3.3 Process Unitholder Deal Maintenance Detail

This topic provides the systematic instructions to set up a deal for an investor.

Process Unitholder Deal Maintenance Detail

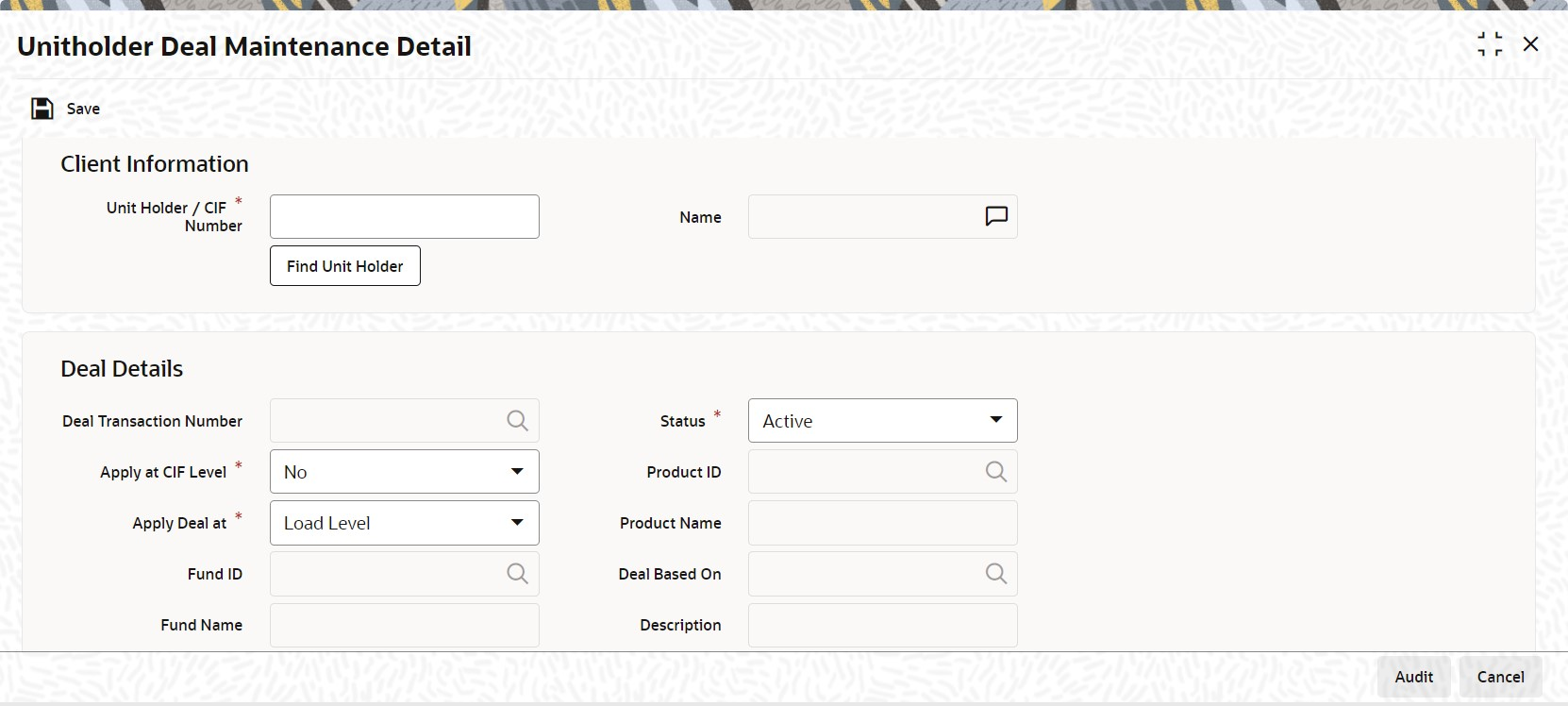

- On Home screen, type UTDUHDEL in the text box, and click Next.The Unitholder Deal Maintenance Detail screen is displayed.

Figure 3-6 Unitholder Deal Maintenance Detail

- On Unitholder Deal Maintenance Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 3-5 Unitholder Deal Maintenance Detail - Field Description

Field Description Client Information In this section, select the ID of the unit holder for whom you are specifying deal options. You can create deals for both authorized and unauthorized unit holders/CIF.

If a deal is created for an unauthorized unit holder, the unit holder/CIF record must be authorized before the deal authorization process is put through. Else, the unit holder deal cannot be authorized.

