1.6 Process Trading Transaction Maintenance Detail

This topic provides the systematic instructions to initiate any of the trading transactions in the system.

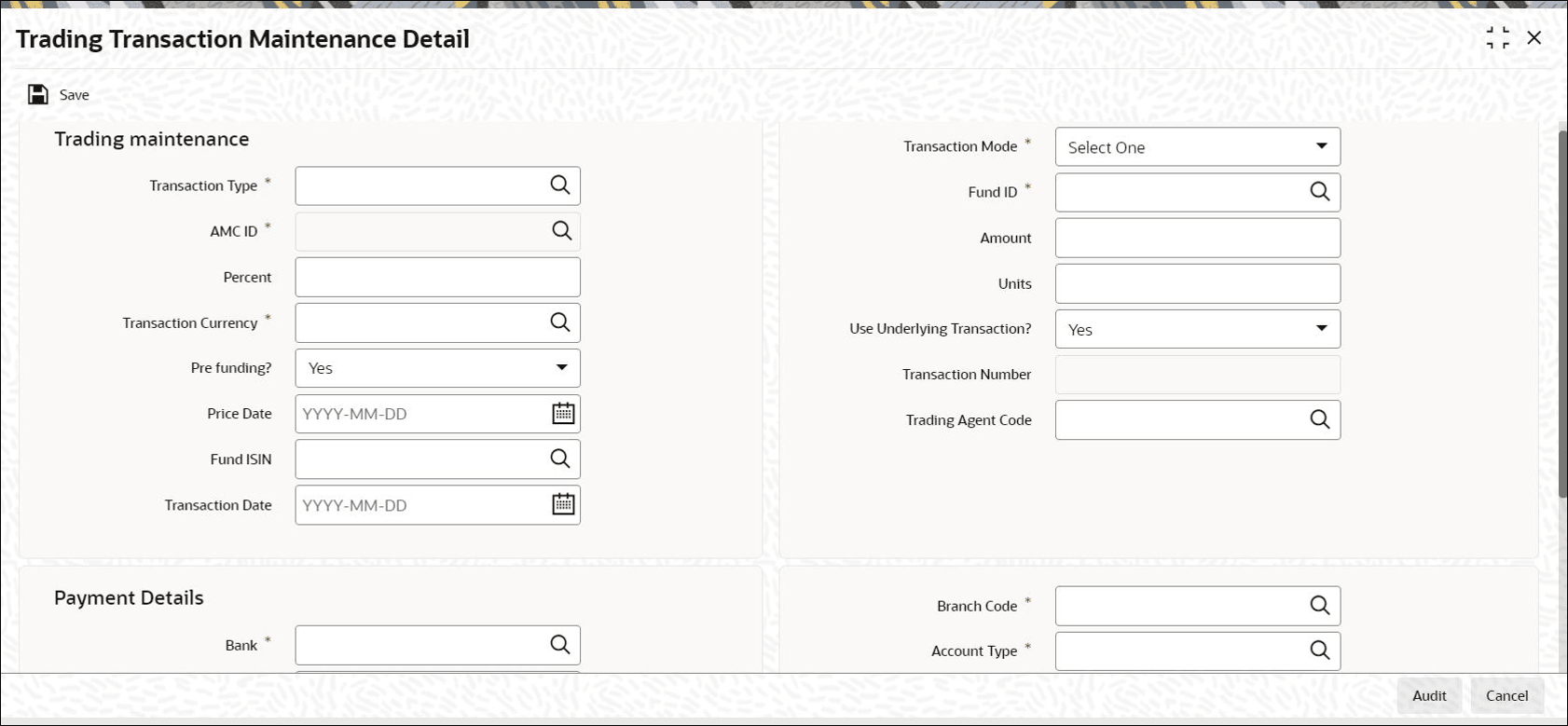

- On Home screen, type UTDTRDTX in the text box, and click Next.The Trading Transaction Maintenance Detail screen is displayed.

Figure 1-4 Trading Transaction Maintenance Detail

Checks and Controls

- Before initiating trading transactions in this screen, it is recommended that you must already have:

- Identified and marked the funds for which the trading functions must be

allowed. When you set up the General Operating

Rules for each fund in the General Operating

Rules screen, you must check the Maintain

Trading Box field.This indicates to the system that trading functions are allowable for the fund. Subsequently, all the fund rules pertaining to the fund must be authorized.

- You can only initiate trading transactions in this screen for all such funds for which the trading functions are allowable.

- Set up the unit holders that are to be linked to the statutory and the suspense account for the AMC in the system, authorized them and accepted the information in the Registrar component.

- Linked the unit holders that you have set up to the desired account type, statutory or suspense account, using the Account Unit Holder Information screen.

