3.2 Product Details Tab

This topic explains the Product Details tab of Product Maintenance Detail screen.

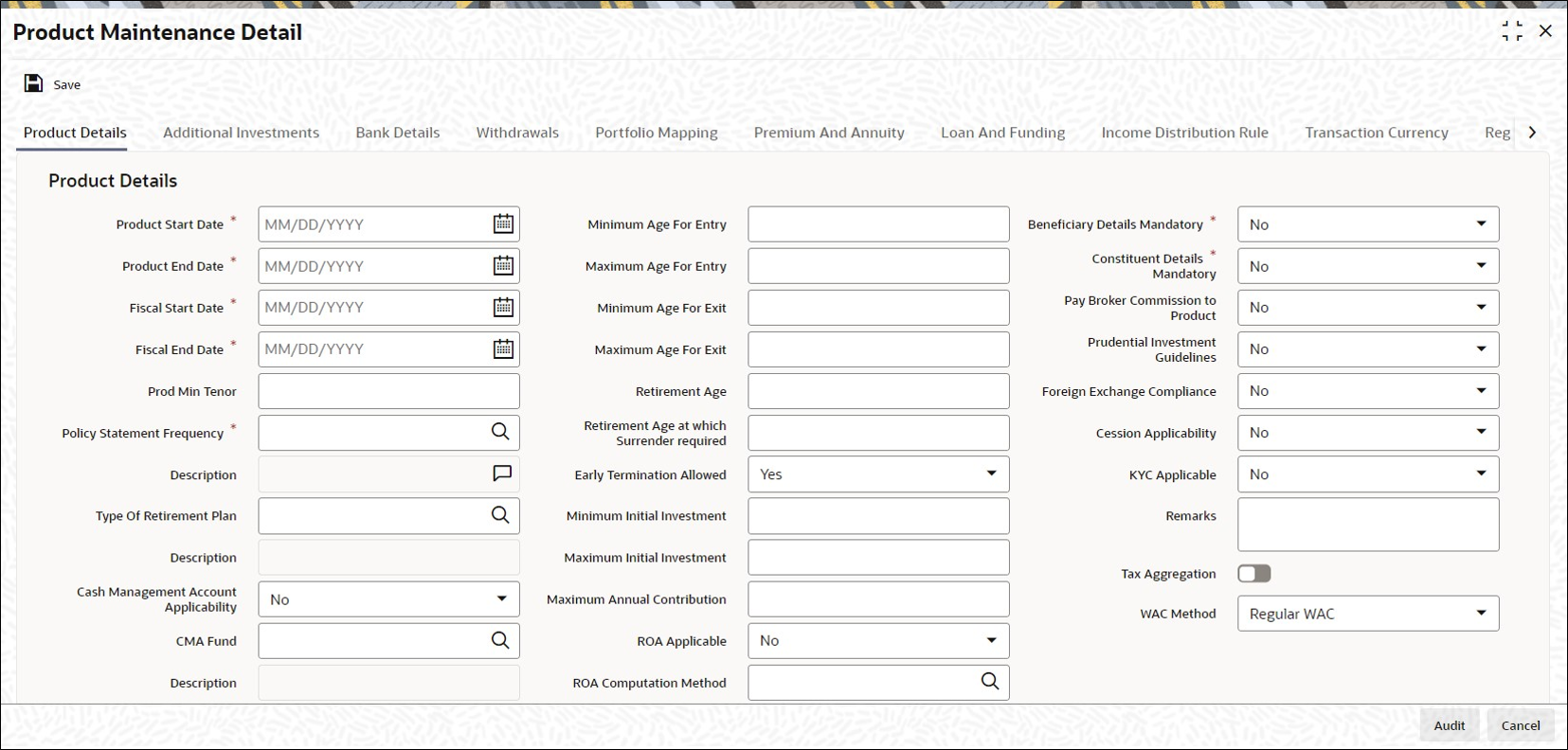

- On Product Maintenance Detail screen, click Product Details tab to enter the details.The Product details are displayed.

