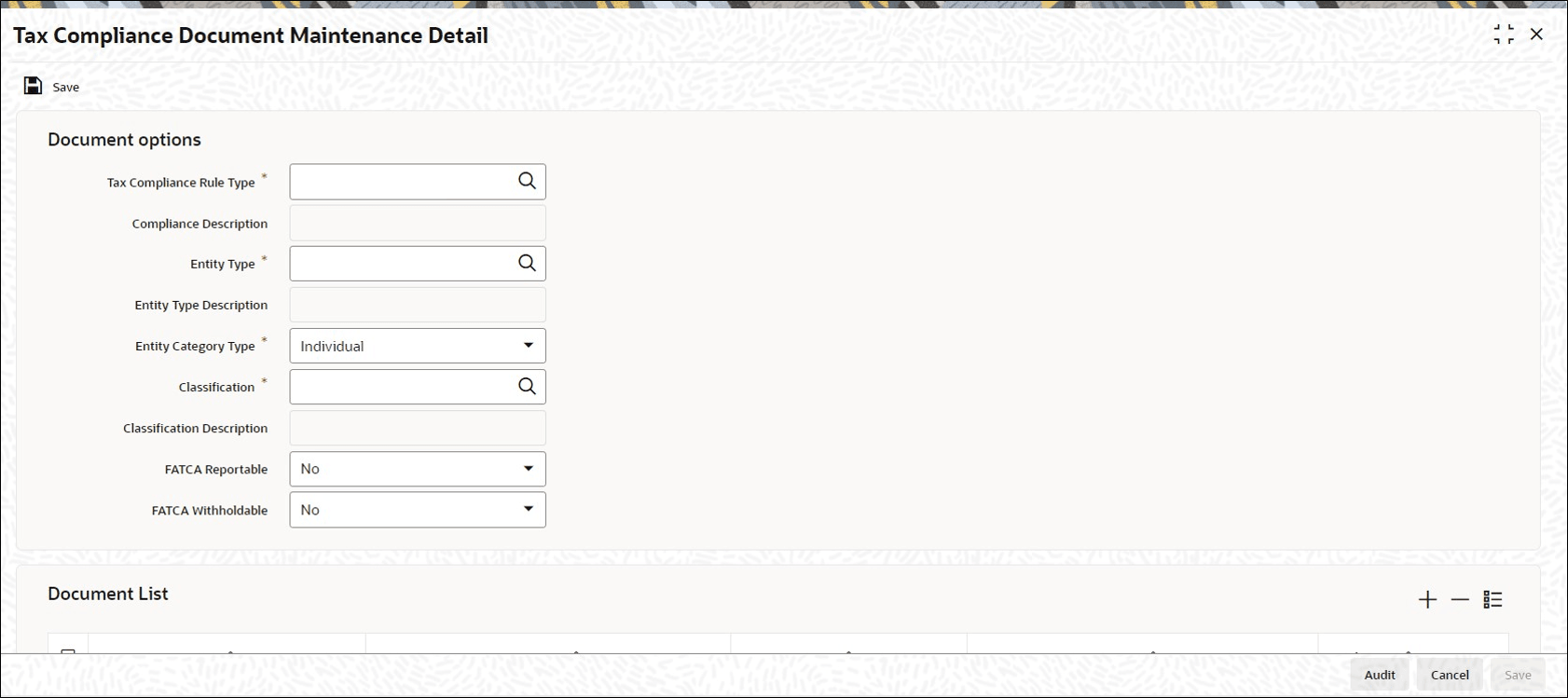

9.6 Process Tax Compliance Document Maintenance Detail

This topic provides the systematic instructions to maintain the list of tax compliance Document details.

- On Home screen, type

UTDFATDT

in the text box, and click Next.The Tax Compliance Document Maintenance Detail screen is displayed.

Figure 9-5 Tax Compliance Document Maintenance Detail

- On Tax Compliance Document Maintenance Detail screen,

click New to enter the details.For more information on fields, refer to the field description table.

Table 9-3 Tax Compliance Document Maintenance Detail - Field Description

Field Description Document Options The section displays the following fields.

Tax Compliance Rule Type Alphanumeric; 10 Characters; Mandatory Specify the tax compliance rule type. Alternatively, you can select Tax compliance rule type from the option list. The list displays all valid tax compliance rule type maintained in the system.

Compliance Description Display The system displays the description for the selected tax compliance rule type.

Entity Type Alphanumeric; 2 Characters; Mandatory Specify the FATCA entity type. Alternatively, you can select entity rule from the option list. The list displays all valid entity type maintained in the system.

Entity Type Description Display The system displays the description for the selected entity type.

Entity Category Type Mandatory Select the entity category type from the drop-down list. The list displays the following values:- Individual

- Corporate

Classification Alphanumeric; 25 Characters; Mandatory Select the FATCA Classification. Alternatively, you can select entity rule from the option list. The list displays all valid entity type maintained in the system.

Classification Description Display The system will display the description based on the selected FATCA Classification.

FATCA Reportable Optional FATCA Reportable gets defaulted from the FATCA Document Maintenance for the entity selected. You can change the value from Yes to No, but vice versa is not allowed.

The system defaults FATCA Reportable as No.

FATCA Withholdable Optional FATCA With holdable gets defaulted from the FATCA document maintenance for the entity selected. You can change the value from Yes to No, but vice versa is not allowed.

The system defaults FATCA Withholdable as No.

Document List The section displays the following fields.

Document Category Alphanumeric; 25 Characters; Mandatory Select the category of the document. Alternatively, you can select document category from the option list. The list displays all valid document category maintained in the system.

Document Category Description Display The system displays the document category description based on the selected document category.

Document Type Alphanumeric; 25 Characters; Mandatory Select the type of document. Alternatively, you can select document type from the option list. The list displays all valid document type maintained in the system.

Document Type Description Display The system displays the document type based on the selected document type.

Mandatory Mandatory Select if the document is mandatory or optional from the drop-down list. The list displays the following values:- Standard - This indicates that the document is mandatory

- Additional - This indicates that the document is optional

Select the appropriate option.

Minimum Document Reqd The section displays the following fields.

Document Category Alphanumeric; 25 Characters; Mandatory Select the document category. Alternatively, you can select document category from the option list. The list displays all valid document category maintained in the system.

Document Category Description Display The system displays the document category description based on the selected document category.

Minimum Number Reqd Numeric; 22 Characters; Mandatory Specify the minimum number of the standard documents that is required.

Parent topic: Common Reporting Standard