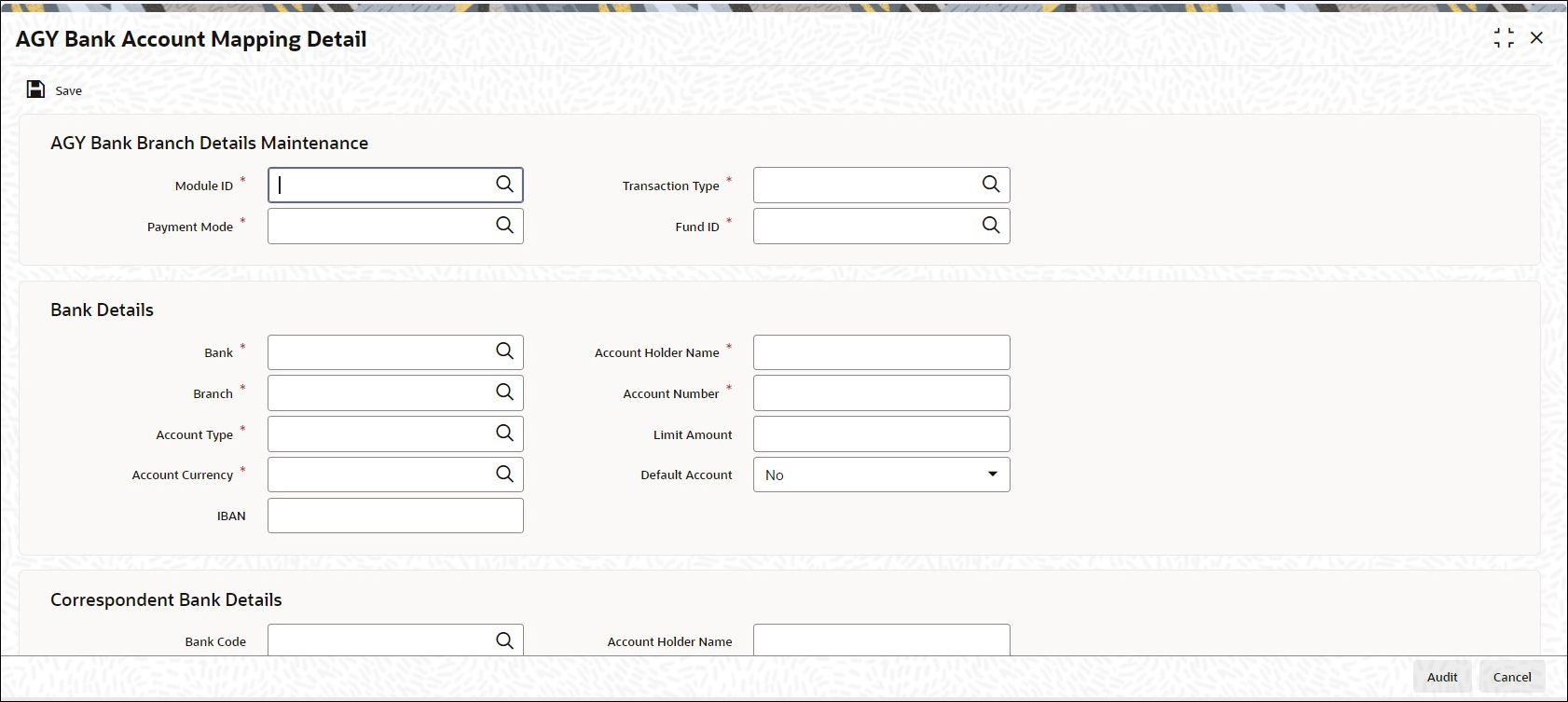

2.42 Process AGY Bank Account Mapping Detail

This topic provides the systematic instructions to designate the collection centers and payout accounts.

Maintain Collection Centers and Payout Accounts

The agency branch maintains accounts in banks that serve as collection centers for receipt of payment for inflow transactions from unit holders. Also, it maintains payout accounts to which payment for outflow transactions would be directed, from where unit holders could cash their payment instruments. Maintenance of collection center accounts and payout accounts is necessary as the default local accounts would not be able to service all unit holders who subscribe to the funds of the AMC.

From each collection center bank and payout bank, the agency branch receives a list of zip codes serviced by the banks. The system uses the maintained accounts and the zip code information while printing payment instruments for outflow transactions or pay-in slips for inflow transactions, to direct them to collection or payout banks that service the unit holders’ zip code.

For instance, if your AMC’s local branch is in London, you would maintain a default collection center and payout account with a London-based bank. However, to service investors of your AMC in Dover, you would need to maintain a collection center and payout account with a bank based in Dover, on a correspondent basis.

For details on how the collection center account or the payout account is reckoned for a transaction, refer topic Printing Checks and Pay-in Slips in the Dividend Maintenance of Oracle® FLEXCUBE Investor Servicing system.

For each agency branch, in Oracle® FLEXCUBE Investor Servicing, you can maintain the appropriate collection center accounts as well as payout accounts to be used. You can assign a default collection center, and a default payout account. You can also maintain other collection center accounts and correspondent payout accounts, to service investors whose zip code is different from any codes serviced by the local default accounts.

Maintain Collection Center Accounts

In the AGY Bank Account Mapping Detail screen, you can maintain collection center accounts for a combination of:

- Agency branch module ID

- Inflow transaction type (either subscription or IPO)

- Payment mode or sub payment mode

- Fund ID

This would mean that you could maintain collection centers for each agency branch, to receive payments through any mode, from unit holders for subscriptions or IPO transactions into each fund.

Maintain Default and Correspondent Payout Accounts

Parent topic: Maintain Reference Information