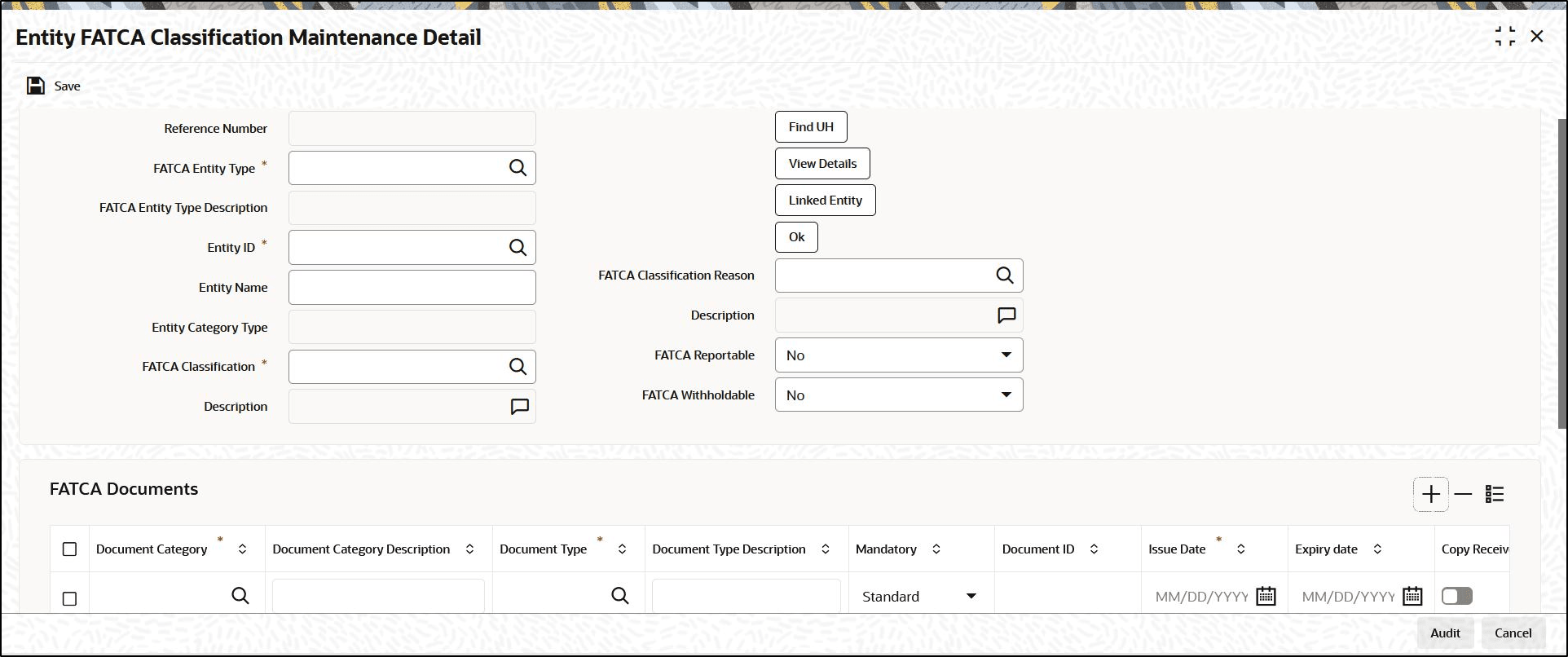

6.2 Process Entity FATCA Classification Maintenance Detail

This topic provides the systematic instructions to maintain FATCA Classification and record document details.

- On Home screen, type

UTDFATMT

in the text box, and click Next.The Entity FATCA Classification Maintenance Detail screen is displayed.

Figure 6-1 Entity FATCA Classification Maintenance Detail

- On Entity FATCA Classification Maintenance Detail

screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 6-2 Entity FATCA Classification Maintenance Detail - Field Description

Field Description Reference Number Display The system displays the reference number.

