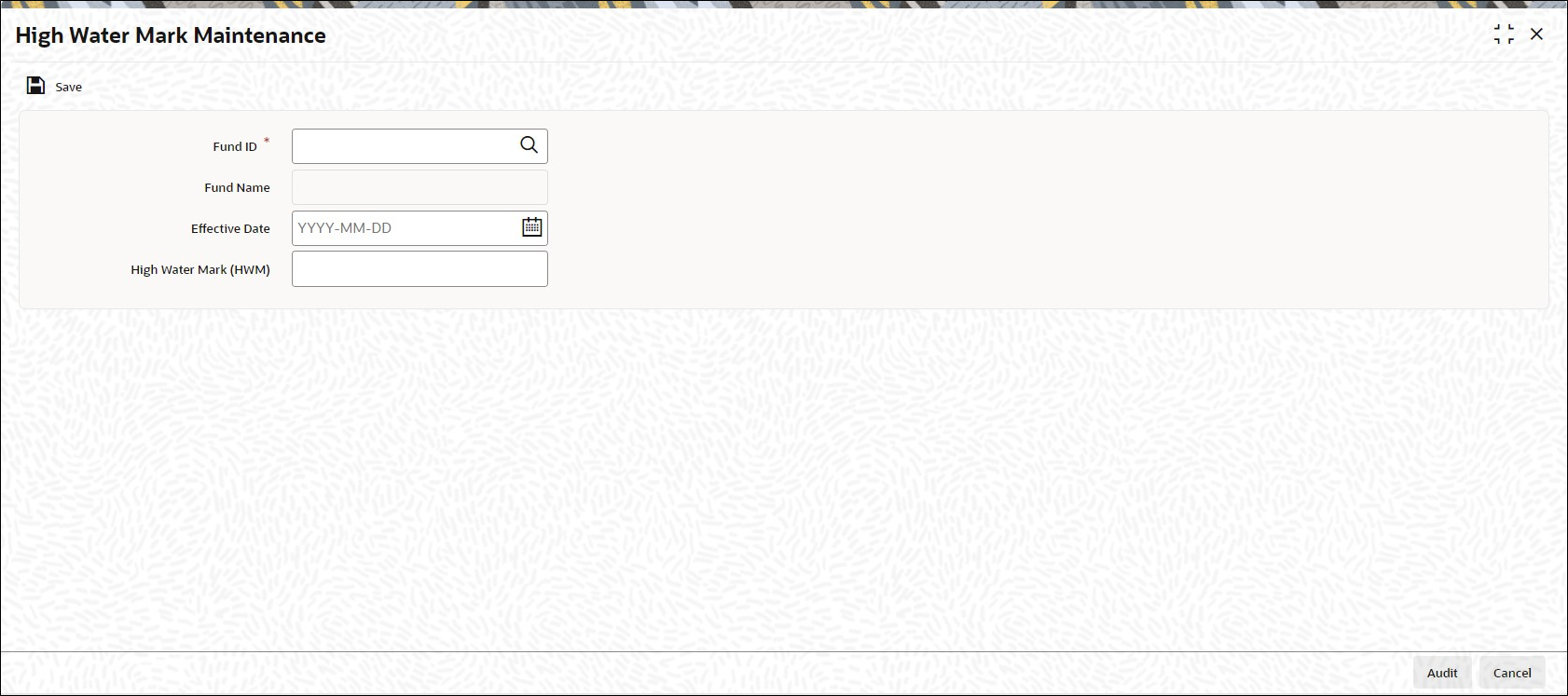

2.60 Process High Water Mark Maintenance

This topic provides the systematic instructions to maintain the details related high water mark for a fund.

The Fund Manager receives performance fee only on increases in Net Asset Value of the fund, in excess of the highest net asset value High Water Mark (HWM) it had previously achieved.

The following example illustrates performance fee calculations for hedge funds having High Water Marks:

Example: Assume that a fund launched at a net asset value of $100 per share, rose to $120 in its first year. In this case performance fee would be payable on the $20 return on each share. If in the next year the share value drops to $110, no performance fee will be paid. If in the third year the share value rises to $130, performance fee will be calculated only on the $10 return from the previous highest value, $120 (high water mark), rather than on the full return from $110 to $130.

Operations on High Water Mark

Parent topic: Maintain Reference Information