1.5 Process Fund Dividend Detail

This topic provides the systematic instructions to maintain the dividend declaration details for a fund, for either a cash dividend or a stock dividend.

- Zero distribution of all funds. In Zero Distribution, the Earning Per Unit (EPU) will be zero, hence if G2 units are converted into G1 units, the unit holder is not financially benefited. This is applicable for equalization funds only.

- Multiple distribution of a fund on the same day. In this case the system allows to maintain the distribution type.

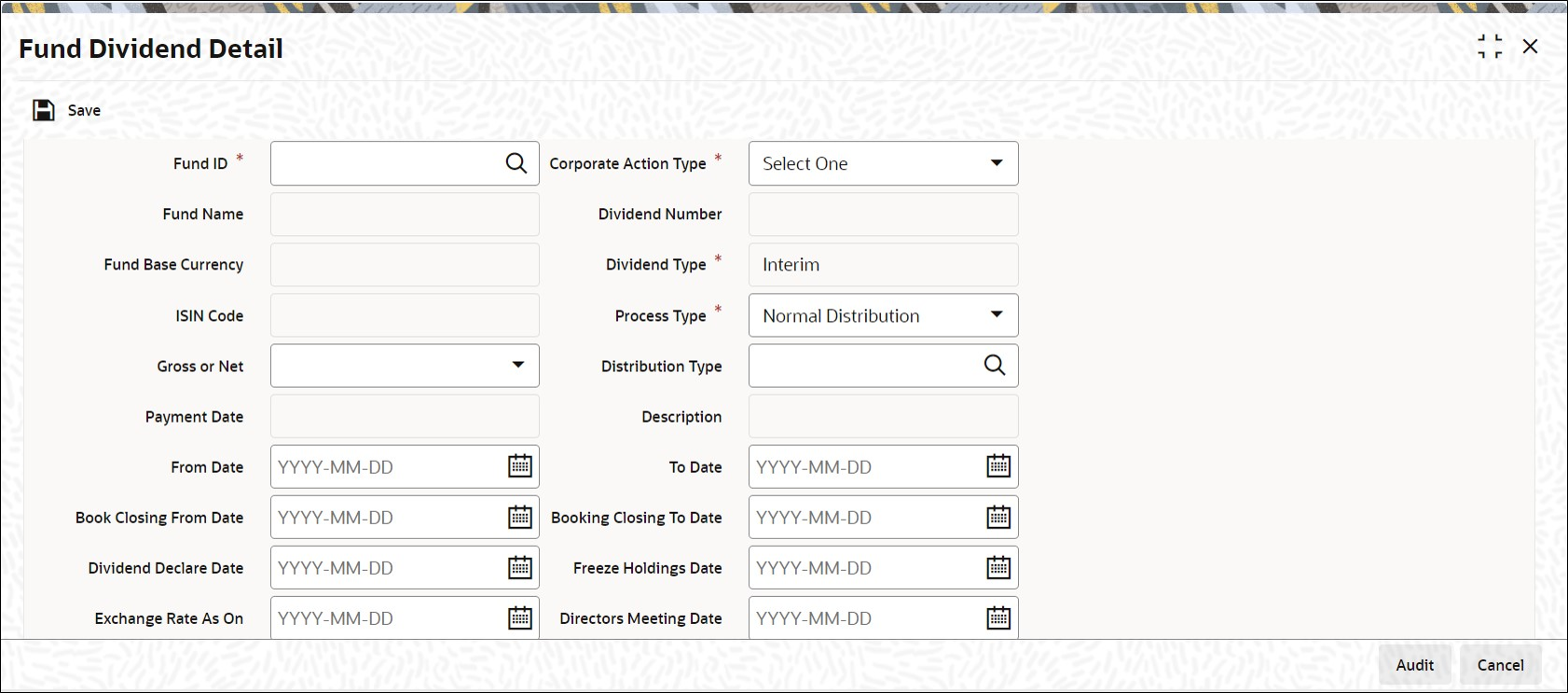

Fund Dividend Detail

- On Home screen, type UTDFUDIV in the text box, and click Next.The Fund Dividend Detail screen is displayed.

- On Fund Dividend Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 1-4 Fund Dividend Detail - Field Description

Field Description Fund ID Alphanumeric; 6 Characters; Mandatory Select the Fund ID, for which the dividend is being set up, from the list provided. The list will display all the funds that have been authorized, along with their latest rule enabled. When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

Fund Name Display The system displays the fund name for the selected fund ID.

