3.12.4 Other Tab

This task topic provides information about other tab details of FCIS Redemption Transaction Detail screen.

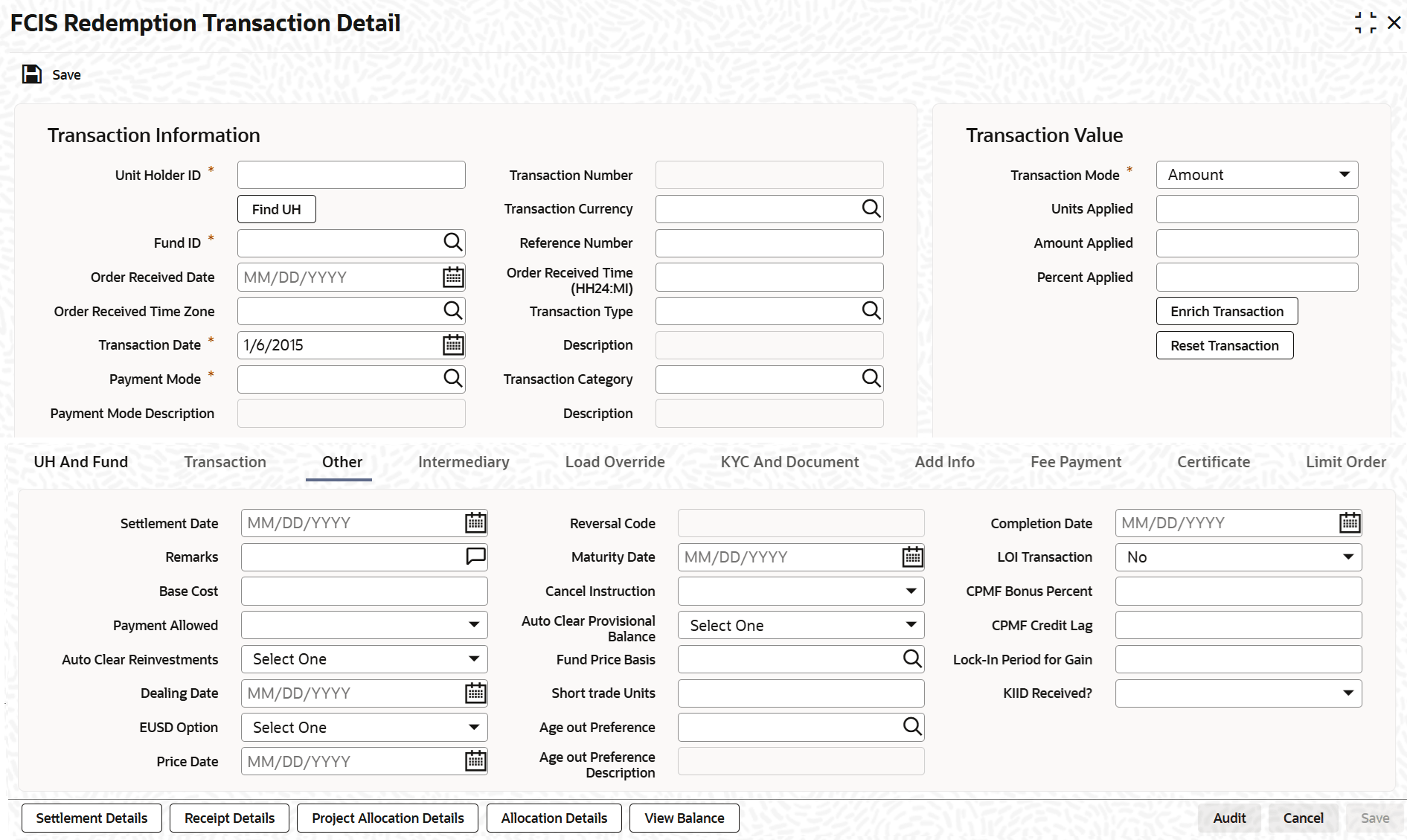

- Click on Other tab in the FCIS Redemption Transaction Detail

screen.The Other screen is displayed.

Figure 3-45 FCIS Redemption Transaction Detail - Other

For more information on fields in the screen, refer the below table.

