3.8 Perform LOI Adjust Proc

This topic provides the systematic instructions to process LOI Adjustment.

To obtain such a report, you must trigger the computation and storing of the actual commission data, from the system database.

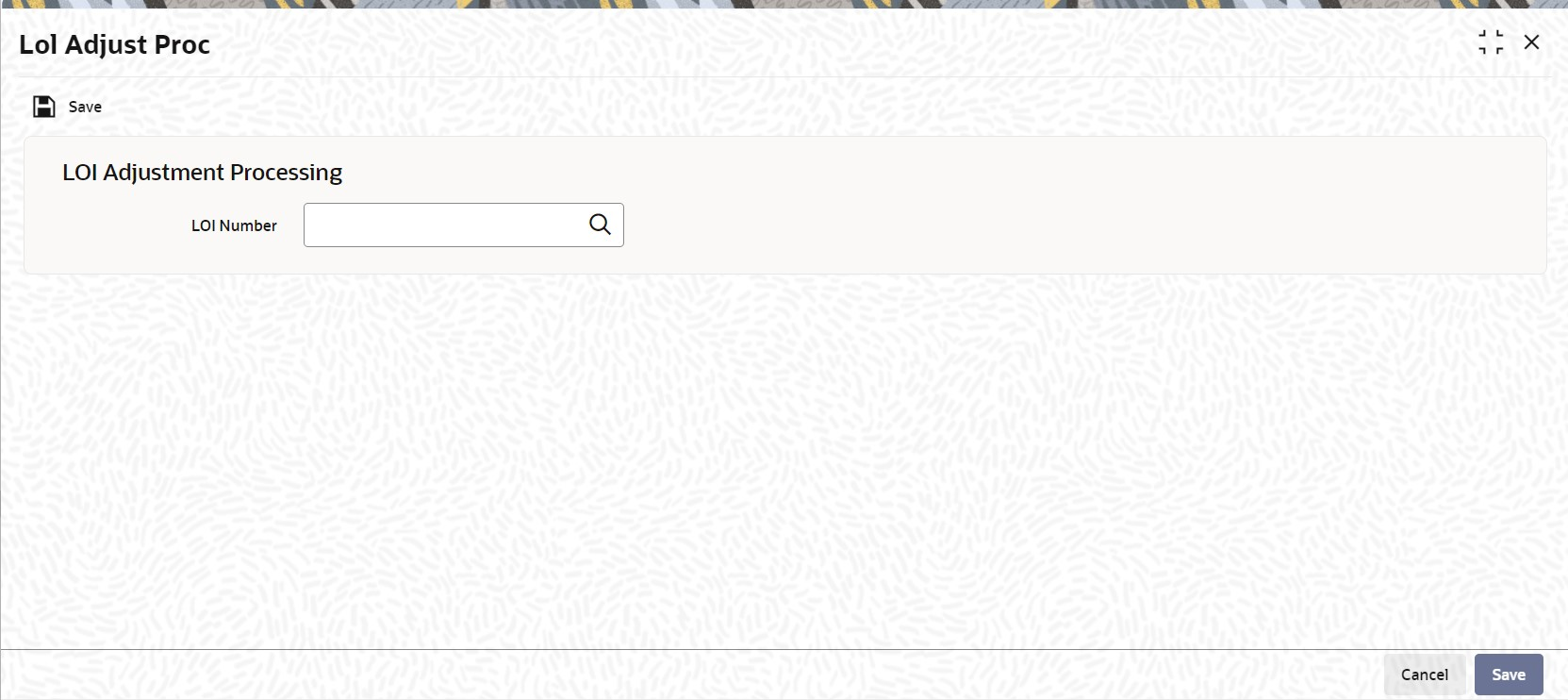

- On Home screen, type

UTDLOIPR

in the text box, and click Next.The LOI Adjust Proc screen is displayed.

- On LOI Adjust Proc screen, click

New to enter the details.For more information on fields, refer to the field description table.

Table 3-10 LOI Adjust Proc - Field Description

Field Description LOI Number Alphanumeric; 25 Characters; Optional

Specify the LOI number of the corresponding letter of intent, on the next business date after the expiry date of the letter of intent.

Alternatively, if you do not specify the number, you can trigger the computation of commission data for all such letters of intent that are unfulfilled, after the expiry date.

After you have triggered the computation of commission data, in the LOI Adjustment Processing screen, you can use the LOI Non-Fulfillment menu item in the Batch menu to obtain the actual report.

This report contains details of the actual commission due on each of the transactions without considering the letter of intent. This amount must be recovered from the unit holder by the AMC.

The following details are displayed in the report for each letter of intent for any investor which is unfulfilled as on the next business date after the expiry date:- LOI Number

- Letter of intent amount agreed (LOI amount).

- Letter of intent amount fulfilled (used up amount).

- ID of the load group to which the fund belongs, for which the LOI was set up for the investor.

- The funds in the load group.

- Transaction number, for each transaction designated as an LOI transaction.

- Commission collected for the transaction.

- Actual commission that should have been collected had there been no letter of intent.

- The loss borne by the AMC, which is computed as the difference between the commission collected and commission that should have been collected had there been no LOI.

The commission for each of the LOI transactions entered into during the LOI period is recomputed as if there had been no letter of intent. For each transaction, the actual commission collected and the commission that should have been collected without the LOI is displayed. The sum of the commissions will be subtracted from the actual commission collected and the difference is reported through the report.

LOI investors have the option of designating any single transaction they enter into, as a Letter of Intent transaction. If so designated, the transaction amount in such transactions will reduce the Letter of Intent used up amount.

Parent topic: Entities - Set Up Investor Preferences