2.24 Process FCIS Withholding Tax Setup Detail

This topic provides the systematic instructions to maintain the slab details for WHT Input in the system.

Set Up Withholding Tax

You can configure the system to perform withholding tax (WHT) deductions out of the earnings derived from any investor or a broker. To do this, you must specify the slabs according to which the rates will be determined.

WHT is deducted from the earnings of an investor or a broker, according to the WHT slabs that you maintain in the system, before the net earnings are paid out or reinvested depending upon the Income Distributions Setup.

You can maintain such slabs for earnings from cash dividends that involve capital gains as well as income earnings.

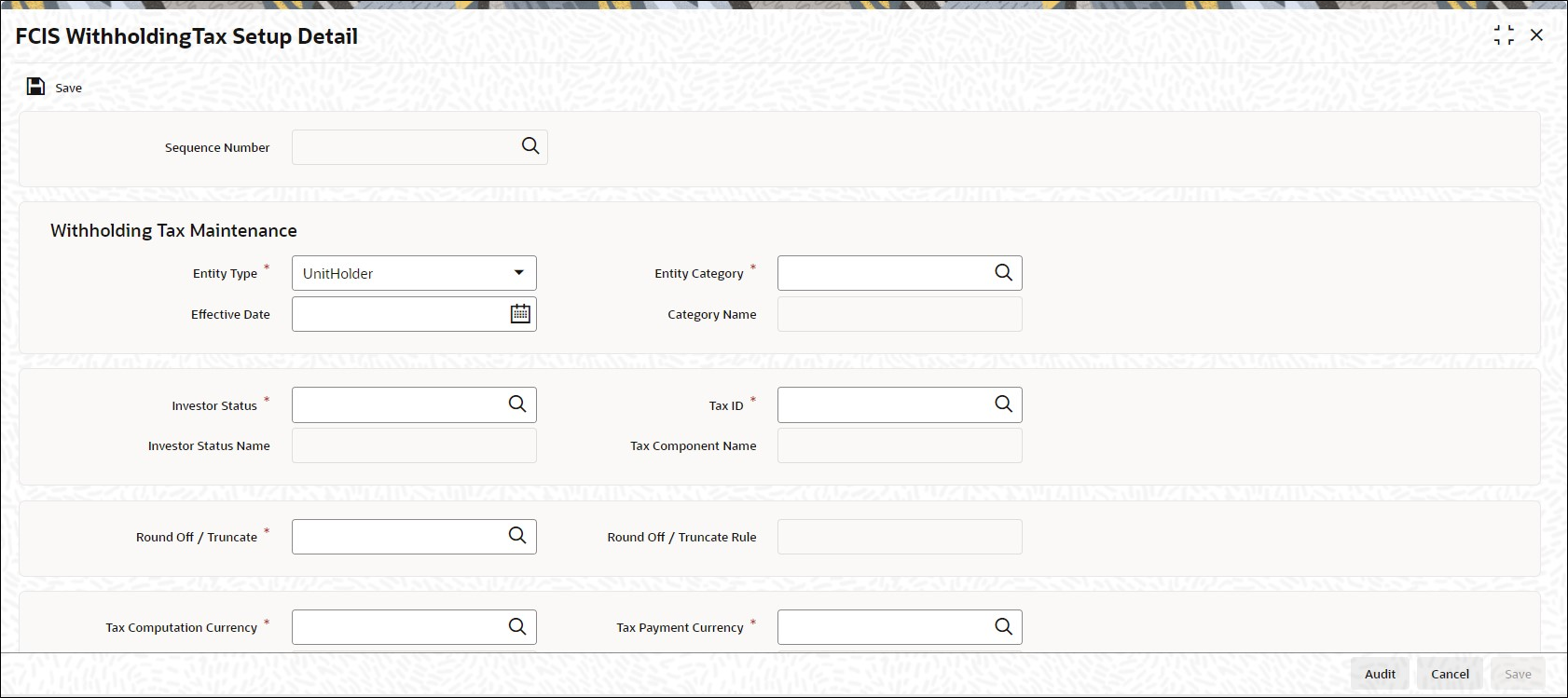

- On Home screen, type UTDWHTAX in the text box, and click Next.The FCIS Withholding Tax Setup Detail screen is displayed.

Figure 2-35 FCIS Withholding Tax Setup Detail

- You can use FCIS Withholding Tax Setup Detail screen to enter the Withholding Tax component slab details that are applicable.

- For a particular investor category

- For a broker category

- For a particular country and currency

- For a specific fund and fund base currency

- For a specific product

- For investors of local residence as well as foreign investors

- For earnings from cash dividends involving capital gains

- For income earnings from cash dividends

- You can either to choose to set up tax slabs at the fund level or at the product level. Product level WHT applies to all funds available in that product portfolio.

- You can also give each set of slabs a separate tax component ID.

- You can define slabs for different income ranges and give each of the slabs a sequence number. You cannot, however, set up duplicate tax slab sequences for the same investor category.

- Before you set up the Withholding Tax details for an investor category for a country, it is desirable to ensure that the following information is already set up in the system:

- The countries have been maintained in the Country Maintenance and the currencies have been set up in the Currency Maintenance.

- The countries have been associated with currencies in the Country Currency Maintenance.

- The different investor and broker categories have been maintained in the System Parameters.

