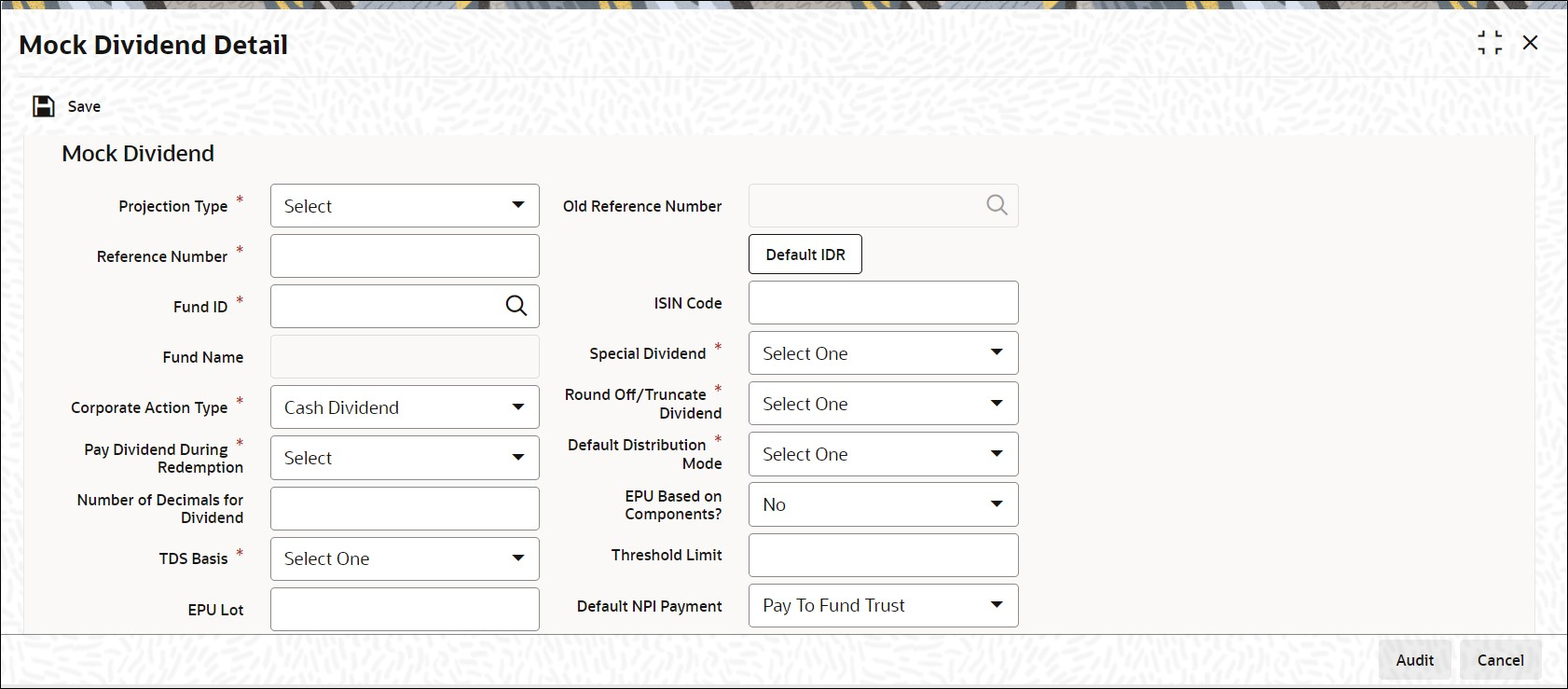

| Old Reference Number | Display For each dividend for which you perform mock processing in this screen, you must provide a unique identification reference number. You can execute the mock processing, and obtain projection reports based on the reference number. Click the Default IDR button to default Old Reference Number. |

| Projection Type | Mandatory Select the projection type from the drop-down list. The list displays the following values: - Mock Dividend