FATCA Entity Type Alphanumeric; 2 Characters; Mandatory Select the FATCA entity type from the adjoining option list. The options available are:- Unit Holder

- Broker

- Single Entity

- Nominee

FATCA Entity Type Description Display The system displays the description for the selected FATCA entity type.

Entity ID Alphanumeric; 12 Characters; Mandatory Select the Entity identification from the adjoining option list.

You can also query for entity ID by clicking Find UH button.

Entity Name Display The system defaults the entity name from the entity record.

Entity Category Type Display The system displays the entity category type.

FATCA Classification Alphanumeric; 25 Characters; Mandatory Select the FATCA Classification from the adjoining option list.

Description Display The system displays the description for the selected FATCA classification.

FATCA Classification Reason Alphanumeric; 25 Characters; Mandatory Select the reason for FATCA classification from the adjoining option list.

Description Display The system displays the description for the selected FATCA classification reason.

FATCA Reportable Optional Select the FATCA Reportable status for the entity selected from the drop-down list. The list displays the following values:- Yes

- No

FATCA With holdable Optional Select the FATCA with holdable status for the entity selected from the drop-down list. The list displays the following values:- Yes

- No

FATCA Documents The section displays the following fields.

Document Category Alphanumeric; 25 Characters; Mandatory Select the document category from the adjoining option list.

Document Category Description Display The system displays the description for the selected document category.

Document Type Alphanumeric; 25 Characters; Mandatory Select the type of the document from the adjoining option list.

Document Type Description Display The system displays the description for the selected document type.

Mandatory Optional You need to indicate whether the document is mandatory or optional. The drop-down list displays the following options:- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Document ID Alphanumeric; 25 Characters; Optional Specify the document identification.

Issue Date Date Format; Mandatory Specify the issue date of the received document.

Expiry Date Date Format; Optional Specify the expiry date of the received document.

Copy Received Mandatory Check this box to indicate that the copy is received.

Original Received Mandatory Check this box to indicate that the original is received.

Received Date Date Format; Optional Specify the document received date.

Document Reference Number Alphanumeric; Optional Specify the document tracking reference number.

Remarks Alphanumeric; 255 Characters; Optional Specify remarks, if any.

Chasing Date Date Format; Optional Specify the document chasing date.

Document Reference Number Alphanumeric; 255 Characters; Optional Specify the document reference number

Document Serial Number Display The system displays the document serial number.

Document Upload Click this button to upload or view the documents.

FATCA Status The section displays the following fields.

FATCA Compliant Display The system displays whether you are FATCA compliant.

Description Display The system displays the description for the FATCA compliant.

Reason Alphanumeric; 255 Characters; Optional Specify remarks, if any.

- Click View Details button.The Single Entity Maintenance Detail screen is displayed. You can maintain the details of single entity in this screen.

- Click Ok button to store the record in the database. The system checks for any duplicate records while saving. If the record is being modified by any other user at the time of saving, then system throws up an error.

