9.8 Process Tax Compliance Classification Maintenance Detail

This topic provides the systematic instructions to maintain tax compliance classification.

Maintain Tax compliance Classification Maintenance and record document details for Unit Holder. You can mark the documents collected in the system, classify the entity in the system and also map the indicia to the UH.

The Tax Compliance Classification Maintenance Detail screen will be available as part of AGY for UH only. You can maintain tax compliance classification maintenance record using this screen.

- On Home screen, type

UTDCOMCL

in the text box, and click Next.The Tax Compliance Classification Maintenance Detail screen is displayed.

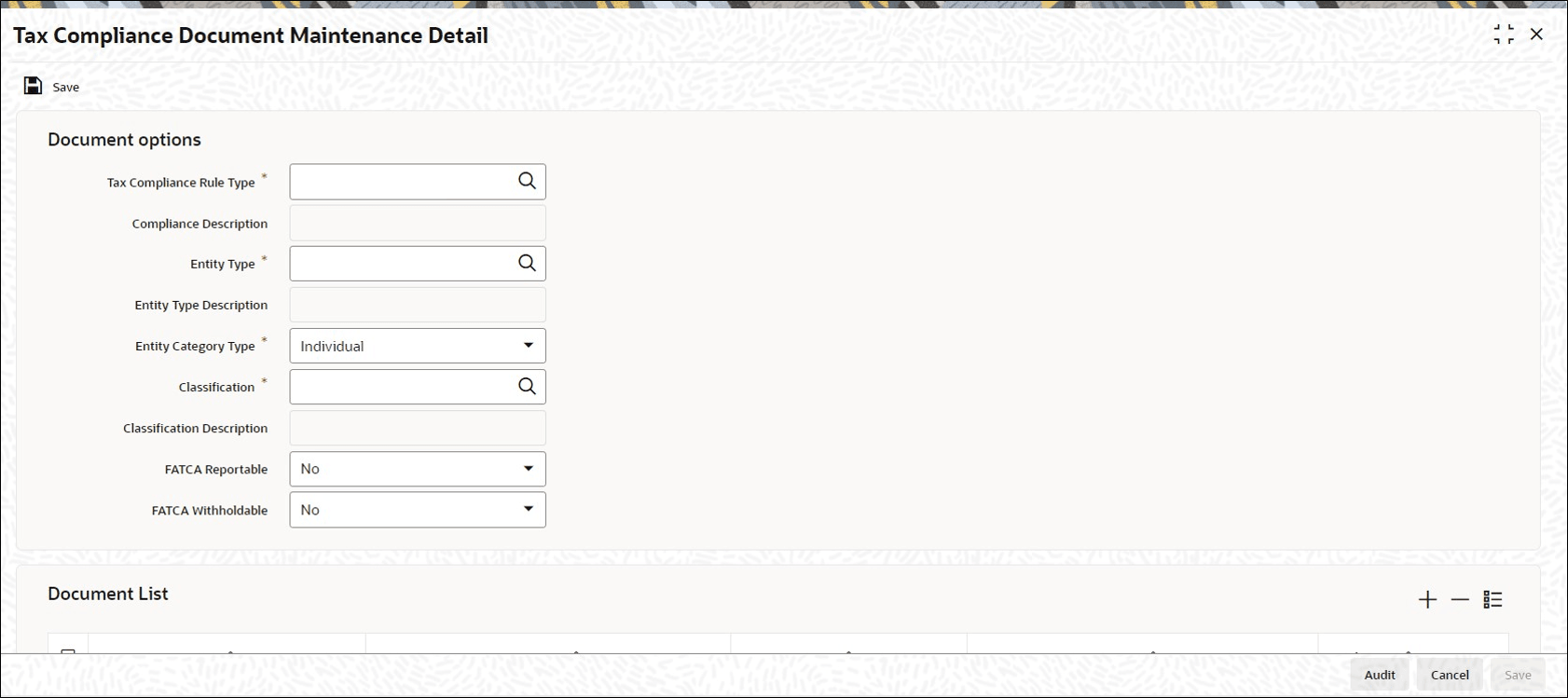

Figure 9-7 Tax Compliance Classification Maintenance Detail

- On Tax Compliance Classification Maintenance Detail

screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 9-4 Tax Compliance Classification Maintenance Detail - Field Description

Field Description Tax Compliance Rule Type Alphanumeric; 10 Characters; Mandatory Specify the tax compliance rule type. Alternatively, you can select Tax compliance rule type from the option list. The list displays all valid tax compliance rule type maintained in the system.

Compliance Description Display The system displays the description for the selected tax compliance rule type.

Entity Type Alphanumeric; 2 Characters; Mandatory Specify the entity type. Alternatively, you can select entity type from the option list. The list displays all valid entity type maintained in the system.

Click Find UH button to select the entity type holder in the system.

Entity Type Description Display The system displays the description for the selected entity type.

