5.1 Process Product With-holding Tax Detail

This topic provides the steps you need to follow to define a With-Holding Tax Product.

Create With-Holding Tax Product

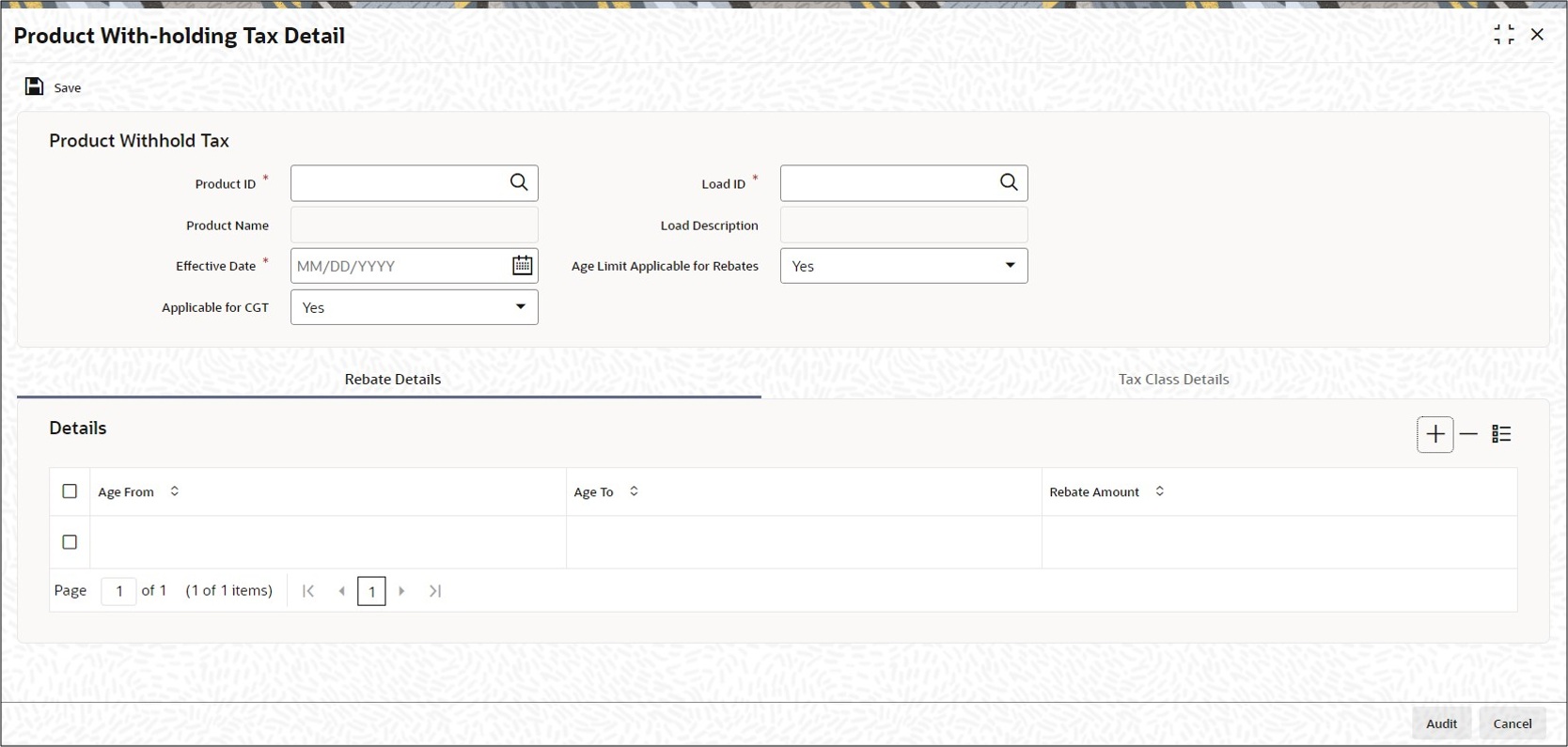

Start the Product With-holding Tax Detail screen.

Enter information in the Product With-holding Tax Detail screen.

Save the information entered.

Parent topic: Product With-Holding Tax