branch

When selecting the settlement details of a deal, the user must specify the debit account Branch.

Debit Account

Specify the account to be debited for the money market deal.

Debit Account Description

The system displays the description of the specified debit account number based on the details maintained at 'Customer Account Maintenance' level.

Credit Branch

When selecting the settlement details of a deal, the user must specify the credit account branch.

Credit Account

Specify the account to be credited for the money market deal.

Credit Account Description

The system displays the description of the specified credit account number based on the details maintained at 'Customer Account Maintenance' level.

Liquidation

When setting up a product, the user specify the mode of liquidation, whether automatic or manual, for the different components of a deal. By default, all deals involving the product will inherit this definition. However, the user can change the mode of liquidation, from automatic to manual, or vice versa, while processing a deal.

Select the type of the Liquidation required.

The options are:

- Auto

- Manual

Rollover Allowed

Select the option if the Rollover is required or not.

While setting up a product, if the user specify the deals involving the product are automatically rolled over, all deals involving the product are rolled over on their respective Maturity Dates, if they are not liquidated. This feature is called auto rollover. If the auto rollover is specified for the product, the deal involves, it is indicated on this screen. However, if the user does not want the deal (whose details are being captured) to be rolled over, the user can disallow rollover for the deal. If rollover has been disallowed for a product, the user cannot rollover deals involving the product.

Note: For rollover to be applicable for the deal, it has to be defined for the product.

Original Start Date

For a deal that has been rolled over, this is the date on which the deal was originally initiated. If a deal has been rolled over more than once, this is the date on which the first deal was initiated.

If the users enter a deal that has already been initiated, the user must enter the date on which the deal began. In this case, the date is for information purposes only and for all accounting purposes the Value Date is considered as the date on which the deal was initiated.

Booking Date

The date on which the deal details are entered would be displayed in this screen. This defaults to the system date (today’s date). This date is for information purposes only. The accounting entries are passed as of the Value Date of the deal (initiation date of the deal). Amendment to this field is considered a financial amendment

Value Date

This is the date on which a deal takes effect. The accounting entries for the initiation of the deal is passed as of this date. The tenor of the deal will begin from this date, and all calculations for interest and all the other components based on tenor is made from this date onwards.

The system defaults to today’s date. The user can enter a Value Date of your choice here. The date that the user enter is any one of the following:

- Today’s date

- A date in the past

- A date in the future (the user can enter a date in the future only if Future Dating has been allowed for the product).

The Value Date must not be earlier than the Start Date or later than the End Date defined for the product involved in the deal. In case of a child rolled over the contract, this value is the same as the maturity date of the parent contract.

If the liquidation date for any component falls before today’s date, the liquidation entries (as defined by the user for the product) is passed if the user has specified for the product. If the Maturity Date of a deal is earlier than today, maturity entries are passed.

Once the deal details have been stored and authorized, this date is amended, if the deposit has a bearing type of interest and NO schedule has been liquidated. Modification to this field is considered as a financial amendment.

An override is sought if the Value Date falls on a holiday, in the country of the deal currency.

User Maturity Date

Change the maturity date of the deal here, based on the requirement.

Maturity Date

If the Maturity Type is fixed (that is, the Maturity Date of the deal is known when the deal is initiated) specify the Maturity Date. This date must be later than the Start Date of the product. If the product has a Default Tenor, this date is defaulted based on the tenor and the From date of the contract. If the user change this date, an override must be provided while saving the deal.

For a deal with Call or Notice type of maturity, the Maturity Date is not entered at the time of deal booking. The user can get this date updated through value dated amendment. This date must be later than the Start Date of the product.

If the product has a Default Tenor, this date is defaulted based on the tenor and the From date of the contract. If the user has specified auto liquidation for the deal, liquidation is done automatically on that date. If manual liquidation has been specified, the user will have to liquidate the deal through the Manual Liquidation function manually.

For a deal with Fixed Maturity Type, this date can either be extended or brought backwards through the Value Dated Changes function, once the deal has been initiated.

Notice Days

For a contract maturing at notice, the user must enter the notice period (in days). This is for information purposes only. When the notice to repay is issued to the counterparty, the user must indicate the Maturity Date of the deal using value dated amendment screen.

Intra Day

For Intra-day deals, the system populates the intra-day deal date in this field. The intra-day deal date is populated as value date +1. Only the user can enter intra-day deals using a product meant for intra-day deals (as set in the Product Preferences).

Tenor

If the product has a Default Tenor, this tenor is defaulted based on the tenor. On overriding this maturity date will get adjusted.

Maturity Type

Select the Maturity type from the options as required.

The Options available are:

- Fixed

- Notice

- Call

Rounding Details Specify the Rounding Details fields. Rounding Required

Select the checkbox if the Rounding process is required

Rounding Rule

Select the Rounding Rule from the drop-down box.

Decimals

Specify the decimal point to be rounded.

Units

Specify the Units to be rounded.

Reporting Details Specify the Reporting Details fields. Currency

Select the reporting currency from the option list.

Amount

The system displays the amount.

Outstanding Amount

The system displays the total amount due as of the value date.

- On Security Repo Contract Online screen, click Schedules.

The contract inherits the schedule details from the associated product where the changes are allowed at the contract level.

The Security Repo Contract Online- Schedules Tab details is displayed.

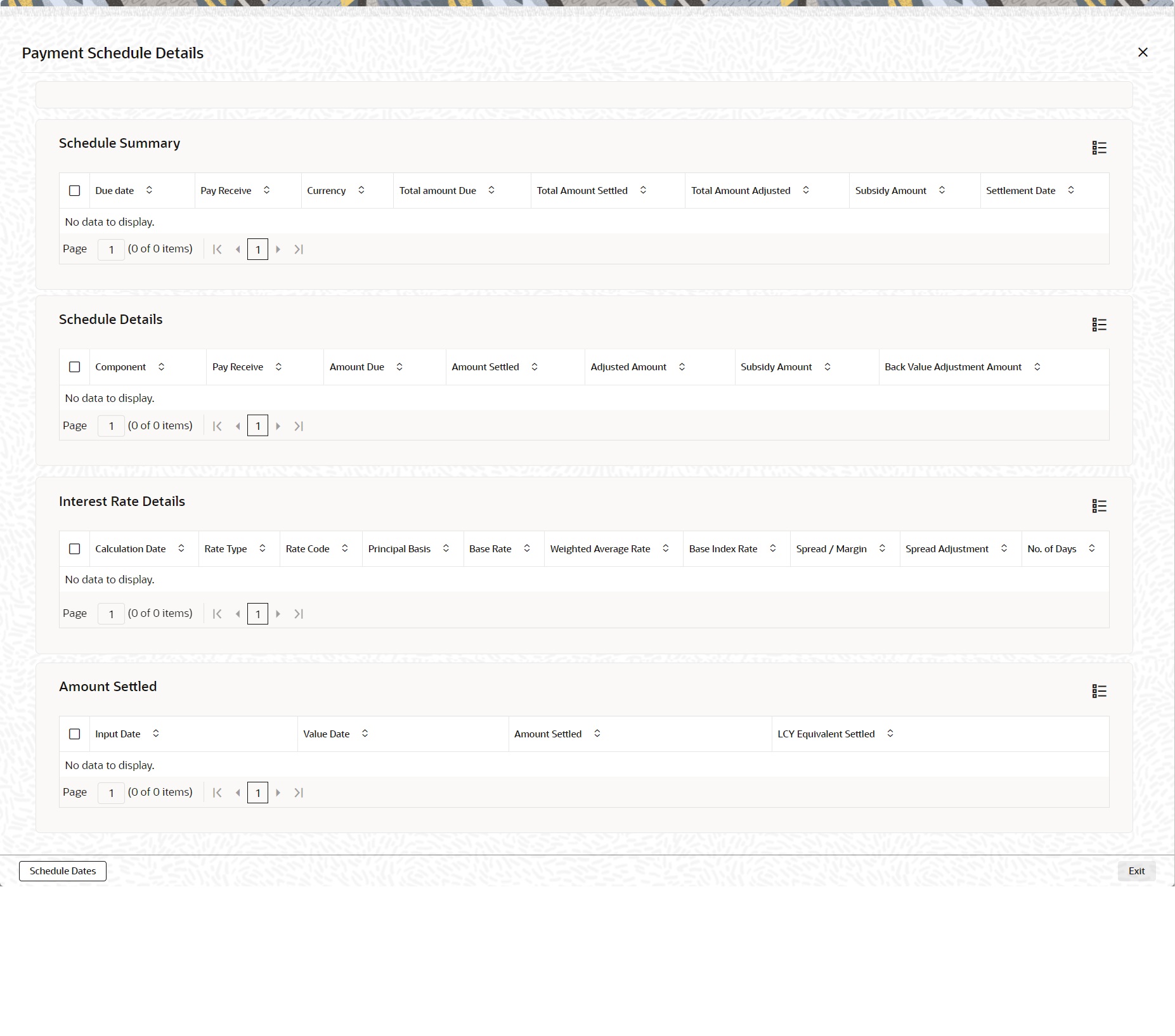

Figure 2-17 Security Repo Contract Online - Schedules

Description of "Figure 2-17 Security Repo Contract Online - Schedules" - On the Security Repo Contract Online - Schedules Tab screen, click Explode.

The Payment Schedule Details screen is displayed.

Description of the illustration srdtronl__payment_schedule.png - On the Payment Schedule Details screen, refer to the provided payment schedule break-up.

The following details are available:

Table 2-20 Schedule Breakup- Field Description

Field Description Schedule Summary

- Due Date after applying payment delay

- Pay Receive

- Currency

- Total Amount Due

- Total Amount Settled

- Total Amount Adjusted

- Subsidy

- Amount

Schedule Details

- Component

- Pay Receive

- Amount Due

- Amount Settled

- Adjusted Amount

- Subsidy Amount

- Back Value Adjusted Amount

Interest Rate Details

- Calculation Date

- Rate Type

- Rate Code

- Principal Basis

- Base Rate

- Base Index Rate

- Spread/Margin

- Spread Adjustment

- No. of Days

- Compound Interest

- Simple Interest

- Total Interest

- Cumulative Interest

- Rate Pickup Date

Amount Settled

- Input Date

- Value Date

- Amount Settled

- LCY Equivalent Settled

- On the Security Repo Contract Online - Schedules Tab screen, specify the details as required.

For information on fields, see the table below:

Table 2-21 Schedules Tab- Field Description

Field Description Contract Schedules Specify the Contract Schedules details. Type Specify the Type of schedule maintained for the contract.

Component

Specify the Component for which schedule is build.

Start Date

Specify the start date of the schedule.

Number

Specify the number of schedule for each component.

Frequency

Select the schedule frequency from drop down value

- Bullet

- Daily

- weekly

- Monthly

- half yearly

- Quarterly

- Yearly

Unit

Specify the Units for each frequency

Amount

System defaults the component amount for each schedule

Contract Linkages Specify the Contract Linkages details. Type

Specify the Contract linkage type

Linked To Account

Specify the linked account

Currency

System defaults the currency linked to the account

Available Amount

System defaults the available balance of the linked account

Exchange Rate

System defaults the currency exchange rate

Linked Amount

Specify the linked amount.

- On the Security Repo Contract Online screen, click Rollover.

The Security Repo Contract Online- Rollover Tab details is displayed.

Figure 2-18 Security Repo Contract Online- Rollover

Description of "Figure 2-18 Security Repo Contract Online- Rollover" - On the Security Repo Contract Online - Rollover Tab screen, specify the details as required.

For more information on Rollover process, refer to the below table.

For information on fields, see the below table:

Table 2-22 Security Repo Contract Online - Rollover Tab - Field Description

Field Description Rollover Amount

Specify the option for the Rollover Amount from the drop down list as required. The options are:

- Principal

- Principal + Interest

- Principal + (Interest - tax)

Special Rollover Amount

Specify the special amount if applicable

Treat Special Amount As

If the Special amount is specified, from the following options specify the what must it be treated as:

- Rollover Amount

- Liquidation Amount

- Maximum Rollover Amount

- Ignore

Daily Refinance Rate

Specify the refinance rate as per the requirement.

Rollover Specify the Rollover details. Roll By

Select the option from the drop-down list.

The options available are:

- Days

- Months

- Quarters

- Semiannual

- Years

Method

Select the Method from the drop-down list.

The options available are:

- Normal

- Split

- Consolidated

Mechanism

Select the Mechanism from the drop-down list.

The options available are:

- New Version

- Spawn Contract

- Linked Contract

Mode

Select the Mode as required.

The options are:

- Auto

- Manual

ICCF Rollover

Select the ICCF Rollover details as required:

The options are:

- Product

- Contract

Schedule Basis

Select the Schedule Basis details as required.

The options are:

- Product

- Contract

Preferences Specify the Preferences details. Apply charge on Rollover Amount

Select this Check box if charge is applied on Rollover

New Components Allowed

Select this Check box if new component is allowed for the rolled over contract

Liquidate Overdue Schedules

Select this Check box to liquidate over due schedules on rollover

Apply Tax on Rollover Amount

The user must indicate if the tax must be applied on the rolled over deal.

Update Limits Utilization

Whether the credit limit utilization is to be updated when a reverse repo deal is rolled over, that is, the interest that has been accrued on reverse repo is also considered as a part of the ‘utilized amount’ for the purpose of risk tracking. This option applies only if the user wants to roll over a deal with interest.

Maturity Specify the Maturity details. Maturity Days

Specify the new maturity days for rolled over contract.

Maturity Date

Specify the new Maturity date for the rolled over contract.

Maturity Type

Select the Maturity Type as required.

The options available are:

- Fixed

- Notice

- Call

Interest Basis Specify the Interest Basis details. Component

System defaults the component which is to be rolled over.

Basis

Select the option from the drop-down list as required.

The options available are:

- Product

- Contract

- User Rate

Rate Type

Select the rate type from the drop-down list.

The options available are:

- Fixed

- Floating

Code Usage

Select the Code Usage from the drop-down list.

The options available are:

- Auto

- Periodic

Interest Basis

Select the Interest Basis from the drop-down list.

The options available are:

- 30-Euro/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30-Euro/Actual

- 30(US)/Actual

- Actual

Rate Code

Specify the new rate code for rolled over contract when the basis is user

Spread

Specify the new spread for the rolled over contract when the basis is user

Margin

Specify the new margin for the rolled over contract when the basis is user

Amount

Specify the new Interest amount for the rolled over contract when the BASIS is user.

Tenor

Specify the new tenor for the rolled over contract

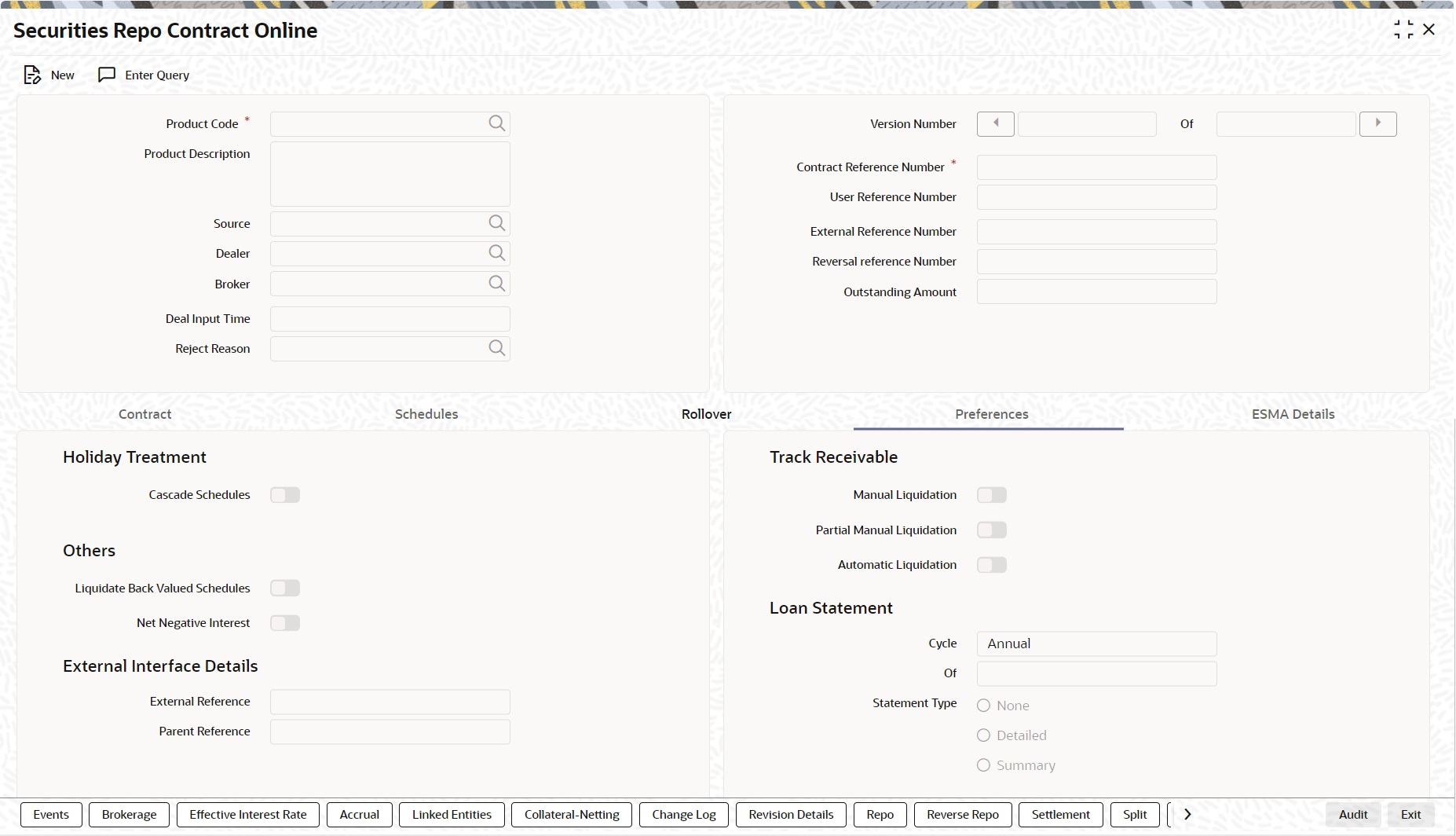

- On Security Repo Contract Online screen, click Preferences.Preferences are options. For instance, for a product, the users have the option of:

- Making liquidation automatic or manual

- Allowing or disallowing rollover

- Applying tax or waiving it

- Applying prepayment penalty or waiving it etc

- Generation of Deliver verse Payment message

- Generation of Receive verse payment message

- Giving Cash margin details

The Security Repo Contract Online - Preference tab details is displayed.

