2.1.21 Hedge Fund

This topic provides information on hedge fund tab.

You can specify the fund rules associated with hedge funds in Hedge Fund Processing Rules screen.

- Click Hedge Fund button in Fund Rules Detail screen.The Hedge Fund Details screen is displayed.

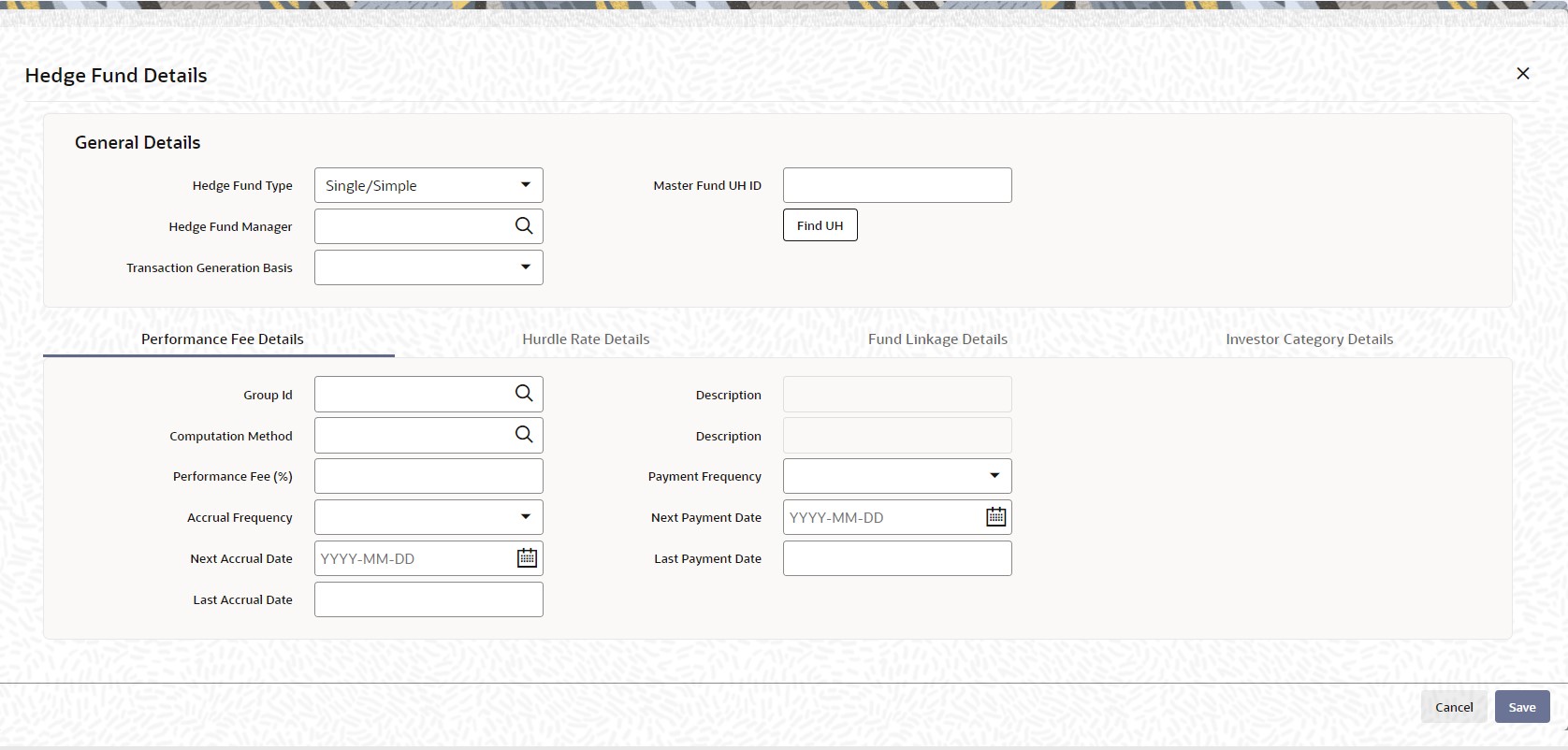

Figure 2-39 Hedge Fund Details - Performance Fee Details

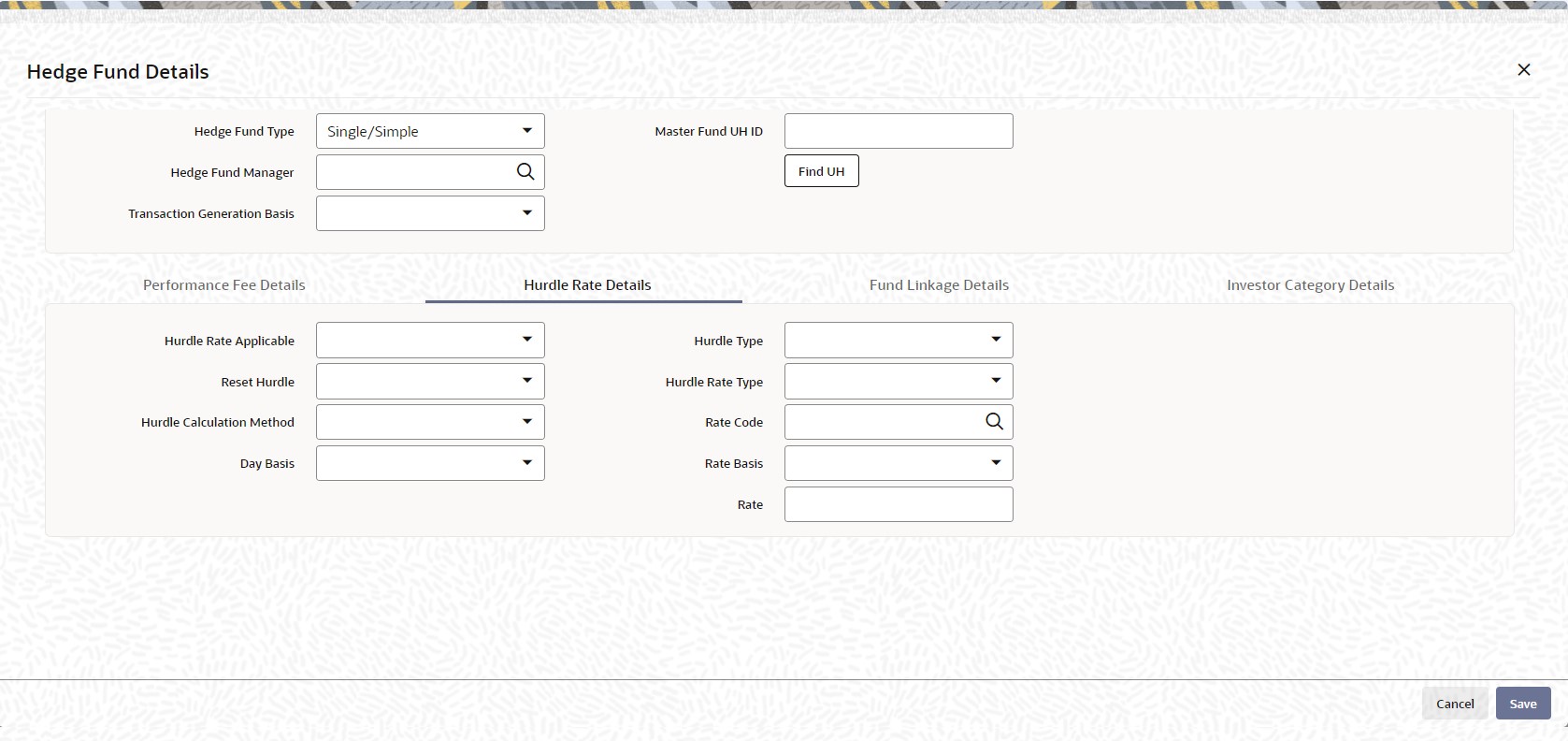

Figure 2-40 Hedge Fund Details - Hurdle Rate Details

