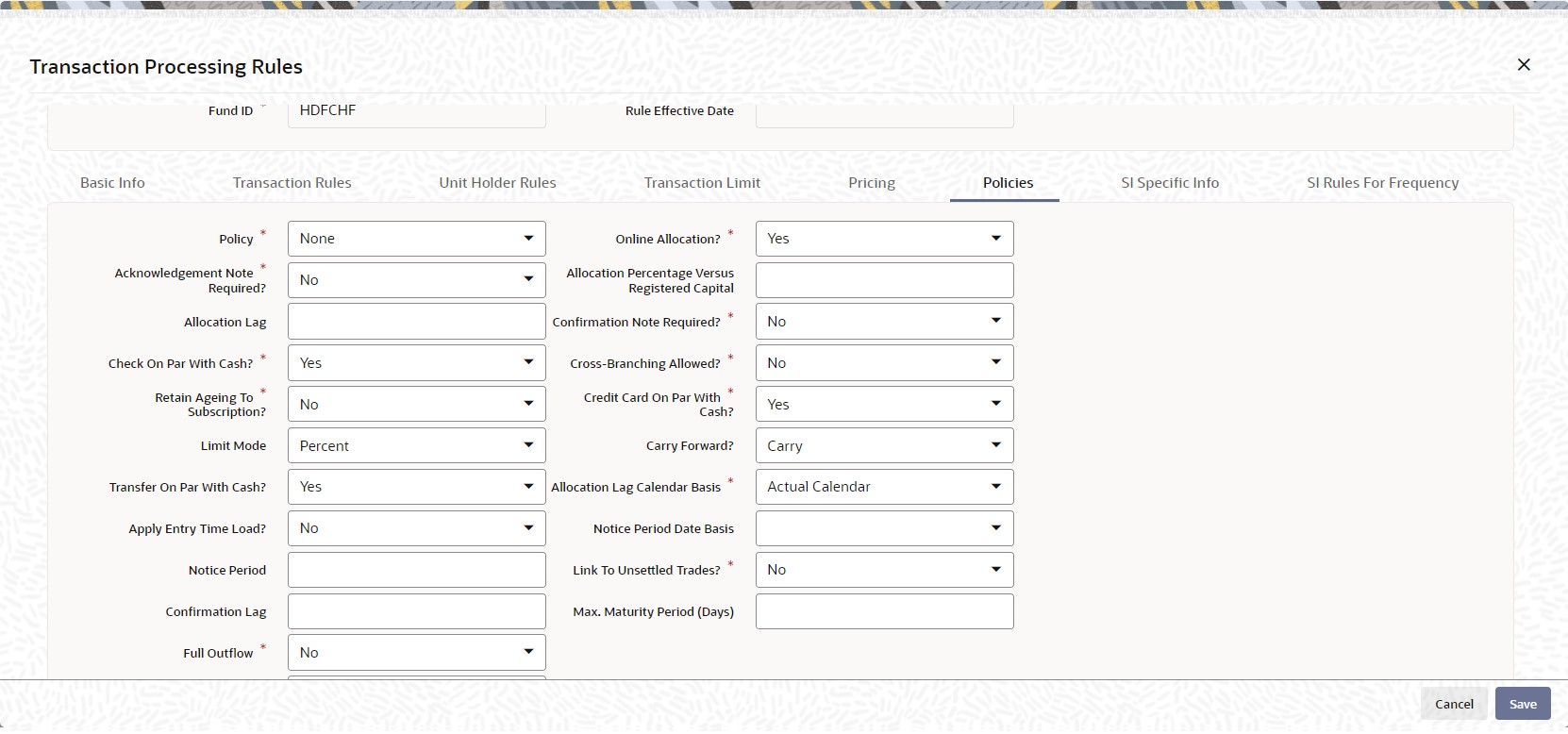

2.1.7.6 Policies

This topic provides information on policies tab of transaction processing rules screen.

In this section, you can set up the following information:

- Allocation details such as allowing of online allocation, credit card/check allocation on par with cash, allocation and confirmation lags, and the allocation policies.

- The limit redemption mode, which can be either percentage of holdings, amount or units.

