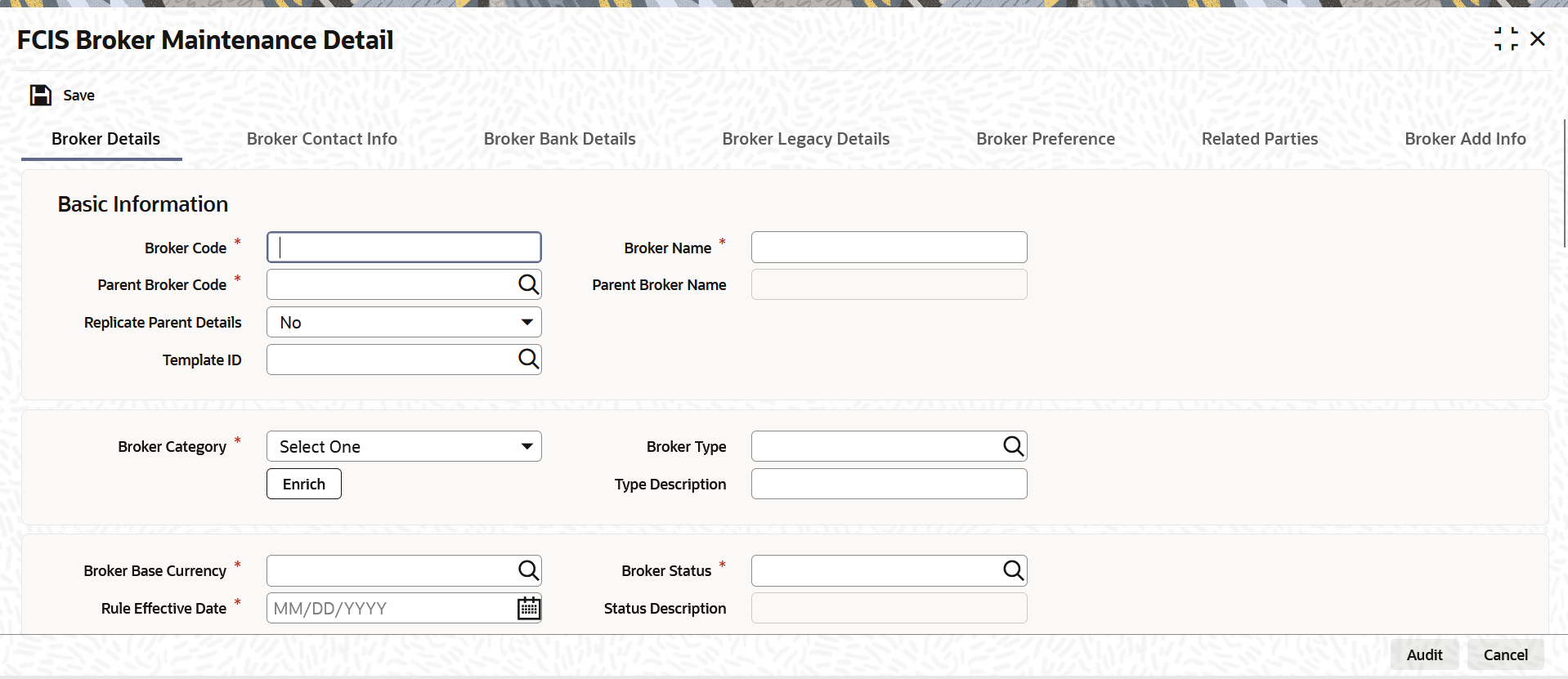

4.3 Process FCIS Broker Maintenance Detail

This topic provides the systematic instructions to maintain a record for a broker.

- Broker Details Tab

This topic explains the broker details tab of FCIS Broker Maintenance Detail screen. - Broker Contact Info Tab

This topic explains all the details of the available modes of communication and correspondence with the broker. - Broker Bank Details Tab

This topic explains the details of any bank accounts operated by the broker, which are preferred for transacting with the AMC. - Broker Legacy Details Tab

This topic explains the broker legacy details tab of FCIS Broker Maintenance Detail screen. - Broker Preference Tab

This topic explains the broker preference details tab of FCIS Broker Maintenance Detail screen. - Related Parties Tab

This topic explains the related parties tab of FCIS Broker Maintenance Detail screen. - Broker Add Info Tab

This topic provides the systematic instruction to indicate the relevant information applicable to the broker under each head if the AMC has designated any additional information heads for brokers in this section.

Parent topic: Entities - Manage Brokers