Unit Holder/ CIF Number Alphanumeric; 12 Characters; Mandatory

Select the unit holder or CIF account number for whom you are creating the deal options from the list.

When you specify the CIF number, the name of the corresponding CIF account is retrieved from the database and displayed alongside the field.

Name Display

The system displays the name of the ID of the non-CIF unit holder for whom you are setting up the deal in this screen.

You can search unit holder or CIF number by clicking Find Unit Holder button.

Deal Details In this section, specify the level at which the deal must be applied for the selected unit holder.

Deal Transaction Number Display

The system displays the deal transaction number of the deal while saving.

Status Mandatory

By default, the status of all newly created deals in this screen is Active. However, you can select the status from the drop-down list. The list displays the following values:- Active

- Cancelled

Apply at CIF Level Mandatory

Select

Yesto indicate that the deal options you are setting up must be applicable to all unit holder accounts under the selected CIF customer account.Note: When the deal is applied at CIF level, a similar set up is not possible at unit holder account level for the same fund / group and load, and vice versa.

Apply Deal At Mandatory

Select and indicate whether the deal must be applied on a single load (Load Level), a particular load for a fund (Fund Level), all funds in a load group (Load Group Level) or a Product (Product Level) from the list.

The options in the drop-down list are as follows:- Load Level

- Load Group Level

- Fund Level

- Product Level

Note: If you select the option

Product LevelorFund Level, the fields Fund and ISIN Code will be displayed. These two fields are explained below.Product ID Alphanumeric; 10 Characters; Optional

Specify the product for which the deal is to be applied.

Product Name Display

The system displays the name of the product for the selected product ID.

Fund ID Alphanumeric; 6 Characters; Optional if Product Level, Mandatory if Fund Level

This field will be displayed only if you have selected the option

Product LevelorFund Levelagainst the field Apply At.If you have selected the option

Product Level, you can set up a deal for the investor at the Product level. You have the option of specifying a particular fund to which the Load that you select applies. If you do not select a fund, the load that you select will be applicable to all funds mapped to the Product.If you have selected the option

Fund Level, from the list, select the fund for which the deal would apply, for the selected unit holder.Fund Name Display

The system displays the name of the fund for the selected fund ID.

Deal Based On Alphanumeric; 1 Character; Optional

Select the deal based on from the following options maintained:

Inclusion Percentage, then the calculation of taxes are as follows:- Basis Annual Tax = Gross Annualized Amount * Load Return Value

- Annual Tax = Apply the Product With Holding Tax slab basis load on Basis Annual Tax

Flat Rate Percentage, then the annual tax is calculated as:

Annual Tax = Policy Annuity Value * Load Return Value

Flat Rate Amount, then the annual tax is calculated as:- Basis Amount = Load Return Value * 12 and

- Effective Rate = Basis Amount * 100 / Gross Annualized Amount

- Annual Tax = (Gross Annualized Amount * Effective Rate ) / 100

Note: An option All is also available to map a load across all the products for a Policy Holder. If All is selected, then the funds cannot be selected.

Description Display

The system displays the description for the selected deal based on details.

Policy Number Alphanumeric; 16 Characters; Optional

Specify the policy for which the deal is to be applied.

Effective Start Date Date Format, Mandatory

Enter the date from which the deal is to be effective.

Specify the date on and following which, the deal options must be applied for transactions for the selected unit holder, in the manner indicated in this record.

Effective End Date Date Format, Mandatory

Enter the date to which the deal is to be effective.

Specify the last date on which, the deal options must be applied for transactions for the selected unit holder, in the manner indicated in this record.

Tax Type Optional

You will be able to select the tax type only if you have selected Apply At as Product Level.

The investor will be charged for tax and the tax rate will be calculated based on the method of tax calculation you specify.

Following are the options available in the adjoining drop-down list:- Directives

- Instructions

- Aggregation

Directives Tax Directives is the tax rate provided by the SARS to the investors. The investors, in turn will instruct the tax that has to be deducted. Accordingly, the system will deduct the tax rate specified by the investor instead of the tax slab that is maintained in the Withholding Tax Setup screen.

Refer the topic Maintain Reference Information for details on maintaining tax slabs.

Based on the tax directive submitted by the investor at the UH level, the UH deal for the tax load will be maintained.

