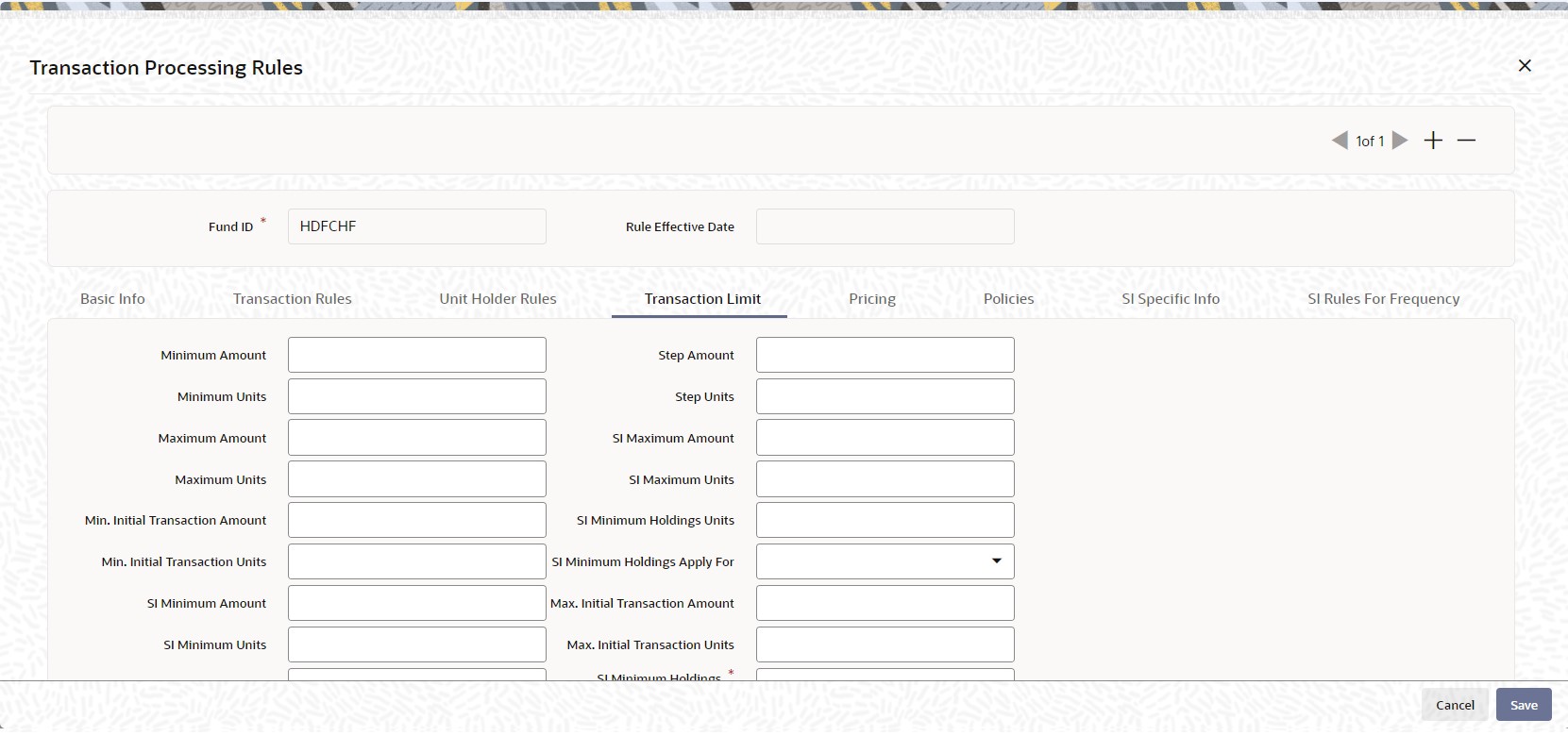

2.1.7.4 Transaction Limit

This topic provides information on transaction rules tab details.

You can use this screen to indicate the minimum volume limits for initial transactions and the limits for standing instruction transactions for investors in a fund, for a certain transaction type.

You can also specify the minimum holdings balance for an IPO or subscription transaction in respect of a standing instruction, for a CIF or an individual unit holder, in the fund.

You can access this screen from the Transaction Processing Rules profile screen for each fund, by clicking on the Limits for SI/Investment link in the Transaction Limits section.

When you save your specifications in this screen, it will be closed and you will be returned to the main Transaction Processing Rules screen. When you save the transaction processing rule record for the fund, the specifications you have made in this screen are saved as part of the same record, in the database.

The volume limits on transactions in the transaction type are captured here.

The limits that may be specified here depend upon the Application Mode specified for this transaction type. If the Mode specified is Amount, then the Amount limits in this section are mandatory. If the Mode is Units, the Units limits are mandatory. If the Mode is ‘Both’, then both limits are mandatory.