- Accumulation

- Accumulation Reversal

|

| Reference Number | Alphanumeric; 16 Characters; Mandatory Specify the reference number. |

| Fund ID | Alphanumeric; 6 Characters; Mandatory Specify the fund ID. Alternatively, you can select fund ID from the option list. The list displays all valid fund ID maintained in the system. |

| Fund Name | Display The system displays the name of the fund for the selected fund ID. |

| ISIN Code | Alphanumeric; 12 Characters; Optional Specify the ISIN code. If you have selected fund ID, the system displays the ISIN code for the selected fund ID. However, you can amend this value. |

| Corporate Action Type | Mandatory Select the corporate action type from the drop-down list. The list displays the following values: |

| Pay Dividend During Redemption | Mandatory Select if dividend is paid during redemption or not from the drop-down list. The list displays the following values: |

| Number of Decimals for Dividend | Numeric; 5 Characters; Mandatory Specify the number of decimals for dividend. |

| TDS Basis | Mandatory Select the TDS basis from the drop-down list. The list displays the following values: - Each Dividend

- Fiscal Year

- Tax Exempt

|

| EPU Lot | Numeric; 6 Characters; Mandatory Specify the EPU lot details. |

| Exchange Rate Source | Alphanumeric; 6 Characters; Mandatory Specify the exchange rate source. Alternatively, you can select exchange rate source from the option list. The list displays all valid exchange rate source maintained in the system. Note: Exchange rate defaulting logic will default from default setup where user has overridden or given a source, system will give preference to overridden value. |

| Payment Date | Date Format; Mandatory Select the payment date from the adjoining calendar. |

| Project Amendment | Optional Select if project is amended or not from the drop-down list. The list displays the following values: |

| IDR Exists | Optional Select if IDR exists or not from the drop-down list. The list displays the following values: |

| NPI Applicable | Optional Select if NPI is applicable or not from the drop-down list. The list displays the following values: |

| Override Unitholder Preference? | Optional Select if unit holder preference is overridden or not from the drop-down list. The list displays the following values: |

| Minimum Amount to be paid out | Numeric; 20 Characters; Optional Specify the minimum amount to be paid out. |

| Special Dividend | Mandatory Select if dividend is special or not from the drop-down list. The list displays the following values: |

| Round Off/Truncate Dividend | Mandatory Select if dividend is round off or truncate from the drop-down list. The list displays the following values: |

| Default Distribution Mode | Mandatory Select the default distribution mode from the drop-down list. The list displays the following values: - PayOut - A/C Transfer

- PayOut - AC Check

- Full Reinvestment

|

| EPU Based on Components? | Optional Select if EPU is based on components or not from the drop-down list. The list displays the following values: |

| Threshold Limit | Numeric; Mandatory Specify the threshold limit. |

| Default NPI Payment | Optional Select default NPI payment from the drop-down list. The list displays the following values: |

| Force Reinvestment of Uncleared Units | Optional Select the uncleared units status from the drop-down list. The list displays the following values: - Force Reinvestment

- No Preference

|

| Value Date | Date Format; Mandatory Select the value date from the adjoining calendar. |

| Payment Number | Numeric; 5 Characters; Optional Specify the payment number. |

| Can be overridden at payment time? | Optional Select if the dividend can be overridden at payment time or not form the drop-down list. The list displays the following values: |

| Action | Optional Select the action from the drop-down list. The list displays the following values: |

| Remarks | Alphanumeric; 255 Characters; Optional Specify remarks, if any. |

| FATCA WHT Amount | Optional Select to deduct the FATCA WHT amount from the drop-down list. Following are the options available in the drop-down list: |

| Dividend Details | The following details are displayed. |

| Dividend Number | Numeric; 5 Characters; Mandatory Specify the dividend number |

| Distribution Type | Alphanumeric; 3 Characters; Optional Specify the distribution type. Alternatively, you can select distribution type from the option list. The list displays all valid distribution type maintained in the system. |

| Net/Gross | Optional Select if the dividend is net or gross. |

| EPU | Numeric; 20 Characters; Optional Specify the Earnings per Unit (EPU) for cash dividends. You can provide the EPU based on components. You can also specify any EPU reporting components. |

| Equalization Rate | Numeric; 20 Characters; Optional Specify the equalization rate. |

| NPI Value | Numeric; 20 Characters; Optional Specify the NPI value. |

| Exchange Rate Date | Date Format; Optional Select the exchange rate date. |

| Ex Distribution NAV Date | Date Format; Optional Select ex distribution NAV date from the adjoining calendar. |

| Freeze Holdings Date | Date Format; Optional Select freeze holdings date from the adjoining calendar. |

| Dividend Declare Date | Date Format; Optional Select dividend declare date from the adjoining calendar. |