Instructions Tax Instructions is the tax rate suggested by the investors to deduct the tax. However, the system will compare the suggested tax rate with that of the tax slabs maintained. If the value of the suggested tax rate is lower than the maintained tax slab, the system can apply the higher value of the tax rate.

Mote: The tax directive or the tax instruction is at the policy level and not at the UH level.

Aggregation This is allowed only if Tax Aggregation is allowed at product level. If Product ID is selected as All in UH deal then the system will look at those products where Tax Aggregation is checked for the product.

If tax directive is maintained in UH-Deal then tax instruction or tax aggregation will not be allowed to maintain for the same deal effective period. Tax instruction and tax directive are mutually exclusive.

When a tax directive is maintained in UH-Deal then existing tax instruction or tax aggregation (for the same UH/product/policy/deal effective period), if any, will be marked as cancelled. You cannot maintain multiple directives/instructions/aggregation for the same deal effective period.

When directive is maintained in UH deal, the system will directly use this value to compute WHT. When tax instruction or aggregated value is maintained then system will project WHT based on Tax-instruction and aggregation, higher of these will be used for WHT deduction.

Internally, the system will track whether slab or directive or instruction or Aggregation was applied for each annuity.

When deal is based on flat rate amount, then it needs to apply directly to the Annuity irrespective of the frequency. The return value would be tax amount payable per annuity frequency and not the annualized value.

If both Tax Aggregation and Instructions are maintained then the system will take the rate with higher tax outgo.

In Product maintenance if Annuity Tax Computation basis is Policy, then rebate also will be at Policy level.

In case of any UH deal (Directive/Aggregation/Instruction) rebate will not be given. It will be applied only on Default slab.

If Unit Holder has multiple policies under one product and the deal based on is selected as Flat rate percentage and UH Deal Tax Type is Directive, then the annuity tax must be calculated at each policy gross annualized annuity amount level.

For instance, If POL1 and POL2 are two policies under a UH, with 3000 and 2000 as respective annuities and assuming 10% is the flat rate deal maintained at the UH deal level, then the system should charge an annuity tax of 300 and 200 respectively each month.

When Annuity Tax Computation Basis at product Level is Policy Holder and the UH Deal Tax Type is Directive (Deal Based On is selected as Flat Rate), the system calculates the annual tax on each policy’s gross annualized annuity amount, if UH has many policies under the same product.

Multiple deals for same deal type/ UH/Product/policy combination will not be supported.

Note: Unit Holder can have multiple policies under one product and if the UH Deal Tax Type is Directive (Deal Based On is selected as Flat Rate), the system will compute annuity tax on each policy’s gross annualized annuity amount.

Group ID Alphanumeric; 16 Characters; Optional

Select the load for which you want to specify the new return value as required for the deal from the list.

For all transactions for the selected unit holder in the selected fund, that occur between the deal start and end dates, for which the selected load is applicable, the deal will be applied.

Load ID Numeric, 5 Characters; Mandatory if the deal is to be applied for all funds in a load group (Load Group Level)

Select the load group for which the deal would apply, for the selected unit holder from the list.

For all transactions for the selected unit holder in any fund belonging to this load group, that occur between the deal start and end dates, the deal will be applied on the selected load.

Load Description Display

The system displays the description for the selected load ID.

Load Calculation Method Display

The system displays the Load method that is used for calculating the Load when you choose the load ID.

Amount or Percentage Display

This field is defaulted depending on whether the load ID selected is an amount based load or a percentage based load.

- Specify the altered return value for the selected load that is applicable as required for the deal in the Load Details section.

- Click Default Load Details button.The Load Details that are maintained gets defaulted in this tab.

- View the following details for each load that you select in the Load field in the Deal Details section.The following details are displayed in this section, in display mode:

- Slab Sequence No, if any and their applicable boundaries.

- From Date

- To Date

- From Amount

- To Amount

- From Units

- To Units

- From Period

- To Period

- Return Value: The original Return Value for the load.

- Override To

- View the following details in the Derived Load Details section.The following details are displayed:

- Load ID

- Description

- Load Percentage: Amount or Percentage (this is the basis on which the return value for the selected load is derived)

- Override To

- Specify the new return value applicable for the load, as required for the deal, in the Override To field and click Exit button.

- Set Up Deal for Investor

This topic provides the systematic instructions to set up deal for investor. - Set Up the Deal

This topic provides the systematic instructions to set up the deal.

Parent topic: Entities - Set Up Investor Preferences