- Click Transaction Processing Rules, click Transaction Limit tab in screen to specify the details.The Transaction Limit screen is displayed.

- On Transaction Limit tab, specify the fields.

For more information on fields in the screen, refer the below table.

Table 2-31 Transaction Processing Rules - Transaction Limit

Field Description Minimum Amount Numeric; 22 Characters; Optional Specify the minimum transaction amount allowed for this transaction type in this fund.

Minimum Units Numeric; 22 Characters; Optional Specify the minimum number of units that may be applied for in this transaction type in this fund.

Maximum Amount Numeric; 22 Characters; Optional Enter a value to specify the Maximum Transaction Amount that a unit holder can invest or redeem. This is the maximum amount that can be accepted for the fund for this given transaction type.

Maximum Units Numeric; 22 Characters; Optional Enter a value to specify the Maximum Transaction Units that a unit holder can invest or redeem.

This operates in lines similar to that of the Transaction Amount.

The maximum volume (in terms of units) of a single transaction that is entered should never exceed or be equal to the figure of one billion.

For instance, if a user wishes to enter a transaction of 1.5 billion units, he will have to consider entering two transactions, with neither exceeding a maximum limit of 999999999.999999 units.

Min. Initial Transaction Amount Numeric; 30 Characters; Optional Specify the minimum amount permitted for an initial transaction, for an investor in this fund.

Min. Initial Transaction Units Numeric, Optional Specify the minimum number of units permitted for an initial transaction, for an investor in this fund.

SI Minimum Amount Numeric; 22 Characters; Optional Specify the minimum amount allowable for a standing instruction transaction in this fund.

SI Minimum Units Numeric; 22 Characters; Optional Specify the minimum number of units allowable for a standing instruction transaction in this fund.

SI Minimum Holdings Amount Numeric; 22 Characters; Optional Specify the minimum redeemable value of holdings in the fund, for an IPO or subscription transaction in respect of a standing instruction involving a CIF or individual unit holder.

Example

For the Royal Trust Growth Fund, you have selected the Amount option as the Minimum Holdings Indicator for IPO or subscription transactions that would be generated in respect of standing instructions. You have also specified the Minimum Holdings Amount value as 1200 USD (the base currency of the fund is USD).

The minimum holdings validation is required to be enforced for individual unit holders and not for CIFs.

Therefore, the redeemable value of total number of units held by an individual unit holder, in the Burton Carey Fund must exceed or equal 1200 USD for an IPO or subscription transaction in respect of a standing instruction involving the unit holder.

Step Amount Numeric; 22 Characters; Optional Enter a value to specify the steps of amount in which a unit holder can invest or redeem.

Step Units Numeric; 22 Characters; Optional Enter a value to specify the steps of units in which a unit holder can invest or redeem. This will operate above the Minimum Transaction Units.

SI Maximum Amount Numeric; 22 Characters; Optional Specify the maximum amount allowable for a standing instruction transaction in this fund.

Note: If the client country parameter is set to SIRULEATFREQ for your bank, in order to maintain SI specific details click on the link ‘SI Rules for Frequency under the Transaction limit tab.

SI Maximum Units Numeric; 22 Characters; Optional Specify the maximum number of units allowable for a standing instruction transaction in this fund.

Note: Note If the client country parameter is set to SIRULEATFREQ for your bank, in order to maintain SI specific details click on the link ‘SI Rules for Frequency under the Transaction limit tab.

SI Minimum Holdings Units Numeric; 22 Characters; Optional Specify the minimum number of units required to be held by an individual unit holder, or a CIF, in the fund, for an IPO or subscription transaction in respect of a standing instruction.

Example

For the Carey Bugle Growth Fund, you have selected the Units option as the Minimum Holdings Indicator for IPO or subscription transactions that would be generated in respect of standing instructions. You have also specified the Minimum Holdings Units value as 1000.

The minimum holdings validation is required to be enforced for individual unit holders and not for CIFs.

Therefore, the total number of units held by an individual unit holder, in the Carey Bugle Growth Fund must equal or exceed 1000 USD, for an IPO or subscription transaction in respect of a standing instruction involving the unit holder.

A note on the minimum holdings validation

If the Minimum Holdings Indicator selected is Lower of Amount/Units, the redeemable value of the specified Minimum Holdings Units is arrived at, and compared with the Minimum Holdings Amount specified. The lower of the two values is considered as the minimum holdings value against which the minimum holdings validation would be made. Similarly, if the Minimum Holdings Indicator selected is Higher of Amount/Units, the redeemable value of the specified Minimum Holdings Units is arrived at, and compared with the Minimum Holdings Amount specified, and the higher of the two values is considered as the minimum holdings value against which the minimum holdings validation would be made.