Table 3-63 FCIS Redemption Transaction Detail - Other Tab

Field Description Settlement Date Date Format; Optional Specify the settlement date.

Remarks Alphanumeric; 255 Characters; Optional Specify remarks, if any.

Base Cost Numeric; 6 Characters; Optional Specify the base cost details.

Payment Allowed Optional Select if payment allowed is or not from the drop-down list. The list displays the following values:

- Yes

- No

Auto Clear Reinvestments Optional Select if reinvestment details should be automatically cleared or not from the drop-down list. The list displays the following values:

- Yes

- No

Dealing Date Date Format; Optional Specify the dealing date.

By default, the dealing date is derived based on the dealing date maintained for the fund in the Specific Fund Price Date Setup screen. The date displayed here can be altered, if required, and you can specify the requisite dealing date. Dealing date will not be displayed on the screen if it is not maintained for a fund or the fund is not a specific price date fund. System will default the transaction date as the dealing date.

If you have defined a different trade cycle for the fund in the Override Trade Cycle Date screen and the transaction falls within the override period mentioned in this maintenance, the system will default the dealing date from the maintenance.

Refer the chapter Other Fund Activities in the Fund Manager User Manual for more details on maintaining alternate trade cycles for a fund

EUSD Option Optional Select the EUSD option from the drop-down list. The list displays the following values;

- With Holding Tax

- Exchange of Information

- Tax Exemption Certificate

Price Date Date Format; Optional The field From Price Date is enabled when you select the fund in which the requested transaction is to be put through. The fund should be one for which you have specified forward pricing is applicable. The price date is arrived at by taking into consideration several conditions. This is explained in the section Defaulting of Price Dates in the Transaction Screens in this chapter. You can modify this field.

If you have defined a different trade cycle for the fund in the Override Trade Cycle Date screen and the transaction falls within the override period mentioned in this maintenance, the system will default the price date from the maintenance.

Reversal Code Display The system displays the reversal code.

This field is only available during transaction amendment, and you can use it to capture the appropriate rejection code, if any, for the amendment. The codes available in the option list are specific to the transaction type being amended.

Maturity Date Date Format; Optional If the fund in which the transaction is being put through is a closed-end fund, then specify the maturity date for the transaction in the Maturity Date field. This field is only applicable for AMCs that have opted for the maturity date facility.

Note: In case of block transactions, enter the maturity date of the block transaction. If the system date is equal to or greater than the date specified here, and the Auto generate Unblock option is checked then system generates an automatic unblock transaction on the date specified here. If the maturity date falls on a holiday, then the unblock transaction will be generated on the next working day.

Cancel Instruction Optional Select the cancel instruction from the drop-down list. The list displays the following values:

- Standing Instructions

You can use this field to indicate whether standing instructions defined in respect of a unit holder, in the selected fund, are to be cancelled. If you select this option, all standing instructions for the transaction is cancelled, including those that are to be generated after an automatic redemption occurs. Select the Standing Instruction option in this field to indicate cancellation of standing instructions.

If this option has been chosen in the General Operating Rules for the fund, the automatic redemption process generates redemption transactions for unit holders in the fund, with the Cancel Instruction option automatically set.

If this option has been set for the transaction in this field, the End of Day process cancels all standing instructions (irrespective of the transaction type) for the unit holder in the fund after the outflow transactions (redemption, switch and transfer) involving the unit holder have been allocated for the day.

Note: Reversal or amendment of an outflow transaction for which Cancel Instruction has been set to Standing Instruction, would re-instate the standing instructions.

Auto Clear Provisional Balance Optional Select Yes option to indicate that 100% outflow transaction should include provisionally allotted units. This option will be enabled if the transaction mode is Percent and the transaction value is 100.

Fund Price Basis Alphanumeric; 6 Characters; Optional Specify the fund price basis details. Alternatively, you can select fund price basis details from the option list. The list displays all valid fund price basis maintained in the system.

Short Trade Units Numeric; 27 Characters; Optional Specify short trade units.

If the unit holder is nominee account, only then system will allow you to capture the short trade units.

Applicable short trade units will be taken for applying penalty.

