2.9.1 Payment Details Tab

This topic explains the payment details tab of Income Distribution Setup Detail.

As part of maintaining the payment details, you can define the pattern in which the entity can receive income earnings in the form of payment. The entity can receive the payment income either in the form of checks or through account transfers.

If you have chosen either Both or Full Payment as the distribution mode, you must specify all information in this section.

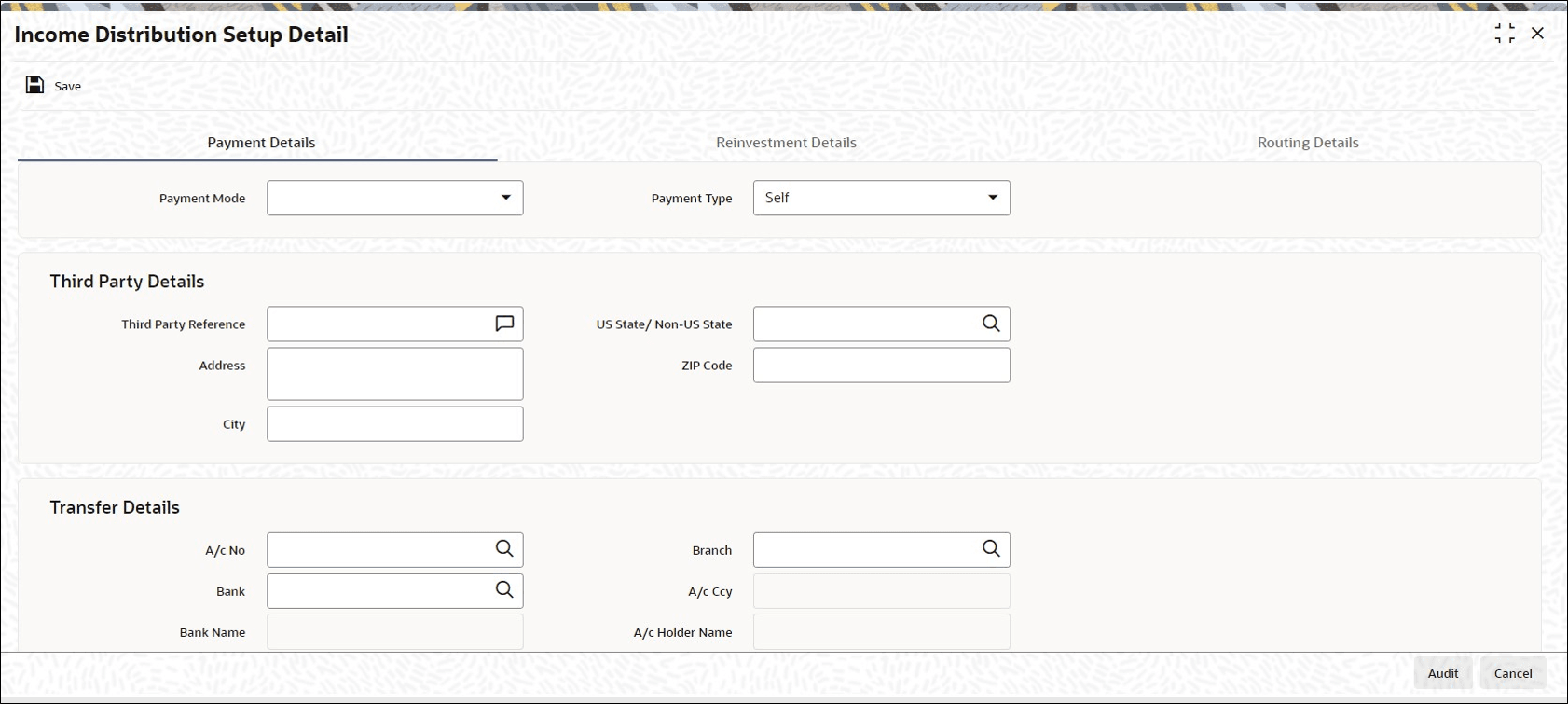

- On Income Distribution Setup Detail screen, click Payment Details tab to specify the payment details for the entity.The Payment Details are displayed.

Figure 2-20 Income Distribution Setup Detail_Payment Details Tab

- On Payment Details Tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-15 Payment Details - Field Description

Field Description Payment Mode Optional

From the list, select the mode in which the entity prefers to receive the paid portion of the income earned – either in the form of a check or an account transfer.

Payment Type Optional

From the list, indicate whether the check payment instrument must be addressed to the entity (self) or a third party.

Third Party Details You will be allowed to maintain the third party details if you have selected Third Party for Payment Type.

Third Party Reference Alphanumeric; 255 Characters; Mandatory for Third Party payment Specify the name or reference of the third party for which the check instrument must be made out.

Address Alphanumeric; 255 Characters; Mandatory for Third Party payment Specify the address of the third party for which the check instrument must be made out.

City Alphanumeric; 20 Characters; Mandatory for Third Party payment Select the city of residence of the third party for which the check instrument must be made out.

US State/Non-US State Alphanumeric; 20 Characters; Mandatory for Third Party payment Select the state of residence of the third party for which the check instrument must be made out.

Zip Code Alphanumeric; 10 Characters; Mandatory for Third Party payment Specify the zip code of the city of residence of the third party for which the check instrument must be made out.

Transfer Details The section displays the following fields. A/c No Alphanumeric; 34 Characters; Mandatory for Self payment type Select the bank account number to which the transfer payment of the income must be made.

The details of the account you select are displayed in the bank account details fields.

You must select a bank account number for which the currency is a valid fund bank account currency so that the income payment transfer can be affected.

Note: For commission payments for entities other than brokers, the account you specify here is used as the default settlement account. If IDS options have not been set for an entity, (and this account is not specified), settlement of commission payment is made to the entity’s default bank account, specified in the Entity Maintenance.

Bank Name Alphanumeric; 12 Characters; Mandatory for Third Party transfer payment Select the name of the bank in which the transfer account is present.

Branch Alphanumeric; 12 Characters; Mandatory for Third Party transfer payment Specify the branch name of the bank in which the transfer account is present

A/C Type Display The system displays the account type (Fixed, Savings or Current) of the transfer account.

A/C Ccy Display The system displays the currency of the transfer account.

A/C Holder Name Display The system displays the name of the holder of the third party account.

IBAN Display The system displays the International Bank Account Number (IBAN) of the account holder.

Parent topic: Process Income Distribution Setup Detail