Figure 2-19 Security Repo Contract Online - Preference

Description of "Figure 2-19 Security Repo Contract Online - Preference" - On the Preferences tab, specify the details as required.

For information on fields, see the table below:

Table 2-23 Securities Repo Contract Online - Preference Tab - Field Description

Field Description Holiday Treatment

Specify the Holiday Treatment details. Cascading schedules Select this check box, if one schedule is moved backwards or forward because of a holiday, the other schedules are accordingly shifted. If the user does not want to cascade schedules, then, only the schedule, which falls on a holiday, is shifted as specified and the others will remain as they were.

Move Across Months

Select this check box, if the user needs to move a schedule falling due on holiday either forward or backwards to the next or previous working day and it crosses over into a different month, then the system moves the scheduled date. If not, scheduled date is kept in the same month, on the last or first working day of the month, depending on whether the schedule is over the month-end or the beginning of the month.

Move Payment Schedule

Select this box, if user needs to move the payment schedule. When the system computes the repayment date, there is a chance that one or more schedules fall due on holiday.

Move Revision Schedules

Select this box, if user needs to move the Revision schedule falling on a holiday

Move Forward

Check against this field to indicate that the schedule of the contract must be moving forward to the next working day.

Move Backward

Check against this field to indicate that the scheduled date of the contract is moved back to the previous working day.

Others Specify the Others details. Liquidate Back Valued Schedules

Select this checkbox to define the product, that a back-dated deal with repayment schedules before today's date, the schedules are liquidated when the deal is initiated, the same will apply to the deal the user is entering. However, through this, the user can choose not to liquidate back valued schedules.

Net Negative Interest

Check this box to indicate that the system should internally net the positive and negative amounts being paid to the customer during interest liquidation.

Track Receivable Specify the track receivable fields. Manual Liquidation

Select this option to track receivables during manual liquidation. In case of manual payments, the system will display an override if sufficient funds are not available in the settlement account. If the user say Yes to the override, the system will mark the fund as a receivable amount.

Partial Manual Liquidation

During manual liquidation, if sufficient funds are not available in the settlement account of the contract, the user can opt to make a partial payment. In this case, the deal is liquidated to the extent of the amount available in the account. The balance due is tracked as a receivable amount. During EOD processing of the contracts, based on the availability of funds, the deal is liquidated. This process will continue until the deal is recovered fully. The deal is in the active status till full liquidation happens. If the user does not choose to make a partial payment, then the entire amount that is being manually paid are tracked as a receivable against the settlement account.

Automatic Liquidation

Select this option if the user want to track receivables during automatic liquidation.

Loan Statement

Specify the Loan statement details. Cycle

Specify the cycle on which loan statement must be generated

Statement Type

The Options available are

- None

- Detailed

- Summary

External Interface Details Specify the External interface details. External Reference System updates the external reference number

Parent Reference System updates the parent reference number

REPO Specify the Repo details. Delivery Verse Payment Select this checkbox to Generate MT543/MT541 message on Repo Booking and liquidation.

Reverse Repo Speify the Reverse Repo details. Receive Verse Payment Select this checkbox to Generate MT541/MT543 message on Repo Booking and liquidation.

Settlement Message Generation Details Specify the Settlement Message Generation Details. Settlement Message Generation Required Select this checkbox, to settle message generation required.

Demand Basis Select the option from the drop-down list.

The options are:

- SGEN

- Billing Notice

Cash Margin Specify the cash margin details. Margin Account Specify the value from the list of values displayed. The Options available are GL or CASA account for cash margin transaction.

Note: This is a Mandatory field if collateral revaluation preference is margin settlement at SR Product.

Account Currency Specify the Currency of the account maintained.

This is a Mandatory field if margin account is chosen

Account Branch Specify the branch of the account maintained.

This is a Mandatory field if margin account is chosen

- On the Security Repo Contract Online screen, click the ESMA Details tab.

The Security Repo Contract Online - ESMA Details page is displayed.

Figure 2-20 Security Repo Contract Online - ESMA Details

Description of "Figure 2-20 Security Repo Contract Online - ESMA Details" - On the Securities Repo Contract Online screen, click the ESMA Details tab and specify the ESMA details as required.For more information on fields, refer to the below table.

Table 2-24 Securities Repo Contract Online - ESMA Details Tab - Field Description

Field Description Report submitting entity

Specify the unique code from the displayed list of values for identifying the reporting counterparty.

Description

The system displays the description of the selected report submitting entity.

Entity responsible for the report

Specify the unique code from the displayed list of values for identifying the financial counterparty responsible for reporting on behalf of the other counterparty.

Description

The system displays the description of the selected entity responsible for the report

Clearing member

Specify the unique code from the displayed list for identifying the responsible clearing member of the reporting counterparty.

Description

The system displays the description of the selected clearing member.

CSD participant code

Specify the unique code of the CSD participant or indirect participant of the reporting counterparty from the displayed list, where both the CSD participant and indirect participant are involved in the transaction.

Note: This CSD Participant Code field is not applicable to commodities.

Description

The system displays the description of the selected CSD participant.

Agent lender

Specify the unique code of the agent lender involved in the securities lending transaction.

Description

The system displays the description of the selected agent lender .

Clearing timestamp

Specify the time and date when clearing took place, where the contract is cleared.

CCP

Specify the unique code of central clearing counterparty (CCP) that cleared the contract.

Description

The system displays the description of the selected CCP.

Centrally cleared

Select the Centrally cleared check box to clear the trade centrally.

Trading venue

Specify the unique code for identifying the venue of execution of the SFT. Where the SFT was concluded over the counter (OTC) and the respective collateral is admitted to trading, MIC code ‘XOFF’ is used.

Agreement type

Specify the unique code for identifying the master Agreement type under which the counterparties concluded a documented SFT.

Other agreement type

Enter the name of the master agreement in this field.

Note: This field is applicable, if OTHR is selected in Agreement type field.

Master agreement version

The user must enter year of the master agreement version used for the reported trade.

Note: This field is applicable, if OTHR is selected in Agreement type field.

Earliest call back date

Specify the Earliest call back date that the cash lender has the right to call back a portion of the funds or to terminate the transaction.

General collateral indicator

Select the SFT associated to a general collateral arrangement from the drop-down list.

The drop-down list shows the following options:- SPEC – Specific Collateral

- GENE – General Collateral

Deliver by value

Select the Deliver by value to settle the transaction by using DBV mechanism.

Collateral method

Specify the unique code from the list of values for identifying whether the collateral in the SFT is subject to a title transfer collateral arrangement, a security financial collateral arrangement, or a security financial collateral arrangement with the right of use.

Description

The description of the selected collateral transfer method is specified.

Termination optionality

Select the Termination optionality from the drop-down list. The drop-down list shows the following options:

- Evergreen

- Extendable

Indicates whether the counterparties to the SFT is extendable or evergreen.

Collateralization of net exposure

Select the Collateralization of net exposure check box for net exposure.

Indicates whether the collateral has been provided for a net exposure, rather than for a single transaction.

Haircut

Specify the collateral haircut value in percentage.

Collateral haircut, a risk control measure applied to the underlying collateral at ISIN level, whereby the value of that underlying collateral is calculated as the market value of the assets reduced by a certain percentage.

Collateral quality

Select the collateral quality from the drop-down list.

The drop-down list shows the following options:

- Investment Grade

- Non Investment Grade

- Non-Rated

Indicates the risk of security classification as a collateral.

Collateral type

Specify the unique code from the displayed list for identifying the type of collateral.

Availability for collateral reuse

Select the Availability for collateral reuse check box to reuse the securities.

Indicates whether the collateral taker can reuse the securities provided as a collateral.

Modify a Repo or a Reverse Repo

There are two types of modifications that the user can make on a contract:

- Those that affect the financial details of the contract.

- Those that do not affect the financial details of the contract

(Financial details include the accounting entries that have already been passed or the advices that have already been generated). For example, the changes made to the User Reference Number, Auto Rollover and Auto Liquidation flags, do not change to the accounting entries that have been passed.

However, the inputs to some fields that contain financial information are changed only under specific circumstances. This is done through the Value Dated Changes function. For example, the changes in the interest rate, increase in the principal, etc., is made only through the Value Dated Changes function.

A deal on which the previous activity has been saved but not been authorized is modified. For example, the user has captured the details of a deal. The details are saved but not yet authorized when the user realizes that some of the details have been wrongly entered. The user can unlock the contract to make the modifications and Save it. The uploaded contracts are amended by any valid user – the contract maker or others.

Note:

Any type of change, however, has to be authorized, before it takes effect.Financial Details available for Change

Inputs to the following fields available for change based on the requirement through the contract processing function:

- Takedown Account if the reverse repo has not yet been initiated and Customer Account if a repo has not been initiated.

- Maturity Account if the deal is yet to mature

- Interest Payment Account if the entire interest on the deal has not yet been liquidated. The new account is used for future interest payments.

- Contract End Date for a notice or call type of deal.

- Tax details if tax has not yet been liquidated

Note:

The changes listed do not trigger any accounting entries or the generation of any advices.View Event Details

This topic provides the systematic instructions to view the event details.

View all the events that have to take place on a Securities Repo deal through the View Events screen.

All the events that taken place on the deal so far are listed in this screen according to the sequence in which they have taken place. The Date on which the event took place will also be displayed.

- Access this screen by clicking on the view events button in any of the Contract On-line screens.

- View the list containing events like Booking, Initiation, Interest Accrual, etc

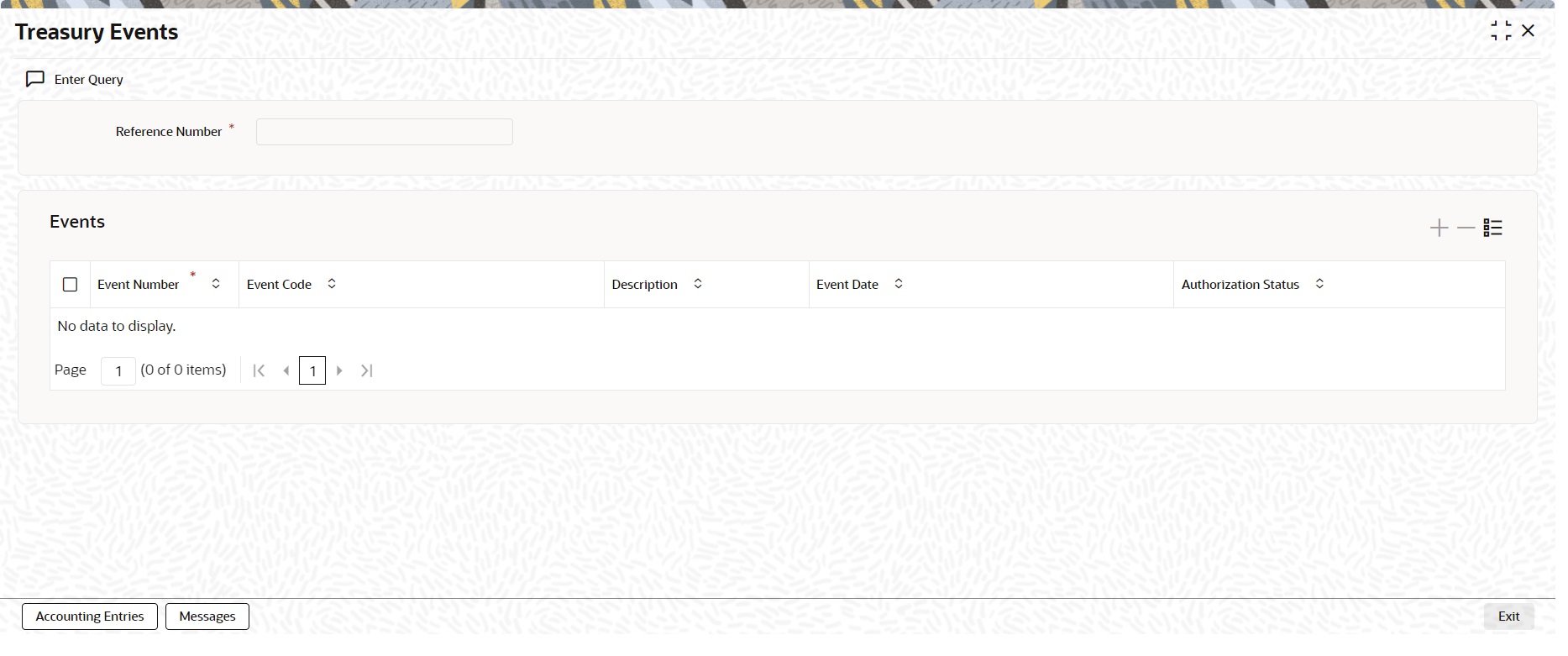

- On the Security Repo Contract Online screen, click Events

The Treasury Events screen is displayed.

Figure 2-21 Treasury Events

- On the Treasury Events screen, specify the details as required.

For information on fields, see the below table:

Table 2-25 Treasury Events - Field Description

Field Description Reference Number

This is a mandatory field.

Payment reference number automatically gets defaulted for the current payment.

Events Specify the events details. Event Number

This is a Mandatory field.

Event Code

Displays the contract event code

Description

Displays the Event description

Event Date

Displays the Date on which event is generated

Authorization Status

Displays the event authorization status

Maker Id

Displays the maker ID

Checker Id

Display the Checker ID

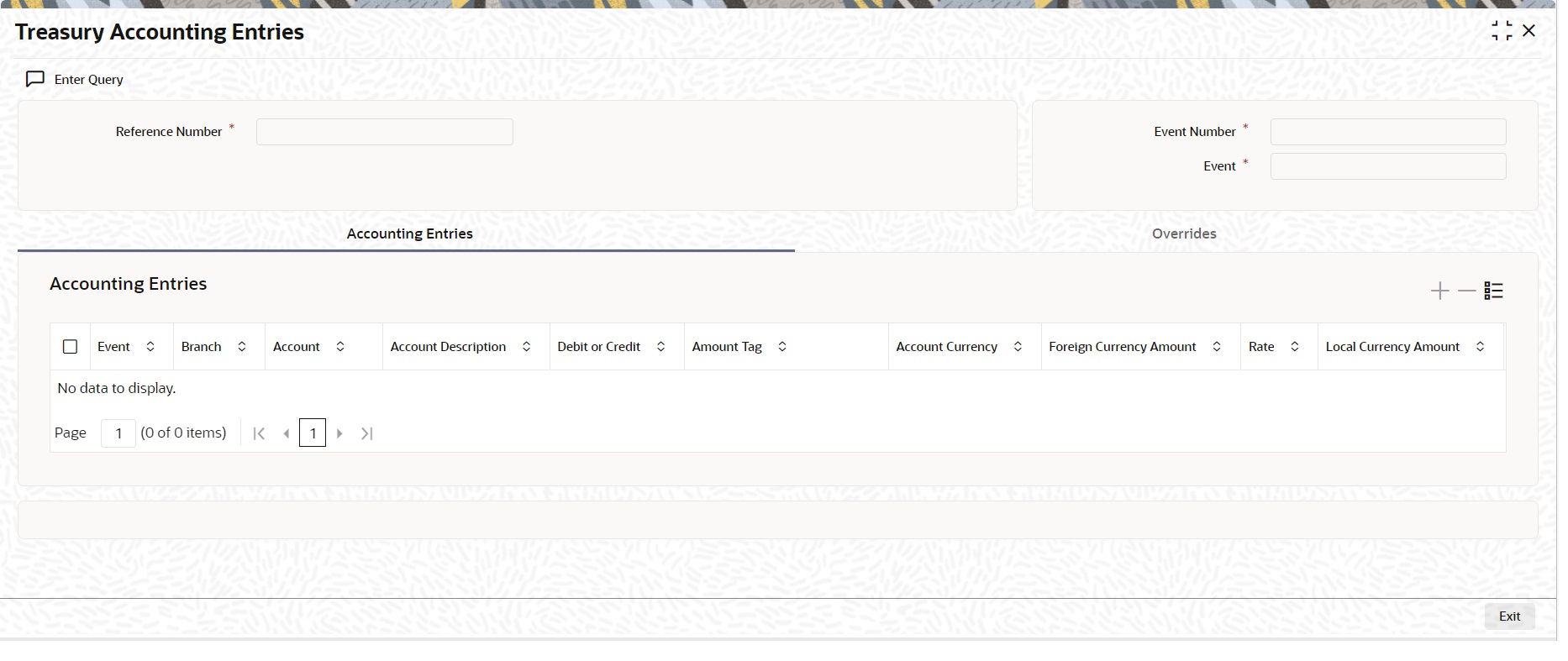

- On the Treasury Events screen, click Accounting Entries.The Treasury Accounting Entries screen is displayed.

Figure 2-22 Treasury Accounting Entries

- On the Treasury Accounting Entries screen, specify the details as required.

For information on fields, see the below table:

Table 2-26 Treasury Accounting Entries- Field Description

Field Description Reference Number

This is a mandatory field.

Specify the contract reference number.

Event Number

This is a mandatory field.

Specify the event number.

Event

This is a mandatory field.

Specify the event code.

