2.33 Perform Fund Transaction Sign Off

This topic provides the systematic instructions to mark the sign off status.

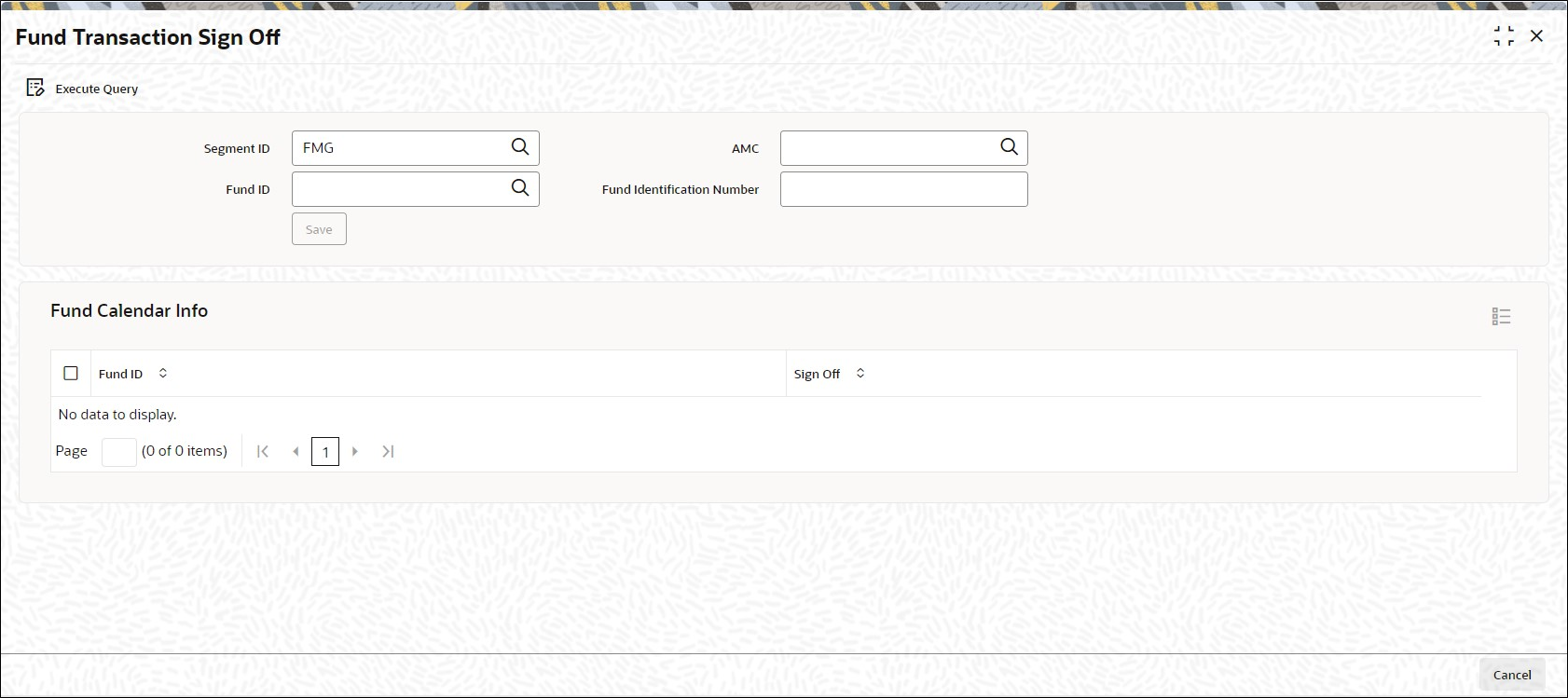

- On Home screen, type UTDTSOFF in the text box, and click Next.The Fund Transaction Sign Off screen is displayed.

- On Fund Transaction Sign Off screen, click New to enter the details.For more information on fields, refer to the field description below,

Table 2-48 Fund Transaction Sign Off - Field Description

Field Description Segment ID Alphanumeric; 12 Characters; Optional

Specify the Segment ID. Alternatively, you can select the Segment ID from the option list. The list displays all valid Segment ID maintained in the system.

Note: Segment ID is mandatory in Global Transfer Agency(GTA) Setup. In Non GTA Setup, Segment ID will be defaulted to value FMG.

Fund ID Alphanumeric; 6 Characters; Optional

Specify the Fund ID.

AMC Display The system displays the description for the selected Fund ID.

Execute Query Click Execute Query button after specifying Fund ID. The following fund calendar information is displayed:- Fund ID

- Sign Off

Fund Identification Number Display The system displays the Fund Identification Number.

Trading Transactions

- Enter the Trading transactions only on working days for the fund in the fund calendar (if maintained) or AMC calendar (if maintained) or System calendar.