If short trade units is not entered, then the transaction allocation will follow the normal allocation process.

Age out Preference Alphanumeric; 1 Character; Optional Specify the age out preference from which we need to preferably redeem the units during outflow and is applicable for Redemption, Switch and Transfer screens. Alternatively, you can select age out preference from the option list. The list displays all valid age out preference code maintained in the system.

While saving a Redemption, Switch or Transfer based on Age out preference value, the system will check for available balance in particular classification like CDSC or FEL. In case of insufficient unit balance, the system will display an error message. The system will consider unalloted transaction for unit balance check.

- In case of an unallotted unit based or percentage based transactions, the unallocated units will be directly identified from the transaction details.

- In case of un unalloted amount based transaction, the system will compute the unallotted units as follows: Unallotted units = Amount/ (Latest Available NAV * (1 - Fluctuation %) Fluctuation % is a system level param value that can be maintained in Parameter Maintenance screen (UTDPARAM) considering the maximum fluctuation in price that can happen. The system maintains the Param Code as FLUCTUATIONPERCENT.

If you have not specified Age out Preference value for the transaction, then system will save the field as blank and will follow the fund level ageing logic.

During actual ageing if there is no sufficient units in respective classification, the system will redeem from available classification based on fund level ageing policy.

Based on the Age out preference selection, the system will age out the transactions during outflow. If there is no sufficient balance in the respective buckets, then system will age out the transactions from other buckets based on fund rule ageing logic.

Age out Preference Description Display The system displays the description for the selected age out preference.

Completion Date Date Format; Optional The date on which the transaction is completed.

LOI Transaction Optional Select the status of LOI transaction from the drop-down list. The list displays the following values:

- Yes

- No

If the unit holder that is subscribing to the fund through IPO is designated as a Letter or Intent investor, then specify if the present transaction is to be deemed and processed as a Letter of Intent transaction.

This specification is only applicable for LOI unit holders that are transacting in a fund in a group for which LOI is deemed as allowed.

This specification is only applicable for LOI unit holders that are transacting in a fund in a group for which LOI is deemed as allowed.

CPMF Bonus Percent Numeric; 30 Characters; Optional Specify the percentage of CPMF bonus.

By default, the CPMF Bonus percentage is displayed here which is arrived at based on the fund CPMF preference. If CPMF Bonus Type is Fixed, Percentage cannot be modified during the transaction input i.e., Bonus is credited on the lag EOD activity. Details regarding CPMF Preference are explained in the section Maintaining Fund CPMF Preferences in the Fund Manager module.

CPMF Credit Lag Numeric; 4 Characters; Optional Indicate the lag for the CPMF bonus to be credited.

Lock-in Period for Gain Days Numeric, 4 Characters; Optional The default lock-in period for the funds where IOF/IRRF are applicable is defaulted here. This can however be modified.

Note: Reversals are not allowed post allocation. However if there is any judicial blocking (partial or full) or the subscription is partially redeemed the reversals will not be allowed.

KIID Received? Optional Select if the transaction is KIID compliant or not from the drop-down list. The list displays the following values:

- Yes

- No

The system will default the KIID compliant at the transaction level upon the selection of the Unitholder and Fund in the transaction screens. If the UCITS Fund at the Fund level is Yes and the UH mapping to the Fund in the UH KIID Compliance tab is NO then at the transaction level, the system will default the KIID Complaint to No.

If the KIID Received is set to No, the system display an error message while saving the transaction as The Unit holder has not received the KIID.

If the flag is set to YES there will be no error message and treated as if the UH has received the KIID. The system will always look at the latest UCITS fund mapping maintained at the UH level.

If the transaction is being done in a fund which is not a UCITS Fund then the field KIID received at transaction level will be defaulted to Blank. You cannot change this option to either a Yes or No at the transactions level if it is not a UCITS Fund.

The business user can change the KIID Compliant flag at the transaction from No to Yes and proceed with the transaction capture but visa versa is not possible. The record at the Unit Holder level will however not get updated. You will have to manually update the same.

In case of backdated transactions, if transaction date is less than effective date, system will default the KIID Compliant field to ‘No’ and then you need to manually override it.

Parent topic: Redemption Transaction Detail