Figure 3-2 Product Maintenance Detail_Product Details Tab

- On Product Details tab, specify the fields.For more information on fields, refer to the field description table.

Table 3-2 Product Details - Field Description

Field Description Product Start Date Date Format, Mandatory

Specify the date on and beyond which the Product is available for transactions by the Policy Holders.

Note: This date must not be earlier than the Application Date, except if the Product is an existing one.

Product End Date Date Format, Mandatory

Specify the date on and beyond which the Product is not available for transactions by the Policy Holders.

Note: This date must not be earlier than the Application Date and the Maturity Date of a policy.

Fiscal Start Date Date Format; Mandatory

Specify the date on which the fiscal year begins.

Fiscal End Date Date Format; Mandatory

Specify the date on which the fiscal year ends.

Prod Min Tenor Numeric; 3 Characters; Mandatory and Enabled only if Maturity Date Basis for Product Type is Minimum Tenor

Specify the minimum age for policies in this Product, in terms of number of years. The age, in number of years, is referred to as the term of the Product, and is considered from the Start Date of the Product.

Note: This field will be enabled only if you have selected the option Minimum Tenor against the field Maturity Date Basis for the Product Type, in the Product Type Maintenance screen.

Policy Statement Frequency Alphanumeric; 1 Character; Mandatory

Specify the frequency at which policy statements must be generated for a Policy Holder who has subscribed to a policy in this Product.

Description Display

The system displays the description for the selected description.

Type of Retirement Plan Alphanumeric; 1 Character; Optional

Specify the type of retirement plan.

Note: This field will be applicable to those Product Types for which you have selected the option Yes against the field IRA Applicable.

Description Display

The system displays the description for the selected type of retirement plan.

Cash Management Account Applicability Optional

Select Yes if you want to make the Cash Management Account feature available in this product, else select No.

If you have chosen this option, you need to also specify your choices for CMA Fund, Restrict CMA for Initial Investments and Redeem Periodic Fee from CMA Fund. This lays the rules for the operation of the CMA Fund.

CMA Fund Alphanumeric; 6 Characters; Optional

Specify a fund to be the CMA fund. You can select from the option list.

Description Display

The system displays the description for the selected CMA applicability.

Restrict CMA for Initial Investment Optional

Select Yes if you wish to restrict initial investments for the CMA Fund. Else select No.

Redeem Periodic Fee from CMA Fund Optional

Select Yes if you want the system to treat the specified CMA fund, as the preferred fund for periodic fee redemptions. Else select No.

If you have chosen this option, then system would treat CMA Fund as preferred fund for periodic fee redemptions, provided no preferred fund is selected at Policy Level.

CGT Applicable Mandatory

Select Yes from the drop-down list if CGT is applicable.

Generate Redemption for CGT Mandatory

Select Yes from the drop-down list to generate redemption for CGT.

CGT Reporting Currency Alphanumeric; 3 Characters; Optional

Specify the currency in which the capital gains and capital gains tax amount should be reported. The capital gains and capital gains tax amount, which is computed at the fund level in the fund base currency, will be converted in terms of the reporting currency using the default exchange rate.

If you do not maintain a reporting currency, the system will convert the capital gains and capital gains tax amount only in terms of the product and policy base currency..

Minimum Age for Entry Numeric, 3 Characters; Optional

The minimum age before which a Policy Holder cannot subscribe to a policy under a Product of this Product Type, will be displayed.

Maximum Age for Entry Numeric, 3 Characters; Optional

Specify the maximum age after which a Policy Holder cannot subscribe to a policy under a Product of this Product Type.

Minimum Age for Exit Numeric, 3 Characters; Optional

Specify the minimum age before which a Policy Holder cannot close a policy under a Product of this Product Type.

Maximum Age for Exit Numeric, 3 Characters; Optional

Specify the maximum age after which a Policy Holder is not allowed to have holdings in the Product.

Note: The age limits that you have specified for the Product Type through the Product Type Maintenance screen will be displayed in the above fields. You will be allowed to change the same for a Product if, for the Product Type, you have selected the option Override Age Limit.

