Note:

The fields which are marked in red asterisk are mandatory.

For more information on fields, refer to the field description table.

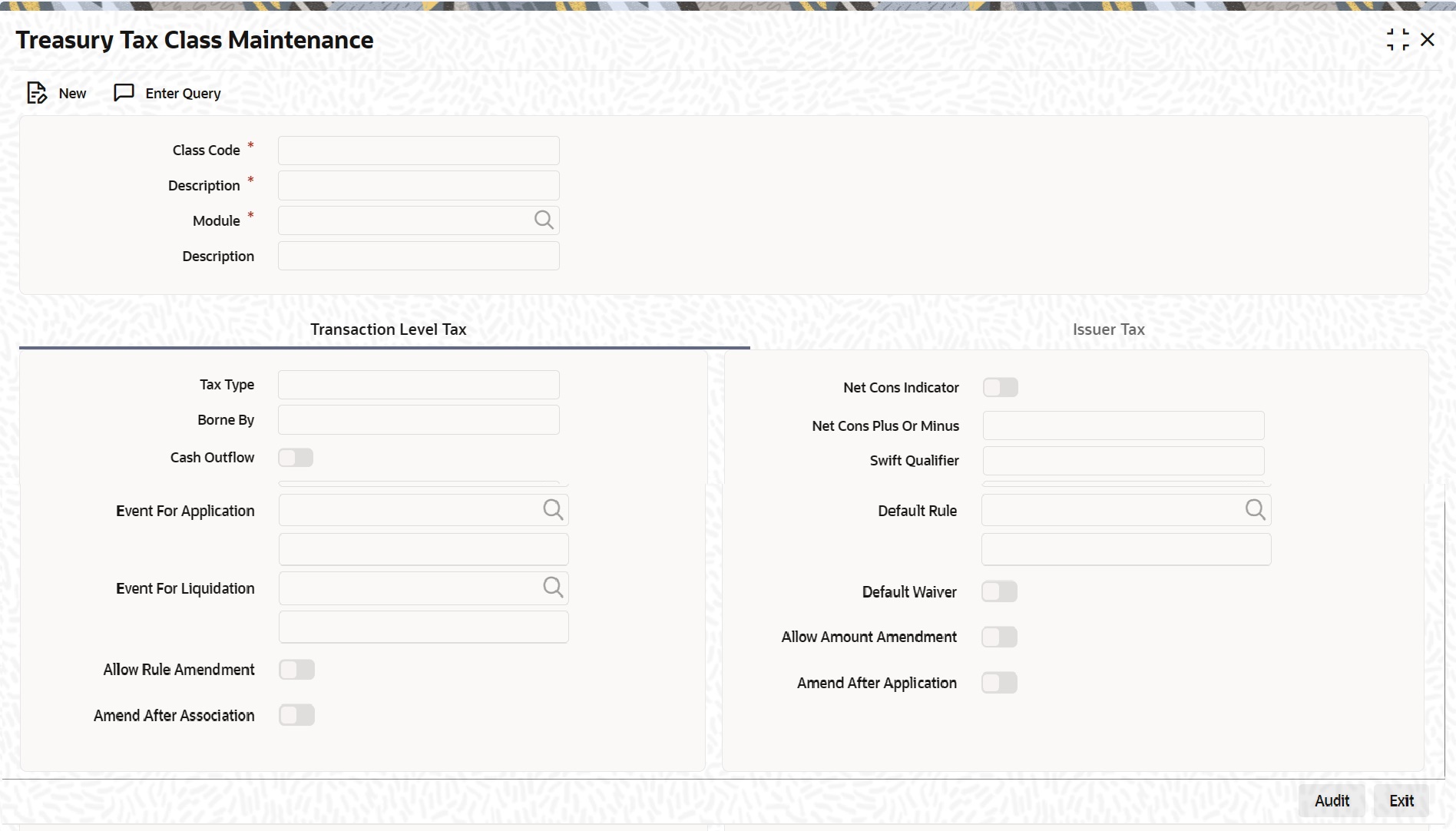

The Net Consideration: The sum of the different components of a contract determines the net value of the contract. To indicate that a transaction-level tax component should be taken into account when determining the net value of a contract, choose the Net Consideration option.