Example

For the Burton Carey Growth Fund, you have selected the Lower of Amount/Units option as the Minimum Holdings Indicator to be validated for successful generation of an IPO or subscription transaction in respect of a standing instruction. You have also specified the Minimum Holdings Amount value as 1200 USD, and the Minimum Holdings Units value as 1000.

The minimum holdings validation is required to be enforced for CIFs, and not for individual unit holders.

To arrive at the minimum holdings value against which the validation would be made, the redeemable value of 1000 units is computed, at the redemption price. If the redemption price is 0.8, the redeemable value = 1000 * 0.8 = 800 USD.

The redeemable value obtained (800 USD) is compared with the Minimum Holdings Amount specified (1200 USD). Since the Minimum Holdings Indicator chosen is Lower of Amount/ Units, the minimum holdings value to be validated against, is 800 USD. Therefore, the redeemable value of total number of units held by all unit holders under a CIF, in the Burton Carey Fund must equal or exceed 800 USD, for an IPO or subscription transaction in respect of a standing instruction involving a CIF.

If the Minimum Holdings Indicator were selected as Higher of Amount/Units, the higher value (1200 USD) would be considered as the minimum holdings value against which the validation would be made. Therefore, the redeemable value of total number of units held by all unit holders under a CIF, in the Burton Carey Fund would have to equal or exceed 1200 USD, for an IPO or subscription transaction in respect of a standing instruction involving a CIF.

SI Minimum Holdings Apply For Optional Select whether the minimum holdings check is applicable for CIFs, or for individual unit holders from the drop-down list. The list displays the following values:

- CIF

- Unit Holder

If the check is to apply at CIF level, the redeemable value of the total number of units held by all investors under the CIF in the fund is considered for validation.

Max. Initial Transaction Amount Numeric; 22 Characters; Optional Specify the maximum amount permitted for an initial transaction, for an investor in this fund.

Max. Initial Transaction Units Numeric; 22 Characters; Optional Specify the maximum number of units permitted for an initial transaction, for an investor in this fund.

SI Minimum Holdings Indicator Mandatory Select the basis upon which the minimum holdings check is performed from the drop-down list. The list displays the following values:

- Amount: The value of holdings (at redemption price). If you choose this option you must specify the minimum amount in the Minimum Holdings Amount field. If the check is to apply at CIF level, the redeemable value of units held by all investors under the CIF in the fund is checked against the Minimum Holdings Amount.

- Units: The number of units held. If you choose this option you must specify the minimum number of units in the Minimum Holdings Units field. If the check is to apply at CIF level, the total number of units held by all investors under the CIF in the fund is checked against the Minimum Holdings Units.

- Lower of Amount/Units: The minimum amount specified or the redeemable value of minimum units specified, whichever is lower.

- Higher of Amount/ Units: The minimum amount specified or the redeemable value of minimum units specified, whichever is higher.

- Not Applicable: The minimum holdings validation is not performed if this option is chosen. For standing instructions involving transactions in the fund, the holdings validation cannot be set.

If you choose either of the last two options (Lower of Amount/Units or Higher of Amount/ Units), you must specify the applicable minimum amount in the Minimum Holdings Amount field as well as the applicable minimum number of units in the Minimum Holdings Units field. Also, in either case, the redeemable value of the total number of units held by all investors under the CIF is considered for validation, if the check is to apply at CIF level.

Amount/Units Limit for Investor Category

The volume ranges of a transaction, for each transaction type, can be limited for each investor category, for a Fund. The limits can be defined in terms of units or amount of the transaction type.

You can set up these limits as part of the Transaction Processing Rules profile for each fund, and, as such, may be set up through that maintenance screen.

When you save your specifications in this screen, it will be closed and you will be returned to the main Transaction Processing Rules screen. When you save the transaction processing rule record for the fund, the specifications you have made in this screen are saved as part of the same record, in the database.

You can also access this screen from the Amount / Units Limits for Investor Category menu of the Fund Manager component. If you have accessed the screen in this manner, the limits defined here will supersede the limits defined in the Transaction Processing Rules profile for the fund and transaction type.

Before you set up an Amount/Units Limits on Investor Categories profile record for a fund, it is desirable to ensure that the following information is already setup in the system:

- The fund already has an existing, unauthorized Fund Demographics profile record.

- The fund already has an existing, unauthorized Shares Characteristics profile record.

- The fund already has an existing, unauthorized Transaction Processing Rules profile record. In fact, this fund rule can be accessed through the Transaction Processing Rules screen itself.

Investor Category Alphanumeric; 2 Characters; Mandatory Specify the category of Investor for whom the amount/units limit is to be set up.