Accounting Entries Specify the accounting entries details. Event

Displays the Event code for the contract

Branch

Displays the Account branch

Account

Displays the Account number

Account Description

Displays the Account Description

Debit or Credit

Displays whether the account is Dr or Cr

Amount Tag

Displays the amount tag associated to the event

Account Currency

Displays the account currency

Foreign Currency Amount

Displays the Foreign currency amount

Rate

Displays the exchange rate

Local Currency Amount

Displays the Local currency equivalent amount when the contract currency is in FCY currency

Date

Displays the Transaction date

Value Date

Displays the value date of the event

Txn Code

Displays the transaction Code

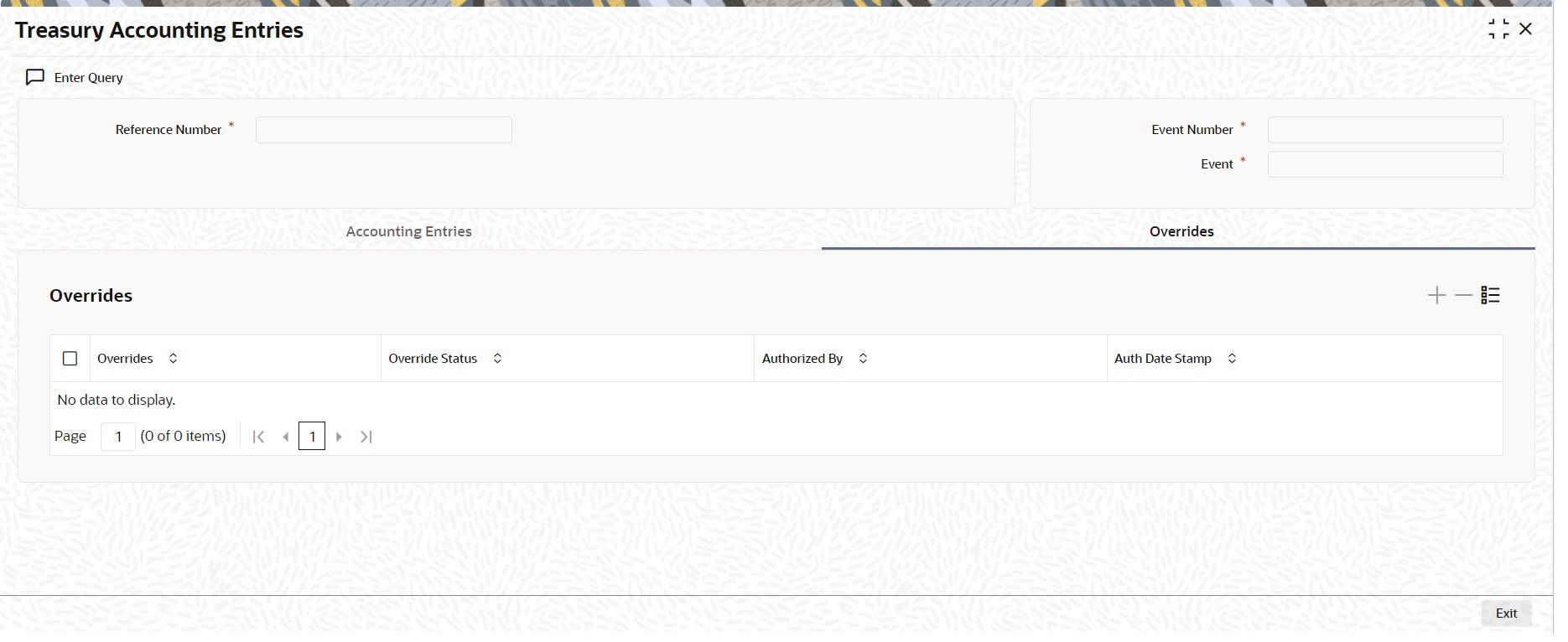

- On the Treasury Accounting Entries screen, click Overrides.

The Treasury Accounting Entries screen with Overrides tab details is displayed.

Figure 2-23 Treasury Accounting Entries- Overrides

Description of "Figure 2-23 Treasury Accounting Entries- Overrides" - On the Overrides tab, specify the details as required.

For more information on fields, see the below table:

Table 2-27 Overrides - Field Description

Field Description Reference Number

Displays the contract reference number

Event Number

Displays the event number

Event

Displays the event code

Overrides

Displays the Override message generated for the event

Override Status

Displays the override status

Authorized By

Displays the Authorizer user ID

Auth Date Stamp

Displays the authorization Time stamp

Advice for Deal Initiation

The advices that have to be generated for any event are specified for the product involved in the deal and are generated after the product is authorized at the product level. For example, the user may have specified the following advices for the product:

- When a deal is initiated, advice, addressed to the customer.

- If any components (like discounted interest, tax on principal etc.) Are liquidated on take-down, advice for each of them.

While processing the deal initiation, the user can do the following:

- Suppress the generation of any of these advices

- Specify the priority of generation

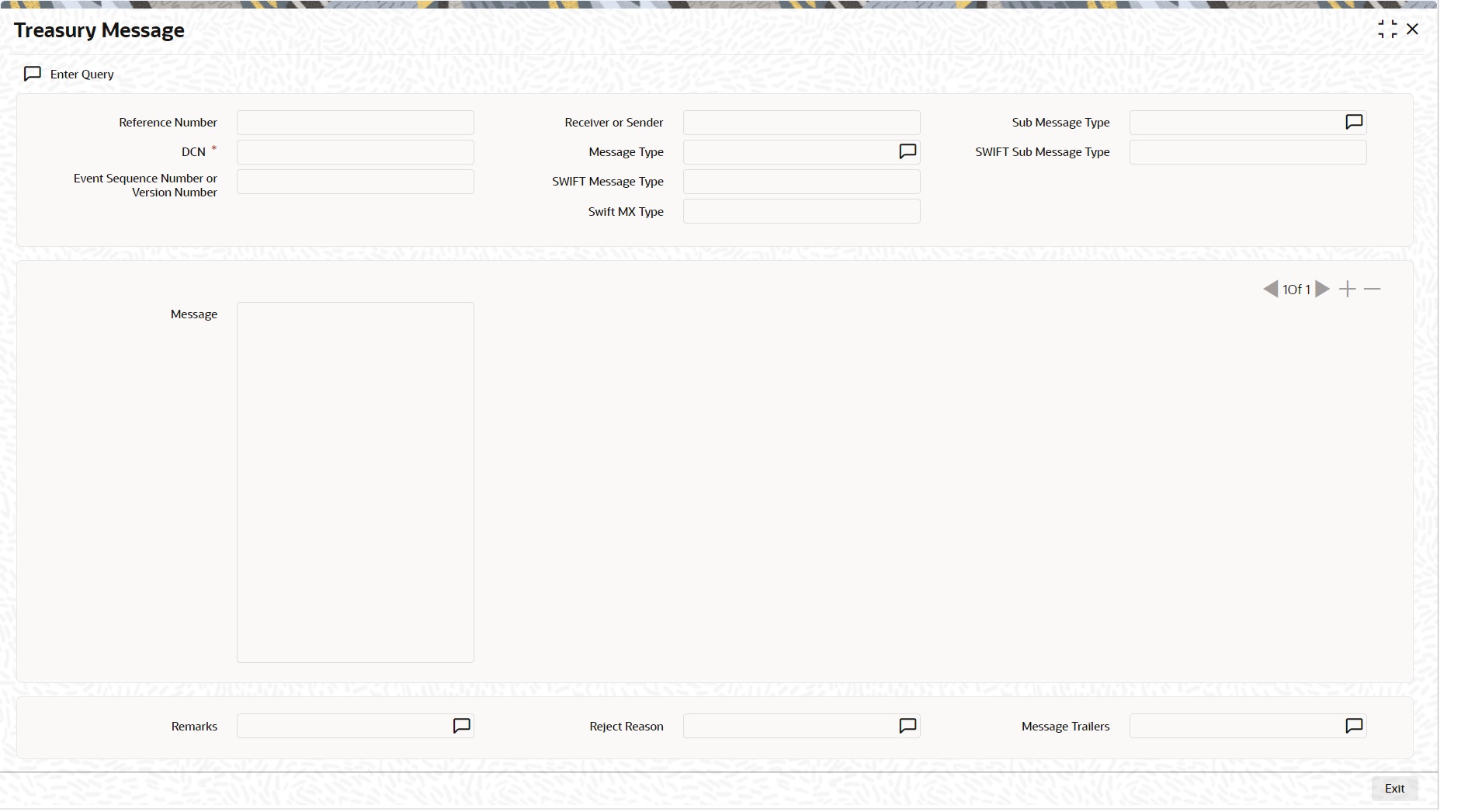

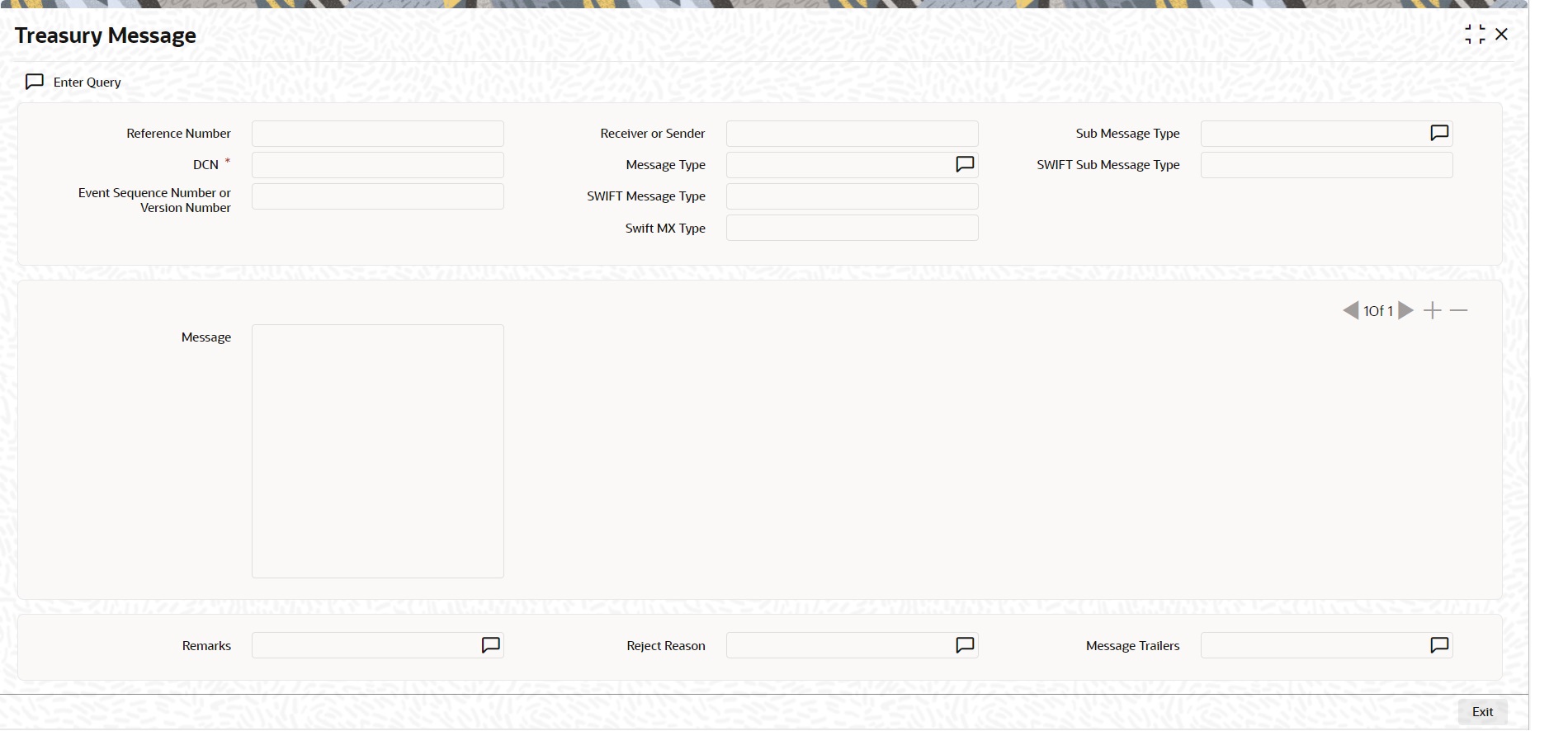

- On the Treasury Events screen, click Messages.

The Treasury Message screen is displayed.

- On the Treasury Message screen, specify the details as required.

For information on fields, see the below table.

Table 2-28 Treasury Message- Field Description

Field Description Contract Reference

Displays the contract reference number

Event Sequence Number

Displays the Event sequence number

Event

Displays the event code

Messages Specifies the messages details. Message Type

Displays the Message Type

SWIFT Message Type

Displays the Swift Message Type

Sub Message Type

Displays the Sub Message Type

SWIFT Sub Message Type

Displays Swift Sub Message type

Test Status

Displays Test status

Medium

Displays message medium

Message Status

Displays the Message status

Authorization Status

Displays Message Authorization status

Receiver

Displays the Receiver of the message

Receiver Name

Displays the Receiver name of the message

- On the Treasury Message screen, click Message Details.Treasury Message screen with Message Details is displayed.

- On the Treasury Message screen, specify the details as required.

To view the text of a message, highlight the message and click Message Details. Click Exit or Cancel button to exit the screen.

Different Versions of a Deal

When a deal is an input, it is assigned a version number of 1. From then on, each amendment of the deal results in its next version. When the user comes to the Detailed View Screen for a deal, the latest version is displayed.

To see the previous version, click the previous icon from a previous version, clicking next icon displays the next version.

Initiate a Future Value Dated Deal

A “future-dated” deal is one that has a Value Date that is later than the date on which it is booked. The Automatic Contract Update function will initiate the deal on the Value Date of the deal.

A future Value Date falling on a holiday is initiated either on the previous working day or the next, depending on your definition for automatic processing at your branch.

All the initiation related entries specified for the product involved in the deal is passed automatically. If currency conversions are involved, the conversion rates as of the date on which the deal is initiated are picked up from the Currency Table. To recall, the rates that are applicable to a deal are defined for the product involved in the deal.

If there is a rate revision applicable for the future dated deal on the day it is initiated (that is, on the future Value Date), the rate revision will also be applied on the deal. This rate revision could either be due to a Floating Rate change or a Value Dated Change.

Display the Other Details of a Deal

Using the buttons that are displayed in the ‘Contract Online’ screens the user can view the following details of a deal:

- The settlement details

- The tax details

- The MIS details

- The ICCB details

- The brokerage details

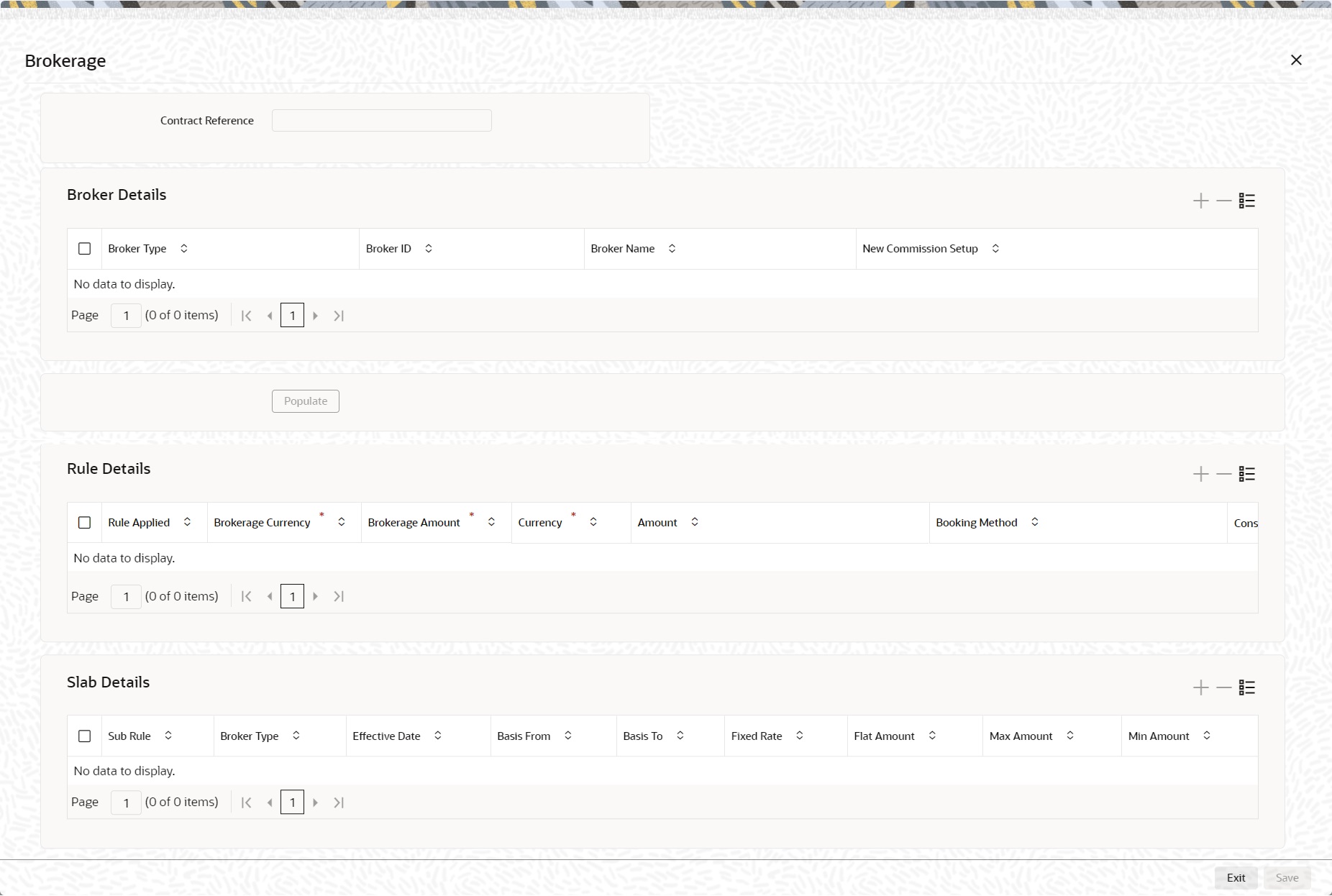

- On Security Repo Contract Online screen, click Brokerage.

The Brokerage screen is displayed.

- On Brokerage screen, specify the details as required.

For information on fields, see the below table:

Table 2-29 Brokerage- Field Description

Field Description Broker

This is a mandatory field.

Defaults Broker ID mapped for the deal

Broker Name

Displays the Broker name

Rule

Defaults the Broker Rule mapped at the product

Payable Specify the payable details. Currency

Defaults Broker payable currency

Amount

Defaults the Broker amount to be paid

Brokerage Specify the Brokerage details. Currency

Defaults the Broker currency

Amount

Defaults the Broker amount

Liquidation Specify the Liquidation details. Status

Displays the brokerage liquidation status

Reference Number

Displays the brokerage liquidation reference number

Booking Specify the Booking details. No Booking

To waive brokerage for the transaction, choose the 'No Booking' option.

Advance

Brokerage is booked when the deal is initiated

Arrears

Brokerage is booked when the deal is liquidated

Consider For Discount

This option is defaulted from the deal product level. However, checkbox is unchecked if the booking method is other than Advance.

