1.22 Process Dividend Equalization Adjustment

This topic provides the systematic instructions to enter additional adjustments for the number of G1 and G2 units that a Unitholder holds in a fund.

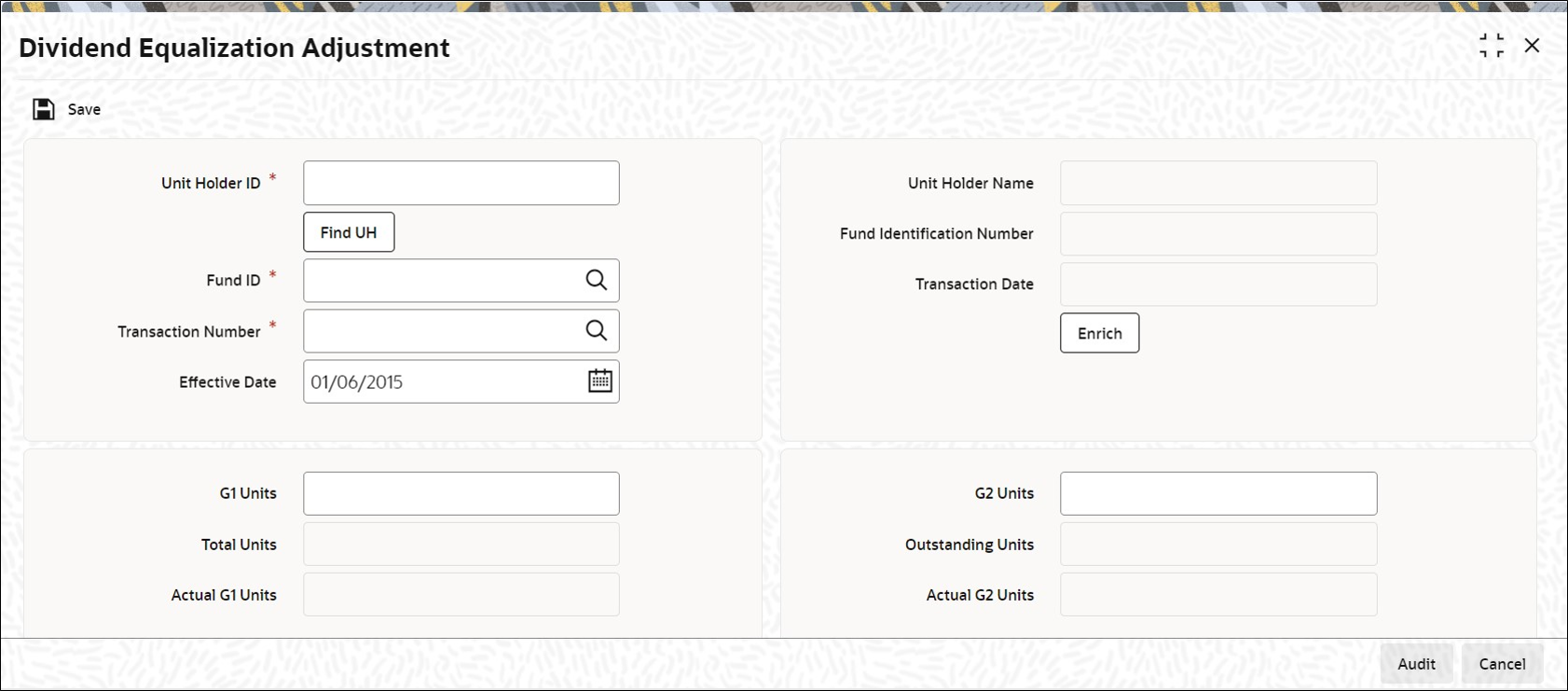

- On Home screen, type UTDDIVEQ in the text box, and click Next.The Dividend Equalization Adjustment screen is displayed.

Figure 1-18 Dividend Equalization Adjustment

- On Dividend Equalization Adjustment, click New to enter the details.For more information on fields, refer to the field description table.

Table 1-16 Dividend Equalization Adjustment - Field Description

Field Description Unit Holder ID Alphanumeric; 12 Characters; Mandatory Specify the ID of the unit holder for which you wish to maintain G1-G2 conversions. You can also select the ID from the adjoining option list. The list contains all unit holder IDs maintained in the system.

You can also select unit holder ID by clicking the Find UH button.

Unit Holder Name Display The system displays the name of the unit holder based on your choice of the Unitholder ID.

Fund ID Alphanumeric; 6 Characters; Mandatory Specify the fund ID. You can also select the ID from the adjoining option list. The list contains all fund IDs maintained in the system.

Fund Identification Number Display The system displays the fund identification number.

Transaction Number Alphanumeric; 16 Characters; Mandatory Select the transaction number for the unit Holder and fund ID combination, from the adjoining option list.

Transaction Date Date Format; Mandatory Select the transaction date from the adjoining calendar.

Effective Date Date Format; Mandatory Specify the date on which the conversions should be considered. The effective date entered is considered to be equal to the transaction date of the selected transaction.

G1 Unit Alphanumeric; 27 Characters; Mandatory Specify the G1 unit for adjustment. These units are converted against a transaction for the UH-Fund Combination.

G2 Units Numeric; Mandatory Enter the number of G2 units that should be converted to G1 units or vice versa.

For instance, if a Unit holder UH1 has 300 G1 units and 500 G2 units as determined by the system based on the Units for Freeze Holding preference.

If you specify 100 units for adjustment, the system will convert 100 G1 units to G2 units during freeze holding (G1 units – 200, G2 units – 600). If you maintain it as -100, then 100 units will be reduced from G2 and added to G1 upon freeze holding (G1 units 400, G2 units 400).

Note: The amount received by each unit holder on the basis of their G1 and G2 units will be calculated as shown below:

Gross Income = ((Total unit balance* Gross Group 1 rate)- (Group 2 units * Equalization rate/ (1-std tax rate)))

Tax deducted =Gross income * tax applied

Net Income = Gross Income-Tax deducted

Equalization amount = Group 2 units * equalization rate

Total Payment = Net Income + Equalization Amount

The unit conversion is effective from the authorization of the record. On conversion, a reference number is generated and is available in the audit trail.

Total Units Display The system displays the total transaction units against the transaction number selected earlier.

Outstanding Units Display The system displays the available units as on the application date.

Actual G1 Units Display The system displays the actual G1 units.

Actual G2 Units Display The system displays the actual G2 units.

Parent topic: Dividend Maintenance