4.5 Load Group Characteristics Detail

This topic provides the instructions to invoke group characteristics detail screen details.

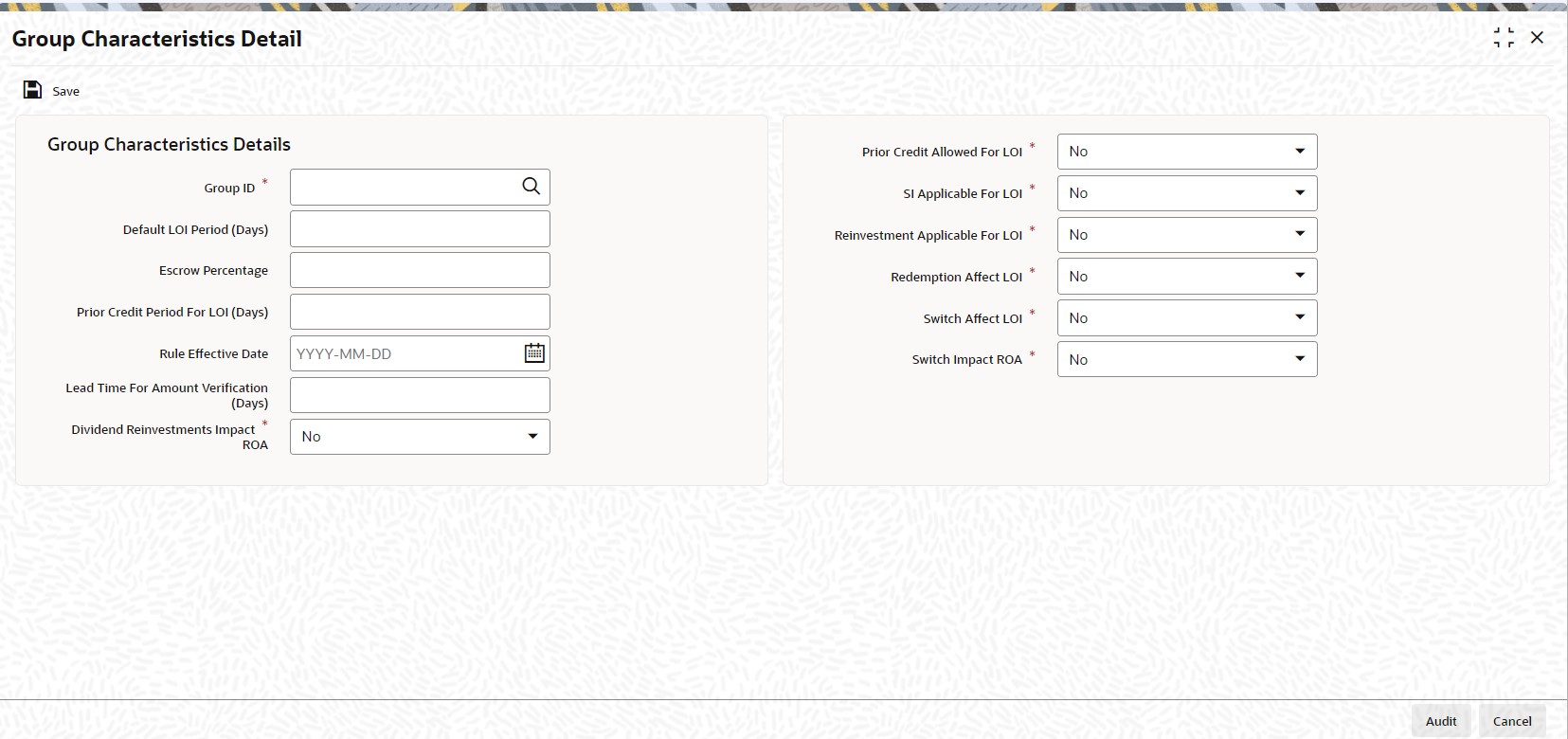

To specify the load and transaction processing characteristics that would apply to transactions in funds in a load group, use the Group Characteristics Detail screen.

- On Home screen, type UTDGRPCH

in the text box and click

Next.The Group Characteristics Detail screen is displayed.