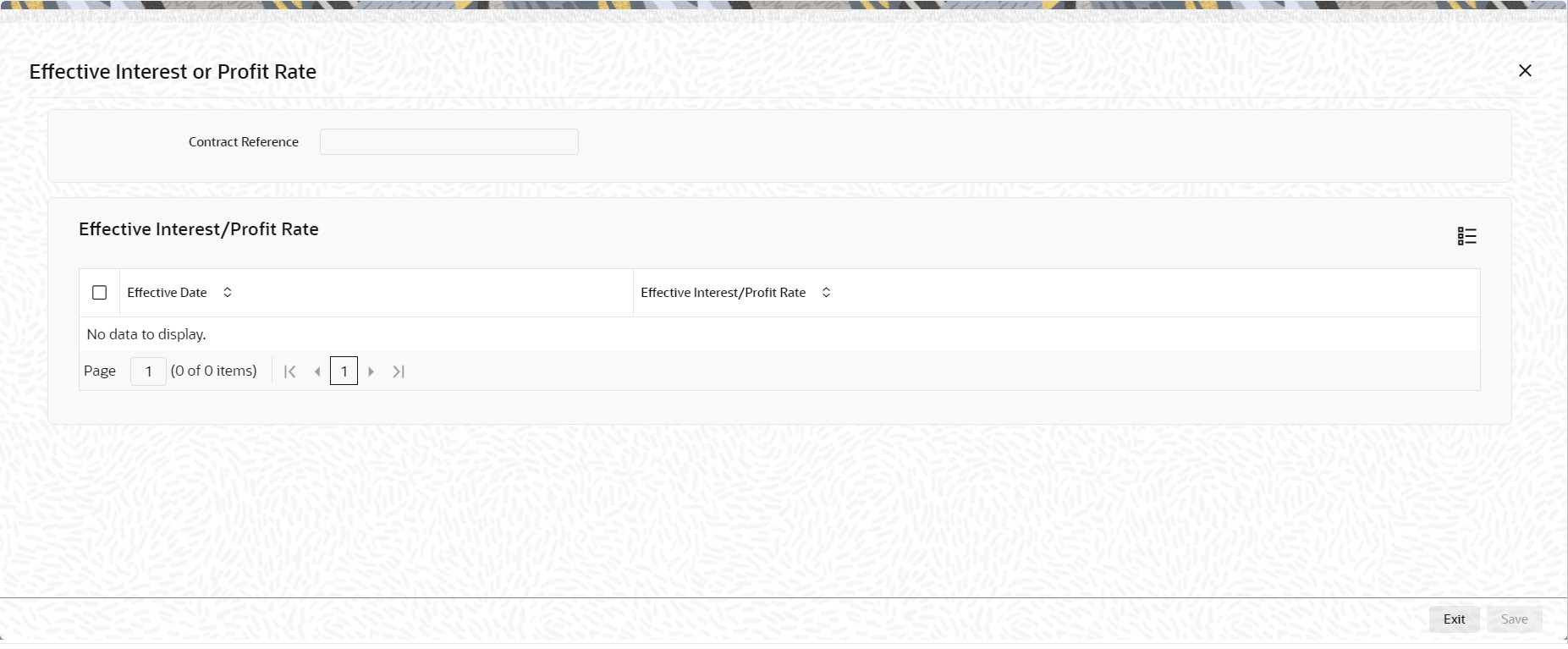

- On Security Repo Contract Online screen, click Effective Interest Rate.The Effective Interest or Profit Rate screen is displayed.

Figure 2-27 Effective Interest or Profit Rate

Description of "Figure 2-27 Effective Interest or Profit Rate" - The processing related to Effective Interest Rate is

as follows:

- During rate revision of contracts with negative interest allowed products, based on the effective interest rate after rate revision being positive or negative, the system assigns the interest rate to main interest or negative interest component internally.

- If the effective rate is negative, the system updates the main interest component rate as zero and assigns the negative rate to negative interest component.

- If negative interest is not allowed for the product, then the system skips rate revision for the contract, if the effective rate becomes negative. Exception is logged for the same. You need to initiate amendment of the spread such that net interest rate becomes positive in such cases.

- If default minimum value is maintained for the main interest component, then the system defaults the same during rate revision, if the interest rate goes below the specified rate.

- On the Effective Interest or Profit Rate screen, specify the details as required.

For Information on fields, see the below table

Table 2-30 Effective Interest or Profit Rate- Field Description

Field Description Contract Reference

Displays the Contract reference number.

Effective Date

Displays the effective date on which rate is revised.

Effective Interest/Profit Rate

Displays the Revised Effective interest rate.

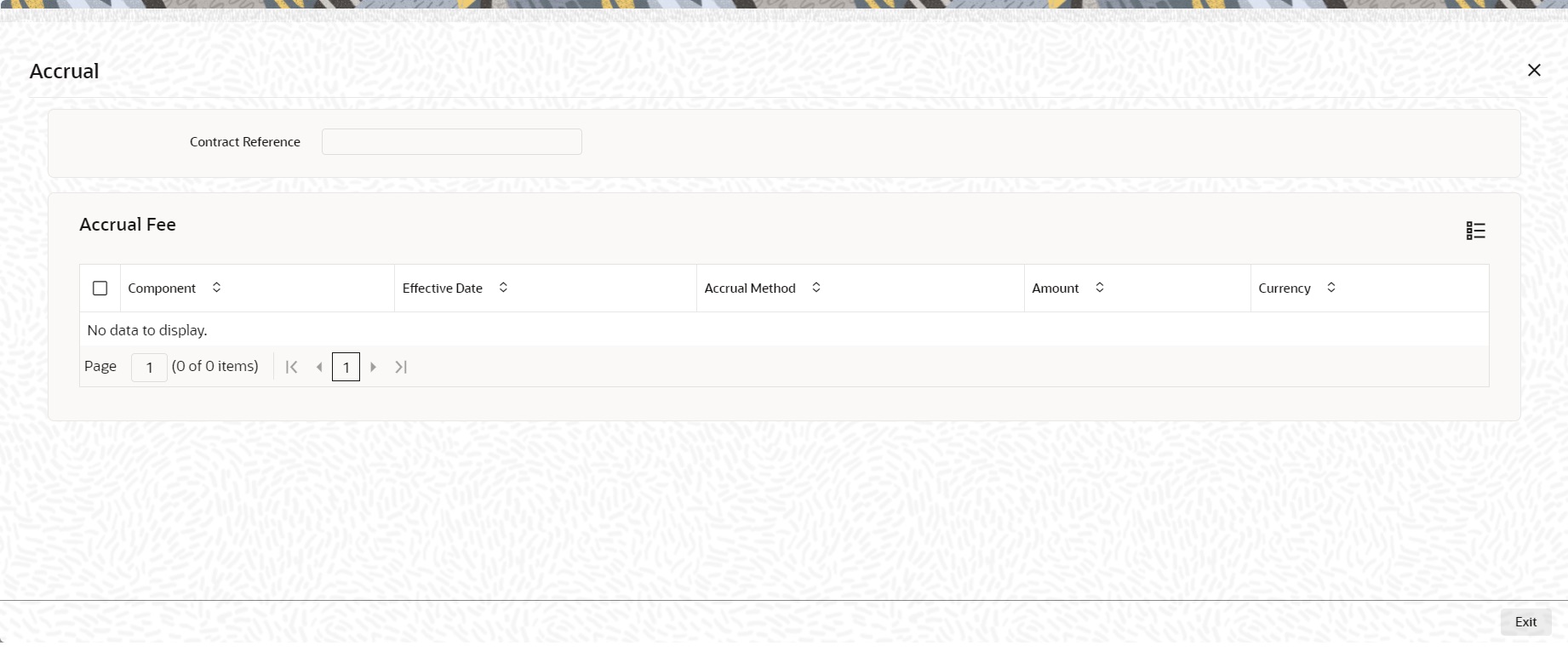

- On the Security Repo Contract Online screen, click Accrual.

The Accrual screen is displayed.

Figure 2-28 Security Repo Contract Online- Accrual

Description of "Figure 2-28 Security Repo Contract Online- Accrual" - On the Accrual screen, specify the details as required.

For information on fields, see the below table:

Table 2-31 Accrual- Field Description

Field Description Contract Reference

Displays the contract reference number

Component

Displays the accrual component

Effective date

Displays the effective date

Accrual Method

Displays the Accrual method

Amount

Displays the Accrual amount

Currency

Displays the Accrual currency

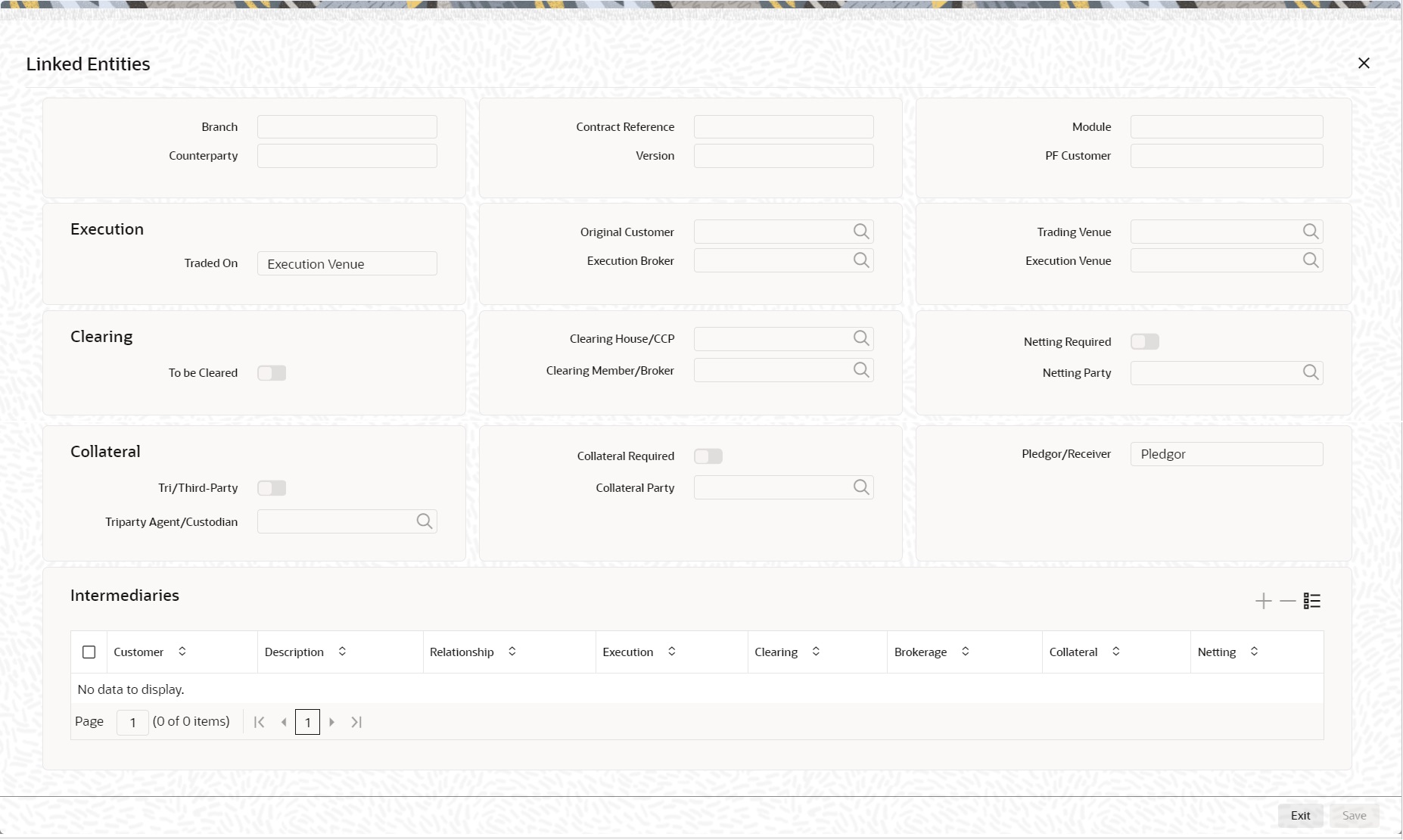

- On Security Repo Contract Online screen, click Linked Entities.

Security Repo Contract Online- Linked Entities screen is displayed.

- On the Linked Entities screen, specify the details as required.

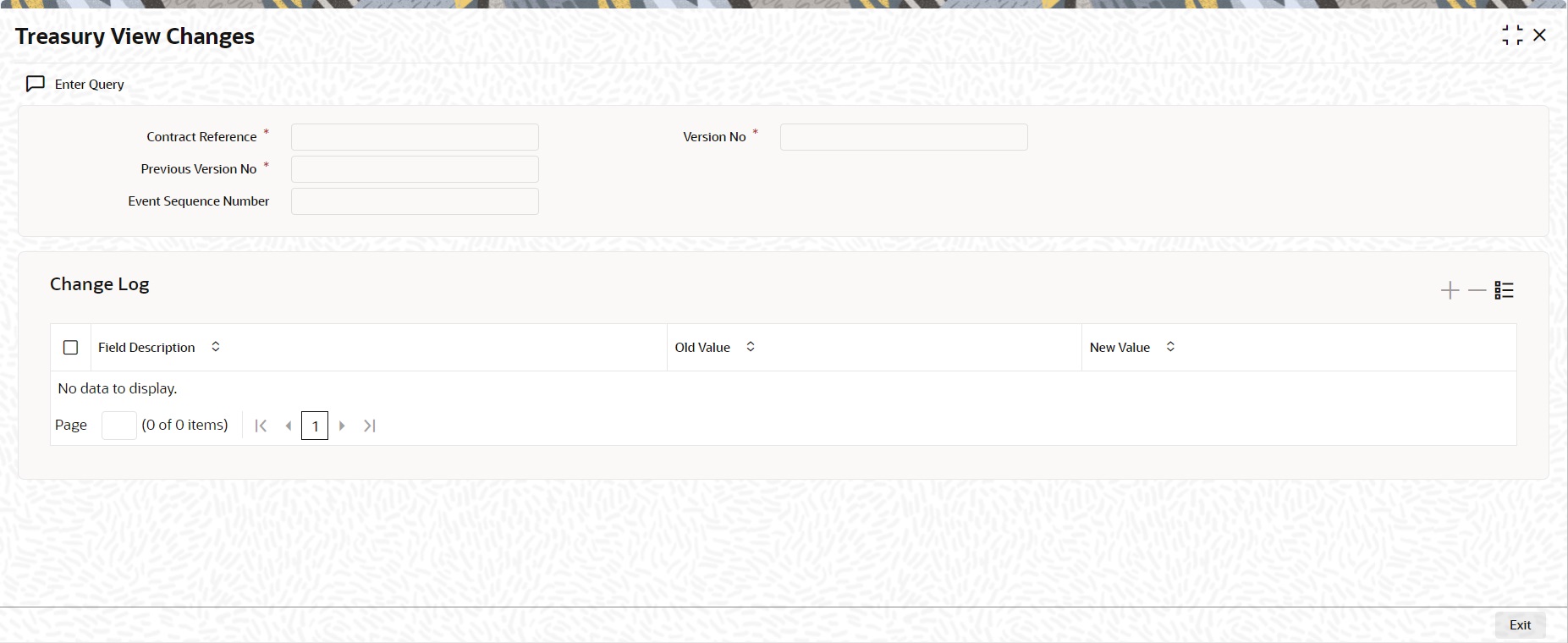

- On the Security Repo Contract Online screen, click Change Log.

Treasury View Changes screen is displayed.

- On the Treasury View Changes screen, specify the details as required.

For information on fields, see the below table:

Table 2-32 Treasury View Changes- Field Description

Field Description Event Sequence Number

Displays the event sequence number

Version No

This is a mandatory field

Displays the event version number

Field Description

Displays the modified field

Old Value

Displays the old value

New Value

Displays the New value

Interest Rate Revision Schedule

A Floating Rate Table containing the market rates for the day - is maintained in the ICCB sub-system so that the latest rates are applied to deals.

The market rates vary daily and are maintained in this table. The rates are applied either every time they change or at periodic intervals. Usually, for Securities Repo deals, floating rates are applied, i.e., the latest market rate is applied. The user can also apply these rates periodically so that the user is in tune with the market rates (as opposed to fixed interest rates which remain the same for the entire period of the deal), and at the same time, the user need not apply the market rates daily.

The user can specify if the latest market rates have to be applied every time they change or apply periodically by defining an attribute called the Rate Code Usage. The Rate code usage is applied through the Product ICCB Details screen for a floating interest type. If the user specifies auto rate code usage, all the rate changes made during the liquidation or accrual period is considered. If the user specifies periodic rate code usage, the rates are periodically refreshed and the rates as of a specific frequency, or date, is applied.

For a deal that has been defined with Periodic Interest that has to be applied at periodic intervals, the user can specify the following:

- The frequency at which the periodic rate change has to be applied.

- The dates on which the periodic rate change has to be applied

Specify the Rate Revision Frequency

In the SR Contract Schedules screen, select the component, for which the Rate Revision frequency has to be defined (say INTEREST1). Select the Type as 'R' (Revision), then enter your specifications in the frequency (it could be daily, weekly, etc.), the number, and unit fields. Also, give the Start Date on which the first revision has to take place.

For example, if the user specify the frequency, like weekly, the revision will take place every week beginning on the Start Date that the user has specified.

Specify the Rate Revision Dates

Instead of specifying the other schedule details like the frequency, the number and unit, indicate the date in the Start Date field. The rate revision is done on that date.

Interest Repayment Schedules as Different from Rate Revision Schedules

For a deal on which floating interest is applied at periodic intervals, the user may have to define:

- An interest rate revision schedule for the interest component.

- A repayment schedule.

The following example shows how this is achieved:

The user has a deal where for the component interest; the user has to define an interest rate revision schedule for revisions every week as well as a fortnightly interest repayment schedule. The Start Date of the deal is 1 October ‘97, and the End Date is 31 October ‘97. The deal is defined with a periodic rate and the rates in the floating rate table change in the following manner:

Define a frequency based rate revision schedule

To define a schedule with periodic rate code usage, through the Contract Schedules screen, mark the component as a revision schedule and specify the component, say INTEREST, from the pick list. Give the frequency at which the interest rate has to be refreshed, say weekly. Give the Start Date, say 8 October. The first revision will happen on this day, and every week from then on. Save the inputs.

Define a date based rate revision schedule

If the user were to define specific dates - 7 October, 15 October and 23 October - for the rate revision to happen, then, through the Contract Schedules screen, mark the component as a revision schedule and specify the component, say INTEREST, from the pick list.

Specify the date on which the rate revision is to be done, in the Start Date field, as 7 October. Similarly, define the other dates, but by picking up the same component INTEREST from the pick list each time.