- Click Transaction Processing Rules, click Policies tab in screen to specify the details.The Policies screen is displayed.

- On Policies tab, specify the details.

For more information on fields in the screen, refer the below table.

Table 2-34 Transaction Processing Rules - Policies

Field Description Policy Mandatory Select First In First Out or Proportionate option from drop-down list to specify the policy for allocation in case the maximum limit is reached for a given day. This policy is with respect to the allocation percentage that is allowed against the fund corpus.

Acknowledgment Note Required? Mandatory Select Yes from drop-down list to indicate that the Acknowledgment Slip is to be printed after every transaction. Otherwise this can be printed only at the User’s request.

Allocation Lag Numeric; 22 Characters; Mandatory Enter a value to specify when the transaction should be allocated if the transaction is T. T + X, where X signifies the number of lag days. Lag can only be positive.

Check On Par with Cash Mandatory Select Yes from drop-down list to indicate that all cheque / Demand Draft transactions are to be treated on par with cash transactions. If this is true, then during allocation, the cheque / demand draft transactions will be taken for allocation for the same day. The units allocated will be provisional, and will be confirmed only after the cheque is cleared.

Retain Ageing to Subscription? Mandatory Select Yes from drop-down list to indicate that the aging principle must be applied to subscription transactions in the fund. Aging is the process of keeping track of a transaction from the transaction date right up to when it is cleared in full from the account of the unit holder. Depending upon the policy specified for aging, ( either FIFO or Proportionate), aging is applied.

In case of CDSC funds it is mandatory for you to select Yes.

Note: Retain Ageing to Subscription should be set to Yes for transaction type 04 but not to the transaction type 03 in order to imply the functionality for TWITCH.

Limit Mode Optional Select the mode based on which redemption will be limited from the drop-down list. The list displays the following values:

- Percent

- Amount

- Units

Transfer On Par With Cash Mandatory Select Yes from drop-down list to indicate that all transfer transactions to be treated on par with cash transactions. If this is true then during allocation the transfer transactions will be taken for allocation for the same day. The units allocated will be provisional, and will be confirmed only after the bank transfers are cleared.

Apply Entry Time Load? Optional For exit fee loads applied on outflow transactions such as redemption, switch-out and transfer, you can choose to apply the return values prevalent at the time of initiation of the inflow subscription or IPO transaction being aged, or the return values prevalent at the time of the outflow transaction.

To indicate that the entry load values must be applied, select Yes from the drop-down list. To indicate that exit load values must be applied, select No in this field.

Pseudo Switch Lag Numeric; 22 Characters; Optional Specify the Pseudo Switch Lag.

Notice Period (%) Numeric; 3 Characters; Optional Notice period is the number of days which an investor has to inform the Transfer Agent in advance before certain number of days, in case of transaction (Subscription / Redemption / Switch / Transfer/ IPO transaction) in a fund.

A notice period is set at each transaction type level for a fund. The system tracks the transaction breaches if any from the notice period. The person who authorizes the transaction is made aware of the notice period breach.

Payment Lag Calendar Basis Mandatory Select whether the payment lag days should be considered based on the holiday calendar for the fund, the actual calendar, the System calendar or the payment currency calendar from the drop-down list. The list displays the following values:

- Actual Calendar

- Currency Calendar

- System Calendar

- Fund Calendar

The following details are captured in the Fund rules - transaction processing rules screen to capture Notice period and the Notice period date basis:

- (Actual Calendar or System Calendar) for Subscription

- Redemption

- Switch

- Transfer transaction

- IPO transaction

The system raises a warning message for breach in notice period if the transaction date added to the notice period is greater than the dealing date during transaction capture. You can view the overridden warning messages at the time of transaction authorization.

The system internally tracks a transaction level indicator to indicate the breach in notice period. The criteria based flat percentage or amount based load can be setup for transactions which breached the notice period based on this indicator.

Note: There is no change in deriving dealing date logic. The system will not re-validate the transaction for any changes in the holiday calendar post transaction save.

Confirmation Lag Numeric; 22 Characters; Mandatory Enter a value to specify when the redemption transaction should be picked for confirmation after allocation. T + X, where X signifies the number of lag days. Lag can only be positive.