Retirement Age Numeric, 3 Characters; Optional and Enabled only if Maturity Date Basis for Product Type is Retirement Age

Specify the age that will be considered as retirement age for Policy Holders under this product. After this age, the Policy Holders with policies in this Product will become eligible for retirement benefits, if any.

This field will be enabled only if, for the Product Type, in the Product Type Maintenance screen:- You have selected the option Yes against the field Retirement Features Supported?.

- You have selected the option Retirement Age against the field Maturity Date Basis.

Retirement Age at which Surrender required Alphanumeric; 3 Characters; Optional

Specify the age at which the Policy Holder must surrender the policy.

Early Termination Allowed? Optional

A policy in a Product can be terminated earlier than the Maturity Date of the Product. Select Yes if such a termination is desired to be applied to policies in this Product.

Minimum Initial Investment Numeric, 18 Characters; Optional

Specify the minimum amount that a Policy Holder has to contribute to hold a policy in this Product at the time of policy creation.

Maximum Initial Investment Numeric, 18 Characters; Optional

Specify the maximum amount that a Policy Holder can invest while making an initial investment in a policy in this Product.

Note: The Policy Holder can top up the policy later if additional investment is allowed for the Product. The same can be indicated through the screen that is invoked when you click on the Additional Investments link. The same is explained in subsequent topics.

Maximum Annual Contribution Numeric, 18 Characters; Optional

This field is locked for non retirement products.

ROA Applicable Optional

Select Yes from drop-down list if Rate of accumulation is applicable for a product.

The initial administrator and broker will use the market value at policy level to derive the fee return value. the Fee is calculated based on the gross amount of the individual transaction value.

For an ROA function to be applicable, a cumulative load would be setup and mapped in the Load Product.

ROA Computation Method Alphanumeric; 1 Character; Optional

Select the appropriate method to calculate the right of accumulation from the option list. The ROA may be calculated on the basis of:- Amount invested in the policy by the policy holder

- Holdings of the customer as on that date

- Holdings subscription price as on that date

- The current days transaction value

Description Display

The system displays the description for the selected ROA computation method.

Include Current TXN for ROA Optional

Select whether the current transaction should be considered for calculating ROA.

Include Reinvestment for ROA Optional

Indicate whether the reinvestments affect the ROA calculation from the drop-down list.

Switch Impact ROA Optional

Indicate whether switch transactions affect ROA computation from the drop-down list.

Beneficiary Details Mandatory Mandatory

Select if beneficiary details are mandatory or not from the drop-down list.

During product amendment system checks if there are any policies associated to the product in which case you will not be allowed to select No.

Note: If you select Yes, it is mandatory to specify beneficiary details in the Policy Maintenance screen.

Constituent Details Mandatory Mandatory

If you select Yes, it is mandatory to specify constituent details in the Policy Maintenance screen.

Pay Broker Commission to Product Optional

Select Yes if pay broker commission is set to the product from the drop-down list.

Prudential Investment Guidelines Optional

Indicate if you need to define the rules for Prudential Investment guidelines. You can either select Prudential Investment Guidelines or Foreign Exchange Compliance.

Foreign Exchange Compliance Optional

Indicate if you are defining rules for Foreign exchange compliance.

You can define rules by selecting either Prudential Investment Guidelines or Foreign Exchange Compliance. The rules are defined on the number of investment components available or also a combination of these investment components. There is no restriction placed on the number of components which can be selected to define a rule.

For example you can specify two components for a rule; for a rule sequence 1, you can define two components, with a threshold percentage within (0-100).

Rule1: For PIG Compliance-Total Cash, Components selected for the rule: CA1; CA2, Operator: Less than or Equal to (<=), Threshold percentage (0 – 100%): 100

Rule2: For FOREXCOMPLIANCE, Components selected for the rule: CA2; EQ2; PR2, Operator: Less than or Equal to (<=), Threshold percentage (0 – 100%): 15

Cession Applicability Optional

Indicate whether you want to allow policies associated with this product for policy cession maintenance.