- Identified and marked the funds for which the trading functions must be

allowed. When you set up the General Operating

Rules for each fund in the General Operating

Rules screen, you must check the Maintain

Trading Box field.

- On Trading Transaction Maintenance Detail screen, click New to enter the details.For more information on fields, refer to the field description table.

Table 1-5 Trading Transaction Maintenance Detail - Field Description

Field Description Trading Maintenance This section displays the following details. Transaction Type Alphanumeric; 2 Characters; Mandatory

Select the type of trading transaction that you are initiating through this screen.

Transaction Mode Mandatory

Select the mode in which the volume of the transaction must be reckoned and the transaction put through from the drop-down list. The list displays the following values:- Amount: The volume of the transaction is specified in terms of an amount. Select this mode for creation and liquidation transactions. It is not allowable for the management transfer transactions.

- Units: The volume of the transaction is specified in terms of the number of units requested. Select this mode for liquidation transactions and the management transfer transactions. It is not allowable for creation transactions.

- Percentage: The volume of the transaction is specified as a specific percentage of the holdings already held in the specified fund in the trading box. Select this mode, if applicable, only for liquidation transactions. It is not allowable for any other transaction types.

When you select the transaction mode in this field, you must specify the actual volume of the transaction in the selected mode in the Amount, Units or Percentage field, as applicable.

AMC ID Alphanumeric; 12 Characters; Mandatory

Select the ID of the AMC that is initiating the trading transaction from the option list.

Fund ID Alphanumeric; 6 Characters; Mandatory

Select the ID of the fund in which the AMC is desirous of initiating the trading transaction, from the drop-down list.

When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

Percent Numeric; 5 Characters; Mandatory if the selected Transaction Mode is Percentage

Indicate the percentage of the holdings of the investor that is to be deemed as the volume of this transaction.

Units Numeric; 27 Characters; Mandatory if the selected Transaction Mode is Units

Indicate the number of units requested in the transaction.

Amount Numeric; 27 Characters; Mandatory if the selected Transaction Mode is Amount

Indicate the amount involved in the transaction.

Transaction Currency Alphanumeric; 3 Characters; Mandatory

Select the currency in which the transactions will be initiated.

When you select a fund in the Fund Name field, the fund transaction currencies that are allowable for transactions into the selected fund are displayed in the drop-down list in this field, from the Fund Transaction Currency fund rule record that has been maintained for the selected fund.

Pre funding? Optional

Select Yes or No from the drop-down list to specify whether pre-funding is required or not for UH Mapping. The list displays the following values:- Yes

- No

Use Underlying Transaction? Optional

Select Yes or No from the drop-down list to specify whether underlying transaction can be used for UH Mapping or not.

Price Date Date format; Mandatory

Indicate the date on which the desired price that is to be reckoned for allocation of the transaction was prevalent. You can specify a past date, but not a future date. If you specify a past date, it must be a date on which the desired authorized fund price was prevalent.

Transaction Number Display

The system displays the transaction number.

FUND ISIN Alphanumeric; 12 Characters; Optional

Select the ISIN Code of the selected fund. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field.

Trading Agent Code Alphanumeric; 12 Characters; Optional

Select the trading agent code from the option list.

Transaction Date Date Format; Mandatory

Select the date on which the transaction is initiated into the system from the adjoining calendar.

You can only initiate trading transactions on the application date, and you cannot initiate trading transactions on a future date or a past date.

Payment Details This section displays the following details. Bank Alphanumeric; 12 Characters; Mandatory

Specify the bank name of the customer.

Branch Code Alphanumeric; 12 Characters; Mandatory

Specify the branch code of the customer.

Account Currency Alphanumeric; 3 Characters; Mandatory

Specify the account currency code used by the customer.

Account Type Alphanumeric; 1 Character; Mandatory

Specify the account type.

Account Number Alphanumeric; 34 Characters; Mandatory

Specify the account number of the customer.

Account Holder Name Alphanumeric; 100 Characters; Mandatory

Specify the account holder name.

Payment Mode Alphanumeric; 1 Character; Mandatory

Specify the mode of payment.

Payment Type Optional

Select the type of payment from the drop-down list. The list displays the following values:- Self

- Third Party

Clearing Date Date Format; Optional

Select the clearing date from the adjoining calendar.

Transfer Reference Number Alphanumeric; 20 Characters; Optional

Specify the transfer reference number.

IBAN Alphanumeric; 40 Characters; Optional

Specify the International Bank Account Number (IBAN) of the account holder.

By default, the price date is reckoned to be the application date. In such a case, the prevalent price as on the application date need not be available at the time of initiating the trading transaction in this screen, but it must be available when the authorization of the trading transaction is done.

Parent topic: Manage Suspense Accounts, Statutory Accounts and Trading