2.1.1 Policy Information Tab

This topic explains the policy information tab of Policy Maintenance Detail screen.

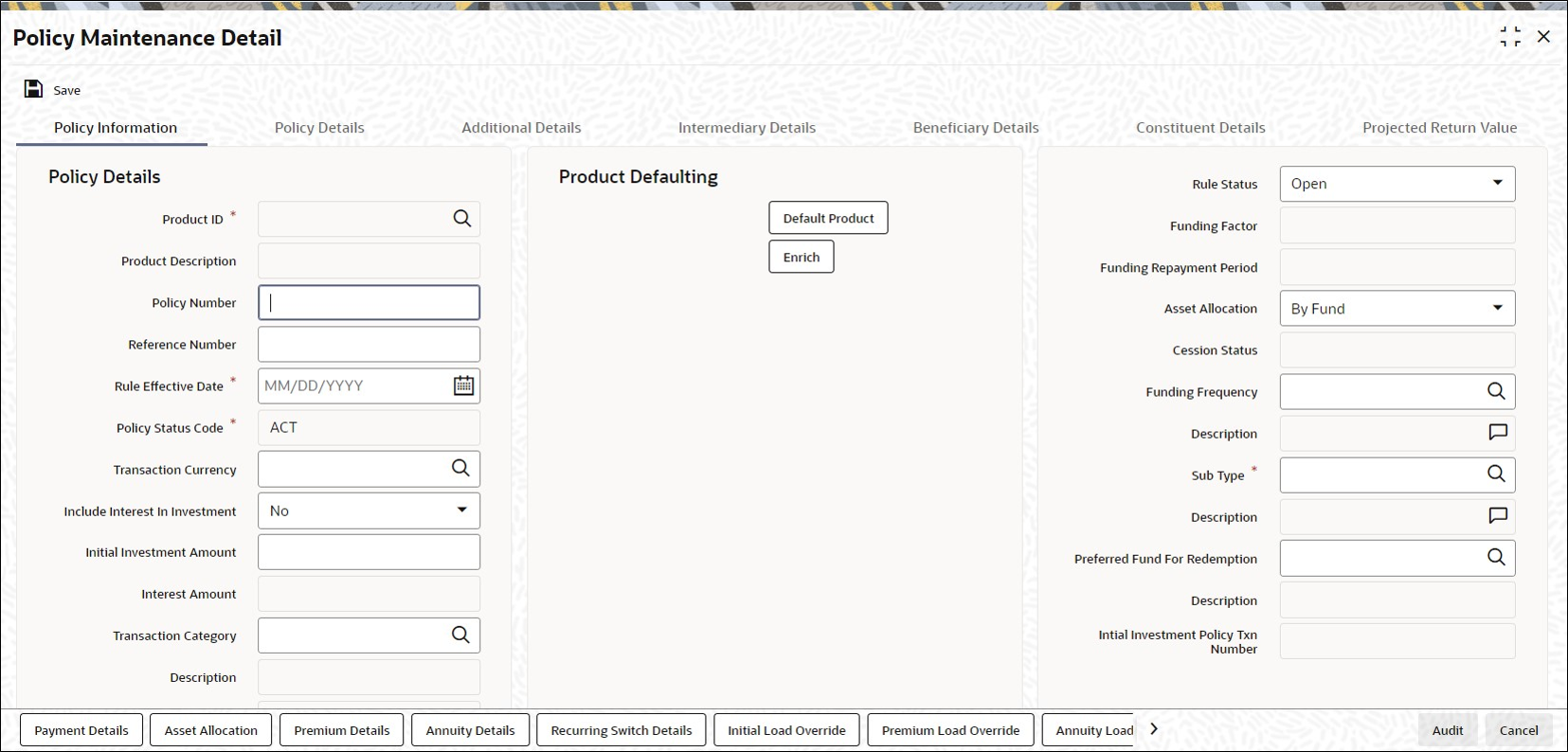

- On Policy Maintenance Detail screen, click Policy Information tab to enter the details.The Policy Information details are displayed.

Figure 2-2 Policy Maintenance Detail_Policy Information Tab

- On Policy Information tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-2 Policy Information - Field Description

Field Description Policy Details This section displays the following details.

Product ID Alphanumeric; 10 Characters; Mandatory

Select the product in which the Policy Holder wants to buy the Policy. The option list includes all valid and active Products.

Product Description Display

The system displays the description of the selected product.

Policy Number Alphanumeric; 16 Characters; Optional

Specify the Policy Number at the time of policy creation. The system validates the value input for its uniqueness. The policy number cannot, however, be changed during subsequent edit or amend operations.

When a Policy Holder subsequently contributes into this Policy that has been created, the same Policy number has to be specified, and the Policy must be an active, valid Policy for the transactions to be accepted.

Reference Number Alphanumeric; 16 Characters; Optional

Specify a unique initial identification for this Policy. The Reference Number is the initial identification that you give to a Policy, before the Policy Number is generated.

You can invoke the Policy or retrieve it through the Find Form using this Reference Number for subsequent inquiries and transactions.

Rule Effective Date Date Format, Mandatory

Specify the date from which the Policy will be effective. The format will be the one that has been maintained for your user ID in the My Dash Board User setting date format.

Policy Status Code Mandatory

By Default Policy Status will be ACT on New Mode.

Transaction Currency Alphanumeric; 3 Characters; Optional

Specify the transaction currency for the policy. If you do not maintain this value, the system will default this value at the time of saving the maintenance. The transaction currency maintained at the fund level will be default if all the transaction currencies for the fund are the same.