Fund Base Currency Display Only After you select the Fund ID, the base currency for the selected fund is displayed in this field.

ISIN Code Display The system displays the ISIN Code of the selected fund.

Gross or Net Optional Select if the fund is Gross or Net from the drop-down list. The list displays the following values:

- Gross

- Net

Payment Date Date Format; Optional Select the payment date from the adjoining calendar.

From Date Date Format, Mandatory The Dividend From Date is the start date of the period for which dividend is being declared. The system defaults this date based on the following criteria:

- For regular dividends, the Dividend Declare Frequency and either the fiscal year for the fund or the First Dividend Declare Date, depending upon the specification made in the Corporate Actions profile for the fund and corporate action type. You can override this defaulted date, if necessary.

- For interim dividends, based on the last dividend payment for the fund. You cannot override this defaulted date.

If overridden, the Dividend From Date should be equal to or later than the Dividend Start Period and equal to or earlier than the Dividend End Period.

To Date Date Format, Mandatory The Dividend To Date is the end date of the period for which dividend is being declared.

- For regular dividends, the system defaults this date to be the next date on which dividend processing is due for the fund, based on the dividend declaration frequency and either the fiscal year for the fund or the First Dividend Declare Date, as specified in the Corporate Actions profile for the fund and corporate action type. You can override the defaulted date, if necessary.

- For interim dividends, this field is enabled for you to enter the To Date for the dividend.

The Dividend To Date should be later than the Dividend Start Period and earlier than the Dividend End Period. It should also be later than the Dividend From Date.

Book Closing From Date Date Format, Mandatory ONLY if Book Closing To Date is specified. The Book Closing From Date is the start date of the period during which the books of the fund are closed. Any transactions accepted during this period will be allotted only after the book closing period is over.

If specified, the Book Closing From Date should be the same as or later than the Dividend To Date. It should also be the same as or later than the System Application Date.

Book Closing To Date Date Format, Mandatory ONLY if Book Closing From Date is specified. The Book Closing To Date is the end date of the period during which the books of the fund are closed. If specified, it must be the same as or later than the Dividend To Date, and the Book Closing From Date.

Dividend Declare Date Date Format, Mandatory Specify the date on which the dividend is to be declared.

The system defaults this date to be the same as the dividend To Date. You can override it if necessary.

The Dividend Declare Date should be later than the Directors Meeting Date.

Exchange Rate as on Date Format; Mandatory if Dividend Declare Date is specified. This field is applicable only if the Exchange Rate Basis specified for the fund is Reference Date. In such a case, the exchange rate to be considered is the rate on the reference date specified here.

Earnings / LOT Numeric, Mandatory if Dividend Declare Date and Exchange Rate As On are specified, and only for cash dividends. Specify the Earnings per Unit per Lot, announced during dividend declaration, in the case of cash dividends.

You must specify this value only if the Earnings per Unit are not to be defined in terms of components, but as a single value. If the EPU is to be defined in terms of components, as specified in the Corporate Actions record for this fund and the System Parameters at the Agency Branch, this field is locked for data entry, and you must specify the EPU in terms of its components.

Click the EPU/LOT Component Values link to invoke the Fund Dividend Component screen, where you can specify the values for each component.

NPI Value Numeric; 20 Characters; Optional Specify the NPI value.

Equalization Rate Numeric; 20 Characters; Mandatory for Dividend Equalization Funds Specify the dividend equalization rate to be applied for the units that have not yet received any benefit (income or dividend) so far. You can input a value only if the fund for which you are maintaining dividend is a Dividend Equalization Fund.

In case of other funds, the system will default null here and will not allow any change in the value.

Override FATCA WHT Optional Select if FATCA WHT for that particular dividend cycle has to be overwritten or not from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

Generate Redemption Optional Select if redemption should be generated or not for negative cash dividends from the drop-down list. The list displays the following values:

- Yes

- No

Corporate Action Type Mandatory Select the type of corporate action for which the dividend is being declared from the drop-down list. The list displays the following values:

- Cash Dividend

- Stock Dividend

Dividend Number Numeric, Display The serial number of the dividend being declared, generated by the system, is displayed. In generating this number, the dividend number of the last, most recent declaration is incremented by 1.