- Select New from the Actions menu in the Application tool bar or click New icon to enter the details of the group that you are defining.

- On Group Characteristics Detail screen, specify the

fields.

You can specify any of the following loading parameters that would be applicable for all funds in the group:

- The date from which the characteristics are effective, in the Rule Effective Date field.

- The default period (in days) for the Letter of Intent facility availability. Specify this in the Default LOI Period field.

- The threshold balance percentage of the holdings that must be maintained in an LOI investor account. Redemption for such investors would not be allowed if the holdings in any funds of the load group falls below this percentage as a result of the redemption. This percentage is known as the escrow percentage. Specify this in the Escrow Percentage field.

- For all funds in the group, the applicability of a prior credit period for LOI fulfilment. Indicate this in the Prior Credit Allow field. If allowed, also specify the prior credit period applicable (by default) in the Prior Credit Period field.

- The applicability of redemption and switch transactions affecting the LOI used up amount, for all funds in the group, in the Redemption Affect LOI and Switch Affect LOI fields.

- The applicability of standing instructions for investors investing in the group, in the SI Applicable field.

- The applicability of reinvestments for investors investing in the group, in the Reinvestment Applicable field.

- The lead time, if any, for the verification of amounts for LOI or ROA applicability, that is to apply to all funds in the group. Specify this in the Lead Time for Amount Verification field.

For a fuller discussion of what Letters of Intent are and how an investor can opt to avail of the same, refer the Managing Investor Accounts topics.

For more information on fields in the screen, refer the below table.

Table 4-6 Group Characteristics Detail

Field Description Group ID Alphanumeric; 6 Characters; Mandatory From the list, select the group of funds for which you are setting up the common load and transaction processing characteristics for transactions.

Default LOI Period (Days) Numeric; 3 Characters; Mandatory Specify the default period (in days) for the Letter of Intent facility availability that would apply to all funds in the group.

Escrow Percentage Numeric; 5 Characters; Mandatory Specify the escrow percentage that is to apply to LOI investors who transact in the funds of the group.

For LOI investors, the AMC stipulates a certain threshold percentage of holdings that must always be maintained. A redemption transaction due to which the holdings balance in the funds of the group falls below this percentage, will not be accepted. This percentage is called an escrow percentage.

Prior Credit Period for LOI (Days) Numeric; 3 Characters; Mandatory only if prior credit is allowed. If prior credit is permitted to investors for fulfillment of LOI in any of the funds in the group, specify the duration (in days) of the period.

Rule Effective Date Date Format; Mandatory Specify the date on and following which the load group characteristics you are specifying for the group will be effective.

Lead Time for Amount Verification (Days) Numeric; 12 Characters; Mandatory Specify the lead time applicable, if any, for the verification of amounts for LOI or ROA applicability that is to apply to all funds in the group.

Dividend Reinvestments Impact ROA Mandatory If you choose Yes, then the units increased due to dividend reinvestment will also be considered for ROA. The system will consider the Reinvestment Units in terms accumulated units.

Prior Credit Allowed For LOI Mandatory Select Yes from drop-down list to indicate that a prior credit period is permitted for the fulfilment of LOI amount, for LOI investors.

If you select No, none of the transactions of an investor earlier than the transaction date, will be reckoned to affect the LOI used up amount.

SI Applicable for LOI Mandatory Select Yes from drop-down list to indicate that standing instructions are permitted to be accepted for investors transacting in the load group.

Reinvestment Applicable for LOI Mandatory Select Yes from drop-down list to indicate that reinvestment instructions are permitted to be processed for investors transacting in the load group.

Redemption Affect LOI Mandatory Select Yes from drop-down list to indicate that redemption transactions can be taken into account for reducing the LOI amount for LOI investors that invest in the load group.

Switch Affect LOI Mandatory Select Yes from drop-down list to indicate that switch transactions can be taken into account for reducing the LOI amount for LOI investors that invest in the load group.

Switch Impact ROA Mandatory If you choose Yes, the system will take into account the fluctuation of units due to Switch in while computing Accumulated Units.

Parent topic: Load Groups Setting