If various currencies have been maintained at the fund level, then the system will default the policy base currency as the policy transaction currency.

Include Interest in Investment Optional

Select, from the adjoining drop-down list, if the interest earned on the initial investment should be considered along with the initial investment for investment in the policy.

If you select Yes, the interest amount will be included in the investment and a single transaction will be generated for both. You need to manually add the interest amount calculated in the settlement details to the transaction amount of the particular currency in the asset allocation details.

For instance, if the interest amount is USD 1000 and the transaction amount is USD 100000, then you are required to add USD 1000 to the transaction amount for the currency USD in the asset allocation details.

If you select No, the interest amount will be generated as a separate UT transaction.

Interest Amount Display

The system computes the interest amount based on the interest calculation days and interest rate provided by you in the Interest Calculation Screen (explained below).

Transaction Category Alphanumeric; 1 Character; Optional

Specify the type of transaction. Alternatively, you can select transaction category from the option list. The list displays all valid transaction category code maintained in the system.

If the transactions captured are for MIFID funds/ products, the transaction category Advised and execution only will be applicable (if fund/ product is MIFID regulated). For MIFID funds/ products related transactions; the defaulting of transaction category to legacy will not be applicable, only if MIFID fund/ Product is selected as Yes at fund and product level.

In the transaction screen, the transaction category will be based on RDRTXNCATEGORY PARAM maintenance.

For products if the risk level for a product is defined and risk profile for a UH is maintained during LEP transactions (plan initial investment, premiums, plan switch, plan top up), the system will perform the risk checks for LEP transactions, considering the product level risk and UH risk profile along with risk expiry date.

If MIFID fund/ product is selected as Yes, the transaction applicable are IPO subscriptions, subscription, switch, Standing instructions and transfer In, plan initial investment, premiums, plan switch, plan top up. For MIFID funds; Transaction Category at the transaction level will be classified as either Advised Business or Execution Only Business.

The SI transactions (subscriptions and switches, includes premiums and recurring switches) escalations will be categorized as Advised Business or Execution Only Business. If you amend the SI, the system displays the warning message as Transaction category amended for the SI. The next SI will reflect the changed category.

If you change the Transaction Category for a MIFID transaction during edit or amend operation, then the system displays the warning message as Default Transaction Category has been overridden. Do you want to continue?.

Description Display

The system displays the description for the selected transaction category.

Policy Tax Class Display

The system displays the tax class of a Policy. The system will default this value from Product Tax Class Maintenance screen.

If a UH Category gets modified, post authorization the system will automatically change at EOD all the underlying policy Tax Class to new policy tax class (based on the new UH Category and Product combinations). The system will also update the SI’s with new tax class fund ID’s and generates 100% switch transactions from the old policy tax class funds.

Initial Investment Amount Numeric; 18 Characters; Optional

You have the option of entering the initial amount to be invested in the policy. If the product is a single premium product (the box Multiple Premiums Allowed? is not checked while creating a product), and you enter an amount here, the system will generate a transaction for this amount.

You will be allowed to change the initial investment amount, interest amount and the asset allocation details for a policy that has been authorized as long as it has not been allocated.

When you modify the details, the system will reverse the existing initial investment transaction and create a new policy transaction for the modified amount. You can modify the policy any number of times till policy allocation.

If transactions like allocation, premium, annuity, recurring switch, top-ups, and surrender have been generated for the policy, the system will not allow you to modify the initial investment amount.

Consider the following cases:Table 2-3 Case Example

Case 1 Case 2 Case 3 Case 4 Case 5 The product is a multiple premium product; you enter the initial investment amount and premium details. The Start Date for the premiums is a system date when the policy is authorized.

When the policy is Authorized, a transaction will be created on the date mentioned for the initial investment amount you have entered.

The product is a multiple premium product; you enter the initial investment amount and premium details. The Start Date for the premiums is the System Date. When the policy is saved:- A transaction will be created for the initial investment amount you have entered.

- A transaction will also be generated for the first premium amount, at EOD.

The product is a multiple premium product; you do not enter any initial investment amount, but only the premium amount. The Start Date for the premiums is the System Date.

When the policy is Authorized, an initial investment transaction will be generated with the premium amount.

The product is a multiple premium product; you do not enter any initial investment amount, but only the premium amount. The Start Date for the premiums is a future date.

When the policy is Authorized, an initial investment transaction will be generated on the date specified, with the premium amount.

Note: In a scenario as described under Case 4, you will be allowed to amend the premium amount till the date specified. You will, however, not be allowed to enter an initial investment amount after you authorize a policy.

The product is a multiple premium product; you do not enter either the initial investment amount or the premium amount. No transaction will be generated on saving the policy. An initial investment transaction will be generated only if you enter any premium details at a later stage.

Note: The initial investment amount and premium amounts are independent of each other. This means that changing the initial investment will not change the premium amount and vice versa.

Let us say, for example, you have not entered the initial investment amount and have entered only the premium amount. You now wish to enter an initial investment amount. You may do so before the policy is authorized, and in doing so, the premium amount you have entered will not be affected. Similarly, if you change the premium amount, the initial investment amount will not be affected.

- Product Defaulting and Exchange Rate Details

This topic explains the Product Defaulting and Exchange Rate Details sections of the Policy Maintenance Detail screen.

Parent topic: Process Policy Maintenance Detail