Dividend Type Display Only If the dividend being entered is part of the dividend cycle for the selected fund, it is a regular dividend. If it is an ad-hoc declaration, it is an interim dividend.

Process Type Mandatory Select the process type from the drop-down list. The list displays the following values:

- Normal Distribution

- Zero Distribution

- Skip

By default, the Non Zero Distribution option is selected here, if you are entering a new dividend. If the dividend is to be skipped, select Skip.

If Zero Distribution is selected, then the system processes the record with the Earnings Per Unit (EPU) as Zero. Also, the income equalization field will be systemically set to Zero. Dividend reversals are also enabled for the zero distribution process. This amendment process supports the following:

- Reversals to the original bucket

- Reprocessing of zero distribution process to non zero distribution process and non zero distribution process to zero distribution process.

Distribution Type Alphanumeric; 3 Characters; Optional The system displays the following options based on the values maintained in the Corporate Action tab of the Fund Rule Maintenance screen.

- Dividend

- Interest

- Property Income Distribution

The system validates whether the distribution type is of Corporate Action type Cash. The list of values are populated based on the fund maintenance, that is, if the fund has only dividend distribution type or two to three distribution types maintained, then the values are populated accordingly.

Description Display The system displays the description for the selected distribution type.

Freeze Holdings Date Date Format, Mandatory The system defaults the freeze holdings date, from the specifications made in the Corporate Actions profile for the fund and corporate action type, as follows:

Freeze Holdings Date = Dividend Declare Date – Freeze Holdings Lead Time.

The Dividend Declare Date is also defaulted in this screen, to be the same as the Dividend To Date.

You can override this default date if necessary. When you override the default date, you can specify a past date if necessary. (i.e., earlier than the application date),

Directors Meeting Date Date Format, Optional The Directors’ Meeting Date is the day after the Book Closing To Date. It is during the directors’ meeting that the dividend is declared. This date must be earlier than the next date on which a regular dividend is due for processing, for the fund and corporate action type.

The system displays the application date in this field, by default. You can override it, if necessary.

Stock Dividend Type Optional Select the type of stock dividend from the drop-down list. Following are the options available in the drop-down list:

- Select One

- Positive

- Negative

This field is mandatory if the dividend type is stock dividend.

Whenever a negative stock dividend is declared a redemption transaction should be passed at current NAV/TXNBP 03 based on maintenance. The number of units that has to be redeemed will depend on the negative stock dividend ratio.

S D Parent Ratio Numeric; 22 Characters; Mandatory for stock dividends For stock dividends, specify the stock dividend ratio that is to be applicable for the dividend declaration.

This field is the parent, which represents the units eligible for dividend in the ratio.

S D Resultant Ratio Numeric; 22 Characters; Mandatory for stock dividends This field is the resultant, which represents the number of units that is gained by the unit holder as dividend for the specified number of parent units eligible for dividend.

For instance, if you specify 2 in the S D Parent Ratio field and 1 in the S D Resultant Ratio, then, for every two units eligible for dividend, the unit holder receives one unit as dividend.

Grandfathered obligation Optional Select to mark the dividend as grandfathered obligation from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

If you select Yes, then the WHT will not be applicable.

Reinvestment Date Date Format; Optional Select the reinvestment date from the adjoining calendar.

Dividend Status Display Only The system displays the status of the dividend, based on the status of the fund. The dividend could be a new one, or the fund could be in its book-closing period, or after the directors meeting. This information is displayed here by the system.

- Click the Show Details button to view the fund dividend details.

- Report Component Values

This topic explains the Report Component Values tab in the Fund Dividend Detail screen. - EPU/Lot Component Values

This topic explains the EPU/Lot Component Values tab in the Fund Dividend Detail screen. - Maintain Regular Dividends

This topic explains the steps to maintain regular dividends in the Fund Dividend Detail screen. - Maintain Interim Dividends

This topic explains the steps to maintain interim dividends in the Fund Dividend Detail screen. - Maintain Cash Dividend for Fund

This topic explains the steps to maintain cash dividend for fund in the Fund Dividend Detail screen. - Maintain Stock Dividend for Fund

This topic explains the steps to maintain stock dividend for fund in the Fund Dividend Detail screen. - Process Negative Cash Dividend

This topic explains the steps to process negative cash dividend in the Fund Dividend Detail screen.

Parent topic: Dividend Maintenance