3.33.2 Process Corporate Actions Maintenance

This topic provides the instructions to invoke corporate actions maintenance screen details.

- On Home screen, type UTDCOACT

in the text box and click

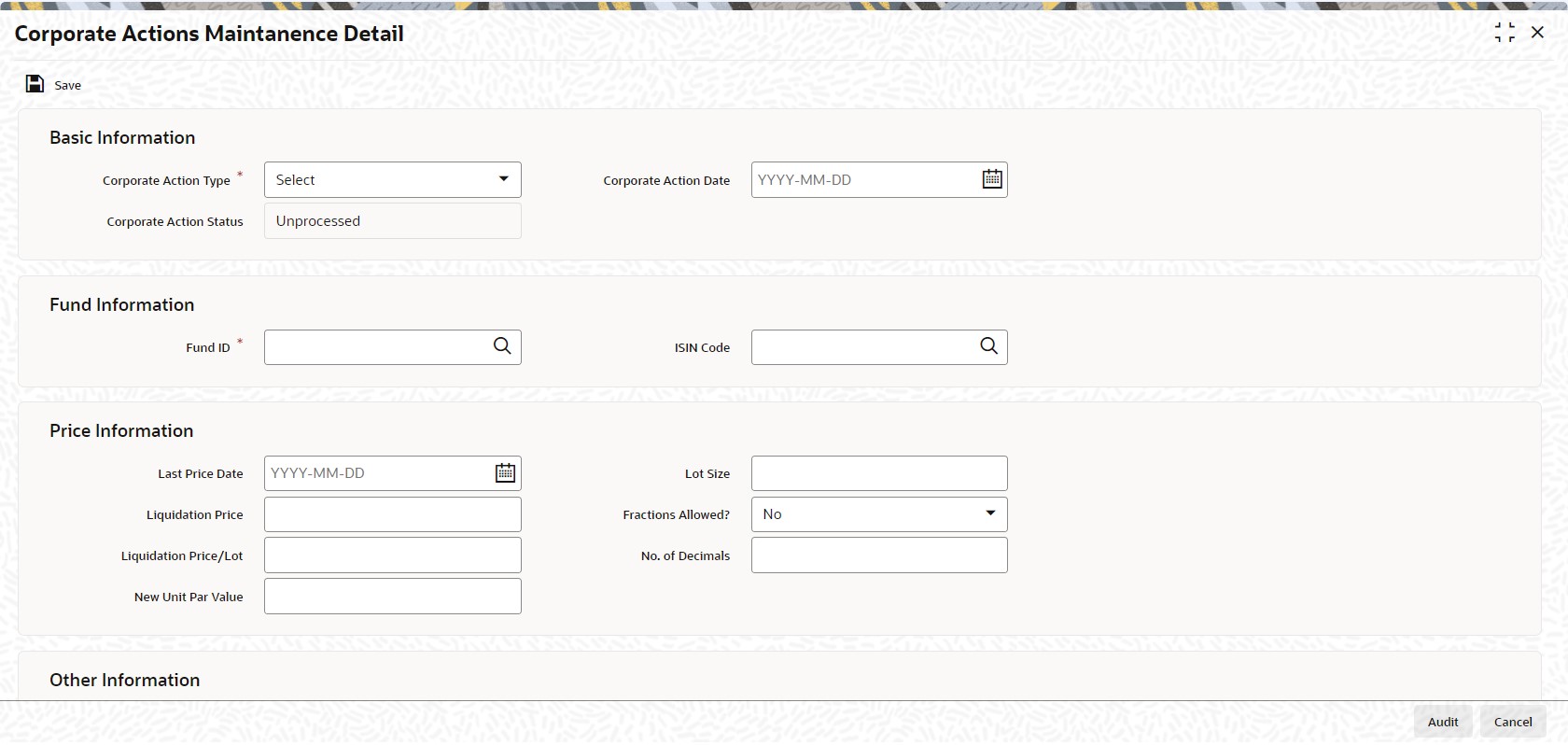

Next.The Corporate Actions Maintenance Detail screen is displayed.

Figure 3-41 Corporate Actions Maintenance Detail

- Select New from the Actions menu in the Application tool bar or click New icon to enter the details of the relevant corporate action.

- On Corporate Actions Maintenance Detail screen, specify

the fields.

For more information on fields in the screen, refer the below table.

