2.1.6.1 Basic Information

This topic provides information on basic information tab of general operating rules.

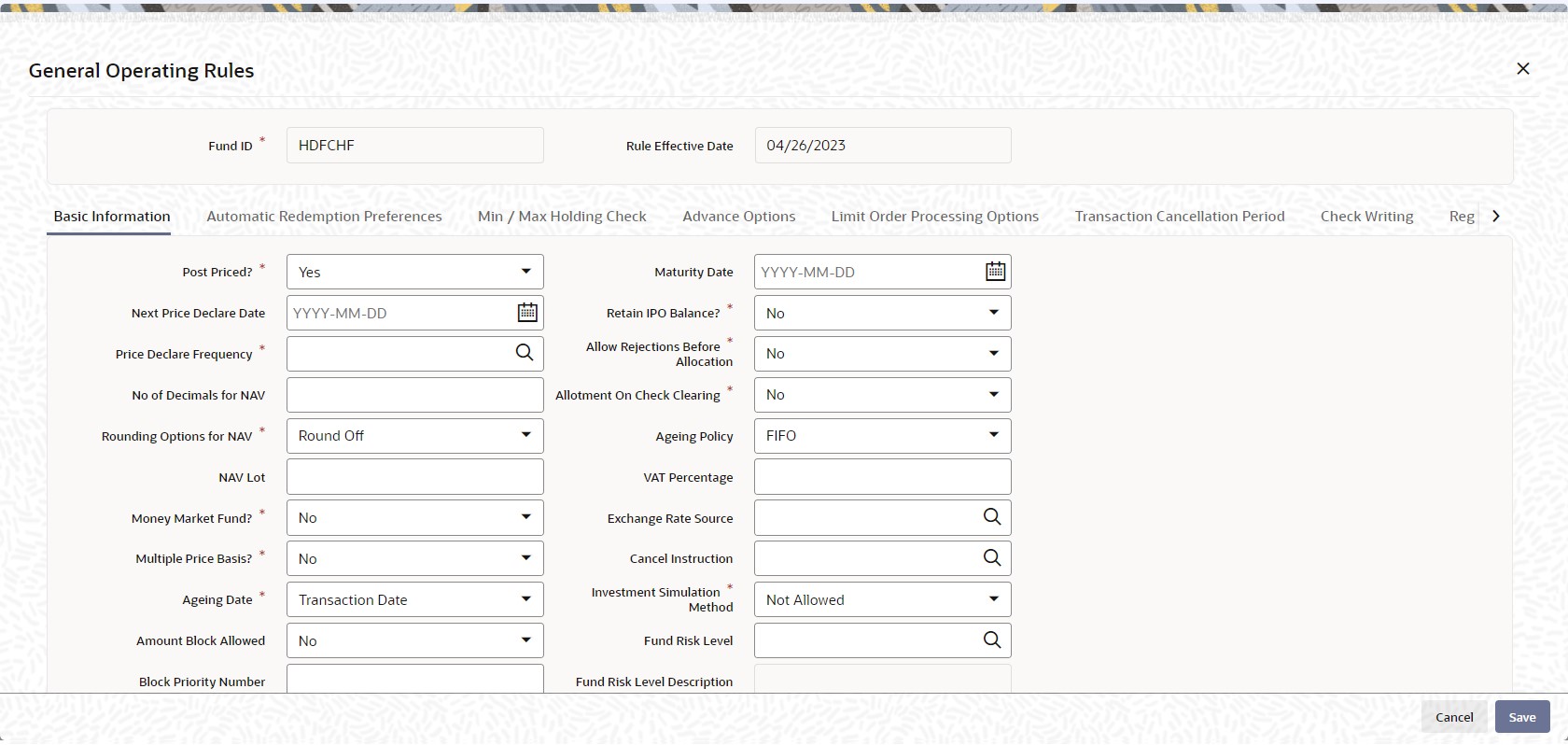

- Click Basic Information tab in General

Operating Rules screen to specify the details.The Basic Information details are displayed in General Operating Rules screen.For more information on fields in the screen, refer the below table.