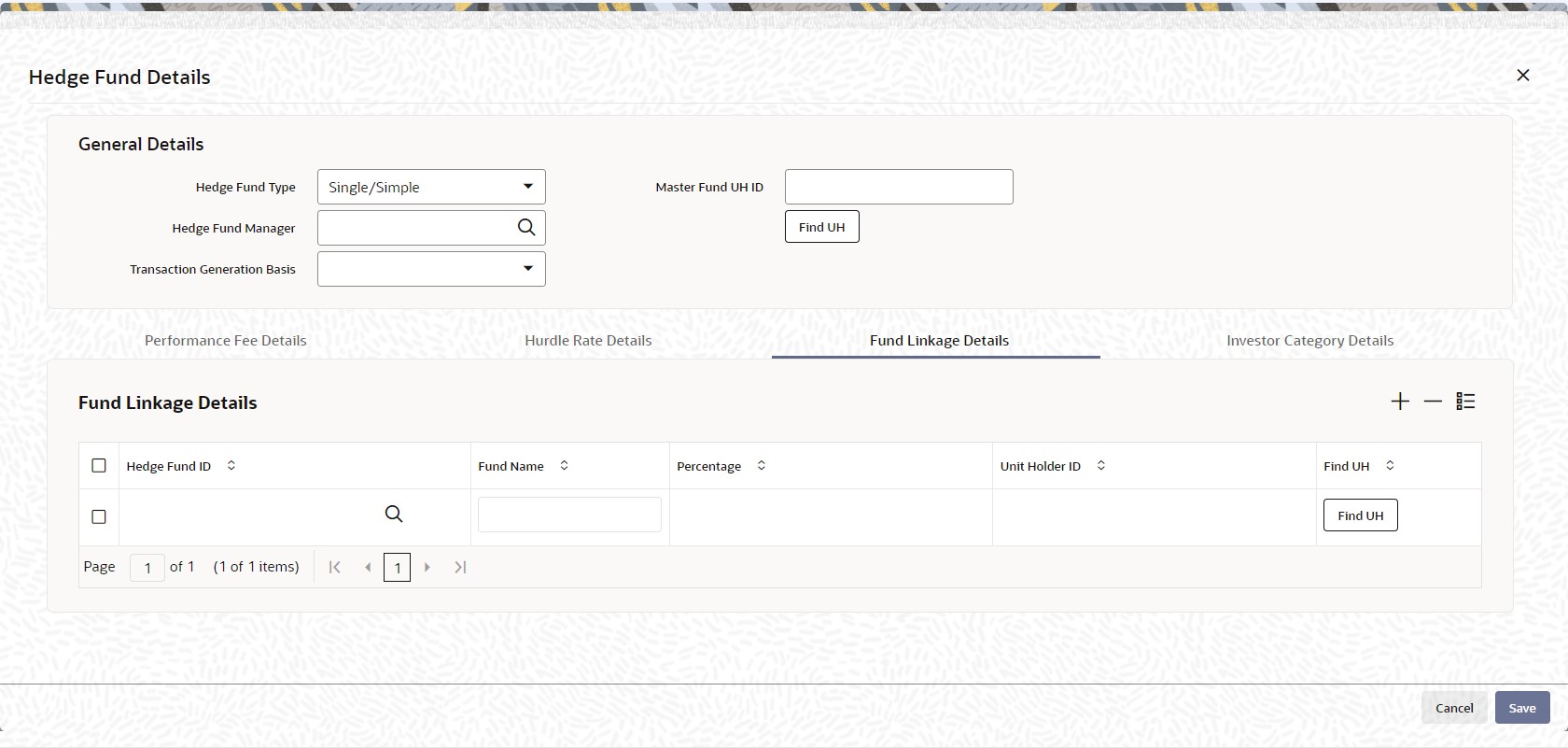

Figure 2-41 Hedge Fund Details - Fund Linkage Details

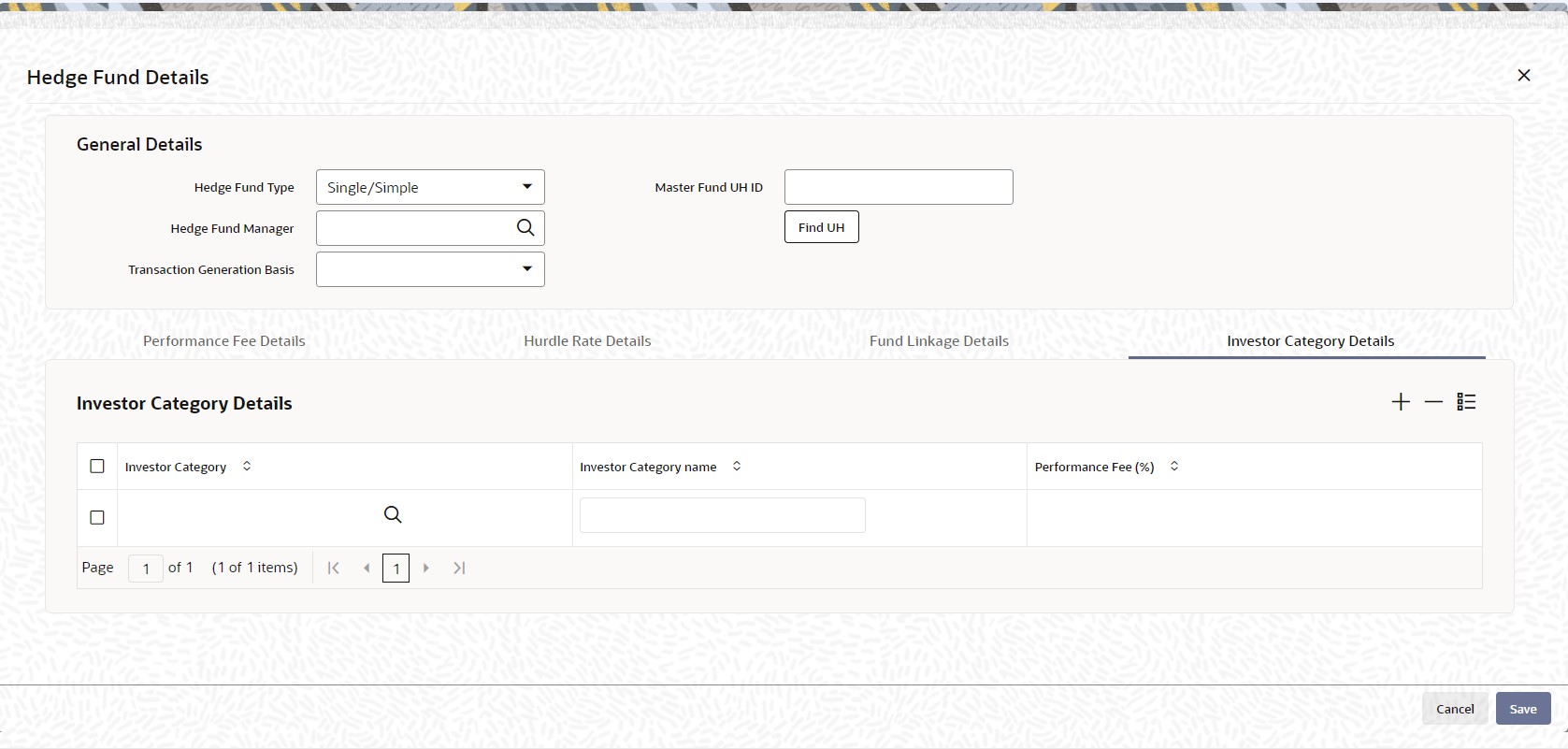

Figure 2-42 Hedge Fund Details - Investor Category Funds

You can click this button only if the related fund has been specified as a hedge fund.

- On Hedge Fund Details screen, specify the fields.For more information on fields in the screen, refer the below table.

Table 2-77 Hedge Fund Details - General Details

Field Description Hedge Fund Type Optional Select the type of the hedge fund from the drop-down list provided. The following options are available:

- Single/Simple - simple hedge fund is a regular fund with normal processing rules

- Master - master-feeder fund structure accepts assets from both foreign and domestic investors in the most tax and trading efficient manner possible. For master funds, you can maintain feeder funds which will be of type Single/Simple.

- Fund of Hedge Funds - fund of hedge fund invests in hedge funds rather than investing in individual securities. You can capture the details of the underlying funds in Fund Linkage Details section.

- Side Pockets - side pocket is a special type of account used in hedge funds to separate illiquid assets from other more liquid investments.

- Lead Series – the initial fund series that is created in case of series method of performance fee calculation.

- Follow Up Series – the subsequent fund series created for the following accounting periods.