Entity ID Alphanumeric; 20 Characters; Mandatory Specify the entity ID to be classified.

Entity Name Display The system displays the name of the specified entity ID.

Entity Category Display The system displays the category of the specified entity ID.

Source Jurisdiction Alphanumeric; 3 Characters; Mandatory Specify the source jurisdiction code.

Jurisdiction Name Display The system displays the name of the specified jurisdiction code.

Classification Alphanumeric; 25 Characters; Optional Specify the classification details. Alternatively, you can select classification code from the option list. The list displays all valid classifications maintained in the system.

Classification Description Display The system displays the description for the selected classification code.

Classification Reason Alphanumeric; 255 Characters; Optional Specify the classification reason. Alternatively, you can select classification reason from the option list. The list displays all valid classification reasons maintained in the system.

Classification Reason Description Display The system displays the description for the selected classification reason.

Account Value Optional Select the value of an account from the drop-down list. The list displays the following values:- Low

- High

Click Indicia Details button to specify indicia and document details.

Indicia Details The section displays the following fields.

Reportable Jurisdiction Alphanumeric; 3 Characters; Optional Specify the reportable jurisdiction details for which Indicia are found. Alternatively, you can select reportable jurisdiction details from the option list. The list displays all valid reportable country list maintained as part of tax rule maintenance.

Description Display The system displays the description for the selected reportable jurisdiction.

Indicia Optional Select the indicia status from the drop-sown list. The list displays the following values:- Yes

- No

The indicia identification will be based on the criteria defined and this is identified on save for new accounts and for pre existing accounts through due diligence process.

Compliance Status Mandatory Select if the account has to be reported to the reportable jurisdiction or not from the drop-down list. The list displays the following values:- Reportable

- Non Reportable

If a UH with no indicia trigger is classified the values will be blank.

Remarks Alphanumeric; 255 Characters; Optional Specify remarks, if any.

Document Details The section displays the following fields.

Document Category Alphanumeric; 25 Characters; Optional Specify the document category such as address proof, ID proof. Alternatively, you can select document category from the option list. The list displays all valid document categories maintained in the system.

Document Category Description Display The system displays the description for the selected document category.

Document Type Alphanumeric; 25 Characters; Optional Specify the document type such as passport details. Alternatively, you can select document type from the option list. The list displays all valid document type maintained in the system.

Document Type Description Display The system displays the description for the selected document type.

Mandatory Optional Select if the document category to be defined as standard set or additional set of document from the drop-down list. The list displays the following values:- Standard

- Additional Documents

Document ID Alphanumeric; 25 Characters; Optional Specify the document identification number.

Issue Date Date Format; Optional Select the issue date from the adjoining calendar.

Expiry Date Date Format; Optional Select the expiry date from the adjoining calendar.

Copy Received Optional Check this box if the copy is received.

Original Received Optional Check this box if the original document is received.

Received Date Date Format; Optional Select the date when the documents were received from the adjoining calendar.

Remarks Alphanumeric; 255 Characters; Optional Specify remarks, if any.

Document Reference Number Alphanumeric; 255 Characters; Optional Specify the document reference number.

- Click the Upload button to upload all the required set of documents.

- You can classify the unit holder accordingly based on the documents submitted

by the unit holder.Post authorization of the unit holder, the unit holder will be available for Tax Compliance Classification Document Maintenance.

- Once the unit holder is classified in Tax Compliance Document Classification Maintenance screen, if you update any details as Reportable status then the same is updated back to the Tax Compliance tab in UH maintenance screen.

- If you identify new Indicia and Tax jurisdiction along with system identified details, then the new details will also be added as part of UH (Tax compliance sub screen).

- Once the Indicia is identified by the system and classified, the system will

not derive indicia status again. The Tax classification document maintenance

will be the final status. In case new Indicia is to be added or deleted, you can

do the same through this Tax Compliance Classification Maintenance

Detail (UTDCOMCL) only.In case indicia is identified /not identified and in case classification is done for the UH (through Tax Compliance Classification Maintenance Detail (UTDCOMCL)) upon UH amendment indicia will not be system derived.

- You can change the Compliance Status, once indicia is identified.

- You can view the following table that explains the indicia attribute and the

corresponding field mapped to the system that trigger indicia for a unit

holder.

