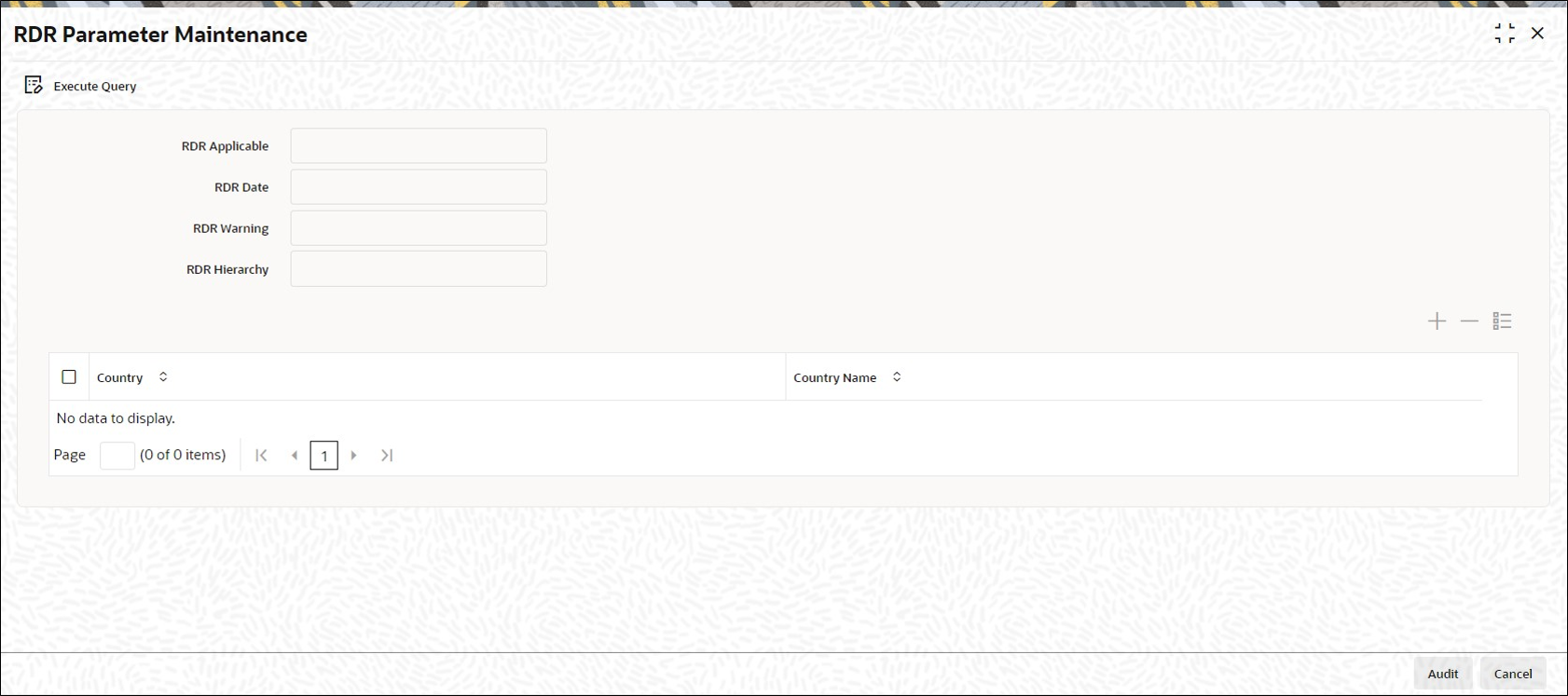

3.20 Perform RDR Parameter Maintenance

This topic provides the systematic instructions to maintain RDR Parameters.

Maintain RDR Parameters

The Financial Services Authority (FSA) is an independent non-governmental regulatory body. FSA has proposed new regulations Retail Distribution Review (RDR) on Retail Advised portion of the Fund Market with effect from 1st January 2013.

The Retail Distribution Review regulations ban the payment of commission on retail advised retail business after 31st December 2012. Execution only Business can be defined as transactions by investor post-RDR without any advice from any advisor. While Advised Business can be defined as transactions done by investor post-RDR based on advice from advisor. Post-RDR, neither front-end nor trail commission can be paid on advised new retail business.

However, payment of commission (front-end/trail) can continue on New Business classified as Execution only Business. Commission payments can also continue to be paid on Legacy Business. Post RDR, the payment of commissions will depend on the classification of transactions (Legacy Business, Advised Business, and Execution only Business).

The RDR regulations will be applicable to UK domiciled advisor irrespective of whether they purchase UK funds or non-UK funds. The TAs for funds outside UK that are purchased as result of advice from a UK domiciled advisor will need to comply with RDR. It will be required to ascertain whether the advisor is domiciled in UK or not.

It is required to define the front-end commission and trail commission payable based on classification of transaction and domicile of advisor. It will be required to provide the audit trail for front-end commission and trail commission.

In the absence of commission payments on new advised business, investor will be required to pay fees to the advisor for the advice received. The advisor fee will be agreed upon by the investor and the advisor. The advisor will also be able to charge for ongoing services provided to investors. It will be required to provide audit trail for advisor fees. These fees are expected to be handled outside the system.

An investor may hold units in a fund and could have made investments based on advice received Pre-RDR and Post-RDR. The payment of commission or fees will depend on the classification of transactions. It will be required to segregate an investors holding (Pre-RDR/ Post-RDR) and classify them. Segregation of investor’s holdings will also be required to classify transactions resulting from reinvestment of dividends. It will be required to provide the audit trail for Pre-RDR and Post-RDR holdings.

Payment of commission on SI transactions will depend on whether the SI transaction is classified as Legacy Business, Advised Business or Execution only Business. The escalation in SI transactions will also need to be classified similarly.

Re-registration of an investment from one platform to another will not be by default classified as an advised event and trail commission can continued to be paid. In case the re-registration is based on advised activity, then trail commission cannot be paid. It will be required to capture whether re-registration is based on advice or not.

Post RDR, in case there is a change in agent, the reason for the same will determine the eligibility for payment of commission. In case the change of agent is due to agent’s decision like old agent selling his business, the new agent will inherit the terms of holdings and receive trail commission. If the change of agent is due decision by investor, no trial commission is payable to the new agent. Trail commission can be paid to the investor and reinvested.

At present, from the management fee charged by the AMC, a portion is paid to advisor as trail commission, portion paid to platform providers and the balance is retained for fund management. The RDR regulations ban payment of trail commission on new retail advised business. In order to comply with the regulations, the AMC may introduce a new fund class for all the existing funds with lower management fees. The AMC may also retain the existing funds and modify the fee structure. Post RDR, AMCs may reduce the management fees or retain the old structure and pay rebate to either or both platform providers and investors. In case platform providers are continued to be paid from the management fees, the same will required to be disclosed to the investors. In the future, the FSA would like to enforce all platforms to receive fees from investors for services provided.

The actual fee charging will be driven by business rules by mapping appropriate load ref type.

- Process RDR Parameters

This topic provides information on processing RDR Parameters. - Front-end Fees and Trail Commission Payments

This topic explains the Front-end Fees and Trail Commission Payments.

Parent topic: Maintain System Parameters