Table 2-10 General Operating Rules

Field Description Post Priced? Mandatory Select Yes from the drop-down list to indicate that the price for the fund will be announced Post Transactions.

Next Price Declare Date Display Specify the next date upon which the fund price is to be declared. This date must be after the Rule Effective Date of the fund, and the current system date.

Price Declare Frequency Alphanumeric; 1 Character; Mandatory Select a value to specify the frequency with which the price will be announced, from the options provided.

If you are specifying the General Operating Rules for a Post-priced Fund, you must specify this frequency as Daily

No of Decimals for NAV Numeric; 22 Characters; Mandatory Indicate the maximum number of decimals that would be reckoned for rounding precision, for the NAV.

Rounding Options for NAV Mandatory Select the rounding options for the value of the NAV for the selected transaction type, for the fund from the drop-down list. The list displays the following values:

- Round Off - Choose Round Off to indicate normal rounding at the precision decimal

- Round Down - Choose Round Down to indicate truncation of the value at the precision decimal place

- Round Up - Choose Round Up to indicate rounding the value at the precision decimal place to the next higher numeral

Example

Let us suppose that the NAV for the fund on a certain date 02-03-2003 is 10.561234, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 10.562.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 10.561.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 10.561.

NAV Lot Numeric; 6 Characters; Mandatory Specify the NAV lot.

Money Market Fund? Mandatory Select Yes from the drop-down list if the fund is for money market.

Multiple Price Basis? Mandatory You can use this field to indicate whether multiple price bases are allowed for the fund. Select one of the options from the drop-down list:

- Yes

- No

If you select this option, price bases other than the standard bases such as NAV and the Transaction Base Prices are also allowed for the fund.

Ageing Date Mandatory Select the ageing basis for the fund from the drop-down list. The list displays the following values:

- Confirmation Date

- Dealing Date

- Transaction Date

Based on the ageing date specified here, ageing for period based loads are calculated.

By default, the ageing date is the transaction date. You are allowed to specify the ageing basis if you are creating a new fund. You cannot modify this value, post authorization of the fund.

Amount Block Allowed Optional Select Yes from drop-down list to indicate that the amount block is allowed at the fund level.

Note: You will be allowed to enter details in the Amount Block Maintenance screen provided this box is checked for the fund. Moreover, the amount blocked will not be available for redemption.

Block Priority Number Numeric; 4 Characters; Optional The funds are selected in the ascending order of the priority number .When blocking is done at UH/ CIF level across funds. During Unblock, funds will be selected in the reverse priority of Block.

This is field is not optional, if check box Amount Block Allowed is Y, it is mandatory. If check box is N, Block priority will be disabled.

Guaranteed Fund Optional Select the option ‘Yes’ if you want the system to:

- Re-compute the fund prices and adjust the units to the investors based on the re forecasted rates during interim periods and actual rate growth during annual rate declaration time

- Share the residual units of investors who have left before interim/annual rate declaration time among the existing investors.

Dividend Equalization Applicable Optional Select Yes from drop-down list to indicate dividend equalization is applicable.

Funds typically consist of units which have received some benefit in the form of income or dividend distribution and units which have not received any such inflows. The former are G1 units and the latter G2 units.

Since the income and dividend distribution rates are different for units belonging to the G1 and G2 groups, you can apply an equalization rate to equalize the benefit for the G2 units during dividend distribution. This rate will be considered only for the G2 units. To enable application of this rate, select Yes Else you can retain the default value No to carry out normal dividend distribution.

Note: You cannot maintain stock dividend if you select this option.

Allow Fee Calculation in Transaction Currency Mandatory If you select Yes from drop-down list, then the field Fee Calculation Basis will be provided at the transaction level, where you can indicate that load should be computed in terms of the transaction currency in addition to the fund base currency for the fund.

