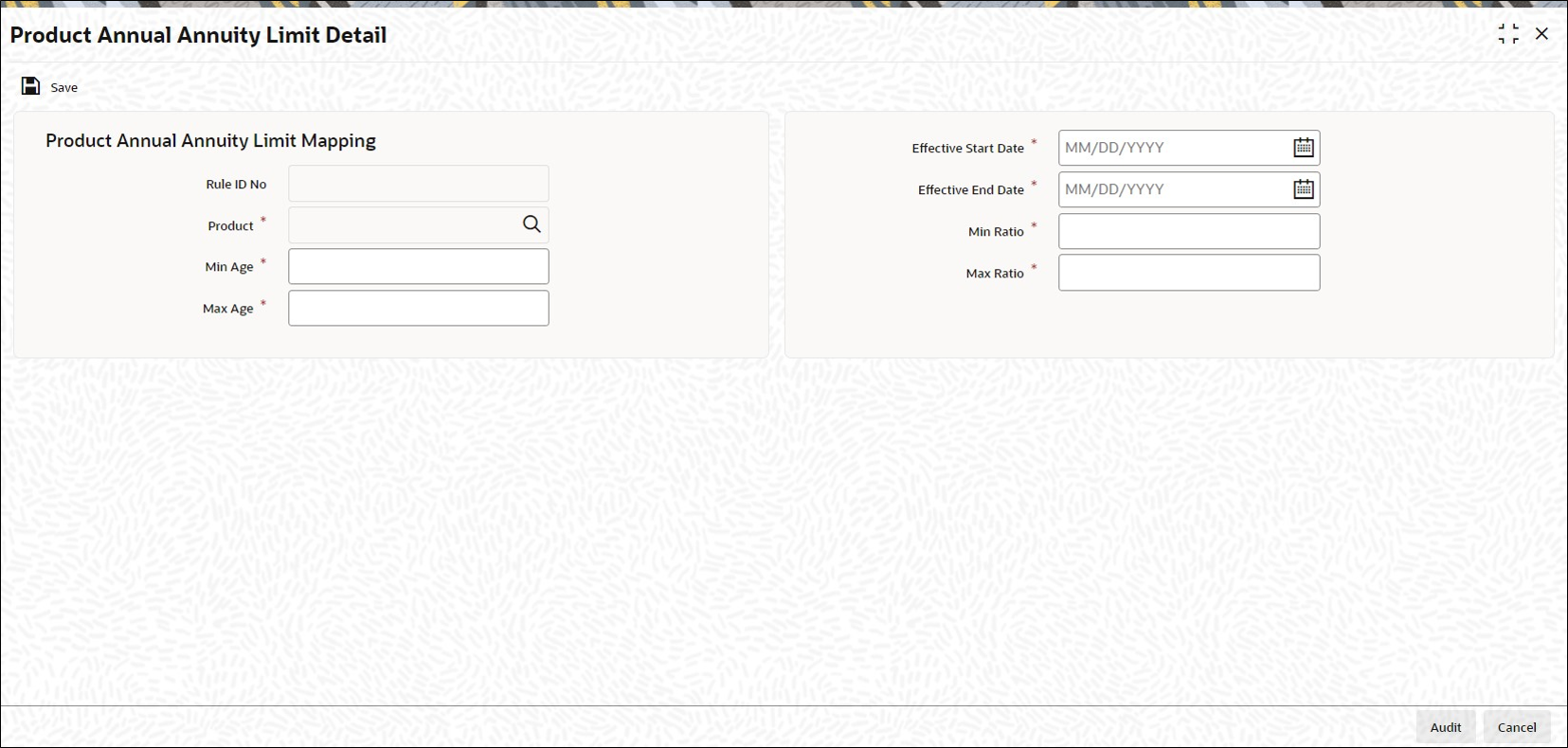

3.16 Process Product Annual Annuity Limit Detail

This topic provides the systematic instructions to define lower and upper annuity income percentage.

Maintain Product Annual Annuity Limit Mapping Details

You can define different lower and upper annual annuity income percentage boundary of a client request per product based on the following criteria:

- Client Age: The upper and lower boundaries can be different based on the client’s age.

- Client Health Status: If age is a parameter for the given product and Policy Start date and if a client suffers from ill health, the same rules apply as if the client was in the highest age bracket:

- If client is healthy, then system will apply the appropriate % between minimum and maximum age range, post deriving the bracket in which client’s age falls into. However, the minimum % cannot be higher than his/her previous requested %.

- If client is ILL, then system will apply the appropriate % between minimum and maximum age range, post deriving the bracket as if the client was in the highest age bracket. However, the minimum % cannot be higher than his/her previous requested %.

- Policy Start Date: The original boundaries that were in place at the time of the creation of the Policy apply even if the boundaries have since changed (except for when the client elects to move to a lower percentage than the initial lower bound). Hence, the client’s Policy Start date stipulates the allowable lower and upper boundaries. For instance, if a client has taken out a Policy on 1 Jan 2000 when the range was 5% to 20% and the range has changed on 1 Mar 2007 to 2.5% to 12%, the client may still choose a percentage between 5% and 20% today. (except for the case shown below).

- If a new upper and lower boundary is declared, and the new lower boundary is lower than the lower boundary for the Policy Start date, product and age, the client may elect to select a percentage in the new range that is lower than the original lower boundary, but then the client may not revert back to the higher percentages associated with the earlier Policy start date. For instance, if a client has taken out a Policy on 1 Jan 2000 when the range was 5% to 20% and the range has changed on 1 Mar 2007 to 2.5% to 12%, and the client elects a percentage of 3% on 1 April 2007, the client may not revert back to a percentage greater than 12% and less than 20% on the next anniversary date, say, on 20% on 1 April 2008.

To drive annuity ranges, the system will compare Effective Start Date and End Date with rule effective date of the policy if annuity is already generated. Also, policy start date should be less than the effective end date. If the annuity is not generated till date then the system will compare Effective Start date and End Date with policy start date.

Parent topic: Product