Minimum Amount Numeric; 18 Characters; Mandatory Specify the minimum amount that an investor who falls under this category can transact in this fund and transaction type.

Step Amount Numeric; 18 Characters; Optional Specify the amount, in steps of which an investor who falls under this category can transact in this fund and transaction type.

Maximum Amount Numeric; 18 Characters; Mandatory Specify the maximum amount that an investor who falls under this category can transact in this fund and transaction type.

The maximum volume of a single transaction that is entered should never exceed or be equal to the figure of one trillion.

For example, if the user wishes to enter a transaction of 1.5 billion, he will have to consider entering two transactions, neither exceeding a maximum limit of 999999999999.999.

Minimum Units Numeric; 27 Characters; Mandatory Specify the minimum number of units that an investor who falls under this category can transact in this fund and transaction type.

Step Units Numeric; 27 Characters; Optional Specify the number of units, in steps of which an investor who falls under this category can transact in this fund and transaction type.

Maximum Units Numeric; 27 Characters; Mandatory Specify the maximum number of units that an investor who falls under this category can transact in this fund and transaction type.

The maximum volume of a single transaction that is entered should never exceed or be equal to the figure of one billion, in terms of units.

For example, if the user wishes to enter a transaction of 1.5 billion units, he will have to consider entering two transactions, neither exceeding a maximum limit of 999999999.999999 units.

The volume ranges of an IPO or subscription transaction, for each transaction type, can be limited for each means of purchase or communication mode, for a fund.

To set up these limits, use the Limit for Communication Mode screen. You can access this screen from the Transaction Processing Rules screen for each fund, by clicking on the Max/ Min for Communication Mode link in the Transaction Limits section.

When you save your specifications in this screen, it will be closed and you will be returned to the main Transaction Processing Rules screen. When you save the transaction processing rule record for the fund, the specifications you have made in this screen are saved as part of the same record, in the database.

You can also access this screen from the Amount / Units Limits for Communication Mode menu item in the Maintenance menu category of the Fund Manager component. If you have accessed the screen in this manner, the limits defined here will supersede the limits defined in the Transaction Processing Rules profile for the fund and transaction type.

Before you set up these limits for a fund, it is desirable to ensure that the following information is already setup in the system:

- The fund already has an existing, unauthorized Fund Demographics profile record.

- The fund already has an existing, unauthorized Shares Characteristics profile record.

- The fund already has an existing, unauthorized Transaction Processing Rules profile record. In fact, this fund rule can be accessed through the Transaction Processing Rules screen itself.

Table 2-32 Transaction Processing Rules - Communication Mode Amount / Units Limits Screen

Field Description Communication Mode Alphanumeric; 2 Characters; Mandatory From the list, select the means of purchase or communication mode for which you are setting up the transaction limits. You can set up the limits for any of the following modes, from the list:

- Direct (in Person)

- Internet

- Registered Investment Advisor

- Registered Dealer

- Savings Plan

- Telephone

If you have selected Internet, then the system will not consider transaction cut-off time maintained at transaction processing rules.

Minimum Amount Numeric; 18 Characters; Mandatory Specify the minimum amount that an investor who subscribes through the selected means of purchase can transact in this fund, through an IPO or subscription transaction.

Maximum Amount Numeric; 18 Characters; Mandatory Specify the maximum amount that an investor who subscribes through the selected means of purchase can transact in this fund, through an IPO or subscription transaction.

The maximum volume of a single transaction that is entered should never exceed or be equal to the figure of one trillion.

For example, if the user wishes to enter a transaction of 1.5 billion, he will have to consider entering two transactions, neither exceeding a maximum limit of 999999999999.999.

Minimum Units Numeric; 27 Characters; Mandatory Specify the minimum number of units that an investor who subscribes through the selected means of purchase can transact in this fund, through an IPO or subscription transaction.

Maximum Units Numeric; 27 Characters; Mandatory Specify the maximum number of units that an investor who subscribes through the selected means of purchase can transact in this fund, through an IPO or subscription transaction.

The maximum volume of a single transaction that is entered should never exceed or be equal to the figure of one billion, in terms of units.

For example, if the user wishes to enter a transaction of 1.5 billion units, he will have to consider entering two transactions, neither exceeding a maximum limit of 999999999.999999 units.

Disallow First Transaction Optional Select Yes from drop-down list to ensure that the users transacting in this fund are not allowed to communicate through the selected communication channels.

This option is applicable for the first subscription for the combination unit holder and fund.

Note:- Subscription transactions will be treated as initial purchase if the balance is zero for the combination of unit holder and fund.

- If the client country parameter is set to SIRULEATFREQ for your bank please refer to Annexure for further details.

Parent topic: Transaction Processing Rules Button