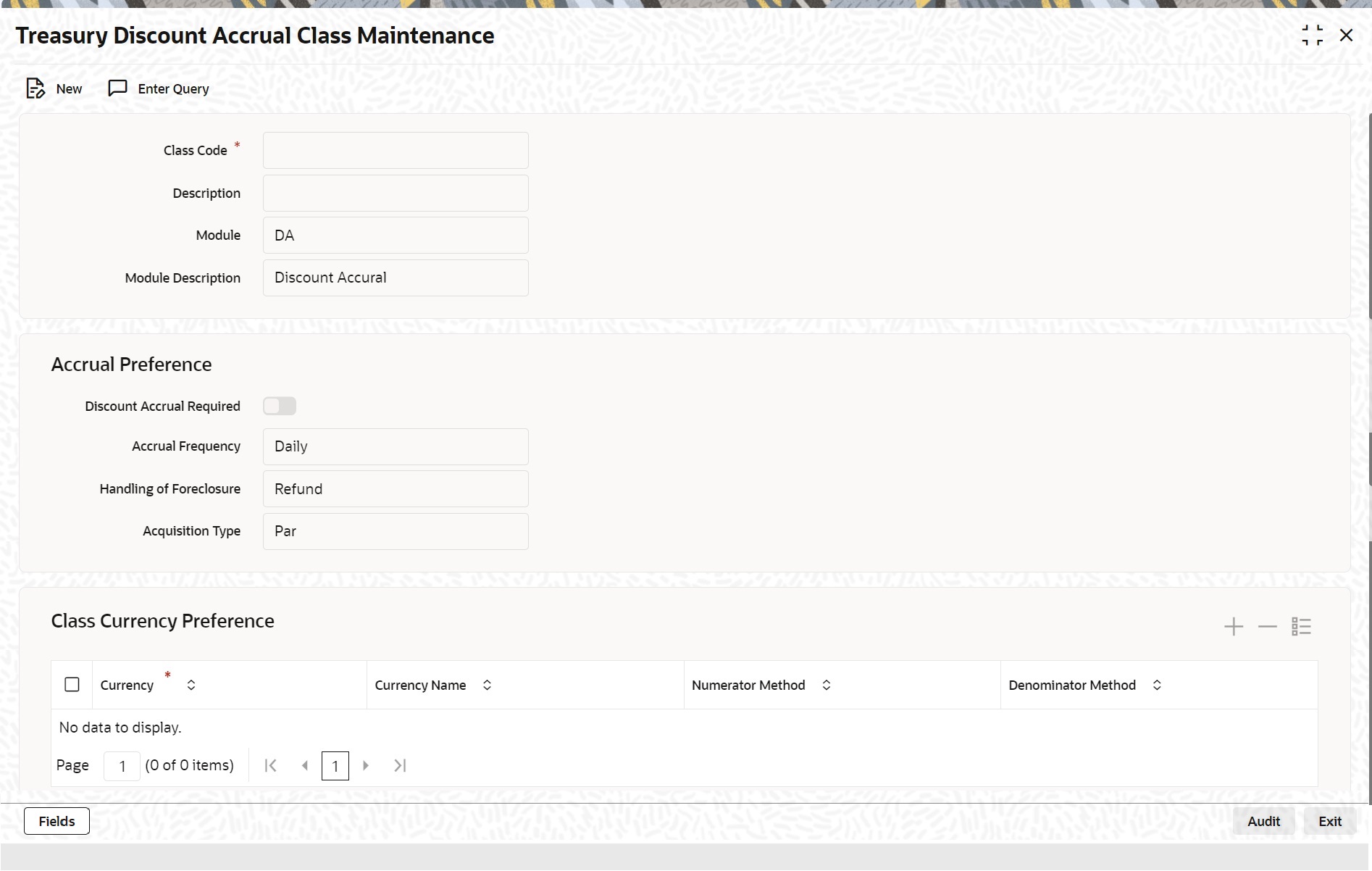

1.7 Discount Accrual Class Maintenance

This topic describes the systematic instruction to maintain discount accrual class.

A discount accrual fee class specifies the accrual parameters for interest, charges and fees. Before defining the attributes of a discount accrual fee class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description would help you easily identify the class.

When building a discount accrual fee class, you define certain attributes such as:

- Whether Discount accrual should be performed for the class.

- The frequency at which discount accrual should be performed. This can be either Daily or Monthly. For monthly accruals, the discount accrual will be done on the last day of the month.

- How foreclosures in respect of the contracts using the class, must be handled. You can opt for complete accruals, or refund.

- The day count methods for each currency using the class.

Parent topic: Create Classes