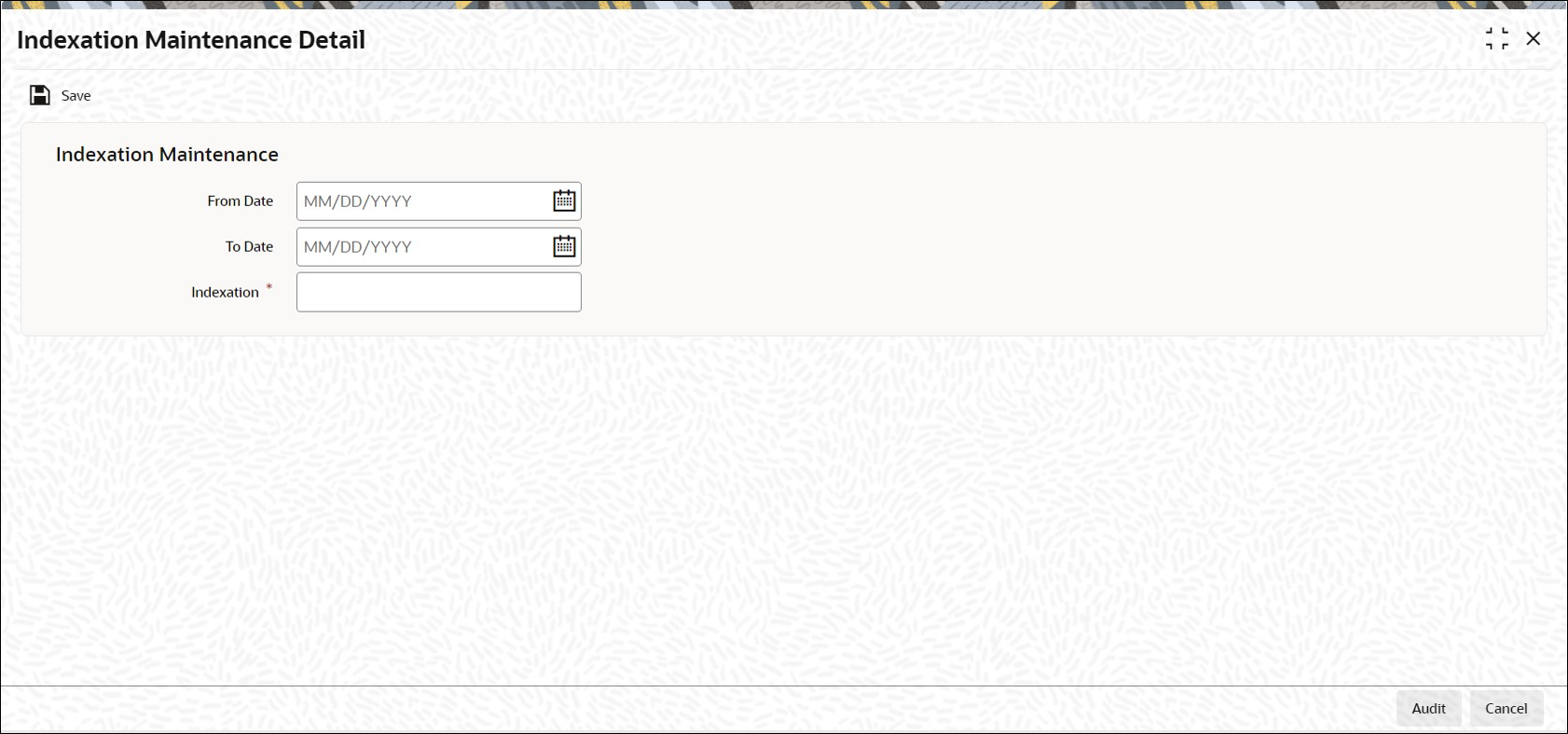

2.40 Process Indexation Maintenance Detail

This topic provides the systematic instructions to maintain indexation values.

Setting up Indexation Values

Investors may opt for indexation to be applicable for the computation of income or capital gains on earnings from investments, on which capital gains tax can be applied. You must maintain the indexation values to be applicable for specific periods, which can then be applied for the computation of capital gains income.

You maintain indexation values to be applicable within a specific period bounded by a From Date and a To Date.