- On FCIS Withholding Tax Setup Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 2-26 FCIS Withholding Tax Setup Detail - Field Description

Field Description Sequence Number Alphanumeric 16 Characters; Optional

Specify the sequence number. Alternatively, you can select the sequence number from the option list. The list displays all valid sequence number maintained in system.

Note: This field is enabled only in Enter Query option.

Withholding Tax Maintenance The section displays the following fields. Entity Type Mandatory Indicate whether the WHT slabs are being maintained to be applicable to an Unit Holder or a broker from the list. The values in drop-down list are as follows:- Unit Holder

- Broker

Entity Category Alphanumeric; 6 Characters; Mandatory Specify a valid category of the unit holder you need to assign to specified entity type. The adjoining option list displays all valid entity categories maintained. You can select the appropriate one.

Category Name Display The system displays unit holder’s category name, if the Entity Type is maintained as Unit Holder.

Effective Date Date Format; Mandatory Specify the date the system should consider for calculating tax.

Investor Status Alphanumeric, 1 Character; Mandatory You will be allowed to select the status if the Entity Type is Unit Holder.

Select the status for which this tax slab is applicable. The system displays the corresponding Investor Status Name. This will enable the system to decide which tax slab needs to be applied depending on whether the unit holder is a foreign / resident unit holder.

If the entity type is a broker, the system defaults the investor status. You will not be able to modify the status.

Investor Status Name Display The system displays the description for the selected investor status name.

Tax ID Alphanumeric, 3 Characters; Mandatory From the list, select the tax ID to be used for application of withholding tax according to the slabs maintained, for the entity type. The system displays the associated Tax Component Name.

Each set of slabs can be given an ID that reflects the nature of the slabs.

The value list for the Tax ID’s is obtained from the system parameter values maintained for the Tax ID system parameter code.

Tax Component Name Display The system displays the description for the selected tax ID.

Round off/Truncate Alphanumeric; 1 Character; Mandatory Indicate whether the decimal portion of the amount should be rounded off or truncated.

Round Off/ Truncate Rule Display The system displays the rule used to round off or truncate the decimal portion of the amount based on the round off or truncate selected.

Tax Computation Currency Alphanumeric; 3 Characters; Mandatory Specify the currency in which the tax must be computed for the selected tax ID. By default, it is reckoned to be the currency of the selected country. You will be allowed to specify the currency only for Unit Holders.

Tax Computation Currency Name Display The system displays the description for the selected tax computation currency code.

Tax Payment Currency Alphanumeric; 3 Characters; Mandatory Specify the currency in which the tax must be paid for the selected tax ID. By default, it is reckoned to be the fund base currency. You will be allowed to specify the currency only for Unit Holders.

Tax Payment Currency Name Display The system displays specified tax payment currency name based on the details maintained at Currency Maintenance level.

Product ID Alphanumeric; 10 Characters; Optional Select the product for which you are setting up the tax slabs. The option list contains all valid products maintained in the system. With-Holding Tax will be applicable to all funds mapped to the product. GL entries will be populated with the respective product Id and policy number along with the dividend payment details and tax details.

Product Name Display The system displays the name of the product for the selected product ID.

Dividend Component ID Alphanumeric; 25 Characters; Mandatory Specify whether the tax slab details being maintained apply to capital gains earnings from cash dividends or income earnings from cash dividends, for the fund.

The system defaults the Dividend Component ID and Description for brokers. You will not be able to modify the ID.

Component Description Display The system displays the description for the selected dividend component ID.

Fund ID Alphanumeric; 6 Characters; Optional Select the fund for which you are setting up the tax slabs. The base currency of the fund is displayed in the Fund Base Currency Code field.

Fund Base Currency Display The system displays the fund base currency name for the selected fund ID.

ISIN Code Display The system displays the ISIN code for the selected fund ID.

This is applicable only for Unit Holder type of entity. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund ID field.

Allow Override Optional Select if you need to override the taxation applicability for UT /LEP or not from the adjoining list. Following are the options available:- Yes

- No

Country Details The section displays the following fields. Country Code Alphanumeric; 3 Characters; Mandatory Specify the country code. Alternatively, you can select the country code from the option list. The list displays all valid country code maintained in the system.

This is the country for which the tax slabs that are being set up must be applicable. All tax deductions and computations will be done in this currency.

Country Name Display The system displays the country name for the selected country code.

Currency Code Display The system displays the currency code for the selected country code.

Currency Name Display The system displays the currency code for the selected country code.

Tax Details section The section displays the following fields. Slab Sequence No Numeric; 22 Characters; Optional Enter the slab number for this investor category tax definition.

Income From Numeric; 30 Characters; Mandatory Specify the minimum income for which this tax slab definition is applicable, for the specified investor category. This slab will apply to incomes that range between the values you specify in this field and the Income To field for the specified investor category.

Income To Numeric; 30 Characters; Mandatory Specify the maximum income for which this tax slab definition is applicable, for the specified investor category. This slab will apply to incomes that range between the values you specify in this field and the Income From field, for the specified investor category.

Tax Percent Numeric; 5 Characters; Mandatory Enter the Tax Percent that is applicable to the given Investor category in the specified slab. This percentage may be equal to or below one hundred percent, but not greater.

No of Decimals for Tax Numeric; 1 Character; Mandatory Indicate the rounding precision or the number of decimals to be applied on the withholding tax amount pertaining to the slab. The decimal portion of the amount will be rounded off or truncated to the number of decimal places you specify here.