Table 9-5 Individual Accounts (New)

Indicia attributes Field at UH Tab Function ID Logic Residence address/ mailing address Country Field (correspondence country field) Contact Details TAB UTDUH If the country field and telephone no (Tel 1, Tel 2, Cell phone number, Fax number) is one of the reportable jurisdiction country then indicia is triggered for the UH. Resident of reportable jurisdiction Domicile Country Client preference TAB UTDUH If the country of domicile is one of the reportable jurisdiction then indicia is triggered for the UH Effective POA granted to a person with an address in reportable jurisdiction Auth Rep ID (if an auth rep is mapped to an UH then the country code of auth rep is to be checked for) Country code field in the Auth rep maintenance UTDATREP If the country code mapped at Auth rep maintenance is one of the reportable jurisdiction then indicia is triggered for the UH Telephone of a reportable jurisdiction or no telephone numbers in participating country International dialing codes (All four country codes Tel 1, Tel 2, Cell phone number, Fax number) Contact Details TAB UTDUH If anyone of the international dialing code maintained is the dialing code of the reportable jurisdiction then indicia to be triggered for the UH and if anyone of the international dialing code maintained is that of a source/ participating jurisdiction then indicia should not be triggered Bank details of a reportable jurisdiction bank branch country code Single entity maintenance- Bank branch maintenance UTDTPMN If the bank branch country code is one of the reportable jurisdiction then the UH which is mapped with that bank branch will be triggered with indicia. Linked Entity- Joint/Nominee (TIN and Date of birth and place of birth) Issuing jurisdiction Multiple Tax id details UTDUH If the issuing jurisdiction of the Tax id is one/all of the reportable jurisdiction then indicia is triggered for the UH Nominee/Joint Correspondence address country field and tax issuing jurisdiction Nominee/ Joint holder- if they are third party mapped UTDUH If the UH being mapped at joint holder/nominee is a third party then; the correspondence address country code field or Tax issuing jurisdictions fields are one of the reportable jurisdiction maintained then indicia is triggered for the UH Nominee/Joint NA Nominee/ Joint holder- if its and existing UH in the system UTDUH If the UH mapped is an existing UH in the system and has indicia triggered then the same indicia triggers will be applicable for the UH. If an existing CIF is being mapped then the county of domicile to trigger indicia. Table 9-6 Entity Accounts (New accounts)

Indicia attributes Field at UH Tab Function ID Logic Residence address/ mailing address Country Field (correspondence country field) Contact Details TAB UTDUH If the country field telephone no (Tel 1, Tel 2, Cell phone number, Fax number) is one of the reportable jurisdiction country then indicia is triggered for the UH Resident of reportable jurisdiction country of incorporation Corporate Details TAB UTDUH If the country of incorporation is one of the reportable jurisdiction then indicia is triggered for the UH Telephone of a reportable jurisdiction or no telephone numbers in participating country International dialing codes (All four country codes Tel 1, Tel 2, Cell phone number, Fax number) Contact Details TAB UTDUH If anyone of the international dialling code maintained is the dialling code of the reportable jurisdiction then indicia to be triggered for the UH And

if anyone of the international dialling code maintained is that of a source/ participating jurisdiction then indicia should not be triggeredBank details of a reportable jurisdiction bank branch country code Single entity maintenance- Bank branch maintenance UTDTPMN If the bank branch country code is one of the reportable jurisdiction then the UH which is mapped with that bank branch will be triggered with indicia. Linked Entitydirector (TIN and Date of birth and place of birth) Issuing jurisdiction Multiple Tax id details UTDUH The Tax ID issuing jurisdiction is one of the reportable jurisdiction then indicia is triggered for the UH- only if the director is marked as controlling person Director Correspondence address country field and tax issuing jurisdiction Director- if its and existing UH/CIF in the system UTDUH If the UH being mapped as director is a third party then; the correspondence address country code field or Tax issuing jurisdictions fields are one of the reportable jurisdiction maintained then indicia is triggered for the UH. If the UH mapped is an existing Uh in the system and has indicia triggered then the same indicia triggers will be applicable for the UH.

If an existing CIF is being mapped then the county of incorporation to trigger indicia.- only if the director is marked as controlling person

For a corporate account (UH) created, if you map one or all of the director as existing UH in the system there will be no check, if the linked UH is an individual UH in the system. If you map a corporate UH as one of the director then there will be no check and this will be operationally controlled process in the system.

Similarly for a individual account(UH) created, if you map one or all of the joint/Nominee as existing UH in the system there will be no check, if the linked UH is an individual UH in the system. If you map a corporate UH as one of the director then there will be no check and this will be operationally controlled process in the system.

For a corporate account(UH) created, if you map one or all of the director as external entity (Third party) in the system there will be no check if the linked third party is an individual entity in the system. If you map a corporate third party as one of the director then there will be no check and this will be operationally controlled process in the system.

Similarly for an individual account (UH) created; if you map one or all of the external entity (Third party) in the system there will be no check, if the linked third party is an individual entity (third party) in the system. If you map a corporate third party as one of the director then there will be no check and this will be operationally controlled process in the system.

If a unit holder created does not have any indicia triggering attributes except the linked UH (which can be a nominee, joint holder or director for a corporate UH); and if the linked UH has indicia triggered for multiple jurisdictions then the main UH will be triggered with indicia for all the jurisdictions.

If you map UH as joint holder/nominee and if indicia is selected as

Yesthen; the correspondence address country code field (including the International dialling code)/ Tax issuing jurisdictions/ country of birth field are one of the reportable jurisdiction maintained then indicia is triggered at the main UH.

Parent topic: Common Reporting Standard