Table 3-54 Corporate Actions Maintenance Detail

Field Description Corporate Action Type Mandatory From the drop-down list, select the type of corporate action for which you are maintaining the processing parameters, in this screen. The list displays the following options are as follow:

- Capital Payout

- Liquidation

- Merger

- Reverse Split

- Split

- Side Pocket Creation

- Side Pocket Merger

- Series Fund Merger

Corporation Action Date Date Format; Mandatory Specify the date on which the corporate action falls due for processing. This must be the same as the current date, or a future date. The implications for the fund in each case are as follows:

- Liquidation - The fund would cease to exist after the corporate action is processed on this date.

- Split and Reverse Split - The par value of the fund would change subsequent to processing of the corporate action on this date.

- Merger -The funds that are being merged would cease to exist and the new fund would become effective, after the corporate action is processed on this date

Corporate Action Status Display The status of the corporate action is displayed in this field.

When you enter a new record, it is marked with the Active or Unprocessed status. After authorization, the corporate action record can be cancelled through an amendment, before it is processed. In such a case, it acquires the Cancelled status.

After the corporate action has been processed, it acquires the Processed status.

Fund Information Section

Table 3-55 Corporate Actions Maintenance Detail

Field Description Fund ID Alphanumeric; 6 Characters; Mandatory Select the Fund for which you are maintaining a corporate action, from the drop-down list. This list contains the names of all the authorized funds in the system.

When you select the Fund, the Fund Base Currency is picked up from the Fund Demographics profile for the selected Fund and displayed in the Fund Base Currency field.

In the case of liquidation, specify the ID of the fund being liquidated. For splits and reverse splits, specify the ID of the child fund. In the case of mergers, you must specify the ID of the resultant fund in this field.

In GTA setup, for Split/Reverse Split/Merger/Side Pocket Creation/Side Pocket Merger and Series fund merger, field Fund ID can have funds selected within same segment.

ISIN Code Alphanumeric; 12 Characters; Mandatory Select the ISIN Code of the fund for which you are maintaining a corporate action, from the options provided. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field and vice versa.

In the case of liquidation, specify the ISIN Code of the fund being liquidated. For splits and reverse splits, specify the ISIN Code of the child fund. In the case of mergers, you must specify the ISIN Code of the resultant fund in this field.

Price Information

Table 3-56 Corporate Actions Maintenance Detail

Field Description Last Price Date Date Format; Optional Specify the last pricing date which should be greater than or equal to the current system date.

Liquidation Price Numeric; 9 Characters; Optional For liquidation, specify the price at which the selected fund is to be liquidated. It is the value at which units are redeemed for liquidation.

Liquidation Price/Lot Numeric; 17 Characters; Optional Specify the liquidation price per lot based on the liquidation price and the lot size you specify.

New Unit Par Value Numeric; 17 Characters; Optional Specify the new par value for units in the new or existing (resultant) fund, to be applicable after the corporate action has been processed.

For Split and Reverse Split actions, the System computes the new par value, and displays the same in this field. You can change this computed value and specify the desired value, if required.

Lot Size Numeric; 6 Characters; Optional Specify the lots for liquidation. By default, the lot is considered to be one. You can alter this and specify the applicable lot size. The liquidation price per lot is computed by the system based on the liquidation price and the lot size you specify.

Fractions Allowed? Optional In this field, you can specify if fractional balances (as a result of processing the corporate action) are allowable, for the fund. Select Yes from drop-down list to indicate that fractional balances are allowed. Select No from drop-down list to indicate that fractional balances are not allowed.

If not allowed, the resulting fractions are redeemed and the proceeds paid out to the unit holders.

No. of Decimals Numeric; 2 Characters; Optional By default, the number of decimals allowed is zero. If you indicate that fractional balances are allowed, the number of decimals specified for the fund in the Corporate Actions fund rule profile, are applicable.

Other Information

Table 3-57 Corporate Actions Maintenance Detail

Field Description Holiday Rule Optional Select whether the corporate action date must be moved forward (after) or backward (prior) in case it falls on a system, fund or AMC holiday. The drop-down list displays the following values:

- Prior

- After

Payment Lag (Days) Numeric; 1 Characters; Optional Specify the payment lag to be applicable for liquidation.

Threshold Amount Numeric; 30 Characters; Mandatory Specify the threshold amount for processing of the corporate action.

Auto Initiation? Mandatory You can use this field to indicate whether the corporate action must be executed manually or automatically. Select Yes from drop-down list to indicate automatic execution; leave it unchecked to indicate manual execution.