Define a repayment schedule for the same component

Now to define a repayment schedule for the same component, INTEREST, click schedules Tab and choose the component interest from the pick list. Now draw up a repayment schedule for this component. Give a value in the Start Date field, say 15 October 1997. The first interest liquidation will be done on this date.

In the frequency field enter ‘monthly’ and in the unit field specify ‘2’. This means the interest repayments will be done every fortnight beginning 15 October.

That is, for a deal defined with frequency-based periodic rates, the rates prevailing on the refresh dates will be used for accruals and liquidation. In the deal we are discussing, with the refresh frequency defined as weekly and the Start Date as 15 October, the rate applied for the interest liquidation on 15 October will be as follows:

Table 2-33 Interest liquidation on 15 October

| From | To | Rate |

|---|---|---|

|

1 October |

8 October |

12 |

|

9 October |

15 October |

11.5 |

For a deal with Periodic rate code usage (date based), the rates prevailing on the specific refresh dates will be used for accruals and liquidation. Shown below are the rates applicable on the specified revision dates.

Table 2-34 Rates Applicable

| From | Rate Applicable |

|---|---|

|

7 October |

12 |

|

15 October |

11.5 |

|

23 October |

11.5 |

In the deal we are discussing, the rates applied for the interest liquidation on 15 October will be as follows:

Table 2-35 Interest Rates

| From | To | Rate |

|---|---|---|

|

1 October |

7 October |

12 |

|

8 October |

14 October |

12 |

|

15 October |

- |

11.5 |

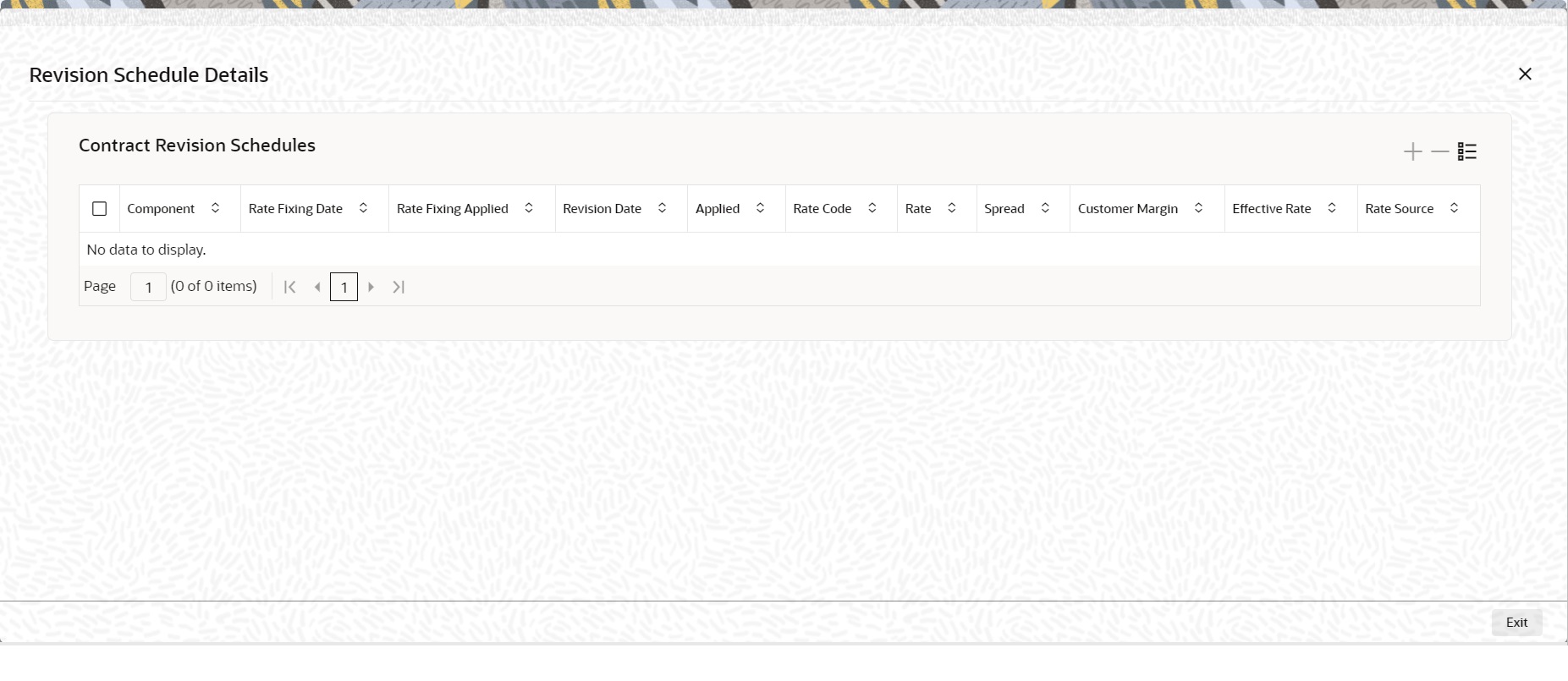

- On Security Repo Contract Online screen, click Revision Details.

The Revision Schedule Details screen is displayed.

Description of the illustration srdtronl_cvs_revsionscheduledetails.png - On the Revision Schedule Details screen, specify the details as required.

For information on fields, see the below table:

Table 2-36 Revision Schedule Details - Field Description

Field Description Component

Specify the component for which the schedule is being defined. The options are

- Principal

- Fee

- Commission

- Charge or interest

Rate Fixing Date

Displays the derived Rate fixing date

Rate Fixing Applied

Displays whether Rate fixing is applied for the contract or not.Values - N, Y

The system generates the SGEN only when the rate fixing applied option is Y for all the revision schedules.

Revision Date

Displays the revision date for the schedule

Revision Applied

Displays whether revision is applied or not Values - N, Y.

Rate Code

Displays the Floating Rate code mapped to the contract

Rate

Displays the Floating rate from the floating rate table

Spread

Displays the Rate Code spread for the contract

Customer Margin

Displays the customer margin

Effective Rate

Displays the Effective interest rate

Rate Source

Displays the Rate source from where the rate is taken

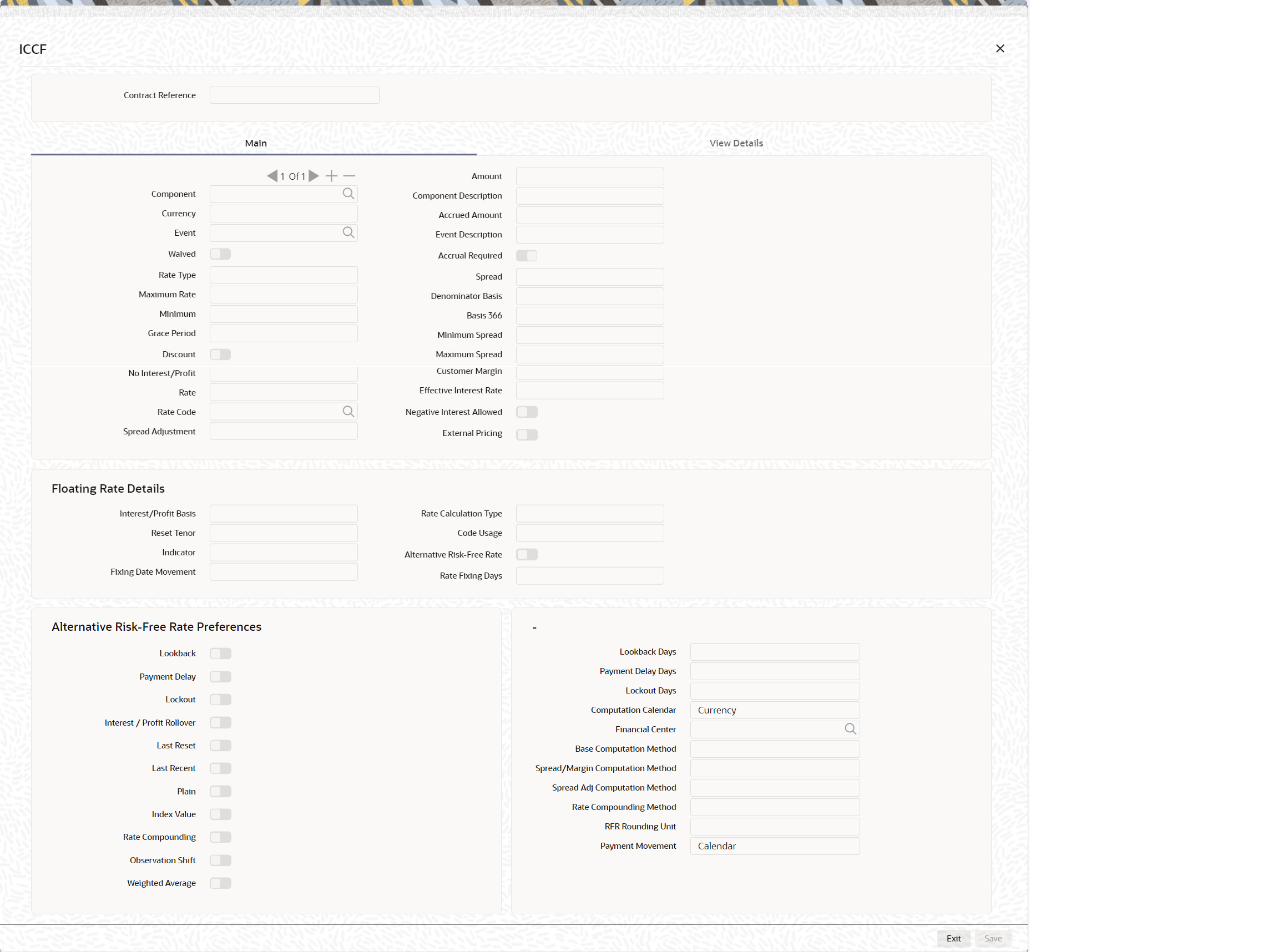

- On the Security Repo Contract Online screen, click Interest.

The ICCF screen is displayed.

- On Interest screen, specify the fields.

Table 2-37 Interest- Field Description

Field Description Contract Reference

Displays Contract reference number

Component

Displays the Interest component mapped to the contract

Currency

Displays the Interest component currency

Event

Display the Event associated with the component

Waived

Specify whether user wants to waive the interest

Rate Type

Select the Rate Type from the drop-down list.

The options are:

- Floating

- Special

- Fixed

Maximum Rate

Displays the maximum rate for the component

Minimum

Displays minimum rate for the component

Grace Period

Select the Grace Period from the drop-down list.

The options are:

- Months

- Years

- Days

Discount

Defaults discount flag from product

No Interest/Profit

Displays the contract Interest

Rate

Specify the contract Fixed interest rate. System defaults 'Default rate' from product. User can modify the same.

Rate Code

Defaults Floating rate code from product. User can modify the same.

Amount

Specify the special interest amount for the contract.

Spread Adjustment

Specify the Rate code spread adjustment.

Component Description

Display the component description.

Accrued Amount

Displays the Interest accrued amount

Event Description

Displays the Event description

Accrual Required

Specify if Interest accrual required or not

Spread

Specify the rate code spread for a floating interest rate

Denominator Basis

Denominator Basis is used to specify how the month of February is treated when the denominator is 'Actual'.

Basis 366

Defaults from product. This is applicable only if the Denominator Basis is set to 'Per Annum'.

Minimum Spread

Displays minimum spread for the floating rate code

Maximum Spread

Displays maximum spread for the floating rate code

Customer Margin

Specify the customer margin

Effective Interest Rate

Displays the effective interest rate of the contract

Negative Interest Allowed

Check this box to indicate that the negative interest should be allowed for the product.

If this box is checked, then the system allows Negative fixed rates or resolved rates at the SR contract and during VAMI,

External Pricing

Defaults external pricing from product

Interest/Profit Basis

Defaults Interest Basis from product, which indicates the Interest basis for the component for which penalty is being computed

Reset Tenor

Floating interest rates are defined for specific amount slabs and tenor combinations.

User can indicate the reset tenor for which floating rates need to be picked up.

Indicator

Defaults from product.

The user can use this field to indicate whether the borrowing rate, lending rate or mid rate must be picked up from the floating rate table, for the specified rate code.

Fixing Date Movement

Defaults Rate fixing date movement from product. user can modify the same. The options are:

- Backward movement

- Forward movement

Rate Calculation Type

Defaults the rate calculation type from product

Code Usage

Specify the rate code usage. It can be periodic or automatic. In case of periodic user needs to define revision schedule for the floating interest component

Alternative Risk-Free Rate

Specify if the interest rate code is a risk free rate

Rate Fixing Days

Defaults the rate fixing days from product.

Interest/Profit Basis

The method in which the number of days are to be calculated for interest, charge, commission or fee components and whether their application is tenor based is displayed here based on the specification the user made at the product level. The User can choose to change it.

The following are the options available:

- 30(Euro)/360

- 30(US)/ 360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/364

- 30(US)/ 364

- Actual/364

Fixing Date Movement

Select the movements from the drop-down list.

The available movements are:- Forward

- Backward

- None

Alternative Risk-Free Rate

Select the Alternate Risk-Free Rate check box to enable the Alternate Risk Free-Rate preferences. For more information on the

Alternate Risk Free-Rate preferences fields, refer to . - The processing and validations involved in this screen

are as follows:

- Contract interest rate, irrespective of whether it is positive or negative, can be specified against main interest component only. Effective rate is displayed against Main Interest component only in both positive or negative cases. Internal allocation of the effective rate to negative interest component is done by the system.

- Effective Interest rate is derived based on the interest rate (Fixed/ Floating) and Margin (Spread) value captured for the SR contract (Deal) in OBTR.

- On a particular day, for a contract, only one interest component from main or negative components is active, based on the effective interest rate being positive or negative.

- If negative rate or amount is specified, then the system validates that product is enabled for negative interest.

- Negative Interest amount for 'Special Rate type' is not allowed

- Special interest amounts will not be allowed in ‘Interest Amount’ of ICCF screen, for negative interest allowed SR contracts.

- Negative interest amounts will not be allowed as ‘Acquired Amount’ in ICCF screen.