- Capital Call – for a capital call fund, hedge fund should be set as Yes and hedge fund type should be set as Capital Call.

- Pre-Settled Trade – for a pre-settled trade fund, hedge fund should be set as Yes and hedge fund type should be set as Pre-Settled Trade. The client country HEDGEFUND should be enabled and pre-settled trade will be applicable only on specific priced funds.

Note:- You can not perform any transactions if the hedge fund is of type Side Pocket

- Lead Series and Follow-up Series are applicable only for Series type of performance fee computation.

For more details on various methods of performance fee computation, refer the section titles Computing Performance Fee for Hedge Funds topic in this user manual.

For more details on different types of hedge funds, refer Overview topic in this user manual.

Hedge Fund Manager Alphanumeric; 12 Characters; Optional Specify the name of the hedge fund manager or select the fund manager from the option list provided. All entities maintained as fund managers in Entity maintenance screen are displayed in the list.

Transaction Generation Basis Optional Select the criteria based on which the transaction has to be generated. The following options are available in the drop-down list:

- Net

- Non-Net

- Non-Net Transaction

Note: This is applicable for master funds and fund of funds.

Master Fund UH ID Alphanumeric; 12 Characters; Optional Specify the unit holder Id for which the master fund transaction is generated. You can also query for unit holder ID by clicking Find UH button.

Note: This is applicable only for master funds.

Error Messages for Hedge Fund TypeTable 2-78 Error Messages for Hedge Fund Type

Validation Type Error code Error Message When user tries to save Pre-Settled Trade fund with values given in any of the hedge fund related fields, system will prompt the error. E E-INVALIDPSHFDET Hedge Funds Fields should not be entered for Hedge Fund Type Pre-Settled Trade. When user tries to enter Hedge Fund Type field as Pre-Settled Trade without marking the fund as Hedge Fund. System will raise an error. E E-INVPSHEDGEFND Hedge Fund should be enabled for Hedge Fund type Pre-Settled Trade When user tries to save Pre-Settled Trade Fund without entering the specific Priced funds. E E-SPFPDTMAN Specific Fund Price details are mandatory for Pre-Settled Funds. - Specify the details in the Performance Fee

Details in the Hedge Fund Details screen.

Performance fee is a periodic fee collected by the fund manager from the investors of the fund, calculated as a percentage of the fund’s profit.

In this section you can specify your preferences related to performance fee calculation. The values you specify here are not applicable for side pocket type of hedge funds.

For more information on fields in the screen, refer the below table.Table 2-79 Hedge Fund Details - Performance Fee Details

Field Description Group ID Alphanumeric; 10 Characters; Optional Specify the rule group to be used for performance fee calculation or select the same from the option list provided. All valid rule groups maintained in the system are displayed in the option list.

Description Display The description associated with the selected rule group gets displayed here.

Computation Method Alphanumeric; 4 Characters; Optional Specify the computation method to be used for performance fee calculation or select the same from the option list provided. The following options are available in the option list:

- ECCL - Equalization Credit/Contingent Liquidation

- ECED - Equalization Credit/Equalization Debit

- FR - Forced Redemption

- SER - Series Method

Description Display The description associated with the computation method selected gets displayed here.

Performance Fee % Numeric; 22 Characters; Optional Specify the percentage of the fund value that needs to be given as the performance fee.

Payment Frequency Optional Select the frequency of payment of performance fee from the options provided in the drop down list:

- Monthly

- Quarterly

- Half-yearly

- Yearly

Accrual Frequency Optional Select the frequency of accrual of performance fee from the options provided in the drop down list:

- Daily

- Weekly

- Monthly

- Quarterly

- Yearly

Next Accrual Date Date Format; Optional Specify the date on which the accrual of the performance fee should happen next. You need to specify this value only once during initial fund setup.

For subsequent accruals, this date gets displayed automatically based on the accrual frequency.

Next Payment Date Date Format; Optional Specify the date on which the payment of the performance fee should happen next. You need to specify this value only once during initial fund setup.

For subsequent payments, this date gets displayed automatically based on the accrual frequency.

Last Accrual Date Display The system automatically displays the date on which performance fee accrual happened last.