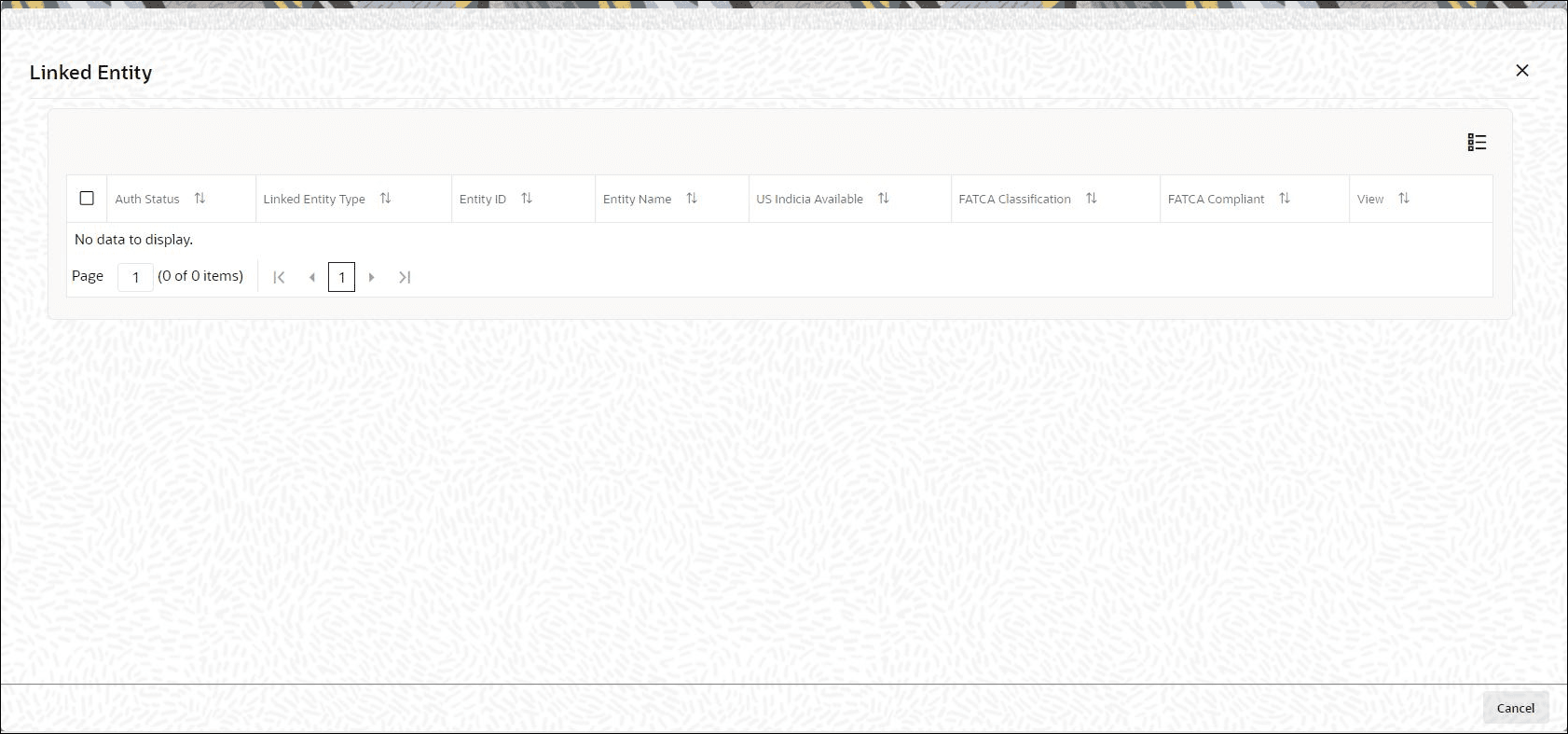

- Click Linked Entity button to view linked entity

details.The Linked Entity screen is displayed.

Figure 6-2 Entity FATCA Classification Maintenance Detail_Linked Entity Button

The system displays the following values:

- Auth Status

- Linked Entity Type

- Entity ID

- Entity Name

- US Indicia Available

- FATCA Classification

- FATCA Compliant

- Click View to view the details of FATCA Maintenance of a

linked entity.

Note:

During UT Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:- Pending, then the system displays a warning message as Maintain FATCA Classification for UH/Linked entity.

- Recalcitrant, then the system displays warning message as Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant.

During LEP Transaction capture for US Indicia Available Funds, if the FATCA Status of the unit holder or linked entity of a unit holder is:- Pending, then the system displays a warning message as Maintain FATCA Classification for UH/Linked entity.

- Recalcitrant, then the system displays warning message as Unit Holder or Linked entities mapped to the Unit Holder is FATCA is recalcitrant.

If the US Indicia is available for one of the customer during the CIF merge, then the customer account to which this account is being merged will also be US Indicia.

Parent topic: Foreign Account Tax Compliance Act (FATCA)