Maturity Date Date Format; Mandatory Specify the maturity date for the fund. This field is only visible and enabled if the fund is close ended.

Retain IPO Balance? Mandatory Select Yes from drop-down list to indicate that the IPO Balance of unit holders must to be stored for later use.

Allow Rejections before Allocation Mandatory Select Yes from drop-down list to indicate that a rejection of a transaction as applicable, for all authorized transactions, prior to allocation. If this is not specified, then all authorized transactions will be taken up for allocation directly.

Allotment on Check Clearing Mandatory Select Yes from drop-down list to indicate that allocation must be done on the check clearing date, using the price prevailing on that date, for transactions in which the payment mode is Check.

Ageing Policy Mandatory Select Yes from the drop-down list if the fund is for money market.

Multiple Price Basis? Optional By default transactions are ordered in a First In First Out (FIFO) basis. If the unit holder has specified as to how transactions are to be ordered, then click on the drop-down menu and select Txn-Receipts. The drop-down list displays the following values:

- FIFO

- IOF/IRRF Optimization

- Txn-Receipts

- FIFO Across Products

- Hierarchy

- USERMNTFIFO

For AMCs, those service distributors, where the distributor books are maintained in the AMC at hierarchical levels mutually decided on through a service level agreement, the option of ageing based on the hierarchy is available.

For funds in which there is a daily declaration of dividend (typically money market funds), and in which redemption transactions would be requested across non-taxable and taxable products, you can select the FIFO Across Products option if required. This feature is available only if your installation has specifically requested for it.

For Funds where IOF and IRRF taxes are applicable on the profits the ageing policy should selected to be IOF/IRRF Optimization.

In case of Certificate Option funds, i.e. if certificate issue is to be based on the choice of the investor at the time of transacting, then the ageing policy can be specified as Hierarchy.

The USERMNTFIFO aging policy will use the Aging sequence maintained in Fund Preference Maintenance (UTDFPMNT) screen during allocation of outflow transaction.

VAT Percentage Numeric; 5 Characters; Optional Specify the VAT percentage.

Exchange Rate Source Alphanumeric; 6 Characters; Optional You can specify the exchange rate source from which the exchange rate for cash dividends must be obtained. By default, the exchange rate source that you specify here is used for cash dividends.

Cancel Instruction Alphanumeric; 2 Characters; Optional You can use this field to indicate whether standing instructions defined in respect of a unit holder, in the fund, are to be cancelled. If you select this option, the standing instructions for the transaction are cancelled, including those that are to be generated after an automatic redemption occurs. Select the Standing Instruction option in this field to indicate cancellation of standing instructions.

If this option has been chosen in the General Operating Rules, the automatic redemption process generates redemption transactions for unit holders in the fund, with the Cancel Instruction option automatically set.

If this option is set for an outflow transaction such as redemption, switch or transfer, the End of Day process cancels all standing instructions (irrespective of the transaction type) for the unit holder in the fund after the outflow transactions involving the unit holder have been allocated for the day.

Investment Simulation Method Mandatory Specify if the investment simulation option would be applicable for the fund or not by selecting an option from the drop down list. The options are:

- Not Allowed

- Historic NAV Based

Refer to the chapter Generating Reports in Volume II of the Agency Branch User Manual for further information regarding investment simulation.

Fund Risk Level Numeric; 3 Characters; Optional Specify fund risk level details. Alternatively, you can select fund risk level from the option list. The list displays all valid fund risk level maintained in the system.

If restricted fund is selected as Yes, then Fund risk level will be defaulted to null. You can modify it.

Note:

You can configure Fund risk level and investor risk level at param maintenance for FUN DRISKPROFILE and INVRISKPROFILE param codes respectively. The system will validate the fund risk for an investor in Investor Fund Risk Rating Mapping screen.

Fund Risk Level Description Display The system displays the description for the selected fund risk level details.

Parent topic: General Operating Rules