Transactions

- If the transaction falls on a holiday, or if the transaction is entered after marking of transaction sign off for the day, or after cut-off time, then the transaction date is defaulted to next working day for the fund.

- The transaction date for switch transactions is arrived at by considering the fund calendar, if any, maintained for the Switch From fund; the date must be a working day for the Switch From fund, but need not be so for the Switch To fund.

- You can derive the backdating limit for backdated transactions from the fund calendar.

- Dates for instrument clearing are also based on the fund calendar.

Settlement Dates

- The settlement dates for payments must not be holidays for the settlement currency, as designated in the currency calendar.

- During transaction entry, the payment date or clearing date for a subscription is computed based on the transaction date and payment lag.The system checks that the payment date derived is a working date for the transaction currency.

- For redemptions, the redemption confirmation process arrives at the payment date (check date) based on payment lag.This date should be a working date for the currency.

- Dividend payments in respect of unit holders are in each unit holder’s preferred currency. The payment date for a unit holder should be a working date for the currency of payment. Therefore a single dividend payment may still be made on different dates for different unit holders.

- The payment date for a broker should be a working date for the broker payment currency.

Batch Functions

- Perform the Menu allocation only for funds working on the application date.

- Perform the Redemption Confirmation only for funds working on the application date.

- Ensure that the Dividend Payments date must be a working day for the fund.

- Verify that the value date for Dividend Reinvestment must be a working day in the system calendar.If the reinvestment fund has a holiday on the reinvestment transaction value date, then the transaction date is set to the next fund working day.

- Perform pre-end of day checks only for the funds working on the application date.

- End of Day Activities are mentioned below.

- Broker reinvestment transactions are only processed for those funds working on the application date.

- Allocations for transactions of all types, for all funds working on the application date, are performed.

- Switch transactions are only allocated if the current date is a working day for both funds. The Switch From leg is allocated at the prevalent price on transaction date, and the Switch To leg, with the current price. Ageing entries for the Switch From leg are booked as of transaction date, and those for the Switch To leg, as of the allocation date.

- The Specific Fund Price date is arrived at after applying the Prior or After holiday rule, as specified in the fund rules. Specific price dates for a fund, if applicable, are updated only on fund working days.

- Periodic load processing is done for all funds only on the value date for periodic load processing, which is arrived at after periodic fee computation, and must be a fund working date.

- Trading net settlement processing as well as trading summary calculation is done only for funds working on the current date.

- Fund bank account transfer processing is done only for funds working on the current date.

- Dividend processing, dividend reinvestment processing and the generation of dividend records are done only for funds working on the current date. For those funds working on the current date, the first dividend record will be generated. For other dividends, if the dividend record generation date arrived at is a fund holiday, the Prior or After fund holiday rule is applied to arrive at a valid fund working day from the fund calendar. If this date is the same as the system date, the dividend record for the fund is generated.

- GL Export processing is done only for funds working on the current date.

- Updating of the latest rule for a fund is done only for funds working on the current date.

- The Beginning of Day outstanding units for a fund are only updated if the fund is working on the current date.

- After the system date change, the fund holiday status change process updates the holiday status for all the funds, and resets the transaction sing-on status.

- Standing instructions escalation processing is done only for funds working on the current date. The generation of standing instructions is done on fund working days, and the generation date is arrived at taking into account the fund calendar, after the standing instructions holiday rule has been applied.

- Amount unblock transactions, as well as amount block escalations and amount block transaction generation for the fund are generated only on fund working days.

- Automatic redemption transactions are only generated for funds working on the current date.

Restricting Transactions into Fund on Working Day

- When a sale restriction is marked, it must be authorized for it to be effective in the system.

- When you restrict sale of a fund in this manner, you can opt for either of the following options for transactions that have been entered after the restrict sale status has been marked for the day.

Table 2-49 Restricting Transactions into Fund on Working Day

Field Description Reverse If you choose this option, any unauthorized transactions entered after the restrict sale status has been marked for the day are deleted. Any authorized transactions including system generated transactions or those that have been entered on the previous system working day after the transaction cut-off time are reversed. Any transactions allotted after the restrict sale status has been marked are left unaltered. An error message is displayed when the sale restriction is authorized, in respect of these transactions.

Carry forward If you choose this option, the transaction date of any transaction that is entered after the restrict sale status has been marked for the day, will be defaulted to the next working day according to the fund calendar (if maintained) or AMC calendar (if maintained) or the system calendar. Any transactions allotted after the restrict sale status has been marked are left unaltered. An error message is displayed when the sale restriction is authorized, in respect of these transactions.

Uploading Holiday Details

- Use the upload facility to upload holiday details, if required.For more details on holiday upload file formats, refer Upload File Formats topic in FCIS system.

Parent topic: Maintain Reference Information