Last Payment Date Display The system automatically displays the date on which performance fee was paid last.

- Specify the details in the Hurdle Rate Details

in the Hedge Fund Details screen.

Hurdle rate is the minimum fund returns necessary for a hedge fund manager to start collecting performance fees. The hurdle rate is usually tied to a benchmark rate such as LIBOR.

In this section you can specify details related to hurdle rates used for performance fee calculation. The values you specify here are not applicable for side pocket type of hedge funds.

For more information on fields in the screen, refer the below table.Table 2-80 Hedge Fund Details - Hurdle Rate Details

Field Description Hurdle Rate Applicable Optional Select the option to indicate whether hurdle rate is applicable for performance fee calculation. Select Yes from drop-down list to indicate that hurdle rate needs to be considered for performance fee calculation and No to indicate otherwise.

Hurdle Type Optional Select the type of hurdle from the options provided in the drop-down list. The following options are available:

- Cumulative

- Non-cumulative

Reset Hurdle Optional Select Yes from the drop-down list to indicate that the hurdle rate needs to be reset and No to indicate otherwise. Hurdle rate gets reset if the fund price at the end of the performance fee calculation fee period is greater than the total of High Water Mark and hurdle rate.

Note: This is applicable only for Cumulative type of hurdles.

Hurdle Rate Type Optional Select the type of hurdle rate from the options provided in the drop-down list. The following options are available:

- Fixed

- Variable

- Semi variable

Hurdle Calculation Method Optional Select the method to be used for calculating the hurdle rate. The following options are available in the drop-down list:

- Simple

- Compounded

Rate Code Alphanumeric; 10 Characters; Optional Specify the interest rate code to be used for hurdle rate calculation. You can also select the rate code from the option list provided.

Note:

Day Basis Optional Select the basis on which the number of days is considered for hurdle rate calculation. The following options are available in the drop-down list:

- Actual

- 360

- 365

Rate Basis Optional Select the basis on which the hurdle rate is calculated from the following options available in the drop-down list:

- Percentage (%) - applicable for Variable and Semi-variable hurdle rate types

- Basis Points – applicable only for Semi-variable hurdle rate type

Rate Numeric; 22 Characters; Optional Specify the value associated with the rate code that is considered for computing the hurdle rate. If you have selected Basis Points as rate basis, then a percentage value of this basis point is considered for computing the hurdle rate.

- Specify the details in the Fund Linkage Details

in the Hedge Fund Details screen.For more information on fields in the screen, refer the below table.

Table 2-81 Hedge Fund Details - Fund Linkage Details Tab

Field Description Hedge Fund ID Alphanumeric; 6 Characters; Mandatory Specify the fund ID of the linked fund or select the linked fund ID from the option list provided. For master funds, this list will display the list of feeder funds and for fund of funds this list will display the list of underlying funds.

Note: In GTA setup, field Hedge Fund ID can have funds selected only within same segment.

If the hedge fund type is specified as Follow-up Series, you can specify the fund ID of the related Lead Fund here.

Note: For side pocket funds the main fund name is captured here with the percentage specified as blank.

Fund Name Display The name of the selected fund gets displayed here.

Percentage Numeric;22 Characters; Optional Specify the percentage to be used for generating the underlying transaction.

Note: For fund of funds the sum of percentage of investment in each fund should not be greater than 100.

Unit Holder ID Alphanumeric; 12 Characters; Optional Specify the unit holder ID for generating the underlying transaction. You can also query for unit holder ID by clicking Find UH button.

Note: Unit Holder ID is applicable only for underlying funds in case of Fund.

- Specify the details in the Investor Category

Details in the Hedge Fund Details screen.

For more information on fields in the screen, refer the below table.

Table 2-82 Hedge Fund Details - Investor Category Details

Field Description Investor Category Alphanumeric; 12 Characters; Optional Specify the investor category of the unit holder or select the category from the option list provided. All unit holder categories existing in the system get displayed in the option list.

Investor Category Name Display The name associated with the investor category selected gets displayed here.

Performance Fee % Numeric; 22 Characters; Optional Specify the percentage of performance fee to be paid for the selected investor category. This value overrides the performance fee percentage specified generically.

Parent topic: Fund Rule