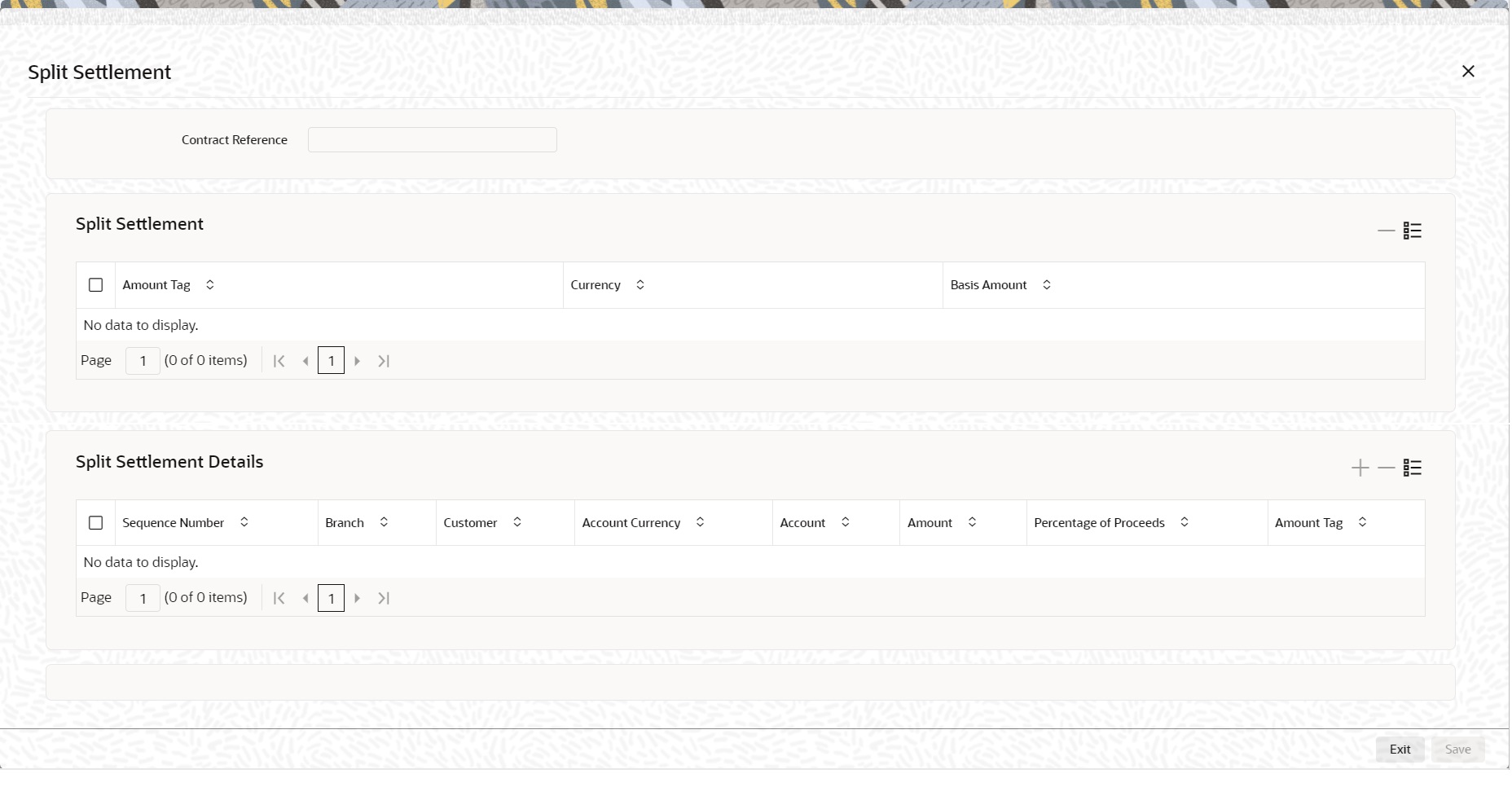

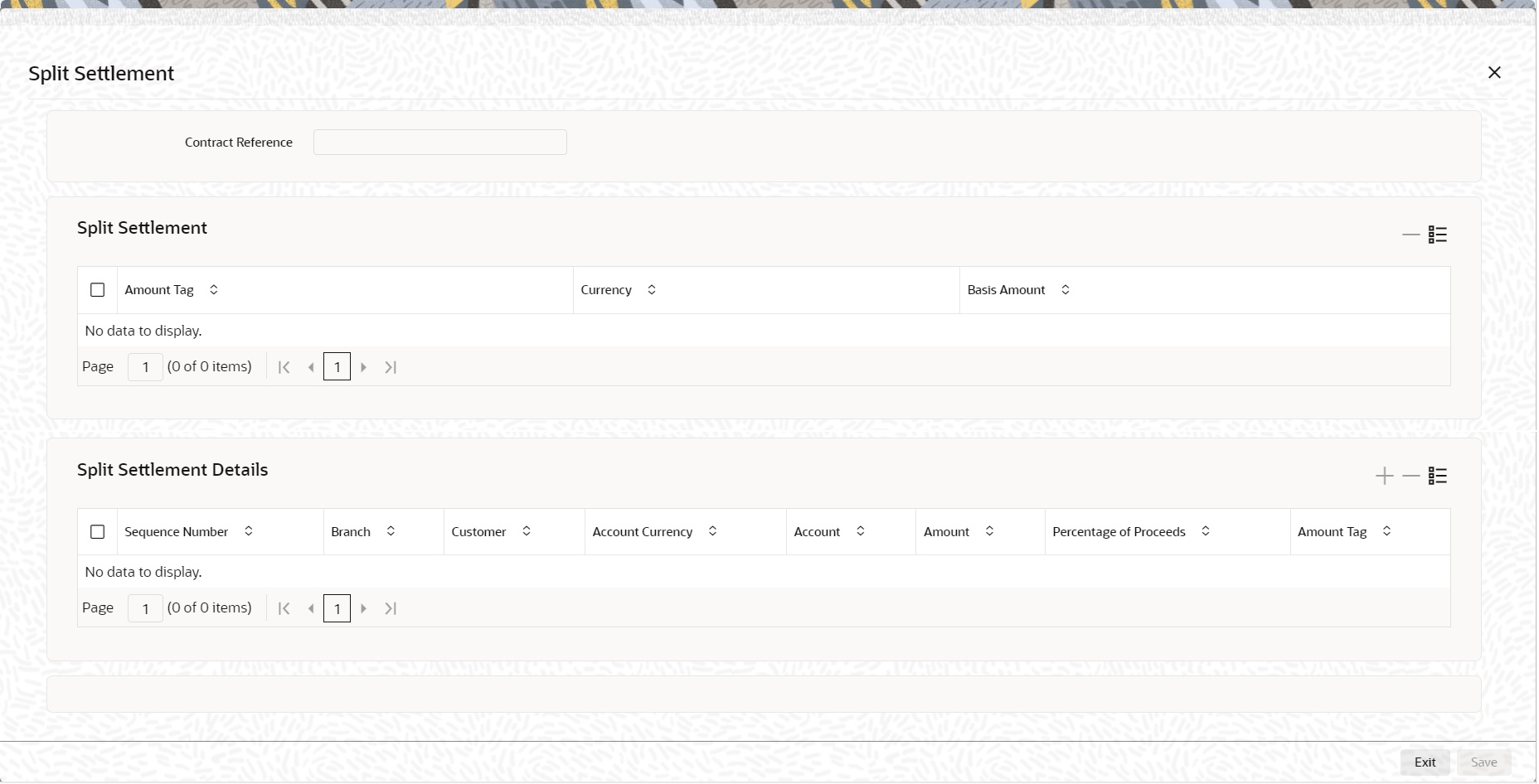

- On the Securities Repo Contract Online screen, click Split.

The Split Settlement Screen is displayed.

- On the Split Settlement screen, select a contract.

- On the Split Settlement screen, under the Split Settlement Details, click the + Icon.

Split Settlement screen with new row is displayed.

Figure 2-33 Split Settlement with a new row added

Description of "Figure 2-33 Split Settlement with a new row added"Note:

This process of splitting the settlements for a contract is allowed on the principal, Interest (Anticipated Interest for new contracts), and charges. - On the Split Settlement screen, specify the details as required.

For information on fields, refer to the below table:

Table 2-38 Split Settlement- Field Description

Field Description Contract Reference

The selected contract reference number is displayed.

Basis Amount

The Basis Amount details is displayed.

Sequence Number

The Sequence number details is displayed.

Branch

The Branch details is displayed.

Click the search icon and select the branch as required.

Customer

The Customer number is displayed.

Click the search icon and select the customer as required.

Account Currency

Click the search icon and select the account currency from the list displayed.

Account

Click the search icon and select the account details from the list displayed.

Amount

Specify the amount details as required.

Percentage of Proceeds

This is a read only field, system displays the percentage of proceeds after save.

Amount Tag

System displays the amount tag details as required.

- Choose the Account Currency, Account, and other necessary

details, to create a split.

- For every Settlement contract the system allows a maximum of twelve splits.

- In case of auto-liquidation, the user must unlock the contract and register the split, upfront, that is prior to auto-liquidation. The updating provision, split settlement for the interest portion, is only available after saving and first approval. For each split amount, SGEN is produced. In field 72 of MT202 and MT202COV, the system will suffix the reference number with a hyphen followed by a running sequence number for each SGEN.

- Only if split settlement details are available, system will process the transaction accordingly, else the payment/settlement is treated as a single payment transaction

- If the user are splitting the contract during the rollover, the application considers the latest available split details and process the liquidation amount, if any. If split settlement details are not available, the transaction (partial (liquidation as part of rollover) is treated as normal/regular/non-split liquidation. The split is allowed in manual rollover as well.

- For a single component, the user can split the settlement amount and use the same settlement account more than once. There is no restriction on the repetition of split settlement amount for the same NOSTRO/settlement account.

- Cross currency split settlement is supported. The Amount field/column in the Split tab is, by default, in the contract currency (though not evident in the User Interface). The currency of the settlement account can be in a different currency. The converted amount has to be viewed in the accounting entries as part of Events tab only.

- Appropriate Amount tags, for each component like principal, interest and charges, are made available at the relevant event(s) for enriching the split settlement details.

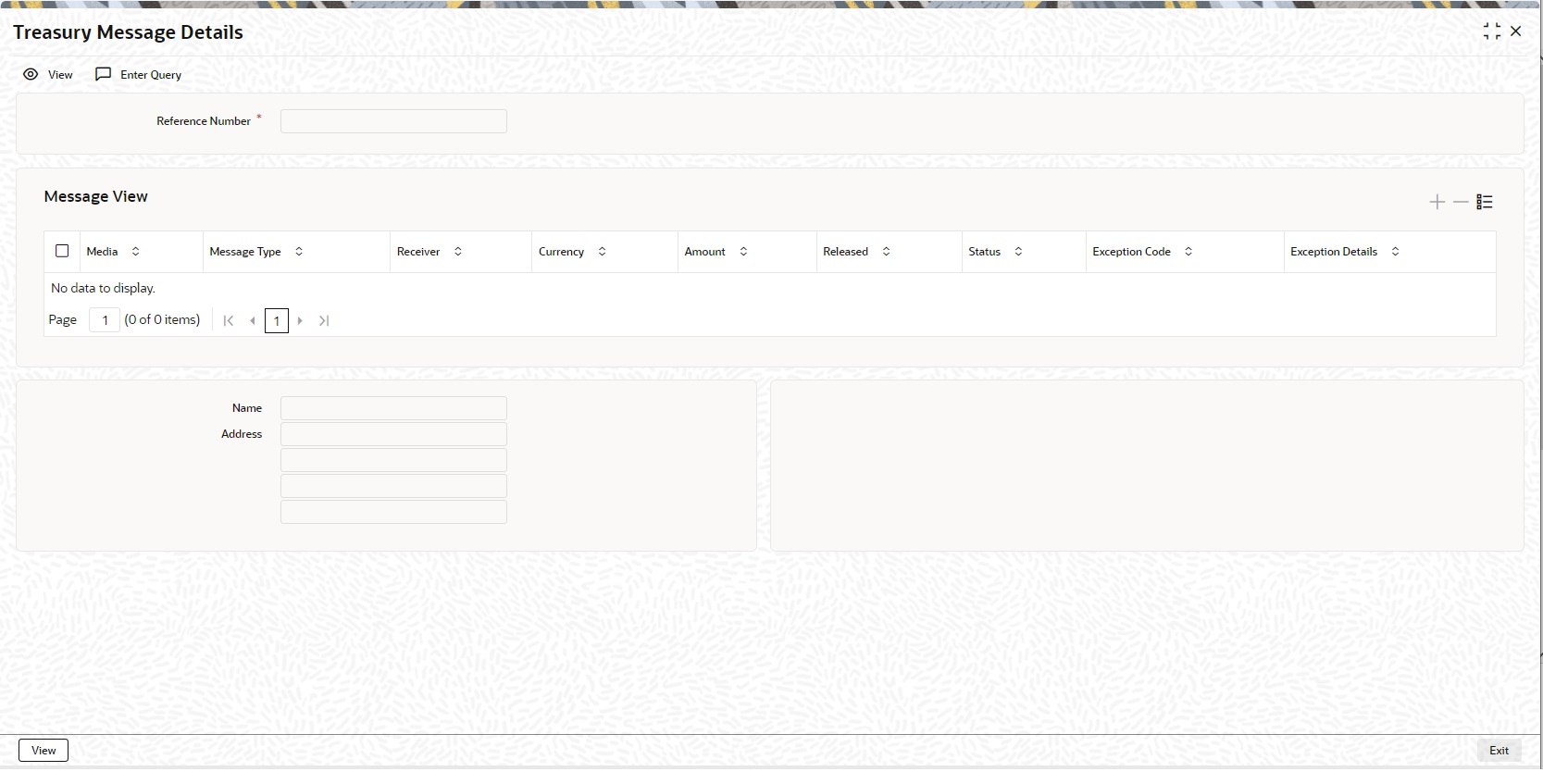

- On Security Repo Contract Online screen, click Messages.

Treasury Message Details screen is displayed.

- On the Treasury Message Details Screen, specify the details as required.

The following details of Advices are displayed:

- The message type

- The Name and ID of the recipient of the message and

- The status of the message.

click Messages to view the list of advices applicable to a particular event in the lifecycle of the repo.

- On the Treasury Message Details screen, click View.

Treasury Message screen is displayed.

- On the Treasury Message screen, specify the details as required.

To view the text of a message, highlight the message and click . Click Exit or Cancel button to exit the screen.

View the following details:

- Reference number of the message/advice

- Document number generated for the message/advice

- Version number of the message/advice

- Receiver/sender of the message

- Type of the message

- Type of the SWIFT message

- Complete text of the message/advice

- Remarks, if any

- Reject reason, if any

- Message trailer

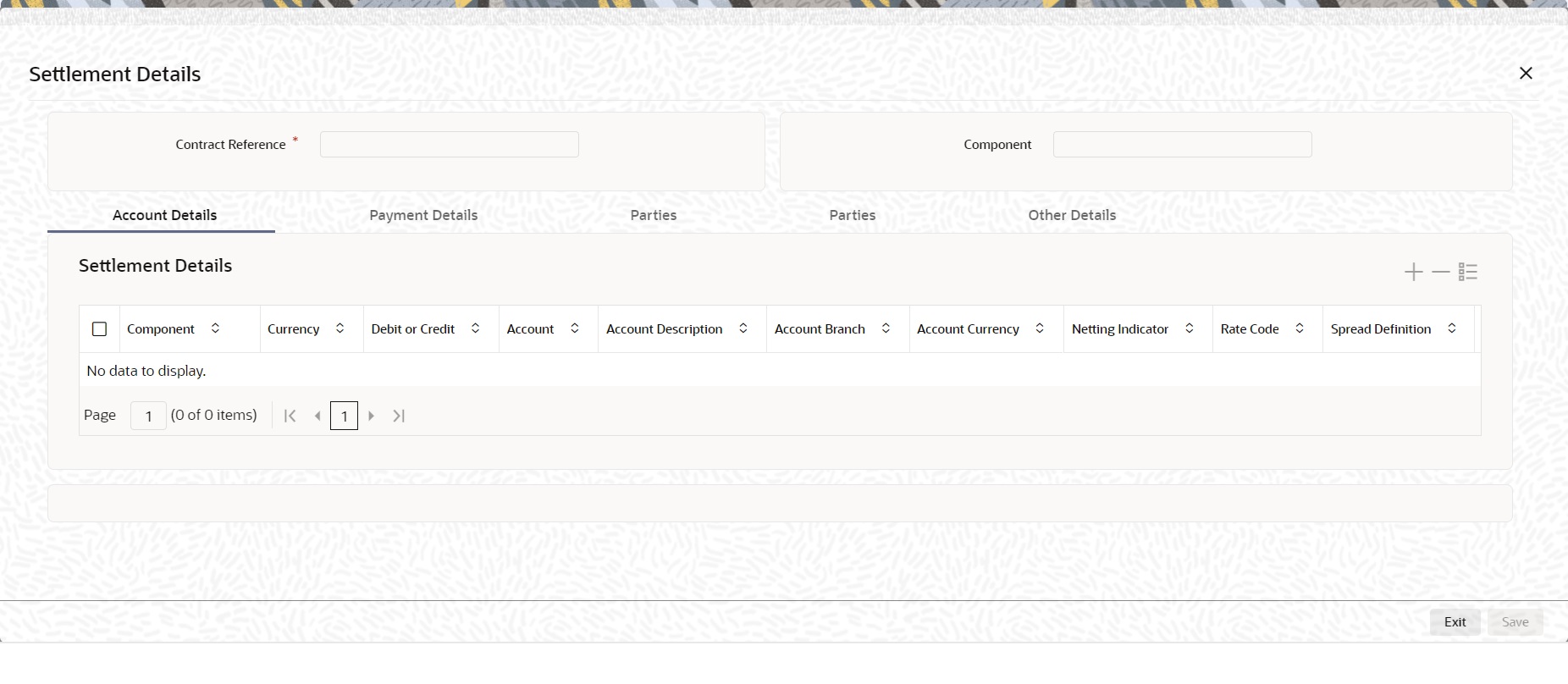

- On Security Repo Contract Online screen, click Settlement.

The settlement account details of each deal is displayed in the Settlement Instructions screen. Click on the contract for which the user want to view the settlement details and it is displayed in the Settlement Instructions section. For each amount tag, the following settlement details are displayed:

- Settlement account

- Currency of the settlement account

- Settlement account branch

- Payable or Receivable

- Ordering Institution

- Ordering Customer

- Beneficiary Institution

- Ultimate Beneficiary

- The settlement details for the latest event of the deal is displayed.

The Settlement Details screen is displayed. - On the Settlement Details screen, specify the details as required.

The deal gets settled based on the details specified in the settlement screen.

Note:

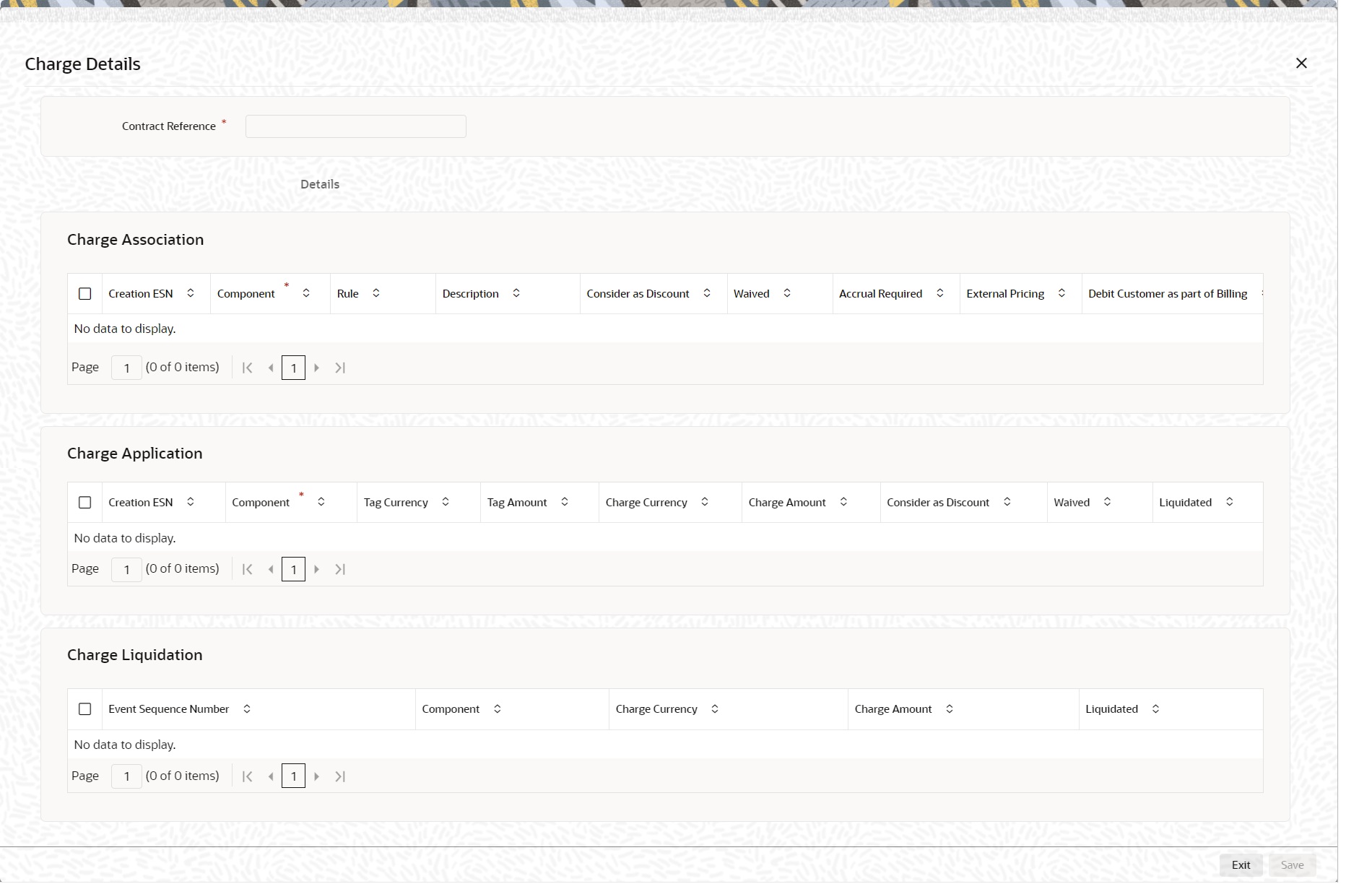

For more details on this screen, refer to Settlements User Manual, section Processing Settlements. - On the Security Repo Contract Online screen, click Charges.

The Charge Details screen is displayed.

- On the Charge Details screen, specify the details as required.

