9.4 Process Tax Compliance Source Country Maintenance

This topic provides the systematic instructions to maintain source country and the respective reportable countries for a rule type.

For instance, for a Rule type Common Reporting standard, you can maintain a source country for an LOB with multiple reportable countries.

- On Home screen, type

UTDTCSCM

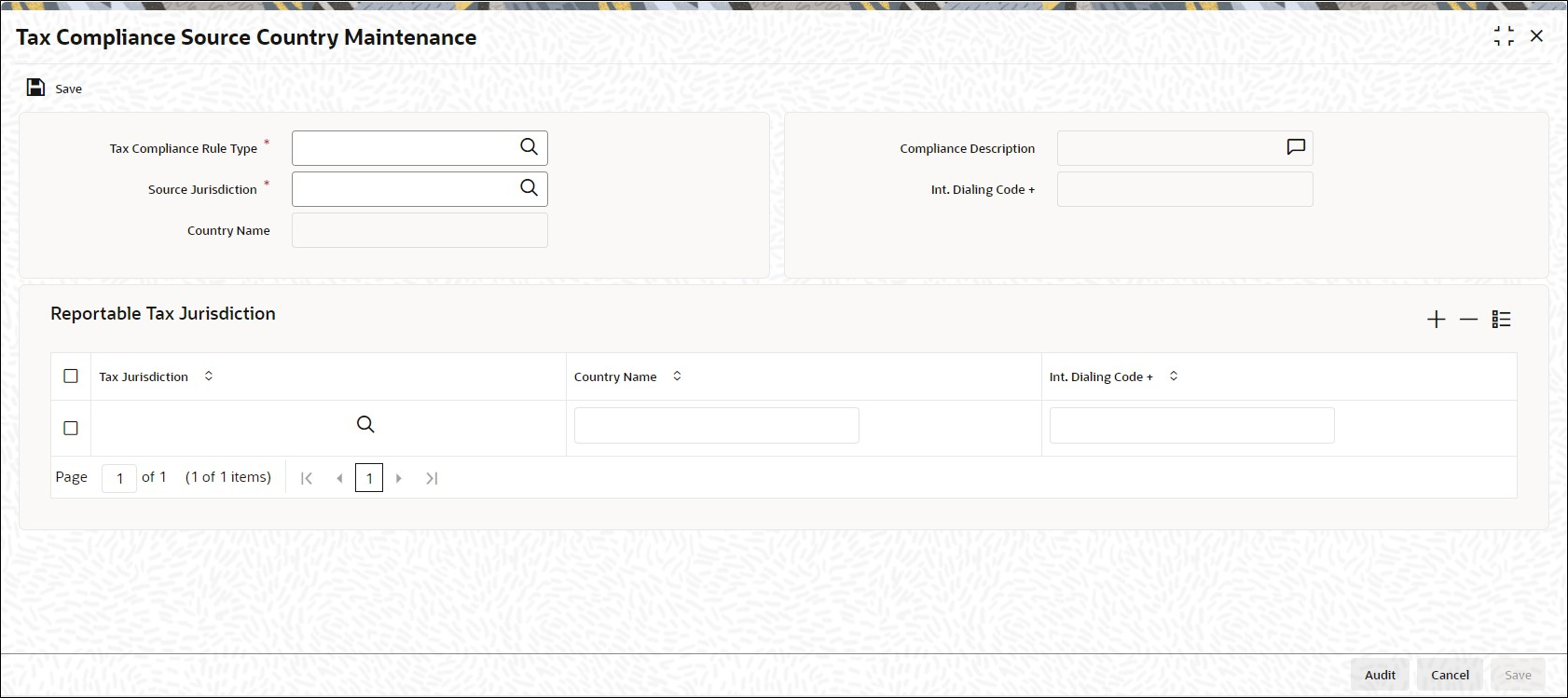

in the text box, and click Next.The Tax Compliance Source Country Maintenance screen is displayed.

Figure 9-3 Tax Compliance Source Country Maintenance

- On Tax Compliance Source Country Maintenance screen,

click New to enter the details.For more information on fields, refer to the field description table.

Table 9-2 Tax Compliance Source Country Maintenance - Field Description

Field Description Tax Compliance Rule Type Alphanumeric; 10 Characters; Mandatory

Specify the tax compliance codes applicable based on rules maintained at PARAMS. Alternatively, you can select tax compliance code from the option list. The list displays all valid tax compliance maintained in the system.

Compliance Description Display The system displays the description for the selected tax compliance code.

Source Jurisdiction Alphanumeric; 3 Characters; Mandatory Specify the source jurisdiction code. Alternatively, you can select source jurisdiction code from the option list. The list displays all valid source jurisdiction code maintained in the system.

Int. Dialing Code + Display The system displays the international dialling code based on the source jurisdiction code maintained.

For instance, if you have selected source jurisdiction code as India, then the system will display international dialling code as 91.

Country Name Display The system displays the name of the country for the selected source jurisdiction code.

Reportable Tax Jurisdiction This section displays the following fields.

Tax Jurisdiction Alphanumeric; 3 Characters; Mandatory Specify the tax jurisdiction code. Alternatively, you can select tax jurisdiction code from the option list. The list displays all valid tax jurisdiction code maintained in the system.

Country Name Display The system displays the name of the country for the selected source jurisdiction code.

Int. Dialing Code + Display The system displays the international dialling code based on the source jurisdiction code maintained.

For instance, if you have selected source jurisdiction code as India, then the system will display international dialling code as 91.

- Click Ok button to save the Time Zone captured in the system.

Note:

- If there are multiple time zones within a country, one Front office module (agency branch) has to be created and associated to each time zone.

- The latest rule of the time zone incase it has been amended is updated during BOD processing.