1.31 Process Portfolio Rebalancing Rule Detail

This topic provides the systematic instructions to Process Portfolio Rebalancing Rule Detail in user profile module.

The pension holdings can be re-structured automatically based on the age slab or pre defined frequency. Pension Administrator can provide service to re-align the portfolio of the party based on various factors like Market condition, Age of the party, Savings habits etc.

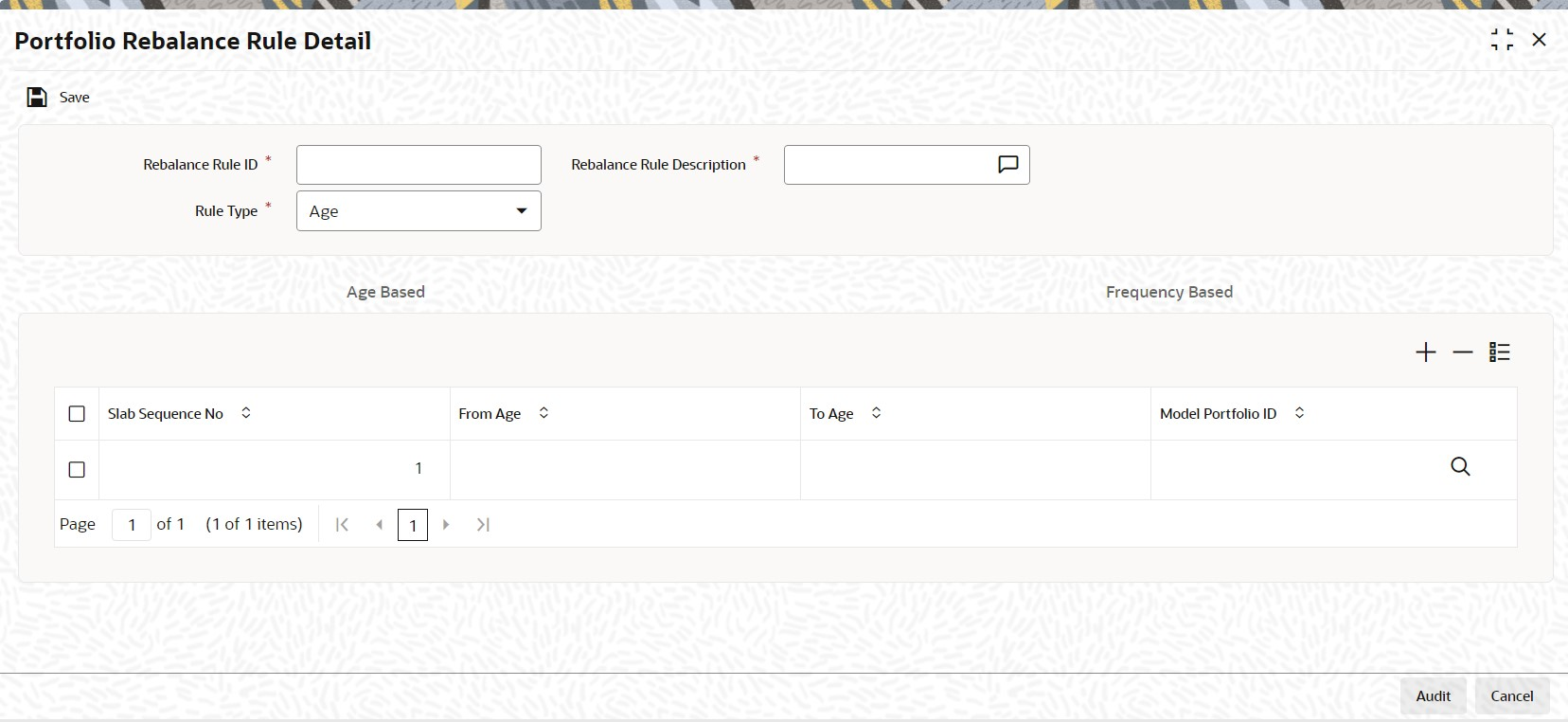

You can define rules for rebalancing with 2 different rule types, namely, Age and Frequency using Portfolio Rebalancing Rule Detail screen.

For age-based rebalancing setup, model portfolio can be provided for the age-based slabs.

For frequency-based rebalancing setup, model portfolio can be provided with processing frequency, next process date and Variance (in percentage). The system processes the last process date on processing.

If the computed actual variance breaches the maintained variance percentage, then eligible portfolios will undergo rebalancing as per half-yearly/Annual frequency maintained.

Actual variance = (Portfolio asset balance in market value / Portfolio asset balance in unit cost) * 100, whereas, unit cost is the average of unit cost derived for a party, portfolio, account and asset combination.

- Age Based Tab

This topic explains the Age Based Detail of Portfolio Rebalance Rule Detail screen. - Frequency Based Tab

This topic explains the Frequency Based Detail of Portfolio Rebalance Rule Detail screen.

Parent topic: Pension Funds Administration