2.7 Process Product Tax Class Maintenance Detail

This topic provides the systematic instructions to maintain the fund tax classes.

Maintaining Product Tax Class

As part of the endowment products regulatory requirements, the taxes are deducted by the Life Company, where as in Life Insurance business taxes are the policy holder’s responsibility. Therefore the Life Company is responsible for payment of such tax to the SARS (Regulatory Authority) so that the investment returns are tax free at the policy holder’s hand. The tax varies among the policy holder depending upon the policy holder’s category, which is one among the following. These are called as Four Fund Tax Classes.

- Individual Fund (IPF)

- Corporate Fund (CPF)

- Retirement Fund (RPF)

- Untaxed Fund (UPF)

The system supports Four Funds Tax Class functionality in the following manner:

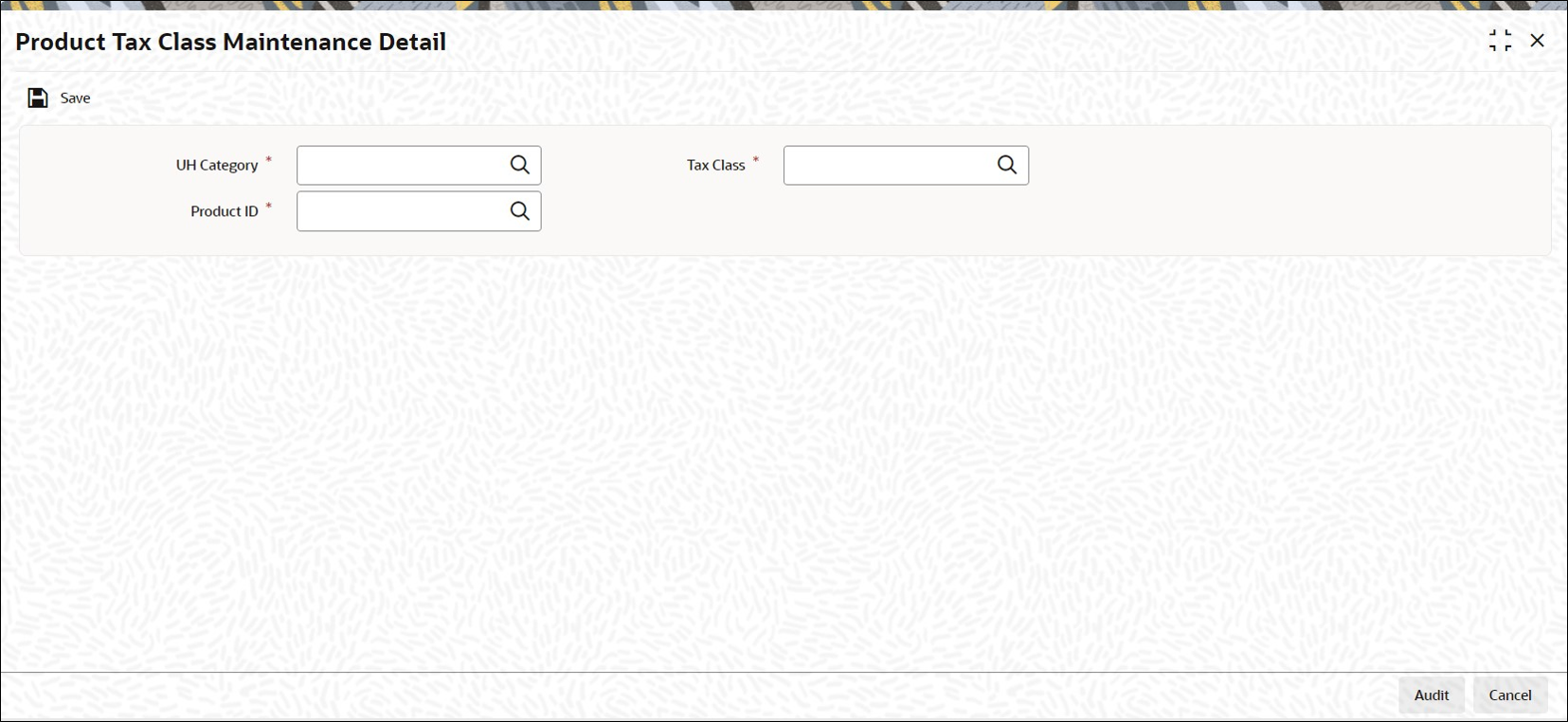

- First the system derives the Tax class of the policy based on the Product and UH Category using Product Tax Class Maintenance(LEDPRTAX) screen

- At the fund level the funds are grouped using Fund Rule Maintenance (UTDFNDRL) for Tax Class Switch

- Then four different funds are created for each Fund Tax Class under one Fund Group

- Fund Rule Maintenance [UTDFNDRL]

- Fund level indicator is used to specify Fund Tax Class. The Fund Tax Classes are:

- Individual Fund (IPF)

- Corporate Fund (CPF)

- Retirement Fund (RPF)

- Untaxed Fund (UPF)

- Client Responsible Tax (CRT)

Policy Tax Class will get defaulted from Product Tax Class maintenance. And if UH Category gets modified, upon its authorization, system automatically changes at EOD all the underlying policy Tax Class to new policy tax class (based on the new UH Category and Product combinations) and update the SI’s with new tax class fund id’s and generates 100% switch transactions form the old policy tax class funds.

Specify User ID and Password, and log in to Home Screen.

Save the information entered

Parent topic: Product Type