Note:

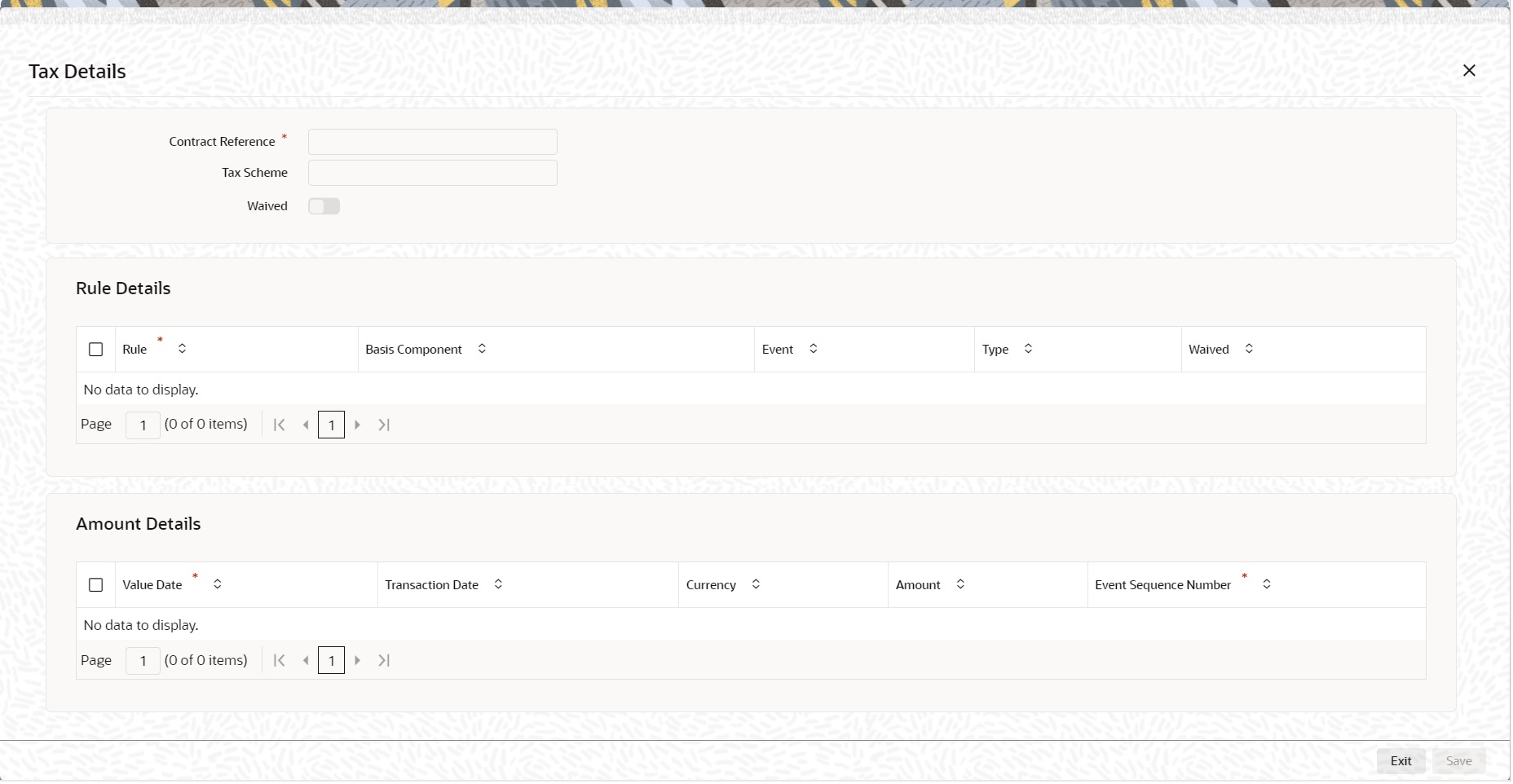

The ICCF rate, amount, currency and the user can specify waive charge parameter. The Processing Charges and Fees manual, details the procedure for maintaining charge rules. - On the Security Repo Contract Online screen, click Tax.

The Tax Details screen is displayed.

- On the Tax Details screen, specify the details as required.

For information on fields, see the below table

Table 2-39 Tax Details - Field Description

Field Description Contract References

Displays the contract reference number

Tax Scheme

Displays the tax scheme associated to the product.

Waived

Specify if the tax must be waived

Rule Details Specify the Rule details. Rule

Displays the tax rules

Basis Component

Defaults the basis component from the product.

Event

Displays the event associated to the tax.

Type

Displays the type of tax.

Waived

Specify if the tax must be waived

Amount Details Specify the Amount details. Value Date

Value date of tax liquidated

Transaction date

Transaction date of the tax processing

Currency

Displays the tax currency

Amount

Displays the tax amount collected

Event Sequence Number

Displays the event sequence number

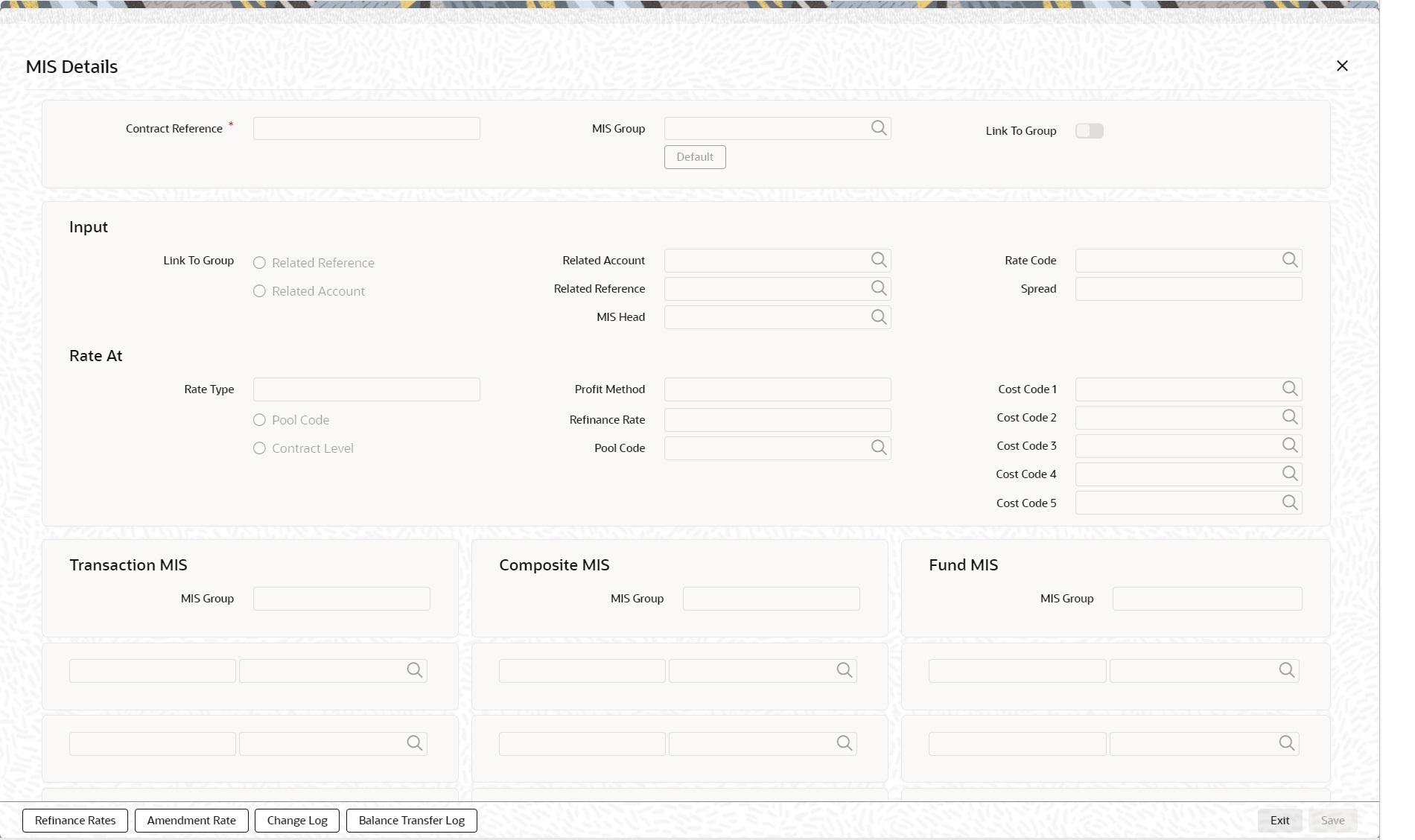

- On the Security Repo Contract Online screen, click MIS.

The MIS Details screen is displayed.

Figure 2-39 MIS Details

- On the MIS Details screen, specify the details as required.

For information on fields, refer the MIS User Guide.

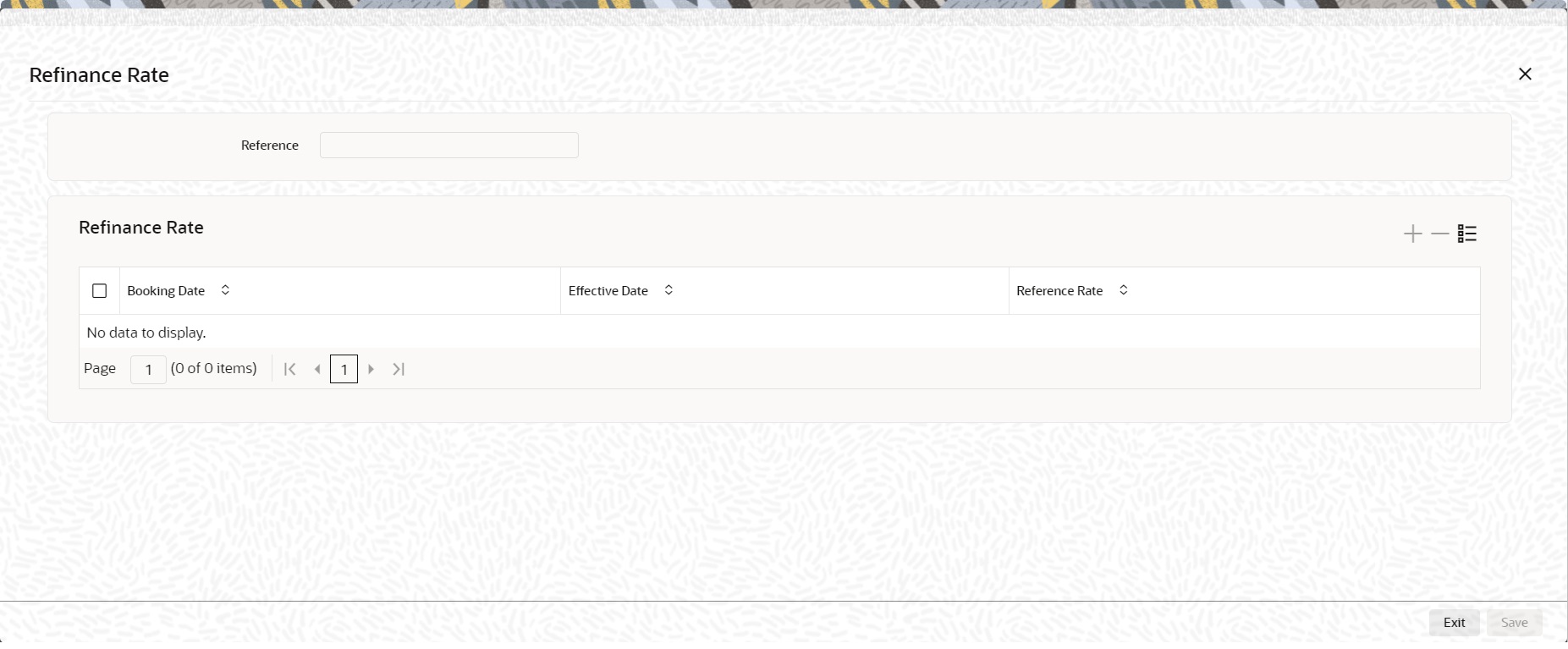

- On the MIS Details screen, click Refinance Rate.

The Refinance Rate screen is displayed.

- On the Refinance Rate screen, specify the details as required.

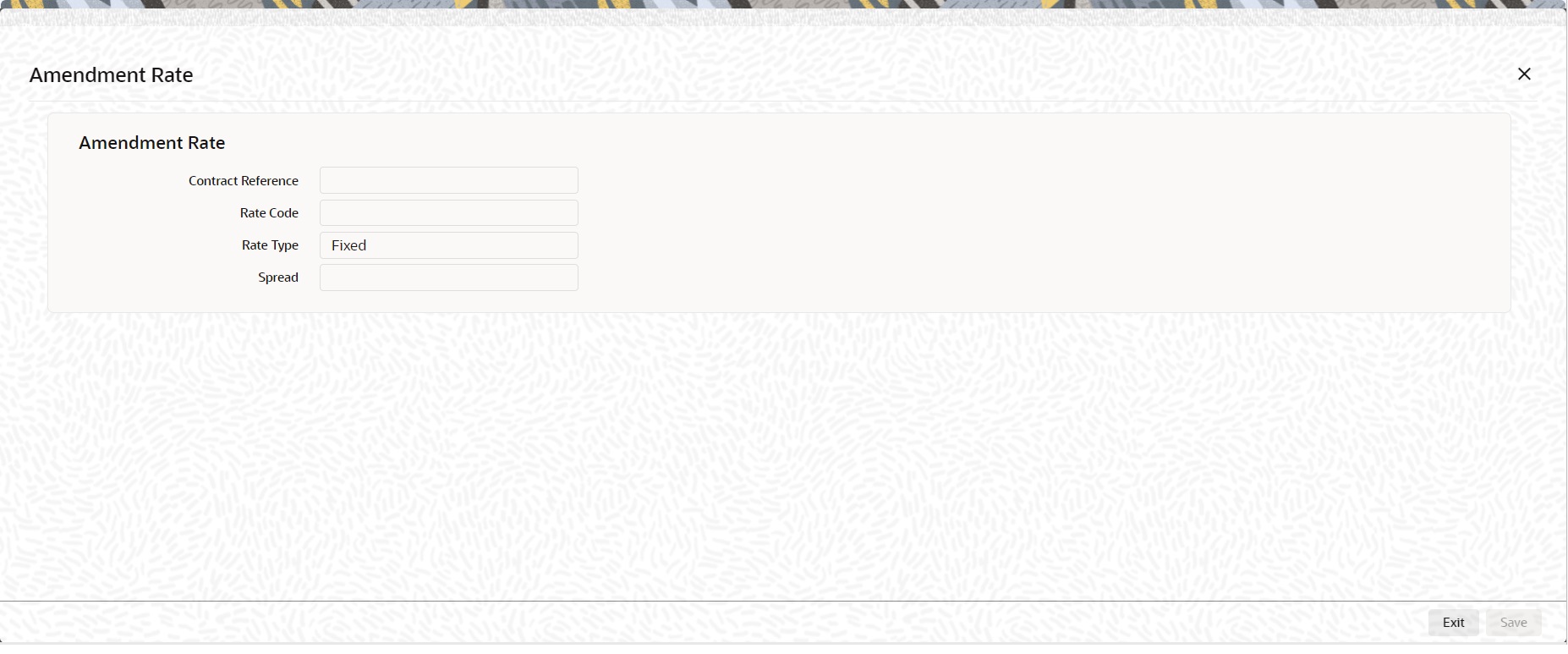

- On the MIS Details screen, click Amendment Rate.

The Amendment Rate screen is displayed.

- On the Amendment Rate screen, specify the details as required.

For information on fields, see the below table

Table 2-40 Amendment Rate- Field Description

Field Description Rate Type

Select the Rate Type from the drop-down list.

The Options are:

- Fixed

- Floating

- Automatic

- Floating Periodic

Contract Reference

Specify the contract reference number.

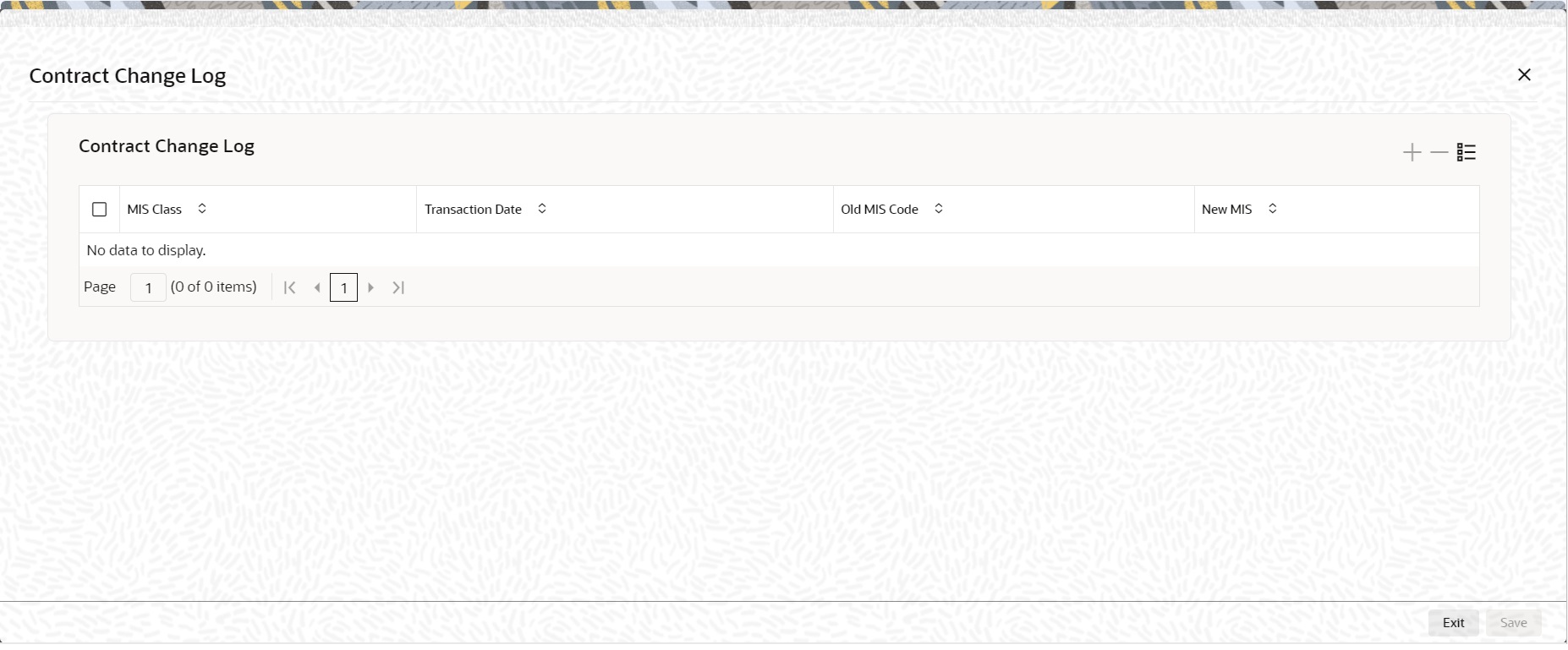

- On the MIS Details screen, click Change Log.

