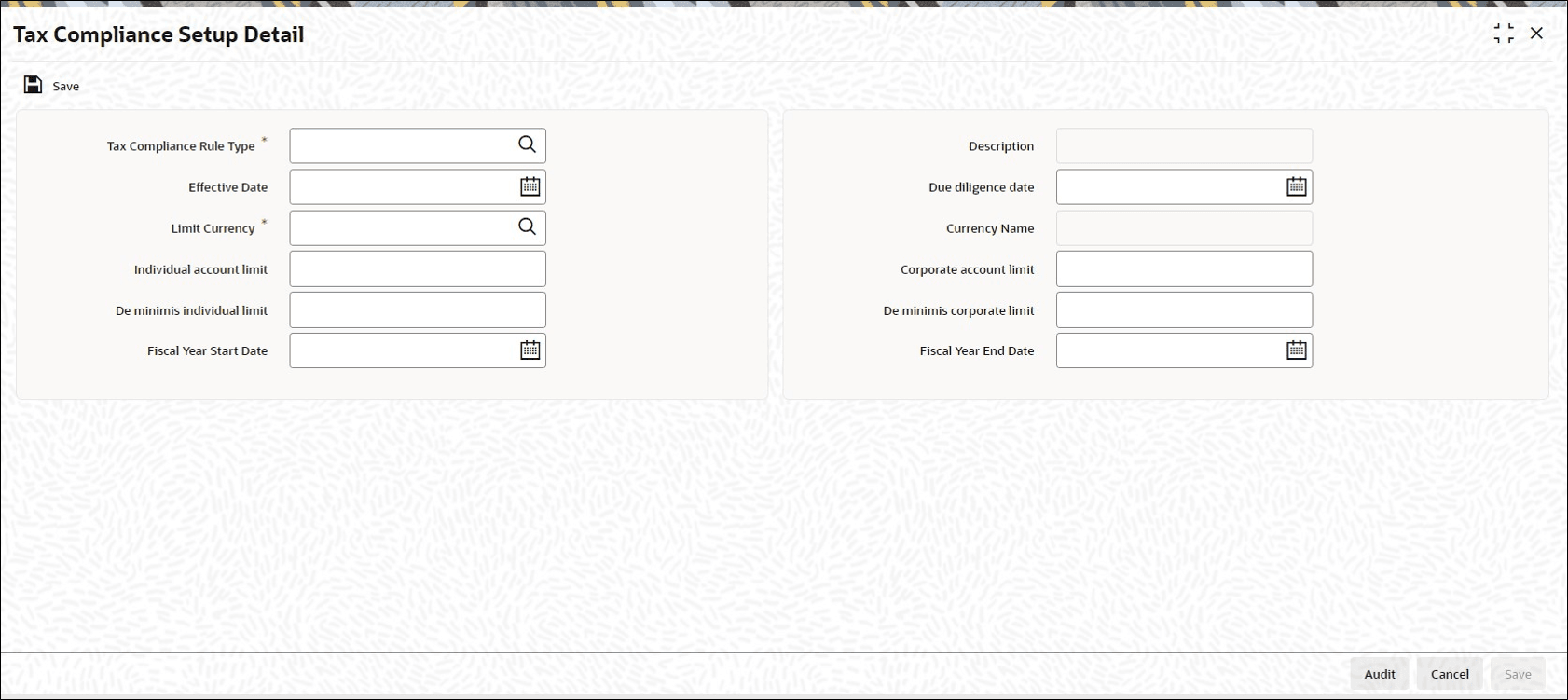

9.2 Process Tax Compliance Setup Detail

This topic provides the systematic instructions to capture tax compliance type, limit maintenance, and limit currency details.

You can also maintain the financial calendar year for reporting account balance.

As part of reporting requirement, you need to submit the account balance as on a calendar year for high value reportable accounts. The financial start and end date field will define the calendar year followed for the reporting.

You can also use Tax Compliance Setup Detail to define the rule effective date, due diligence date, individual account limit, corporate account limit and calendar year to be followed for reporting.

Parent topic: Common Reporting Standard