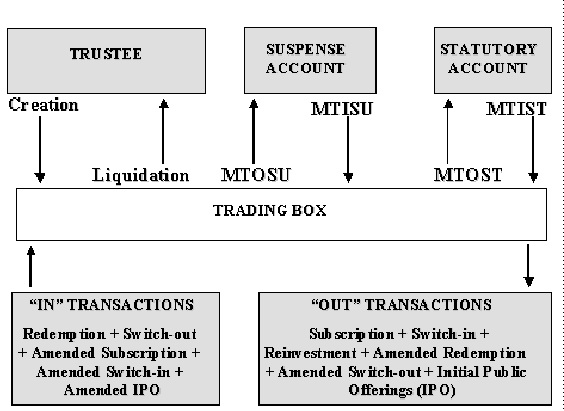

1.2 Trading Transactions

This topic provides explanation on trading transactions of the AMC.

- Creation

- Liquidation

- Management Transfer transactions

- Management Transfer Out to Statutory Account (MTOST)

- Management Transfer Out to Suspense Account (MTOSU)

- Management Transfer In from Statutory Account (MTIST)

- Management Transfer In from Suspense Account (MTISU)

- Net Settlement

- Net Settlement In (NSI) transactions

- Net Settlement Out (NSO) transactions

Note:

Global Order transactions can also be entered by an AMC. The system also services these transactions. However, the global order feature is only available if you installation has specifically requested for it. An exhaustive note on global order transactions may be found in the Annexure. This chapter only discusses the transaction types mentioned above. Trading box functionality is applicable only for Daily priced funds.Creation

Creation of units by the AMC is a result of a management decision to buy a certain amount of units from the trustees. The units that are bought are either sold to the unit holders at a more favourable price to generate profit, or kept in the suspense account, or both.

Creation of units by the AMC is a typical activity when it is desirous of generating earnings on favourable movement of fund prices.

A creation transaction will have the effect of incrementing the number of units in the trading box, and is considered an in transaction.

Liquidation

- To minimize losses on its holdings due to unfavourable movement of fund prices.

- To generate earnings out of an abundance of units in the trading box and a favourable price for liquidation.

A liquidation transaction will have the effect of depleting the number of units in the trading box, and is considered an out transaction.

Management Transfer transactions

- Management Transfer out to Statutory Account (MTOST)

- Management Transfer out to Suspense Account (MTOSU)

- Management Transfer in from Statutory Account (MTIST)

- Management Transfer in from Suspense Account (MTISU)

Table 1-2 Movement of Units

| Movement of Units | Descriptions |

|---|---|

| Management Transfer out to Statutory Account (MTOST) |

This activity is a result of a management decision to transfer part of the AMC’s holdings from the trading box to the statutory account. The MTOST transaction has the effect of depleting the number of units in the trading box, and is considered an |

| Management Transfer out to Suspense Account (MTOSU) |

This activity is a result of a management decision to transfer part of the AMC’s holdings from the trading box to the suspense account. The MTOSU transaction has the effect of depleting the number of units in the trading box, and is considered an |

| Management Transfer in from Statutory Account (MTIST) |

This activity is a result of a management decision to transfer part of the AMC’s holdings from the statutory account to the trading box. The MTIST transaction has the effect of incrementing the number of units in the trading box, and is considered an |

| Management Transfer in from Suspense Account (MTISU) |

This activity is a result of a management decision to transfer part of the AMC’s holdings from the suspense account to the trading box. The MTISU transaction has the effect of incrementing the number of units in the trading box, and is considered an |

Net Settlement

- Net Settlement In or NSI

- Net Settlement Out or NSO

Table 1-3 Net Settlement

| Net Settlement | Descriptions |

|---|---|

| Net Settlement In or NSI |

The net number of units flowing into the trading box due to redemption, switch-out, amended switch-in and amended subscription (or initial public offering) transactions. This is called the Net Settlement In or NSI. The NSI transaction has the effect of incrementing the number of units in the trading box, and is considered an |

| Net Settlement Out or NSO |

The net number of units flowing out to the trading box due to subscription, initial public offering, switch-in, reinvestment, amended switch-out and amended redemption transactions. This is called the Net Settlement Out or NSO. The NSO transaction has the effect of depleting the number of units in the trading box, and is considered an The AMC ensures that the trading box never goes into a negative or a zero position where the net settled units due to |

Trading – Graphical Work-flow View

Parent topic: Manage Suspense Accounts, Statutory Accounts and Trading