The confirmation lag can be defined to be applicable to both AMC as well as Distributor installations.

Full Outflow Mandatory Select Yes from drop-down list to allow full outflow of a fund. Else select No.

If this option is checked for a redemption transaction, then partial redemption will not be allowed for the fund.

Note: If this checked then the maturity date of a fund will not be displayed and the transaction mode will be defaulted as Percent and transaction value as 100 in the redemption screen.

Min Maturity Period (Days) Numeric; 4 Characters; Optional Specify the minimum maturity period of the fund here. During subscription transaction, maturity date will be defaulted as the sum of the application date and the minimum maturity period specified here.

Transaction Threshold Amount Numeric; 30 Characters; Optional Specify a threshold amount for redemption type transaction. On saving a redemption transaction, the system will display a warning message if the transaction amount (in fund base currency) is greater than the maintained threshold amount.

In case of unit based transaction, units applied and latest available NAV will be used to derive the basis value for comparison. The system will use the par value if latest NAV is not available. Similarly, for multi-currency transaction, to derive the basis value for comparison, the transaction base currency is converted to fund base currency based on the transaction exchange rate. If transaction’s exchange rate is not available, then the system will use the latest available exchange rate (as per project allocation logic). The system will not validate the transaction value with maintained threshold amount if the exchange rate is not available.

Online Allocation? Mandatory Select Yes from drop-down list to indicate that Online Allocation is to be allowed for the given transaction type. This can be enabled only if the fund is pre-priced.

For Post Priced Fund with Allocation as Online, the Transaction Frequency is Allocation.

Allocation Percentage Versus Registered Capital Numeric; 20 Characters; Optional Specify the percentage up to which allocation can be allowed for a given registered capital on a given day, for the selected transaction type.

Confirmation Note Required? Mandatory Select Yes from drop-down list to indicate that the Confirmation Slip is to be printed after every transaction. Otherwise this can be user initiated after allocation of the transaction.

Cross Branching Allowed? Mandatory Select Yes from drop-down list to indicate that the transactions of the selected type can be entered from a different branch.

Credit Card On Par With Cash? Mandatory Select Yes from drop-down list to indicate that all credit card transactions to be treated on par with cash transactions. If this is true then during allocation the credit card transactions will be taken for allocation for the same day. The units allocated will be provisional, and will be confirmed only after the credit card transaction is cleared.

Carry Forward? Optional Select the manner in which the balance over redeemed quantity to be treated from the drop-down list. The list displays the following values:

- Carry

Allocation Lag Calendar Basis Mandatory Select whether the allocation lag days should be considered based on the holiday calendar for the fund, the System calendar or the actual calendar. Select one of the options from the drop-down list:

- Actual Calendar

- Fund Calendar

- System Calendar

Pseudo Switch Calendar Basis Optional Select the pseudo switch calendar basis option from the drop-down list. The list displays the following values:

- Actual Calendar

- Fund Calendar

- System Calendar

Notice Period Date Basis Optional Select the notice period date basis option from the drop-down list. The list displays the following values:

- Actual Calendar

- System Calendar

Link to Unsettled Trades? Mandatory Select the option Yes from the drop-down list to indicate redemption transactions can be linked to unsettled inflow transactions. Select the option NO to indicate redemption transactions can be linked to settled inflow transactions only.

Note: This field, by default, will be set to NO.

If entry time loads are being applied as specified here, and the loads are overridden at the time of transaction entry, the overridden load values are applied.

Similarly, if entry time loads are being applied, and a unit holder deal has been specified for the unit holder, the deal values are applied.

Note: This feature is only available if your installation has specifically requested for it.

Max Maturity Period (Days) Numeric; 4 Characters; Optional Specify the maximum maturity period applicable for the fund.

Note:- The minimum and maximum maturity period can be specified only if FundOutflow field is checked.

- The subscription, maturity date should lie with in the Min/Max Maturity period specified here.

Once the maturity date is reached, automatic redemption of the fund will take place as a BOD activity provided there is no judicial block (partial or full) on the subscription.

Parent topic: Transaction Processing Rules Button