2 Bureau Integration Service

This topic provides the overview about the Bureau Integration Service.

Bureau Integration Service facilitates financial institutions to send requests to the credit bureau agencies for credit scores and reports. It also facilitates viewing reports received from the bureaus.

The credit report presents the credit information of an individual or a company, which is fetched by credit bureaus from various financial institutions. It is a detailed report, which contains the history of borrowings, repayment routine, defaults, and delays. This report contains vital information about a customer’s credit score, personal information, employment details, contact information, and details of accounts in various banks of a given geographical region. The objective of this report is to present the financial history of an individual or a company, which further helps a bank to take a decision on granting a loan based on the credit score of a company or an individual.

For requesting and receiving the credit reports, bureau integration service is integrated with the financial institution or the product processor.

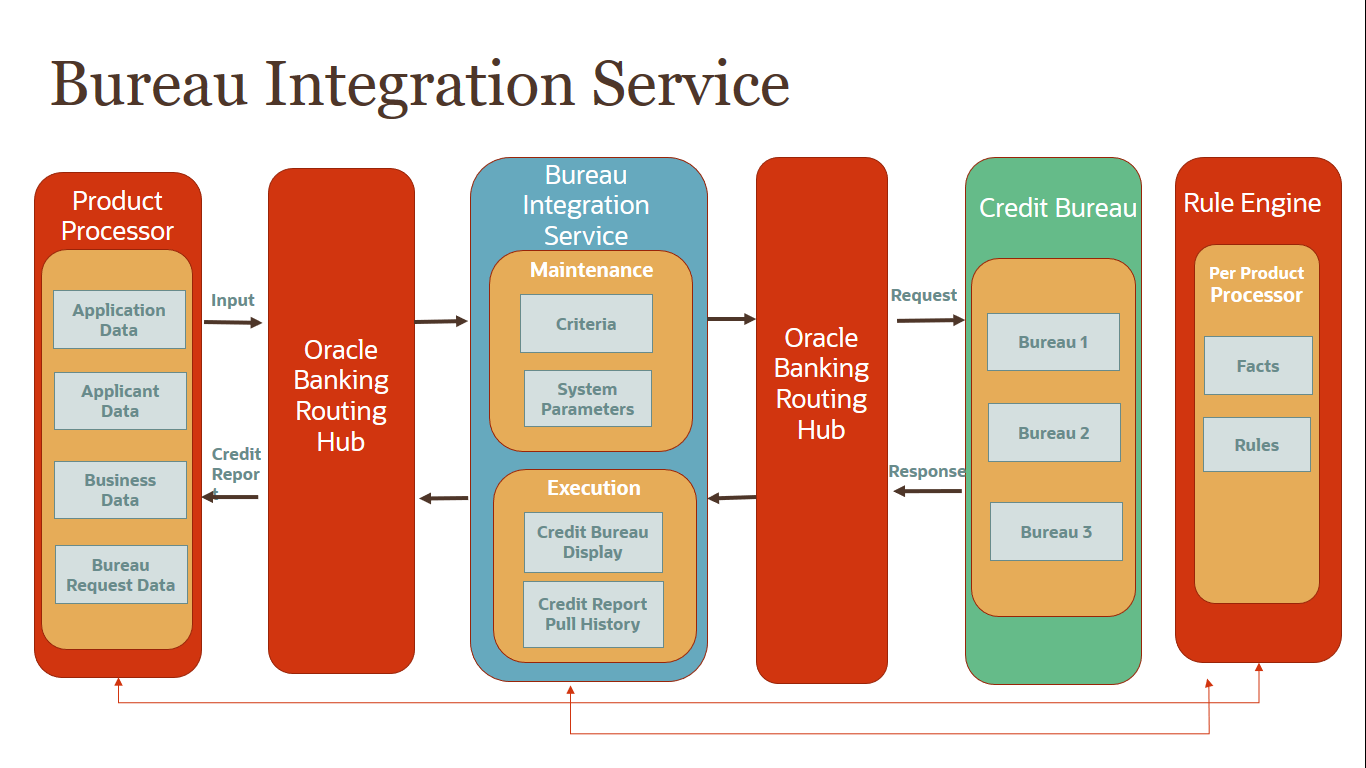

- The product processor requests bureau integration service for credit reports. It provides the required customer information for whom the report is requested.

- The routing hub transforms the data and forwards the request to the bureau integration service.

- Once the integration service receives the request, the data is processed based on various criteria. The criteria contain the rules and facts of the product processor that are maintained in the rules engine.

- Bureaus to be called are identified based on evaluation of the rules.

- The integration service then sends the request to the routing hub, which transforms the data and sends the request to the respective credit bureaus.

- The bureau processes the request and sends the credit report back.

- The routing hub receives the report and transforms the report as per the defined template and sends it back to bureau integration service.

- Bureau integration service then saves the data, displays the credit report, and sends the same to the product processor through the routing hub.

One or more bureaus can be called based on evaluation of the rules. The bureaus can be either called simultaneously or based on the response from the previous bureau call.

Bureau integration service maintains aging for credit report of an applicant. History service allows to store and pull existing credit report of an individual customer. The integration service retrieves report from history for those applicants if subsequent call to same bureau is made within defined period, beyond which a new credit report is called from the bureau. Existing credit reports from history are sent back to the product processor.

In case of multiple applicants being received by bureau integration service as a part of a lending application, based on the evaluation of criteria, the integration service consolidates all the multiple bureau responses into one and sends it to the product processor.

A new bureau can be added with only a configuration and without any change in the code. Two lookup types are required to be created in the bureau integration service. One for bureau and another for bureau product type. The additional maintenance required is configuration of the new bureau in the routing hub.

Bureau integration service supports override of criteria rules if the product processor wants to call a specific bureau or bureau product, for an applicant. In such cases, bureau service will not check criteria for rules evaluation. Instead, bureau service will call the bureau as intimated by the product processor in the request. Here, product processor can list one or more bureau’s to be called.

Bureau Integration service supports decoding of encoded pdf string from a bureau response to a pdf report using web content document server. The document server generates a unique document ID for each record stored. Bureau service can access the pdf reports using this document ID.

The below flow diagram depicts how bureau integration service works with the integrated product processor and interfaces with the routing hub for fetching and displaying the credit bureau reports:

- Overview

This topic describes the overview about the Decision service. - System Parameter

This topic describes the information about the system parameter configured in Bureau Integration service. - Lookup

This topic describes the information about the lookup feature in Bureau Integration service. - Product Processor

This topic describes the information about the product processor. - Criteria

This topic describes the information about the criteria to identify the Credit Bureau. - Credit Bureau Display

This topic describes the information about Credit Bureau display. - Integrating Bureau Integration Service with Oracle Banking Routing Hub

This topic describes the information to integrate the Bureau Integration service with Oracle Banking Routing Hub.