2.1.7.5 Pricing

This topic provides information on pricing tab of transaction processing rules screen.

In this section, you can set up the pricing details, such as the basis of price definition, the base price factor, the number of decimals for the price, the price lag and the back dating limits.

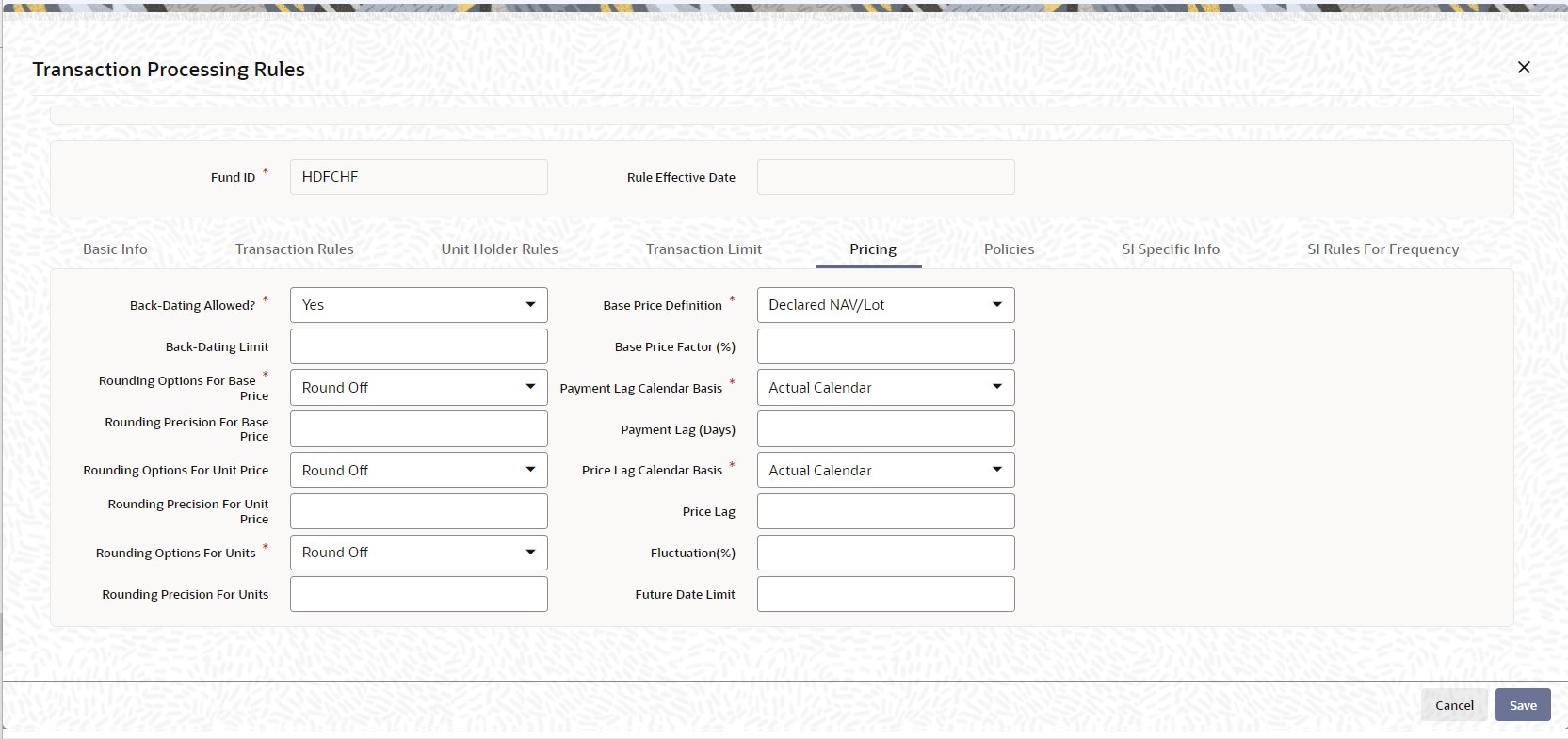

- Click Transaction Processing Rules, click Pricing tab in screen to specify the details.The Pricing screen is displayed.

- On Pricing tab, specify the fields.

For more information on fields in the screen, refer the below table.

Table 2-33 Transaction Processing Rules - Regulations

Field Description Back-Dating Allowed? Mandatory Select Yes in this field to specify that backdating should be allowed for this fund. This means that on any given date, for this transaction type, the system will allow the user to enter transactions dated earlier to the current date.

Back Dating Limit Numeric; 22 Characters; Mandatory Enter a value to specify the number of days that one can back date. This is applicable only if Allow Back Dating is True. This has to be later than the transaction start date. Fund Price as effective on that date will be taken into account during allocation.