The Change Log screen is displayed.

- On the Change Log screen, specify the details as required.

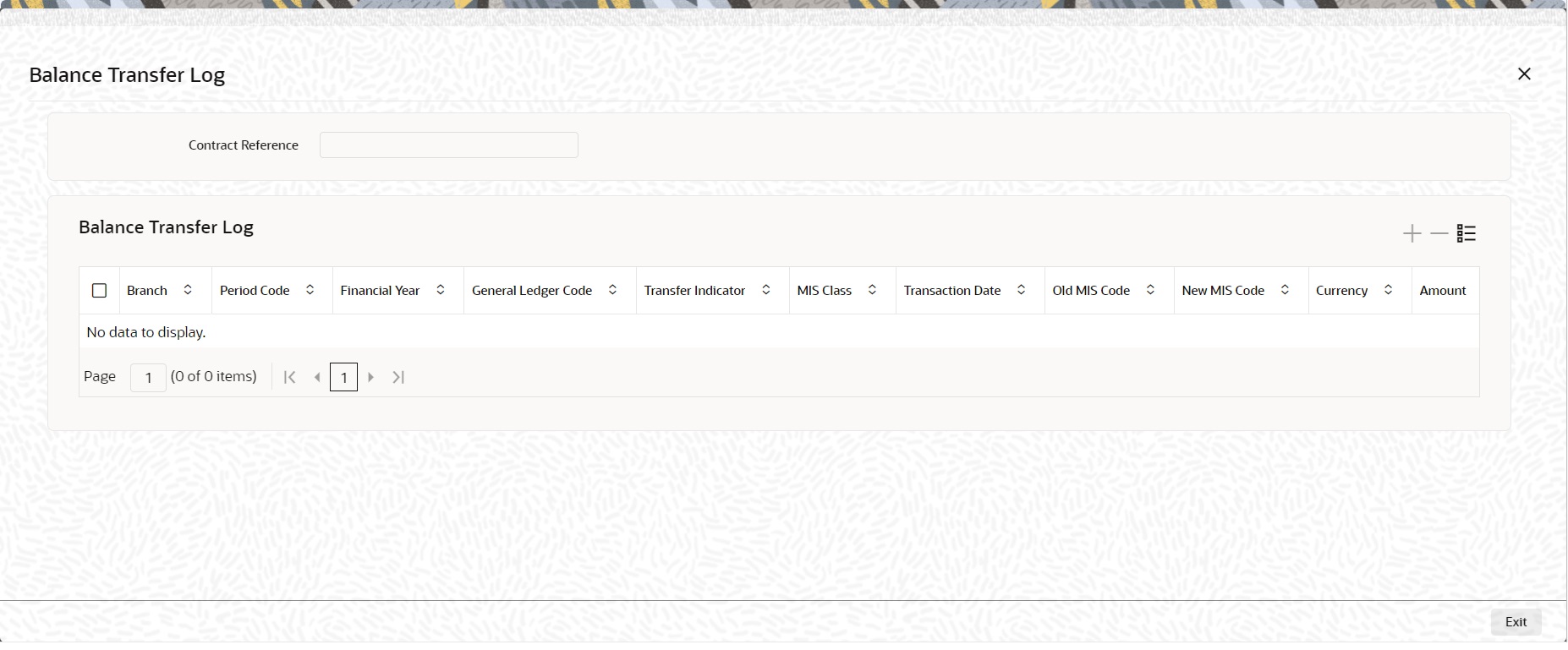

- On the MIS Details screen, click Balance Transfer Log.

The Balance Transfer Log screen is displayed.

- On the Balance Transfer Log screen, specify the details as required.

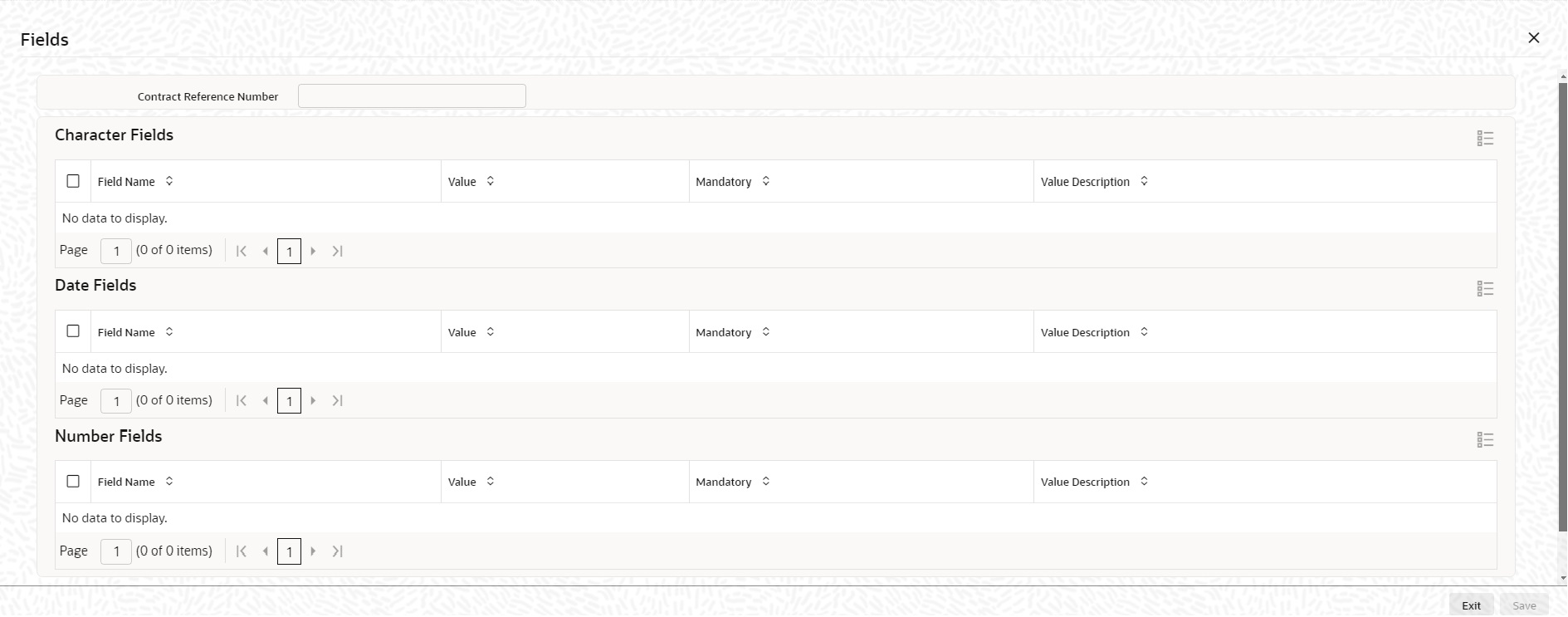

- On the Security Repo Contract Online screen, click Fields.

The Fields screen is displayed.

Figure 2-44 Fields

- On the Fields screen, specify the details as required.

For information on fields, see the table below

Table 2-41 Fields - Field Description

Field Description Contract Reference Number

Displays contract reference number

Field Name

Defaults user defined field name mapped to the product

Value

Specify the UDF value

Mandatory

Defaults the mandatory flag from user defined maintenance screen

Value Description

Displays the user defined value description

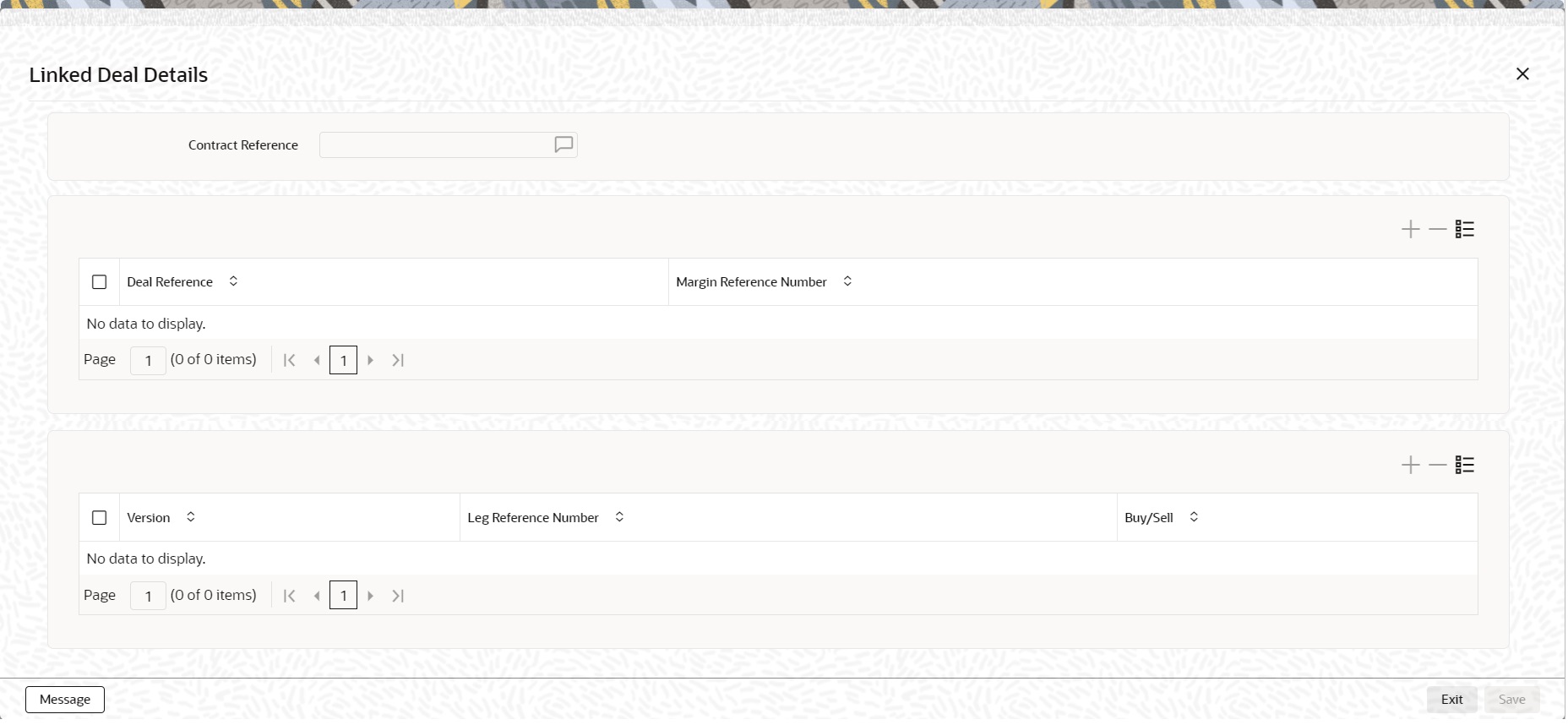

- On the Security Repo Contract Online screen, click Linked Deal Details.

The Linked Deal Details screen is displayed.

- On the Linked Deal Details screen, specify the details as required.

For information on fields, see the table below

Table 2-42 Linked Deal Details - Field Description

Field Description Contract Reference

Displays the contract reference number

Deal Reference

Displays all linked deal reference number for the repo contract.

The options of Deal type are:

- Buy deal

- Sell deal

- Block deal

Margin Reference Number

Displays all the margin reference number created for the repo contract on margin processing

Version

Once the user clicks the Deal reference, system displays the leg reference version number

Leg Reference Number

Once the user clicks the Deal reference, system displays the leg reference number

Buy/Sell

Displays the leg type

- On the Linked Deal Details screen, click Messages.

User can view the MT5X message generated for a repo/reverse repo deal.

Treasury Messages Details screen is displayed.Figure 2-46 Treasury Messages Details

- On the Treasury Messages Details screen, specify the details as required.

For information on fields, see the below table:

Table 2-43 Treasury Messages Details - Field Description

Field Description Reference Number

Displays contract reference number

Media

Displays the message media

Message Type

Displays the message type

Receiver

Displays Receiver ID.

Currency

Displays message currency

Amount

Displays the amount

Released

Displays the released status

Status

Displays current status of message.

Exception Code

Displays the exception code, if the message goes in exception

Exception Details

Displays the exception details.

Name

Displays the name of the receiver.

Address

Displays the receiver address.

- On the Treasury Messages Details screen, click View.Treasury Messages screen is displayed.

Figure 2-47 Treasury Messages

- On the Treasury Messages screen, specify the details as required.

For more information on fields, see the below table

Table 2-44 Treasury Messages - Field Description

Field Description Reference Number

Displays the contract reference number

DCN

Displays document reference number of a contract

Event Sequence Number or Version Number

Displays the event sequence number

Receiver or Sender

Displays Receiver or Sender ID.

Message Type

Displays the type of message.

SWIFT Message Type

Displays the Swift MT number of the message sent or received.

Sub Message Type

Displays the sub message type

SWIFT Sub Message Type

Displays the Swift sub message type.

Message

Displays the Message view

Remarks

Displays the remarks

Reject Remarks

Displays the reject remarks.

Message Trailers

Displays the message trailers.

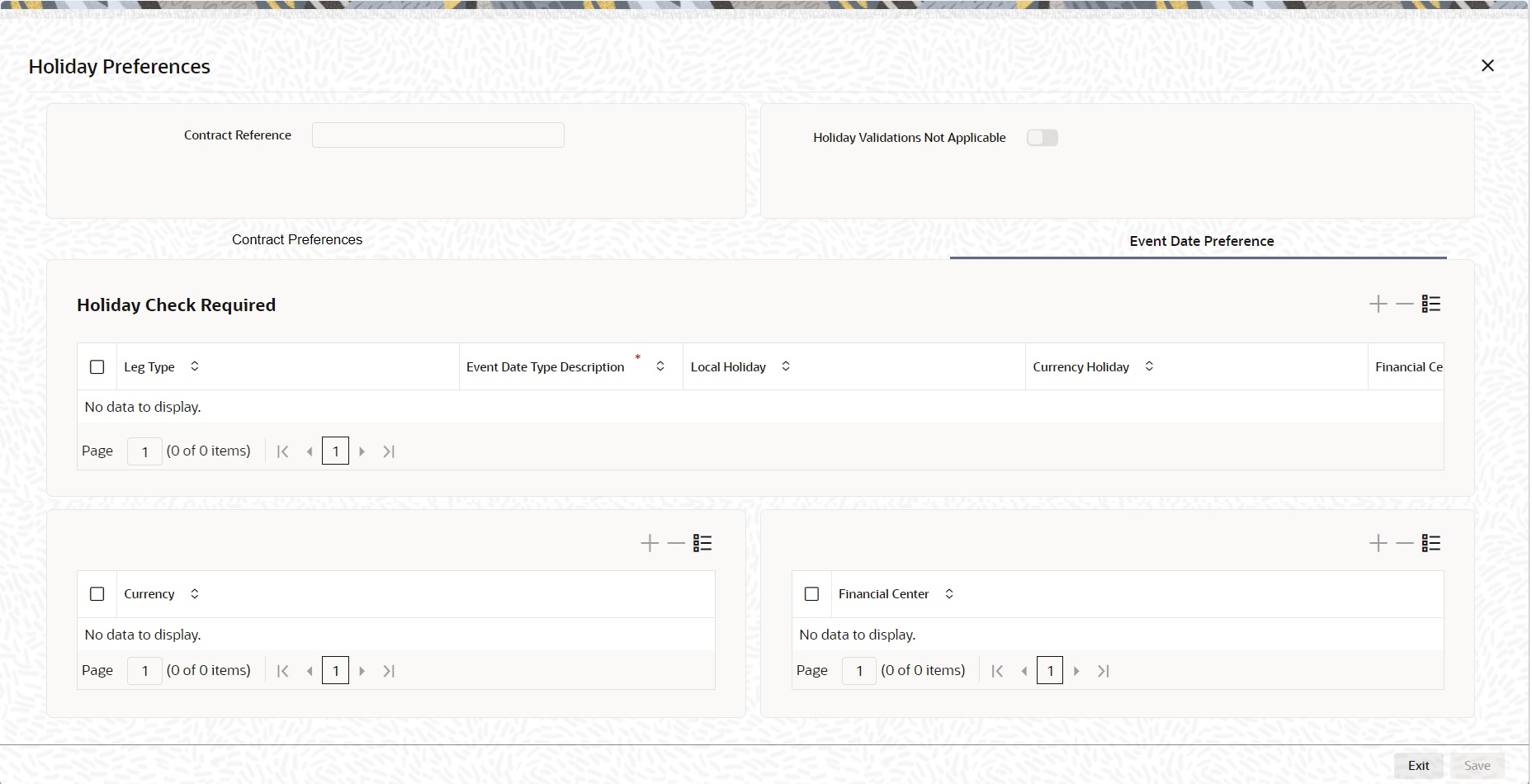

- On the Securities Repo Contract Online screen, click Holiday Preference.

Holiday Preference screen is displayed

- On the Holiday Preference screen, specify the details as required.

For information on fields, see the below table

Table 2-45 Holiday Preference - Field Description

Field Description Contract Reference

The Contract Reference number from the main screen is displayed here.

Holiday Validations Not Applicable

Check this box to indicate that the holiday calendar validation must not be performed.

Local Holiday

Select this check box, if the local holiday validation of dates and schedule movement is required, which is defaulted from product and amendable.

Currency Holiday

Select this check box, if the currency holiday calendar validation of dates and schedule movement is required, which is defaulted from product and amendable.

Financial Center Holiday

Select this check box, if the financial center holiday calendar validation of dates and schedule movement is required, which is defaulted from product and amendable.

Move Across Months

Check this box to indicate that the final date must be derived next month if the date falls on holiday. Otherwise, final date becomes end of the month though actual date derived is on next month.

Date Movement

Select the holiday date movement when the date falls on holiday. The adjoining drop-down list displays the following values:- Forward

- Backward

Currency

Specify the currency details for which the holiday validation for dates and schedules movement is required, which is defaulted from product and amendable.

Financial Center