3.33.4 Merge Details

This topic provides information on merge details tab.

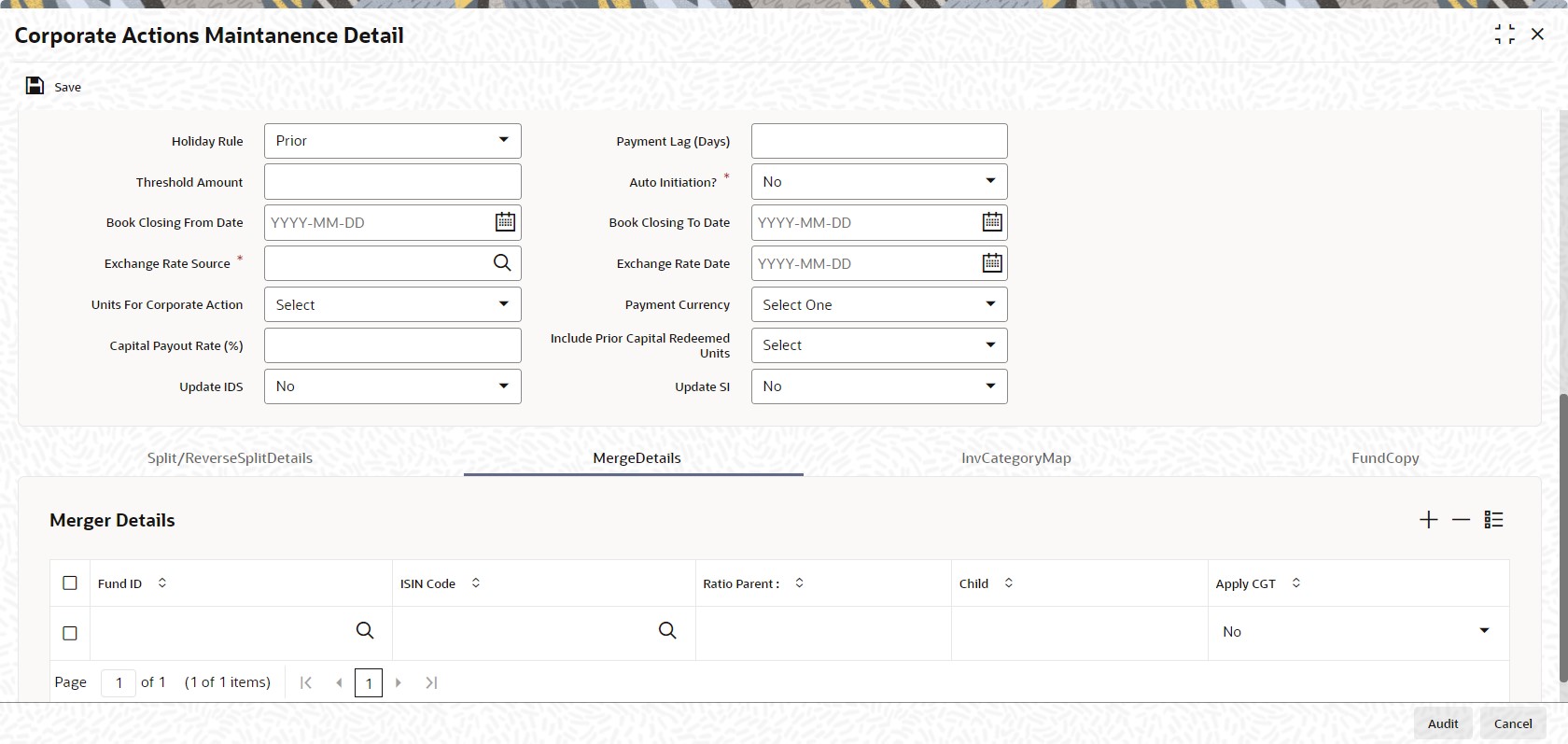

- Click Merge Details tab in Corporate Actions

Maintenance Detail screen. The Merge Details are displayed in Corporate Actions Maintenance Detail screen.

Figure 3-43 Corporate Actions Maintenance Detail

For more information on fields in the screen, refer the below table.

Table 3-60 Corporate Actions Maintenance Detail - Merge Details

Field Description Fund ID Alphanumeric; 6 Characters; Optional Specify the parent fund for the corporate action. This list contains the names of all the authorized funds in the system.

ISIN Code Alphanumeric; 12 Characters; Optional Select the ISIN Code of the parent fund for the corporate action, from the options provided. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field and vice versa.

Ratio Parent : Numeric; 22 Characters; Optional Specify the Parent Ratio.

Child Numeric; 22 Characters; Optional Specify the Child Ratio.

Apply CGT Optional Select Yes from drop-down list to apply CGT. Else select No.

The parent – resultant ratio for the merger the parent ratio can either be less than or greater than the resultant ratio.

- Whether fractional units are allowable as a result of the merger. If you indicate so, you can also specify the applicable number of decimals.

- Whether the merger date must be moved forward or backward, if it falls on a holiday.

- Payment lag, if any, for the merger

- Threshold amount

- Whether or not the merger process must be automatically initiated on the merger date (the Beginning of Day processes initiate the merger process in the system, if automatic initiation is specified)

- The book closing period that signifies the dates between which transactions into the fund are suspended for processing the merger.

- The exchange rate source applicable and the exchange rate date

- Whether the system should update the income distribution setup for the merger

- Whether the system should change the standing instructions and policy details

- Fund merger can either result in transfer of holdings to a new fund or an existing fund based on Ratio Parent: Child defined in Corporate Action Maintenance Detail. The system will classify the holdings of an investor in the merger fund as Execution Only Business and Advised Business based on the classification of underlying transaction in the source fund.

Example

Fund A merging into Fund B in the ratio of 2:1.

Holdings in Fund A are as follows:Unit Advised Execution Total UH1 120 10 130 UH2 180 - 180 UH3 - 100 100 Post merger, the Holdings in Fund B will be as follows:Unit Advised Execution Total UH1 60 5 65 UH2 90 - 90 UH3 - 50 50

Parent topic: Corporate Actions for Fund