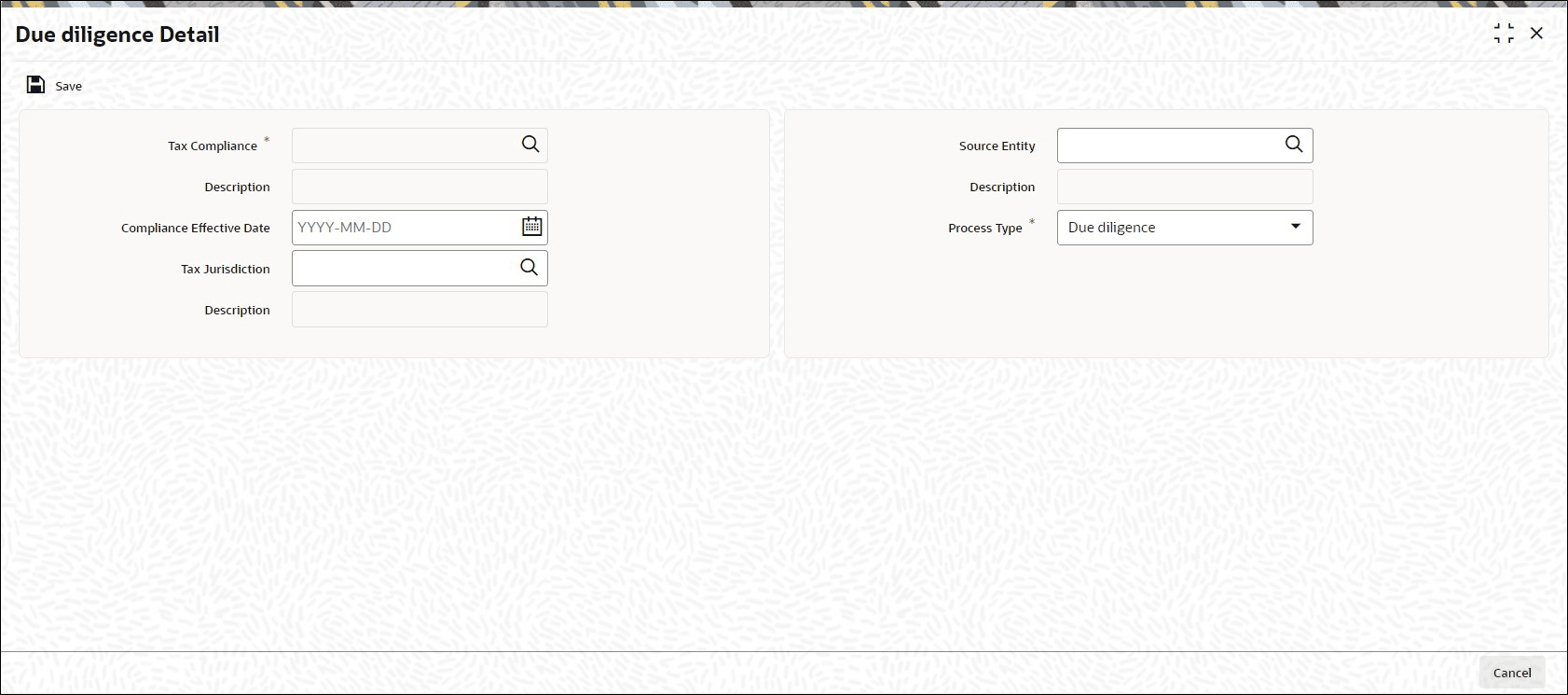

9.12 Process Due Diligence Detail

This topic provides the systematic instructions to maintain due diligence details.

- On Home screen, type

UTDDUDEL

in the text box, and click Next.The Due Diligence Detail screen is displayed.

- On Due Diligence Detail screen, click

New to enter the details.For more information on fields, refer to the field description table.

Table 9-13 Due Diligence Detail - Field Description

Field Description Tax Compliance Alphanumeric; 4 Characters; Mandatory

Specify the tax compliance details. Alternatively, you can select tax compliance details from the option list. The list displays all valid tax compliance details maintained in the system.

Description Display The system displays the description for the selected tax compliance details.

Compliance Effective Date Date Format; Mandatory Select the compliance effective date to process the due diligence from the adjoining calendar.

The default value will be effective date maintained in the Tax Compliance Setup Detail. You should not specify the date less than the effective date and greater than the application date.

The system will pick all accounts opened on or before the date input here. It will be applicable for all process type. For due diligence process the date cannot be less than the effective date and greater than the application date.

For Diminimis process, the date cannot be less than the due diligence date maintained as part of Tax compliance setup and not greater than the application date.

For diminimis yearly process, the date cannot be less than the last diminimis or dimininis yearly batch and not greater than the application date

Tax Jurisdiction Alphanumeric; 3 Characters; Mandatory Specify the tax jurisdiction details. The list displays all valid tax jurisdiction details maintained in the system.

Description Display The system displays the description for the selected tax jurisdiction details.

Source Entity Alphanumeric; 12 Characters; Mandatory Specify the source entity code. Alternatively, you can select source entity code from the option list. The list displays all valid source entity code maintained in the system.

Description Display The system displays the description for the selected source entity code.

Process Type Mandatory Select the process type to be executed from the drop-down list. The list displays the following values:- Due Diligence

- De minimis

- De minimis yearly

Refer to the topic Due Diligence Batch Process for further details on due diligence batch process in Batch Process User Manual.

Parent topic: Common Reporting Standard