If you choose to include the tax component in the net value of the contract, you should also indicate if the tax component is to be added or subtracted, while calculating the net consideration amount.

Assume you buy securities from a counterparty. The different components of the deal are:

- The value of the securities USD 50,000

- The applicable tax USD 1,000

- The accrued interest USD 1,500

- The applicable charge USD 50.

If you choose to include the tax component when calculating the value of the deal, choose the Net Consideration option. Indicate if the component is to be Added or Subtracted.

Result: If you choose the Net Consideration option and decide to add the tax component to the value of the deal, the net value of the deal would be USD 52,550.

If you choose the Net Consideration option and decide to subtract the tax component from the value of the deal, the net value of the deal would be USD 50,550.

If you do not choose the Net Consideration option, the net value of the deal would be: USD 51,550.

Define the Events and the Basis Amount: Each contract that your bank enters into goes through different stages, each of which is referred to as an Event in Oracle Banking Treasury Management.

A securities deal, for instance, goes through different stages in its life cycle, such as:

- Deal Booking

- Money Settlement of Securities Deal

- Settlement of Securities Deal

- Reversal of Securities Deal

- Cancellation of Securities Deal.

Each of these stages is referred to as an Event in Oracle Banking Treasury Management.

The following are examples of the events for a portfolio that you maintain:

- Booking of Contingent Asset

- Accrual of Discount Earned

- Accrual of Interest Earned

- Forward Profit and Loss Accrual.

At any of these events, you can choose to apply a tax. The event at which you would like to associate a tax component is referred to as the Association Event. At this event, no accounting entry (for the tax component) is passed.

The event at which the tax component is actually computed is referred to as the Application Event. The tax is liquidated at the Liquidation Event.

The basis on which a tax is calculated is referred to as the Basis Amount. A tax can be on the basis of the principal, the brokerage paid and so on. When building a tax class, you have to specify the tag associated with the Basis Amount.

Choosing the Default Tax Rule: A tax rule can be linked to the tax component that you are building. When you link a rule to a component, the attributes that you have defined for the rule, will default to the component.

A tax rule identifies the method in which tax, is to be calculated. A rule is built with attributes such as the following:

- The tax currency

- Whether the tax is to be a flat amount or calculated on a rate basis

- The minimum and maximum tax that can be applied

- The tier or slab structure on which the tax is to be applied

- The currency restrictions, etc.

The tax component to which you link a rule acquires ITS properties. Tax for the contracts with which you associate a tax component will, by default, be calculated according to the rule linked to the component. However, when processing a contract, you can choose to waive the rule.

When building a tax class, you can choose to allow the amendment of the rule linked to it, under the following conditions:

- You can choose to allow amendment after the association event.

- You can choose to allow amendment after the application event.

- You can choose to allow amendment of the tax amount.

Including a Component in SWIFT Messages: To report a component of a contract in the SWIFT messages that you generate, identify the component with the appropriate SWIFT code. You can identify a tax component with its SWIFT code when building the component.

For example, you would like to report the details of a contract to a customer, over SWIFT. Assume you would like to report the tax component (amongst others) in the message that you generate. Each component is identified in SWIFT by a unique code. Even while building the tax component in the Tax Class Maintenance screen, you can identify it with its SWIFT Code.

In the SWIFT Qualifier field of the Tax Class Maintenance screen, you can enter the component identifier, as follows:

| If the tax component you are building is… |

Enter |

| a Country, National, Federal tax |

COUN |

| a Payment Levy sort of tax |

LEVY |

| a Local tax |

LOCL |

| a Stock Exchange tax |

STEX |

| a Transfer tax |

TRANSACTION |

| a Transaction tax |

TRAX |

| a Value Added tax |

VATA |

| a Withholding tax |

WITH |