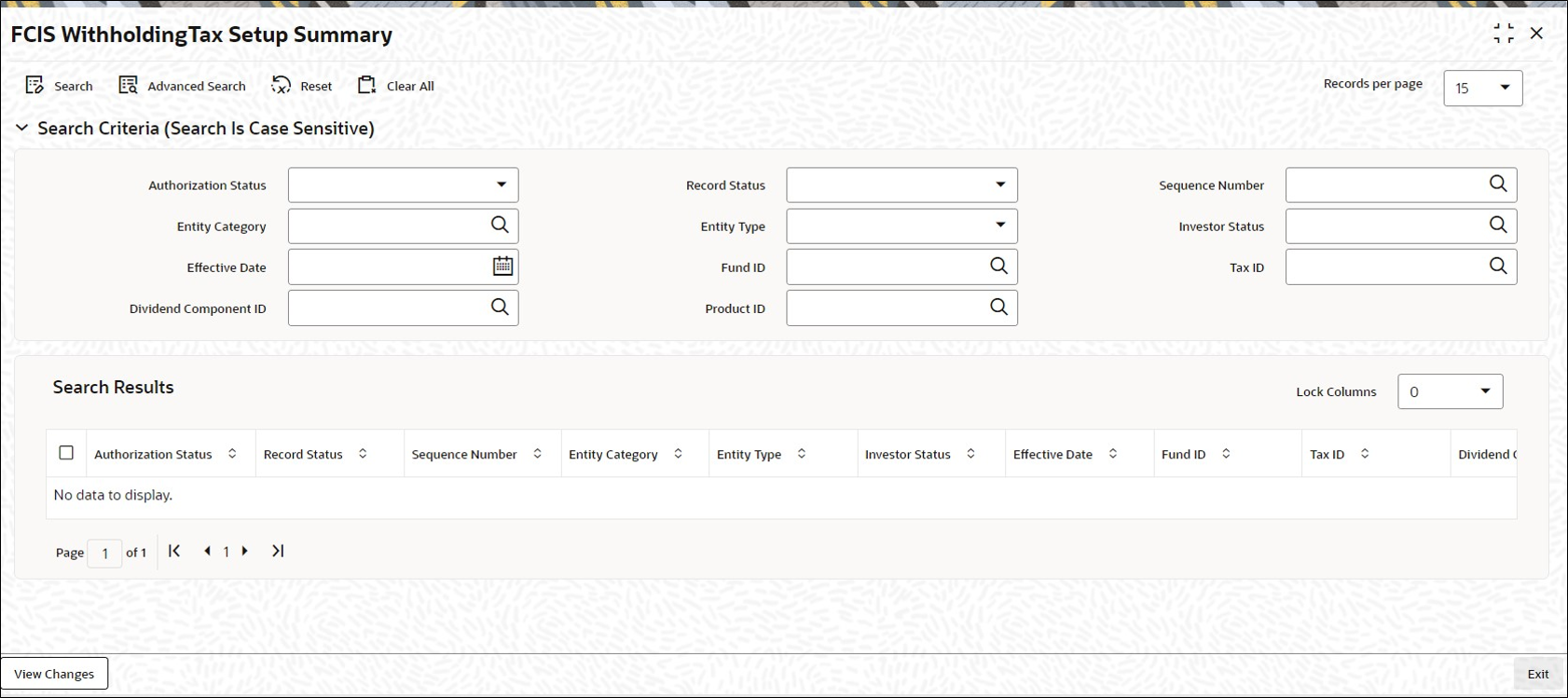

2.25 FCIS Withholding Tax Setup Summary

This topic provides the systematic instructions to perform the basic operations on the selected records.

- After you have set up the WHT details, you must have another user authorize them so that they would be effective in the system.

- Before the WHT details are authorized, you can edit them as many times as necessary. You can also delete a WHT record before it is authorized.

- After authorization, you can only make changes to WHT details through an amendment.

- The With-Holding Tax Find screen can be used for the following operations on WHT details:

- Retrieval for viewing

- Editing unauthorized details

- Disabling unauthorized details if necessary. This is possible during editing or amendment.

- Authorizing details

- Amending authorized details

Retrieve Withholding Tax Setup Record