Refer to the topic Policy Cession Maintenance in the LEP User Manual for details.

KYC Applicable Optional

If you select Yes, the transaction limit will be checked at the time of capture of Policy Transactions.

Note: System level existing workflow of KYC would still be applicable irrespective of the status selected.

Remarks Alphanumeric; 255 Characters; Optional

You may enter remarks on the Product, if necessary.

Tax Aggregation Allowed Optional

Check if tax aggregation is applicable for the product.

WAC Method Optional

Select WAC method from the drop-down list. The list display the following values:- Regular WAC

- Life WAC

If you select Life WAC, Base Cost is not provided while capturing a transaction, then the system will calculate Weighted Average Cost (WAC) as follows:

LIFE WAC = ((No of units in the fund before inflow) * (WAC before inflow) + (No of units in the inflow for fund) * (Unit Price of inflow)) / (Total Units in Fund)

Where,

Unit price = (Net investment amount) / number of units purchased

Net Investment amount = Gross investment amount – all Fee except the ones which are paid to AMC

The net investment amount will not exclude any Fee for which To Entity is AMC. The system will deduct any other fee (apart from those where To Entity is AMC) from the gross investment amount to arrive at the net investment amount.

Total units in Fund = (No of units in the fund) + (No of units in the inflow for the fund)

If you select a product with WAC method as LIFE WAC, and if a Switch transaction is done within the same Fund Family and Base Cost is not provided while capturing the transaction then the system will calculate WAC as follows:

Life WAC = ((No of units rolling over) * (WAC in ‘From’ Fund) + (No of units in the ‘To’ fund) * (WAC in ‘To’ Fund)) / (Total Units in ‘To’ Fund)

Where,

Total units in ‘To’ Fund = (No of units rolling over into To Fund) + (No of units in the ‘To’ fund)

The system will calculate Capital Gain or Loss as follows:

Gain / Loss = Units surrendered / redeemed from Fund* ((Price of fund on the date of Redemption / Surrender) – WAC for fund)

If there is a gain then Capital Gain Tax has to be deducted.

To deduct the capital Gain Tax, a separate Load will be mapped under Product load mapping as post allocation load. If the Slab basis is selected as weighted average then this load will be applied on the Gain portion and tax will be deducted and only the net amount will be paid to the customer.

Tax Deductible Contributions Allowed? Optional

This field will be enabled only if, for the Product, you have selected the option IRA Enabled. Select Yes to indicate tax deductible contributions are allowed for the IRA Product.

WHT Applicable Mandatory

Select the option to indicate withholding tax needs to be calculated on the reinvested income from the policies in this Product. The options in the drop-down are as follows:- Reinvestment

- Dividend Payout

- Annuity

- Reinvestment + Dividend

- Reinvestment + Annuity

- Annuity + Dividend

- Reinvestment + Dividend +Annuity

Reinvest IRA Income? Optional

Select the option Yes to indicate the income from IRA Plan is to be reinvested in the same plan. Select the option No to indicate the income is to be paid out to the Policy Holder.

Note: This field will be applicable to those Product Types for which you have selected the option Yes against the field IRA Applicable.

Auto Clear Prov Bal Mandatory

Indicate whether 100% outflow transactions based on the product should include provisionally allotted units. You can specify any of the following options:- Option not allowed: Provisionally allotted units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Provisionally allotted units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Provisionally allotted units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Auto Clear Reinvestments Mandatory

Indicate whether 100% outflow transactions based on the product should include freeze held and reinvestment units. You can specify any of the following options:- Option not allowed: Freeze held/reinvestment units should not be considered while processing 100% outflow transactions.

- Allowed – Default checked: Freeze held/reinvestment units should be considered while processing 100% outflow transactions by default.

- Allowed – Default unchecked: Freeze held/reinvestment units will not be considered while processing 100% outflow transactions by default. However, you can check this option while performing transactions.

Refer to the topic Cash Management Account for details on the operation of Cash Management Account.

- Calculating Capital Gain Tax

This topic provides information on calculating Capital Gain Tax.

Parent topic: Product