Rounding Options for Base Price Mandatory Select whether the base price value must be rounded off or truncated from the drop-down list, for the selected transaction type, for the fund. The list displays the following values:

- Round Off

- Truncate

Rounding Precision for Base Price Numeric; 22 Characters; Mandatory Indicate the maximum number of decimals that would be reckoned for rounding precision, for the transaction base price.

Rounding Options for Unit Price Optional Select the rounding options for the value of the unit price for the selected transaction type from the drop-down list. The list displays the following values:

- Round Off - Choose Round Off to indicate normal rounding at the precision decimal

- Round Down - Choose Round Down to indicate truncation of the value at the precision decimal place

- Round Up - Choose Round Up to indicate rounding the value at the precision decimal place to the next higher numeral

Example

Let us suppose that the unit price computed for a subscription transaction is 10.561234, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 10.562.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 10.561.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 10.561.

Rounding Precision for Unit Price Numeric; 22 Characters; Optional Indicate the maximum number of decimals that would be reckoned for rounding precision, for the unit price for the selected transaction type.

Rounding Options for Units Mandatory Select the rounding options for the computation of the units allotted in respect of a transaction, for the selected transaction type from the drop-down list. The list displays the following values:

- Round Off - Choose Round Off to indicate normal rounding at the precision decimal.

- Round Down - Choose Round Down to indicate truncation of the value at the precision decimal place.

- Round Up - Choose Round Up to indicate rounding the value at the precision decimal place to the next higher numeral.

The rounding options specified for the fund in the Shares Characteristics profile is displayed here by default, and you can alter this specification if necessary. The rounding option specified in this field will be deemed as the final specification for the fund and transaction type.

Rounding Precision for Units Numeric; 22 Characters; Optional Specify the decimal value or negative value for the units and the units would be reckoned for rounding precision.

Base Price Definition Mandatory Select the Base Price definition for the transaction, from the drop-down list. The list displays the following values:

- Par Value

- Declared NAV/Lot

The Unit Price will be calculated based on this price and loads defined for this transaction.

Base Price Factor (%) Numeric; 7 Characters; Mandatory Enter a value to specify the Percentage of Base Price value that is defined above. This percentage will be applied to the price arrived from the above calculations to arrive at the Base Price for this transaction type for the fund.

Payment Lag Calendar Basis Mandatory Select whether the payment lag days should be considered based on the holiday calendar for the fund, the actual calendar, the System calendar or the payment currency calendar from the drop-down list. The list displays the following values:

- Actual Calendar

- Currency Calendar

- System Calendar

- Fund Calendar

Payment Lag (Days) Numeric; 22 Characters; Optional Specify a value to indicate the number of days by which the settlement for a transaction would be lagged or deferred, after it has been allotted and confirmed.

In the case of redemption transactions, to arrive at the actual date of redemption settlement, both the confirmation lag (if specified) and the payment lag (if specified here) are taken into consideration. For instance, if the redemption transaction was allocated on 15th January and both the confirmation lag and payment lag were specified as 2, then the actual redemption payout to the unit holder would be effected on 19th January (15 + 2+ 2), provided it is not a holiday in the system, and provided there are no intervening holidays.

Price Lag Calendar Basis Mandatory Select whether the price lag days should be considered based on the holiday calendar for the fund, the actual calendar or the System calendar from the drop-down list. The list displays the following values:

- Actual Calendar

- System Calendar

- Fund Calendar

Price Lag Numeric; 22 Characters; Mandatory If you require the price applied for transactions of the selected type in the fund to be the prevalent price as on a date earlier than the transaction date (for cash-based transactions) or the clearing date (for instrument-based transactions), you can specify the number of lag days in this field.

The number of days you specify is considered based on the Price Lag Calendar Basis specified.

For instance, if you specify a price lag of 2, and the lag is based on the fund calendar, and the transaction date for a cash-based transaction is 12th December 2003, the price as of 10th December is used for allocation, provided both 11th and 10th December is working days for the fund. If the lag is based on the actual calendar, the price as of 10th December is used.

Fluctuation (%) Numeric; 22 Characters; Optional You can specify the fluctuation allowable in the base price for the transaction type, for the fund. When prices are entered for the transaction type for the fund, for the day, the system validates whether the fluctuation is within the allowable limit specified in this field.

Future Date Limit Numeric; 22 Characters; Optional Indicate the number of days (in terms of fund calendar days) up to which the future dating will be allowed. The transaction date should be within the future dating limit.

Parent topic: Transaction Processing Rules Button