If automatic execution is indicated, the Beginning of Day processes execute the corporate action on the corporate action date. If manual execution is indicated, then you can manually trigger the execution on the corporate action date, through the Corporate Action Processing screen.

Book Closing From Date Date Format; Optional Specify the book closing dates, between which transactions into the fund are suspended, for processing the corporate action. The corporate action date must fall within the book-closing period.

Book Closing To Date Date Format; Optional Specify the book closing dates, between which transactions into the fund are suspended, for processing the corporate action. The corporate action date must fall within the book-closing period.

Exchange Rate Source Alphanumeric; 6 Characters; Mandatory Specify the exchange rate source from which the exchange rate would be derived for processing the corporate action, for conversion from fund base currency to unit holder preferred currency.

By default, the first source entry in the list is deemed to be the exchange rate source. You can change this and specify the requisite source by choosing from the list.

Exchange rate defaulting logic will default from default setup where user has overridden or given a source, system will give preference to overridden value.

Exchange Rate Date Date Format; Mandatory Specify the date, the exchange rate prevalent on which, would be used for processing the corporate action, for conversion from fund base currency to unit holder preferred currency.

By default, it is considered to be the same as the corporate action date. You can change this and specify the requisite date.

Units for Corporate Action Optional Select the Units for Corporate Action from the drop-down list. The list displays the following values:

- Allocation Date(ALL)

- Allocation Date(Confirmed)

- Price Date(ALL)

- Transaction Date(ALL)

- Transaction Date(Confirmed)

Payment Currency Optional Select whether the capital payout amount is paid in the default currency of the unit holders or the base currency of the fund in respect of which the payout is being processed from the drop\u0002down list. The list displays the following values:

- Fund Base Currency

- Unit Holder Preferred Currency

Capital Payout Rate (%) Numeric; 22 Characters; Optional For capital payouts, specify the percentage of units in the fund that are to be liquidated as a result of processing the payout.

Include Prior Capital Redeemed Units Optional Select Yes from drop-down list to redeem prior capital redeemed units redeemed as a result of the capital payout.

Update IDS Optional If you choose Yes option from the drop-down list, the system updates the income distribution setup of the parent Fund ID with that of the resultant Fund ID. For a successful update, you should choose No for the Restrict IDS for the Unit Holder option for the resultant Fund ID in the Corporate Actions screen in Fund Rules Maintenance

Update SI Optional If you choose Yes from drop-down list, the system changes the Fund ID of the following from the parent Fund ID to the resultant Fund ID:

- Standing Instructions for all types of Unit Trust transactions

- Policy Premium details

- Policy Annuity Details

- Policy Recurring Switch details

Examples

- Merger of Fund 1 into Fund 2: Let us assume Fund 1 is being merged into Fund 2.and both are available in the asset allocation for premium and annuity to the extent of 40% and 60% respectively. In this case, at the time of transaction processing, the system updates the resultant Fund ID to Fund 2 and the ratio to 100%.

- Merger of Fund 1 and Fund 2 into Fund 3: Let us assume Funds 1 and 2 are being merged into Fund 3 and both (Funds 1& 2) are available in the asset allocation for premium and annuity to the extent of 40% and 60% respectively. Here, at the time of transaction processing, the system updates the resultant Fund Id to Fund 3 and the ratio to 100%.

- Merger of Fund 1 into Fund 2: Let us assume Fund 1 is being merged into Fund 2. Both these funds (From Fund – Fund1 and To Fund – Fund2) are available in the asset allocation for switch. In this case, at the time of transaction processing, the system will not process the transaction.

The following table depicts the possibilities for each corporate action:Table 3-58 Possibilities for Corporate Action

Corporate action type Basis for holdings Remarks Liquidation Allocation date All available holdings must be liquidated as the fund would cease to exist subsequent to the corporate action.

Split/Reverse split with ISIN change Allocation date All available holdings must be processed for split / reverse split as the fund would cease to exist subsequent to the corporate action.

Split/Reverse split with no ISIN change Transaction date

Price date

Allocation date

Basis could be either of the options available. The processing logic is similar to dividend freeze holdings.

Merge Allocation date All available holdings must be processed for merge as the underlying funds would cease to exist subsequent to the corporate action.

Capital Payout Transaction date

Price date

Allocation date

Basis could be either of the options available. The processing logic is similar to dividend freeze holdings.

Parent topic: Corporate Actions for Fund